Philadelphia Property Tax

Philadelphia, the city of brotherly love, is renowned for its rich history, vibrant culture, and diverse neighborhoods. However, one aspect that often weighs heavily on the minds of residents and property owners is the city's property tax system. Understanding the ins and outs of Philadelphia's property tax can be crucial for individuals looking to buy, sell, or invest in real estate within the city limits. In this comprehensive guide, we will delve into the intricacies of Philadelphia property tax, exploring its assessment process, rates, exemptions, and strategies for effective management.

Understanding Philadelphia Property Tax: A Comprehensive Guide

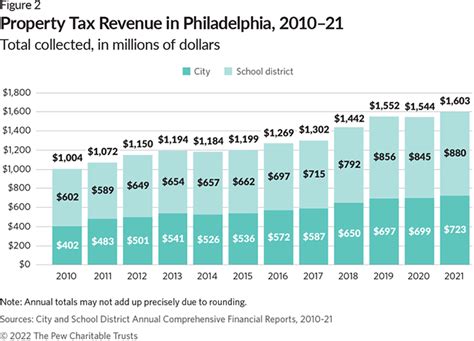

Philadelphia's property tax system is an essential component of the city's revenue stream, contributing significantly to the funding of public services, infrastructure, and local government operations. The tax is levied on both residential and commercial properties, with rates and assessment processes that vary based on property type and location within the city.

Property Assessment Process

The Philadelphia Office of Property Assessment (OPA) is responsible for determining the assessed value of all properties in the city. This value is a critical factor in calculating the property tax owed. The OPA employs a market-based approach, taking into account recent sales data, property characteristics, and neighborhood trends to arrive at an estimated fair market value for each property.

Property owners receive an annual notification of their property's assessed value, known as the "Tentative Taxable Value" (TTV). This value is then used as the basis for calculating the property tax due. It's important to note that the assessed value may not necessarily reflect the current market value of a property.

Property owners have the right to appeal their assessed value if they believe it to be inaccurate or if they have evidence of a significant discrepancy. The appeal process involves submitting relevant documentation to the OPA, which will then review the case and make a final determination.

| Property Type | Assessment Process |

|---|---|

| Residential Properties | OPA considers recent sales of comparable homes, neighborhood trends, and property improvements. Exterior and interior inspections may be conducted to assess the property's condition. |

| Commercial Properties | Commercial properties are assessed based on their income-generating potential, taking into account factors like rental income, vacancy rates, and operating expenses. OPA may request financial statements and lease agreements for evaluation. |

Property Tax Rates and Calculations

Philadelphia's property tax rates are determined by the City Council and can vary from year to year. As of [current year], the city's tax rate stands at [current tax rate per $100 of assessed value]. This rate is applied to the assessed value of the property to calculate the annual tax bill.

For instance, if a residential property has an assessed value of $200,000 and the current tax rate is $1.65 per $100 of assessed value, the annual property tax due would be calculated as follows:

$200,000 (assessed value) x $1.65 (tax rate per $100) = $3,300

It's important to note that the tax rate can vary across different neighborhoods and districts within Philadelphia, with some areas enjoying lower rates due to various factors such as economic development initiatives or historical significance.

Property Tax Exemptions and Relief Programs

Philadelphia offers a range of exemptions and relief programs to eligible property owners, aimed at reducing their tax burden. These programs are designed to support homeowners, seniors, and individuals with specific circumstances.

- Homestead Exemption: The Homestead Exemption provides a reduction in the assessed value of a property for homeowners who use it as their primary residence. To qualify, homeowners must apply and meet certain income and residency requirements. The exemption amount can vary but typically reduces the assessed value by a set percentage.

- Senior Citizen Tax Relief: Philadelphia offers a tax relief program for senior citizens aged 65 and above. Eligible seniors can receive a reduction in their property tax bill, with the amount of relief dependent on their income and assessed property value. This program aims to ease the financial burden on seniors who may be living on fixed incomes.

- Other Exemptions: There are additional exemptions available for certain properties, such as those owned by non-profit organizations, religious institutions, and properties used for specific public purposes. These exemptions can significantly reduce or eliminate the property tax liability for eligible properties.

Strategies for Effective Property Tax Management

Managing Philadelphia property tax efficiently can make a significant difference in an individual's financial planning and overall real estate strategy. Here are some strategies to consider:

- Stay Informed: Keep yourself updated on any changes to tax rates, assessment processes, and exemption programs. The City of Philadelphia's website and the OPA's resources provide valuable information on these matters.

- Understand Your Assessment: Review your annual Tentative Taxable Value (TTV) notification carefully. If you believe the assessed value is inaccurate, gather evidence and appeal within the designated timeframe. Accurate assessments can lead to significant savings.

- Explore Exemptions: Research and determine if you are eligible for any of the available exemptions or relief programs. Applying for these programs can result in substantial tax savings, especially for long-term residents and seniors.

- Strategic Improvements: Making improvements to your property can potentially increase its market value, but it's essential to consider the impact on your assessed value. Consult with a real estate professional or tax advisor to understand how improvements may affect your tax liability.

- Long-Term Planning: Property tax is a recurring expense, so incorporating it into your long-term financial planning is crucial. Consider setting aside funds specifically for property tax payments to ensure you can comfortably meet your obligations.

The Impact of Philadelphia Property Tax on Real Estate Transactions

Understanding Philadelphia's property tax system is not only essential for existing property owners but also for individuals considering real estate transactions within the city. Here's how property tax considerations can influence buying, selling, and investing decisions:

Buying a Property

When purchasing a property in Philadelphia, potential buyers should factor in the annual property tax liability. This expense is typically included in the overall cost of ownership and can significantly impact a buyer's financial planning. It's advisable to discuss property tax estimates with a real estate agent or tax professional to ensure a comprehensive understanding of the financial commitment.

Selling a Property

Sellers should consider the impact of property tax when pricing their homes. A competitive pricing strategy may involve taking into account the property's tax burden, especially if the seller intends to offer a smooth transition for the buyer. Providing potential buyers with accurate tax information can enhance the selling process.

Investing in Philadelphia Real Estate

Investors looking to expand their portfolios in Philadelphia should carefully evaluate the property tax implications. Understanding the tax rates and assessment processes for different property types can influence investment decisions. Additionally, exploring available exemptions and relief programs may provide opportunities for cost savings and improved investment returns.

Philadelphia Property Tax: A Community Perspective

Philadelphia's property tax system plays a vital role in shaping the city's real estate market and the lives of its residents. While it can be a significant financial obligation, it also funds essential public services and infrastructure improvements that benefit the community as a whole.

The city's commitment to maintaining a fair and transparent assessment process, along with the availability of exemptions and relief programs, demonstrates its focus on supporting its residents. By understanding and effectively managing their property tax obligations, individuals can contribute to the city's growth and development while enjoying the vibrant and historic city of Philadelphia.

How often are property assessments conducted in Philadelphia?

+The Philadelphia Office of Property Assessment (OPA) conducts a citywide assessment every eight years. However, individual properties may be reassessed more frequently, especially if there are significant improvements or changes in the property’s value.

Can I appeal my property’s assessed value if I disagree with it?

+Yes, property owners have the right to appeal their assessed value if they believe it to be inaccurate. The appeal process involves submitting an appeal application to the OPA along with supporting documentation. It’s important to act promptly, as there are specific deadlines for filing appeals.

Are there any online resources available to estimate my property tax?

+The City of Philadelphia provides an online property tax estimator tool on its official website. This tool allows property owners to input their assessed value and other relevant information to estimate their annual property tax liability. It’s a useful resource for preliminary calculations.