How Much Is Ca Sales Tax

Sales tax is a common and significant source of revenue for state and local governments in the United States. In California, sales tax is a vital component of the state's tax system, contributing to the funding of various public services and infrastructure. Understanding the rates and regulations surrounding California sales tax is crucial for both businesses and consumers alike.

The Complex Landscape of California Sales Tax

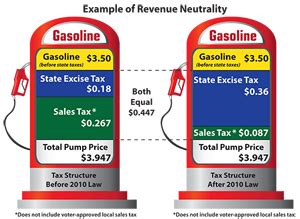

California boasts one of the most intricate sales tax structures in the country. This complexity arises from a combination of factors, including a state-wide sales tax rate, additional district taxes, and the influence of various tax-free exemptions and special programs. As of my last update in January 2023, the state-wide sales tax rate in California stood at 7.25%. However, it’s essential to note that this rate is merely the baseline, and the actual sales tax rate applicable to a purchase can vary significantly depending on the specific location.

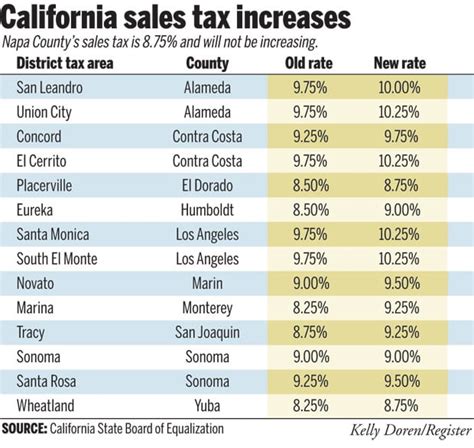

District Taxes and Local Variations

California allows local governments, such as counties and cities, to levy additional sales taxes. These district taxes can add up to 2.5% or more to the state rate, resulting in a combined sales tax rate that can exceed 10% in some areas. For instance, the city of San Francisco has a district tax rate of 1.5%, bringing the total sales tax rate to 8.75% within city limits. Similarly, Los Angeles County imposes a district tax of 2.25%, resulting in a combined rate of 9.5% for many areas within the county.

To illustrate the variations in sales tax rates across the state, consider the following table showcasing the effective sales tax rates for some major cities in California:

| City | District Tax Rate | Total Sales Tax Rate |

|---|---|---|

| San Francisco | 1.5% | 8.75% |

| Los Angeles | 2.25% | 9.5% |

| San Diego | 0.5% | 7.75% |

| Sacramento | 1.25% | 8.5% |

| Fresno | 1% | 8.25% |

Sales Tax Exemptions and Special Programs

California’s sales tax system also features a range of exemptions and special programs that can reduce or eliminate sales tax for certain types of transactions. These exemptions include purchases made by qualifying nonprofit organizations, certain agricultural equipment, and select medical devices. Additionally, the state offers a variety of special programs, such as the Manufacturers’ Investment Credit and the Research and Development Tax Credit, which provide tax incentives for specific economic activities.

Impact on Businesses and Consumers

California’s high sales tax rates can have a significant impact on both businesses and consumers. For businesses, especially those operating in multiple locations or selling goods online, managing the complexities of sales tax can be a challenge. It requires careful tax planning and compliance strategies to ensure accurate tax collection and remittance. For consumers, the varying rates across the state can lead to discrepancies in the prices of goods and services, influencing purchasing decisions and overall consumer experience.

The Role of Technology in Sales Tax Compliance

In recent years, technology has played a pivotal role in simplifying the sales tax landscape for businesses. Sales tax software and automation tools can help businesses automatically calculate the correct tax rate based on the customer’s location, ensuring compliance and reducing the risk of errors. These tools also facilitate efficient tax filing and reporting, making it easier for businesses to manage their sales tax obligations.

Sales Tax and Online Shopping

The rise of e-commerce has further complicated sales tax collection, especially with the state’s varying district tax rates. Online retailers must consider the destination-based tax rules, ensuring they collect the appropriate sales tax based on the customer’s shipping address. This can be particularly challenging for businesses selling to customers across the state, as they must keep track of the ever-changing tax rates and regulations.

Looking Ahead: Future Trends and Challenges

As California’s sales tax system continues to evolve, several key trends and challenges are shaping its future. One notable trend is the increasing focus on tax simplification and modernization. Efforts are underway to streamline the tax collection process, reduce administrative burdens, and enhance transparency. This includes exploring the potential of blockchain technology for more efficient and secure tax collection and compliance.

Sales Tax and E-Commerce: A Growing Challenge

The rapid growth of e-commerce presents a significant challenge for sales tax collection in California. With online retailers selling to customers statewide, the complexity of managing varying tax rates and regulations is magnified. This has led to ongoing discussions and initiatives to address the “digital sales tax” issue, aiming to establish a more equitable tax system for online transactions.

The Impact of Remote Work and COVID-19

The COVID-19 pandemic and the rise of remote work have introduced new complexities to sales tax. As more employees work remotely across state lines, the question of nexus and tax obligations becomes increasingly complex. This has implications for both businesses and states, as they navigate the evolving landscape of sales tax in the context of a changing workforce.

Conclusion: Navigating California’s Sales Tax Landscape

California’s sales tax system is a dynamic and ever-evolving entity, presenting both opportunities and challenges for businesses and consumers. Understanding the state’s complex sales tax structure, including the variations in district taxes and the impact of exemptions and special programs, is crucial for effective tax planning and compliance. As the state continues to adapt and modernize its tax system, staying informed and utilizing technology will be key to navigating the complexities of California sales tax.

How often are sales tax rates updated in California?

+Sales tax rates in California can change periodically, typically as a result of voter-approved initiatives or legislative actions. While there is no set schedule for rate changes, it’s essential for businesses and consumers to stay informed about any updates to ensure compliance.

Are there any plans to simplify California’s sales tax system?

+Efforts to simplify California’s sales tax system are ongoing. Proposals have been made to consolidate and streamline the tax structure, aiming to reduce the complexity and administrative burdens associated with the current system. However, implementing such changes can be a complex process and may require legislative action.

How can businesses stay updated on sales tax regulations in California?

+Businesses can stay informed about sales tax regulations and updates by subscribing to newsletters or alerts from the California Department of Tax and Fee Administration. Additionally, utilizing sales tax software and consulting with tax professionals can help ensure compliance with the latest regulations.

What are the penalties for non-compliance with California sales tax regulations?

+Non-compliance with California sales tax regulations can result in penalties and interest charges. The severity of penalties depends on factors such as the amount of tax owed, the duration of non-compliance, and the cooperation of the business. It’s crucial for businesses to prioritize compliance to avoid these consequences.

How does California’s sales tax system impact online retailers?

+Online retailers selling to customers in California must navigate the state’s complex sales tax system, including varying district tax rates and destination-based tax rules. This can be challenging, especially for businesses selling across the state. Utilizing sales tax automation tools and staying informed about tax regulations is crucial for online retailers to ensure compliance.