Ny State Retail Tax

The New York State Retail Tax is a vital component of the state's revenue system, contributing significantly to its economic infrastructure. Understanding this tax is crucial for both consumers and businesses operating within the state, as it impacts various aspects of retail operations and consumer experiences.

Understanding the New York State Retail Tax

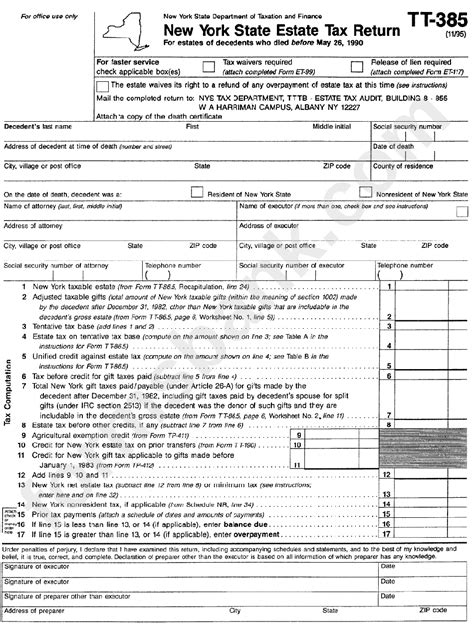

The New York State Retail Tax, often referred to as the sales tax, is a consumption tax imposed on the sale of goods and certain services. It is a critical revenue source for the state, helping to fund essential services, infrastructure development, and various government programs. This tax is administered by the New York State Department of Taxation and Finance, which sets the tax rates and oversees compliance.

Retail tax in New York operates on a destination-based principle, which means the tax rate applied to a purchase is determined by the location where the item is delivered or received, not the location of the seller. This is an important distinction, especially for online retailers, as it affects how tax obligations are calculated and collected.

Tax Rates and Exemptions

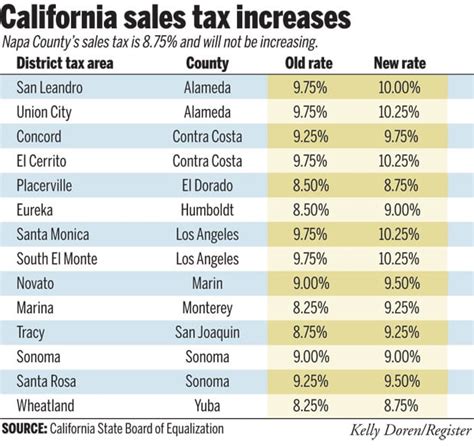

The tax rate for New York State Retail Tax varies across the state. The state sets a base tax rate, which is then supplemented by additional local and municipal taxes. This results in a combined sales tax rate that can differ significantly from one region to another. For instance, while the state’s base rate is 4%, this can rise to over 8% when local taxes are included, particularly in urban areas.

| Tax Type | Tax Rate |

|---|---|

| State Sales Tax | 4% |

| Average Local Sales Tax | 4% |

| Total Average Sales Tax | 8% |

Not all items are subject to the full retail tax rate. Certain goods and services are exempt or tax-free, such as prescription medications, some clothing items under a certain value, and certain agricultural products. Additionally, there are tax holidays during which specific items, often back-to-school supplies, are temporarily exempt from the sales tax.

Collection and Remittance Process

Businesses registered for sales tax in New York are responsible for collecting the appropriate tax from customers at the point of sale. This tax is then remitted to the state at regular intervals, typically monthly or quarterly, depending on the business’s sales volume. The process involves careful record-keeping and accurate reporting to ensure compliance with the state’s tax regulations.

For online retailers, the tax collection process is more complex due to the varying tax rates across the state. These businesses often utilize sales tax automation software to ensure they are collecting the correct tax amount based on the customer's shipping address.

Impact on Retail Businesses and Consumers

The New York State Retail Tax has a significant influence on the state’s retail landscape and consumer behavior.

Retail Business Operations

For retail businesses, the sales tax is an essential consideration in their operational strategies. They must factor in the tax when setting prices and consider the impact of the tax on customer purchasing decisions. The complexity of the tax system, with its varying rates and exemptions, often necessitates dedicated resources for tax compliance and management.

Businesses also need to stay informed about tax law changes, as these can significantly affect their operations. For example, changes in tax rates or the introduction of new tax holidays can impact pricing strategies and sales forecasts.

Consumer Perspective

From a consumer standpoint, the retail tax affects purchasing decisions and overall shopping experiences. Consumers in New York are accustomed to factoring the sales tax into their purchases, especially when making significant purchases. The varying tax rates across the state can also influence shopping patterns, with consumers potentially traveling to areas with lower tax rates to save money.

The tax system also plays a role in consumer awareness of local and state initiatives. For instance, tax-free weekends or holidays often generate buzz and encourage shopping, benefiting both consumers and local businesses.

Compliance and Enforcement

Ensuring compliance with the New York State Retail Tax is a key focus for the Department of Taxation and Finance. The department employs a range of strategies to enforce tax laws, including audits, investigations, and educational initiatives to help businesses and consumers understand their tax obligations.

For businesses, non-compliance can result in significant penalties, including fines and the revocation of business licenses. Therefore, many businesses invest in robust tax management systems and professional advice to ensure they are meeting their tax obligations accurately and on time.

Future Outlook and Potential Changes

The landscape of the New York State Retail Tax is subject to change, influenced by various factors including economic conditions, political decisions, and advancements in technology.

Potential Reforms

There have been ongoing discussions about potential reforms to the tax system, particularly regarding the sales tax. Some proposals suggest simplifying the tax structure by standardizing rates across the state or introducing a single state-wide rate, which could reduce the administrative burden on businesses and improve consistency for consumers.

Other potential reforms focus on expanding the tax base to include more services or adjusting tax rates to reflect the value of certain goods, such as luxury items, to generate additional revenue for the state.

Impact of E-commerce and Technology

The growth of e-commerce and advancements in technology have significantly impacted the retail tax landscape in New York. The state has implemented measures to ensure that online retailers, particularly those selling to New York residents, are collecting and remitting the appropriate taxes. This includes laws requiring out-of-state sellers to collect sales tax and the use of technology to track and report online sales.

Looking forward, the state may continue to adapt its tax laws to keep pace with the evolving e-commerce sector, ensuring that all businesses, regardless of their physical location, contribute to the state's revenue.

Conclusion

The New York State Retail Tax is a critical component of the state’s fiscal system, shaping the retail landscape and influencing consumer behavior. Its complexity, with varying rates and exemptions, presents both challenges and opportunities for businesses and consumers alike. As the state continues to adapt to economic changes and technological advancements, the retail tax system is likely to evolve, impacting the way retail businesses operate and consumers shop.

How often do businesses need to remit sales tax in New York?

+The frequency of sales tax remittance depends on a business’s sales volume. Businesses with higher sales volumes typically remit taxes more frequently, often on a monthly basis. Those with lower sales volumes may remit taxes quarterly.

Are there any tax-free days in New York?

+Yes, New York does have tax-free holidays. These are typically designated days where certain items, often back-to-school supplies, are exempt from sales tax. These holidays are designed to provide a temporary sales boost for retailers and savings for consumers.

How does New York handle sales tax for online purchases?

+New York has laws in place requiring online retailers to collect sales tax from customers residing in New York. This is done to ensure that all businesses, regardless of their physical location, contribute to the state’s revenue. Online retailers often use sales tax automation software to manage this process.