California Use Tax

In the complex world of taxation, the California Use Tax stands as a crucial yet often misunderstood component of the state's revenue system. This article aims to demystify this tax, providing a comprehensive guide to its nature, implications, and practical applications for both individuals and businesses operating within the Golden State.

Understanding California Use Tax

The California Use Tax is a type of excise tax imposed on the storage, use, or consumption of tangible personal property in the state. It’s essentially a counterpart to the state’s sales tax, ensuring that all purchases, whether made within the state or from out-of-state vendors, contribute to California’s revenue. This tax mechanism ensures a level playing field for in-state and out-of-state businesses and maintains a stable revenue stream for the state government.

This tax was introduced to address the issue of tax evasion, particularly in the context of online shopping, where consumers often avoid paying sales tax on purchases made from out-of-state retailers. By imposing a use tax, the state ensures that all purchases are taxed, regardless of the point of sale.

Legal Framework

The California Use Tax is governed by Section 6201 of the Revenue and Taxation Code, which defines the tax as “an excise tax on the storage, use, or other consumption in this state of tangible personal property.” This tax is distinct from the sales tax and is applied to purchases where sales tax was not collected or was collected at a lower rate.

| Statute | Description |

|---|---|

| Section 6201 | Imposes the use tax on tangible personal property stored, used, or consumed in California. |

| Section 6202 | Defines the tax base as the purchase price of the property. |

| Section 6203 | Sets the rate of use tax as the same as the sales tax rate in the county where the property is used. |

The California State Board of Equalization (BOE) is responsible for administering and collecting the use tax, ensuring compliance and fair taxation across the state.

How California Use Tax Works

The California Use Tax operates on a simple principle: if you purchase an item and use it in California, you owe use tax on that purchase. This tax applies to both individuals and businesses and covers a wide range of transactions, from online purchases to out-of-state rentals.

Applicable Scenarios

- Online Shopping: Perhaps the most common scenario, individuals who purchase goods online from out-of-state retailers often don’t pay sales tax at the time of purchase. In such cases, the use tax kicks in, requiring the purchaser to pay the equivalent tax amount to the state.

- Out-of-State Rentals: Renting a car, equipment, or other assets from an out-of-state vendor and using them in California triggers the use tax. The renter is responsible for paying the tax on the rental value of the asset.

- Business Transactions: Businesses that purchase goods or services from out-of-state vendors and use them in California operations are also subject to the use tax. This includes machinery, raw materials, and other business-related items.

The use tax is calculated based on the purchase price of the item, including shipping and handling charges, and is applied at the same rate as the sales tax in the county where the item is used. For instance, if you purchase a laptop online from an out-of-state retailer for $1,500 and use it in Los Angeles County, you would owe a use tax of approximately $120 (assuming a sales tax rate of 8% in LA County), which is due to the state.

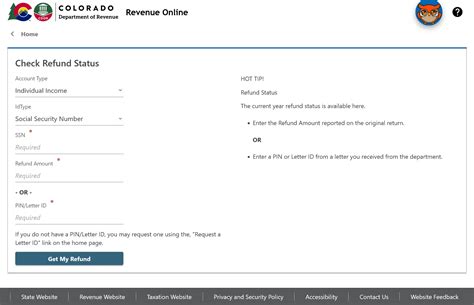

Collection and Payment

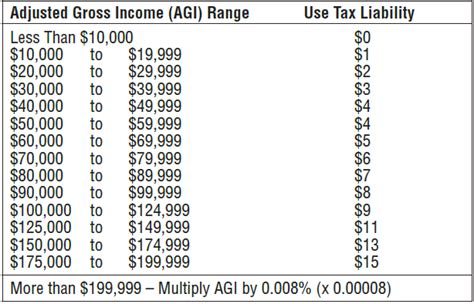

For individuals, the use tax is often self-assessed and paid annually through the California Personal Income Tax Return (Form 540). The tax is typically included as part of the “Other Taxes” section of the form. However, businesses with substantial out-of-state purchases may be required to register with the BOE and remit use tax on a regular basis, often quarterly or monthly.

The California BOE provides a Use Tax Return (Form BOE-555-UT) for businesses to report and pay their use tax obligations. This form requires detailed information about the purchases, their values, and the applicable tax rates.

Compliance and Enforcement

The California State Board of Equalization takes compliance with the use tax seriously. While the state encourages self-assessment and voluntary compliance, it also employs various enforcement measures to ensure businesses and individuals fulfill their tax obligations.

Audits and Penalties

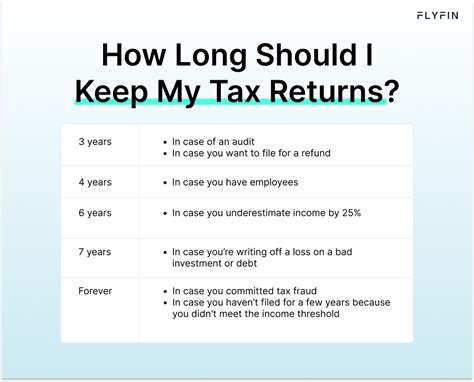

The BOE has the authority to conduct audits of businesses and individuals to verify compliance with the use tax. These audits can be triggered by a variety of factors, including suspicious activity, high-risk industries, or random selection. If an audit reveals underreporting or non-compliance, the BOE can impose penalties and interest on the outstanding tax amount.

Penalties for non-compliance can be significant, often ranging from 5% to 50% of the underpaid tax, depending on the severity of the violation and whether it was intentional or negligent. Interest on the outstanding tax is also charged at a rate of 1% per month, or fraction thereof, until the tax is paid in full.

Registration and Reporting Requirements

Businesses with substantial out-of-state purchases are often required to register with the BOE and file regular use tax returns. The registration threshold varies depending on the nature of the business and its transactions. For example, businesses that sell taxable goods or services to California consumers must register if their total sales exceed $500,000 in the previous 12 months.

Registered businesses must file Use Tax Returns (Form BOE-555-UT) on a regular basis, typically quarterly or monthly, depending on their filing frequency. These returns must be filed even if the business has no use tax liability for the period, to ensure compliance with reporting requirements.

Voluntary Disclosure Program

The BOE offers a Voluntary Disclosure Program for businesses and individuals who have underreported or failed to report their use tax obligations. This program allows taxpayers to come forward, disclose their non-compliance, and resolve their tax liabilities on favorable terms. By participating in this program, taxpayers can often avoid penalties and interest, making it a beneficial option for those who have inadvertently overlooked their use tax obligations.

Future Implications and Trends

The California Use Tax is an evolving component of the state’s tax system, influenced by changing consumer behaviors, technological advancements, and legal precedents. Understanding these trends can provide valuable insights for businesses and individuals looking to navigate the tax landscape effectively.

E-Commerce and Digital Taxation

The rise of e-commerce has significantly impacted the use tax, with online retailers and marketplaces becoming increasingly common sources of out-of-state purchases. The state has responded by enhancing its use tax collection efforts, often targeting large online retailers and platforms. In recent years, the state has entered into agreements with major e-commerce companies to collect and remit use tax on behalf of their marketplace sellers, simplifying the process for both the state and taxpayers.

Legal Challenges and Court Rulings

The use tax has faced several legal challenges over the years, particularly from businesses and individuals arguing that it violates constitutional principles such as due process and equal protection. However, the courts have generally upheld the validity of the use tax, recognizing its importance in maintaining a fair and efficient tax system.

One notable case, Quill Corp. v. North Dakota, established the principle that states cannot require out-of-state sellers to collect and remit use tax unless the seller has a physical presence in the state. This ruling, while limiting the reach of the use tax, also provided clarity on the boundaries of state taxation authority.

Simplification and Modernization

In recent years, the BOE has undertaken efforts to simplify the use tax system and make it more accessible to taxpayers. This includes the development of online filing systems, the expansion of the Voluntary Disclosure Program, and the implementation of more user-friendly tax forms and guidelines. These initiatives aim to reduce the administrative burden on taxpayers and improve overall compliance.

Looking forward, the state is likely to continue its focus on digital taxation, particularly as e-commerce continues to grow. This may involve further agreements with online retailers, the development of more sophisticated tax collection technologies, and ongoing legal challenges to define the boundaries of state tax authority in the digital age.

Conclusion

The California Use Tax is a critical component of the state’s tax system, ensuring fair taxation and a stable revenue stream. By understanding the nature, implications, and practical applications of this tax, businesses and individuals can navigate their tax obligations with confidence. From online shopping to out-of-state rentals, the use tax covers a broad range of transactions, making it an essential consideration for anyone operating within the Golden State.

This article has provided an in-depth exploration of the California Use Tax, covering its legal framework, practical applications, compliance requirements, and future trends. By staying informed and proactive, taxpayers can ensure they fulfill their obligations and contribute to the state's economic health while also protecting their own financial interests.

FAQ

What is the California Use Tax rate for my county?

+

The California Use Tax rate varies depending on the county where the item is used. You can find the specific rate for your county by referring to the California County Sales and Use Tax Rates published by the State Board of Equalization. This resource provides a comprehensive list of all California counties along with their respective sales and use tax rates.

Do I need to pay Use Tax on every out-of-state purchase I make online?

+

Yes, if you purchase an item from an out-of-state retailer and use it in California, you generally owe Use Tax on that purchase. However, some purchases may be exempt from Use Tax, such as certain food items, prescription drugs, and certain types of clothing. It’s important to understand the specific exemptions and requirements for Use Tax in California.

How can I calculate the Use Tax amount I owe for a specific purchase?

+

To calculate the Use Tax amount, you’ll need to know the purchase price of the item (including shipping and handling charges) and the applicable Use Tax rate for the county where the item will be used. Multiply the purchase price by the Use Tax rate to determine the tax amount. For example, if you bought an item for 500 and the Use Tax rate is 8%, the Use Tax amount would be 40 (500 x 0.08 = 40).

Are there any exemptions or special considerations for small businesses when it comes to Use Tax?

+

Yes, small businesses may be eligible for certain exemptions or reduced tax rates depending on their sales volume and the nature of their business. For instance, businesses with total sales below a certain threshold may not be required to register for Use Tax purposes. It’s important to consult with a tax professional or refer to the State Board of Equalization’s guidelines for specific details on small business exemptions and considerations.

What happens if I don’t pay my Use Tax obligations?

+

Failure to pay Use Tax can result in penalties and interest. The State Board of Equalization has the authority to conduct audits and impose penalties for non-compliance. It’s important to understand your Use Tax obligations and file accurate returns to avoid potential penalties and maintain good standing with the state.