Where Do You Mail Nys Tax Returns

Navigating the world of taxes can be a daunting task, especially when it comes to mailing your tax returns. In the case of New York State (NYS) tax returns, there are specific guidelines and procedures to follow. Let's delve into the details to ensure you send your tax returns to the right place and avoid any unnecessary delays or complications.

Understanding the Process: Mailing Your NYS Tax Returns

When it's time to file your New York State tax return, the process may seem straightforward, but it's crucial to follow the correct procedures to ensure timely processing and avoid any potential penalties. Here's a comprehensive guide to help you navigate the mailing process smoothly.

Determining the Right Address

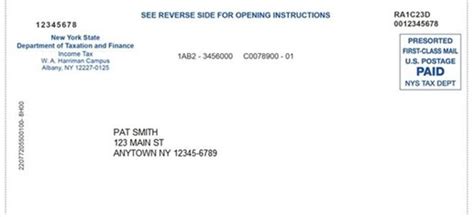

The first step in mailing your NYS tax return is determining the correct address. The New York State Department of Taxation and Finance provides specific mailing addresses based on the type of tax return you are filing and your residency status. It's essential to select the appropriate address to ensure your return is processed efficiently.

For individual income tax returns, residents of New York State are generally required to use the following address:

New York State Department of Taxation and Finance

PO Box 15129

Albany, NY 12212-5129

However, there are exceptions for specific tax forms and situations. For instance, if you are filing an amended return, the address might differ. It's crucial to refer to the official guidelines provided by the Department of Taxation and Finance to ensure you use the correct address.

Additionally, if you are a non-resident of New York State, the mailing address could be different. Non-residents and part-year residents typically use the following address for their tax returns:

New York State Department of Taxation and Finance

PO Box 15147

Albany, NY 12212-5147

These addresses are subject to change, so it's advisable to double-check the official website for the most up-to-date information before mailing your tax return.

Preparing Your Tax Return Package

Once you have determined the correct mailing address, the next step is to prepare your tax return package. Here are some essential considerations to keep in mind:

- Complete Forms: Ensure that you have filled out all the necessary forms accurately and completely. Double-check your calculations and provide all the required supporting documents.

- Payment or Refund: If you owe taxes, include a check or money order made payable to the New York State Department of Taxation and Finance. If you are expecting a refund, ensure that your bank details are up-to-date to receive the refund promptly.

- Envelopes and Postage: Use a sturdy envelope that can accommodate your tax return documents and any additional enclosures. Ensure that you use the correct postage to avoid delays in delivery.

- Tracking and Proof of Mailing: Consider using a tracking service or obtaining proof of mailing, especially if you are filing close to the deadline. This provides evidence that you mailed your return by the due date, which can be crucial in case of any disputes.

Tips for a Smooth Mailing Process

To ensure a hassle-free mailing experience, consider the following tips:

- Allow Sufficient Time: Start preparing your tax return early to avoid last-minute rushes. This gives you ample time to gather all the necessary documents and complete the forms accurately.

- Review and Double-Check: Before mailing your tax return, review it thoroughly. Check for errors, missing information, or incorrect calculations. It's always a good idea to have someone else review it as well to catch any potential mistakes.

- Keep Records: Maintain a copy of your filed tax return and any supporting documents. This can be beneficial for future reference and in case of an audit.

- Seek Professional Help: If you are unsure about any aspect of the mailing process or have complex tax situations, consider consulting a tax professional. They can provide guidance and ensure your tax return is filed correctly.

By following these guidelines and taking a systematic approach, you can ensure that your NYS tax return is mailed to the right place and processed efficiently. Remember, staying organized and being proactive can make a significant difference in the tax filing process.

The Future of Tax Return Mailing: Digital Options

In an era of digital transformation, the traditional method of mailing tax returns may soon become a thing of the past. The New York State Department of Taxation and Finance is actively promoting digital filing options, offering a more convenient and efficient way to submit tax returns.

The Rise of e-Filing

e-Filing, or electronic filing, has gained popularity in recent years due to its numerous advantages. Here's why it might be worth considering for your NYS tax returns:

- Convenience: e-Filing allows you to submit your tax return from the comfort of your home or office, eliminating the need for physical mailings. It saves time and effort, especially if you have multiple tax returns to file.

- Accuracy: Digital filing systems often include built-in error checks, reducing the chances of mistakes and ensuring a more accurate tax return.

- Faster Processing: e-Filed tax returns are typically processed quicker than mailed returns, leading to faster refunds or reduced wait times for tax payments.

- Secure Transmission: The NYS Department of Taxation and Finance uses secure digital platforms to protect your personal and financial information during the filing process.

Exploring e-Filing Options

The NYS government offers several e-Filing options to cater to different taxpayer needs:

- Online Filing: The NYS Department of Taxation and Finance provides an online filing platform accessible through their official website. This platform guides you through the filing process, ensuring a user-friendly experience.

- Software Programs: Several tax preparation software companies offer e-Filing services. These programs often include tax calculators, forms, and guidance to simplify the filing process.

- Professional Assistance: If you prefer a more personalized approach, consider engaging a tax professional who can assist with e-Filing and provide expert advice.

While e-Filing is an excellent option for many taxpayers, it may not be suitable for everyone. Some individuals may prefer the traditional mailing method or have unique circumstances that require physical documentation. It's essential to assess your needs and comfort level before choosing the filing method that works best for you.

The Impact on Mailing Addresses

As e-Filing gains traction, the reliance on traditional mailing addresses for tax returns may decrease over time. However, it's important to note that mailed returns will still be accepted and processed by the NYS government. The mailing addresses provided earlier in this article will remain valid for the foreseeable future.

Conclusion: Navigating the Tax Landscape

Filing your New York State tax return is a critical responsibility, and ensuring you send it to the right place is an essential part of the process. Whether you choose to mail your return or explore digital filing options, staying informed and proactive can make a significant difference in your tax journey.

By understanding the mailing addresses, preparing your tax return package diligently, and considering the benefits of e-Filing, you can navigate the tax landscape with confidence. Remember, the key to a stress-free tax experience lies in staying organized, seeking expert guidance when needed, and staying up-to-date with the latest filing procedures.

Stay tuned for future updates on tax filing procedures and explore the many resources available to make your tax journey as seamless as possible.

Can I mail my NYS tax return to any address, or is it specific to my situation?

+It is crucial to use the correct mailing address for your NYS tax return. The address depends on your residency status and the type of tax return you are filing. Refer to the official guidelines provided by the NYS Department of Taxation and Finance to ensure you use the right address.

What if I miss the mailing deadline for my NYS tax return?

+Missing the mailing deadline can result in penalties and interest charges. It’s essential to plan and file your return promptly to avoid any additional costs. If you anticipate missing the deadline, consider e-filing, which often provides more flexibility and faster processing.

Can I track the status of my mailed NYS tax return?

+Yes, you can track the status of your mailed NYS tax return. The NYS Department of Taxation and Finance provides an online tool to check the processing status of your return. You will need to provide your social security number and other personal details to access this information.