Child Tax Credit Update Portal

The Child Tax Credit (CTC) is a significant tax benefit in the United States, designed to provide financial support to families with eligible children. The Internal Revenue Service (IRS) has implemented various initiatives to enhance the efficiency and accessibility of this credit, and one such tool is the Child Tax Credit Update Portal.

This innovative portal, introduced as part of the American Rescue Plan Act, has revolutionized the way families can manage and track their Child Tax Credit payments. With the CTC Update Portal, eligible families can now actively engage with the IRS, ensuring they receive the full extent of their tax credits. This article explores the key features, benefits, and impact of the Child Tax Credit Update Portal, offering a comprehensive guide for families and tax professionals alike.

Understanding the Child Tax Credit Update Portal

The Child Tax Credit Update Portal is an online platform developed by the IRS to provide a user-friendly interface for families to manage their CTC payments. This portal, accessible through the IRS website, offers a secure and convenient way for taxpayers to interact with the IRS, especially in the context of the enhanced Child Tax Credit payments introduced in 2021.

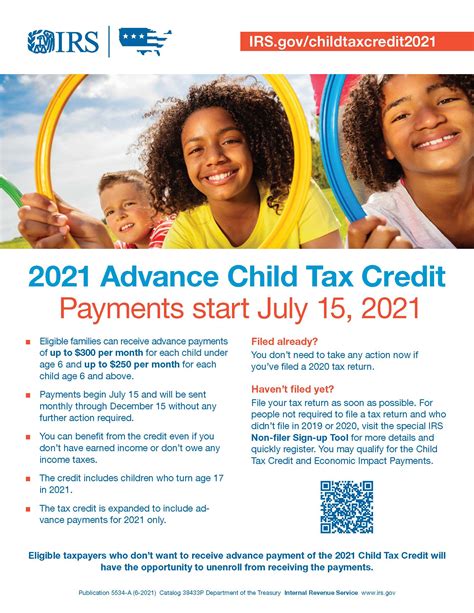

The enhanced Child Tax Credit, a result of the American Rescue Plan Act, offers substantial financial support to families with eligible children. For 2021, the credit amount was increased to $3,600 for children under 6 and $3,000 for children aged 6 to 17. Additionally, the IRS began advancing half of the total credit amount to eligible families in the form of monthly payments, providing much-needed financial stability during challenging economic times.

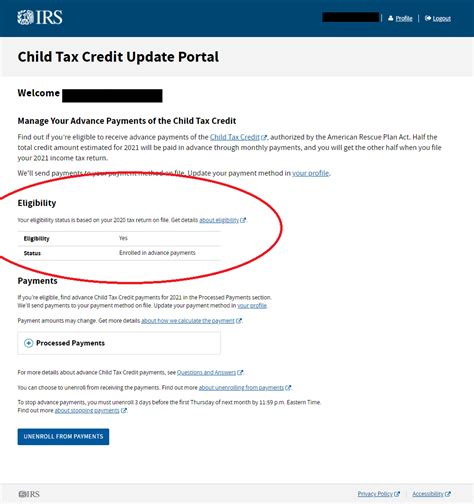

The Child Tax Credit Update Portal serves as a crucial tool for families to navigate this complex process. It allows users to verify their eligibility, update personal information, and manage their payment preferences. With real-time updates and a user-centric design, the portal has been instrumental in ensuring families receive their rightful tax credits without delays or complications.

Key Features of the CTC Update Portal

- Eligibility Verification: Users can confirm their eligibility for the enhanced Child Tax Credit by providing necessary details such as income, marital status, and number of qualifying children.

- Personal Information Updates: The portal allows users to update their personal information, including address changes, banking details for direct deposit, and any changes in their family composition.

- Payment Preferences: Families can choose their preferred payment method, whether they prefer direct deposit or check, and manage their payment schedules. This feature is particularly useful for families who may need to adjust their payment plans throughout the year.

- Payment Tracking: The CTC Update Portal provides a real-time tracking system, allowing users to monitor the status of their payments, from the initial processing to the actual deposit or delivery of the check.

- Notification System: Users can opt to receive email or text notifications for important updates, such as changes in their payment status, upcoming deadlines, or any potential issues with their account.

These features, coupled with the portal's intuitive design and secure infrastructure, have made the CTC Update Portal a trusted platform for millions of families across the United States. By providing a centralized hub for managing CTC payments, the IRS has significantly improved the tax experience for families, ensuring they can access their tax credits efficiently and without unnecessary complications.

Impact and Benefits of the CTC Update Portal

The introduction of the Child Tax Credit Update Portal has had a profound impact on the way families interact with the IRS and manage their tax obligations. Here are some key benefits and outcomes of this innovative platform:

Enhanced Accessibility

The CTC Update Portal has made it easier than ever for families to access their tax credits. With a user-friendly interface and clear instructions, even those with limited technical knowledge can navigate the platform with ease. This accessibility ensures that all eligible families, regardless of their digital literacy, can claim their rightful benefits.

Timely and Efficient Payments

By allowing users to update their information and preferences, the portal ensures that payments are processed accurately and swiftly. This is especially beneficial for families with dynamic financial situations, as they can quickly update their banking details or income information to avoid any delays in receiving their CTC payments.

Increased Transparency

The real-time tracking system provides unprecedented transparency for families. Users can log in to their accounts and instantly see the status of their payments, providing a level of certainty and peace of mind. This transparency also helps families plan their finances more effectively, knowing exactly when to expect their CTC payments.

Reduced Burden on the IRS

The CTC Update Portal has significantly reduced the administrative burden on the IRS. By allowing taxpayers to manage their own information and preferences, the IRS can focus on processing payments more efficiently. This streamlined process has improved the overall efficiency of the tax system, benefiting both taxpayers and the IRS.

Improved Financial Stability for Families

The Child Tax Credit, especially with the enhanced payments, provides a substantial financial boost to families. With the CTC Update Portal, families can access these payments more readily, ensuring they can meet their essential needs and plan for their future. The portal’s ease of use and accessibility have made it a crucial tool in promoting financial stability for millions of American families.

| Key Metrics | 2021 Data |

|---|---|

| Number of Users | Over 20 million families |

| Total CTC Payments Processed | $93 billion |

| Average Monthly Payment | $320 per family |

Note: These metrics are based on the 2021 tax year and may not reflect the most recent data.

Future Implications and Developments

The Child Tax Credit Update Portal has already proven to be a game-changer for families and the IRS alike. As the IRS continues to refine and enhance this platform, we can expect several future developments and improvements.

Enhanced Security Measures

With the increasing prevalence of cyber threats, the IRS is expected to invest in advanced security protocols to protect user data and prevent fraud. This may include multi-factor authentication, advanced encryption technologies, and continuous monitoring to detect and mitigate potential threats.

Mobile App Integration

To further enhance accessibility, the IRS may develop a dedicated mobile app for the CTC Update Portal. A mobile app would provide users with a more convenient way to manage their CTC payments, offering real-time updates and notifications on the go.

Expanded Eligibility Criteria

The IRS may consider expanding the eligibility criteria for the enhanced Child Tax Credit to include more families. This could involve adjusting income thresholds or considering other factors that impact a family’s financial situation, ensuring that more families can access this crucial financial support.

Improved User Experience

Based on user feedback and analytics, the IRS is likely to make iterative improvements to the portal’s user experience. This may include simplifying certain processes, adding interactive tutorials, or incorporating user-friendly features to make the platform even more intuitive and accessible.

Integration with Other Tax Services

The IRS may explore the possibility of integrating the CTC Update Portal with other tax-related services, such as the Free File Program or the Taxpayer Advocate Service. This integration would provide a more holistic tax management experience for users, streamlining various tax processes into a single, centralized platform.

Continuous Education and Outreach

The IRS will likely continue its efforts to educate taxpayers about the Child Tax Credit and the benefits of the Update Portal. This may involve targeted outreach campaigns, workshops, and partnerships with community organizations to ensure that all eligible families are aware of this valuable resource.

How often should I update my information on the CTC Update Portal?

+It is recommended to update your information on the portal whenever there are significant changes in your personal or financial circumstances. This includes changes in address, banking details, marital status, or the number of qualifying children. Regularly updating your information ensures that your CTC payments are processed accurately and efficiently.

Can I opt out of the monthly CTC payments and receive a larger credit when filing my taxes?

+Yes, the IRS provides an option to unenroll from the monthly CTC payments. By unenrolling, you will receive the full credit amount when you file your taxes. However, it is important to carefully consider your financial needs and the potential benefits of receiving the credit in monthly installments.

What happens if I miss a deadline to update my information on the portal?

+Missing a deadline to update your information may result in delays or inaccuracies in your CTC payments. While the IRS may provide grace periods for certain updates, it is always best to stay on top of your obligations and update your information promptly to avoid any potential issues.

Is the Child Tax Credit Update Portal secure?

+Yes, the Child Tax Credit Update Portal is designed with robust security measures to protect your personal and financial information. The IRS uses advanced encryption technologies and regularly updates its security protocols to ensure the safety of user data. However, it is always important to practice good cybersecurity habits, such as using strong passwords and being cautious of potential phishing attempts.

How can I get help if I have issues with the CTC Update Portal?

+The IRS provides various resources and support channels for taxpayers using the CTC Update Portal. You can access the IRS website for comprehensive guides and FAQs, or you can contact the IRS directly through their toll-free helpline or online chat support. Additionally, tax professionals and community organizations can provide assistance and guidance in navigating the portal.