Santa Barbara Tax

Welcome to the comprehensive guide on Santa Barbara Tax, a topic of great interest to residents, businesses, and those considering relocating to this picturesque city. In this article, we will delve into the intricacies of Santa Barbara's tax system, exploring its unique features, implications, and the ways it shapes the local economy. From property taxes to sales taxes and beyond, we will provide an in-depth analysis, ensuring you have a thorough understanding of the fiscal landscape in this vibrant Southern California community.

Unraveling the Santa Barbara Tax Landscape

Santa Barbara, with its stunning coastline and rich cultural heritage, boasts a dynamic tax structure that supports its thriving economy. The city’s tax system is a crucial aspect of its financial framework, impacting individuals, businesses, and the overall development of the region. Let’s explore the key components that make up the Santa Barbara tax landscape.

Property Taxes: A Foundation of Santa Barbara’s Revenue

Property taxes play a pivotal role in Santa Barbara’s fiscal strategy. The city, like many other localities, relies on these taxes to fund essential services, infrastructure, and community initiatives. Here’s a breakdown of how property taxes work in Santa Barbara:

- Assessment: Properties within Santa Barbara County are assessed by the County Assessor’s Office to determine their taxable value. This value is often based on the property’s market value and is subject to change annually.

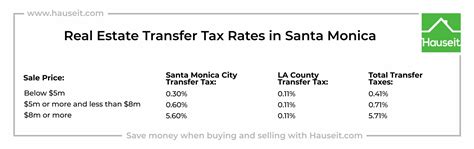

- Tax Rate: The property tax rate in Santa Barbara is determined by a combination of factors, including the general tax rate, special assessments for specific services or improvements, and voter-approved bonds for infrastructure projects. As of the last update, the general tax rate stood at 1% of the assessed value.

- Tax Bill: Property owners receive an annual tax bill, detailing the assessed value, applicable taxes, and any special assessments. These bills are typically due in two installments, with specific due dates determined by the county.

- Exemptions and Reductions: Santa Barbara offers various exemptions and reductions to certain property owners. For instance, seniors and disabled individuals may qualify for the Senior Citizens Exemption or the Disabled Veterans Exemption, reducing their taxable property value.

| Property Tax Statistics | Data |

|---|---|

| Average Property Tax Rate | 1.00% - 1.15% of Assessed Value |

| Median Property Tax Bill | 4,500 - 6,000 annually |

| Number of Property Owners | Over 150,000 |

Sales and Use Taxes: Capturing Revenue from Transactions

Santa Barbara, like the rest of California, imposes sales and use taxes on the sale of goods and services within the city. These taxes are a significant source of revenue for the local government and are used to fund a wide range of public services and infrastructure projects.

- Sales Tax: When you purchase goods or services in Santa Barbara, you are typically charged a sales tax. The rate consists of a statewide base rate (currently 7.25%) and any local add-on rates approved by the city or county. As of the latest update, the total sales tax rate in Santa Barbara stands at 8.75%, including the state base rate and local add-ons.

- Use Tax: Use tax is applicable when goods are purchased from out-of-state vendors and brought into Santa Barbara for use. This tax ensures that businesses and individuals pay their fair share, regardless of where the purchase is made. The use tax rate is usually the same as the sales tax rate, ensuring equity in taxation.

- Exemptions: Certain goods and services are exempt from sales tax in Santa Barbara. These include prescription medications, most groceries, and certain agricultural products. Additionally, non-profit organizations and government entities are often exempt from sales tax on their purchases.

| Sales and Use Tax Statistics | Data |

|---|---|

| Total Sales Tax Rate | 8.75% (as of 2023) |

| State Base Rate | 7.25% |

| Local Add-On Rate | 1.5% |

| Estimated Annual Revenue | $250 million (approx.) |

Business Taxes: Supporting the Local Economy

Santa Barbara recognizes the importance of its business community and has implemented a range of business taxes to support local commerce and development. These taxes not only generate revenue but also contribute to the city’s vibrant economic landscape.

- Business License Tax: All businesses operating within Santa Barbara are required to obtain a business license and pay an annual Business License Tax. The tax rate varies based on the type of business and its gross receipts. The city provides a user-friendly online calculator to help businesses determine their tax liability.

- Transient Occupancy Tax (TOT): This tax is imposed on the rent paid for temporary accommodations, such as hotels, motels, and vacation rentals. The TOT rate is typically 12% of the rent, and it is a significant source of revenue for the city, particularly in the thriving tourism sector.

- Gross Receipts Tax: Some businesses, especially those with high gross receipts, are subject to a Gross Receipts Tax. This tax is based on the total revenue generated by the business within Santa Barbara. The rate varies depending on the industry and the size of the business.

| Business Tax Statistics | Data |

|---|---|

| Business License Tax Rate | Varies based on business type and gross receipts |

| Transient Occupancy Tax (TOT) Rate | 12% of rental income |

| Estimated Annual Business Tax Revenue | $50 million (approx.) |

The Impact of Santa Barbara’s Tax System

Santa Barbara’s tax system has a profound impact on the city’s economy, shaping the financial landscape and influencing the decisions of residents, businesses, and investors. Let’s explore some of the key impacts and how they affect the community.

Economic Development and Job Creation

The tax revenue generated by Santa Barbara’s various taxes plays a crucial role in funding economic development initiatives. These initiatives include infrastructure projects, business incentives, and support for local industries. By investing in these areas, the city fosters an environment conducive to job creation and business growth.

- Infrastructure: Tax revenue is used to maintain and improve the city’s infrastructure, from roads and public transportation to utilities and public spaces. This not only enhances the quality of life for residents but also makes the city more attractive to businesses and investors.

- Business Support: The city offers a range of programs and incentives to attract and retain businesses. These may include tax breaks, grants, or low-interest loans, especially for startups and businesses in targeted industries. Such support encourages entrepreneurship and economic diversification.

- Workforce Development: Part of the tax revenue is dedicated to education and training programs, helping to develop a skilled workforce. This investment ensures that Santa Barbara has the talent pool needed to support its growing businesses and industries.

Community Services and Quality of Life

The taxes collected by Santa Barbara fund a wide array of community services and amenities, enhancing the overall quality of life for residents and visitors alike. These services contribute to the city’s reputation as a desirable place to live, work, and visit.

- Public Safety: A significant portion of the tax revenue is allocated to public safety services, including police, fire, and emergency medical services. These services ensure the safety and well-being of the community, fostering a sense of security.

- Healthcare: Tax dollars support local healthcare initiatives, such as public health programs, clinics, and hospitals. These services ensure that residents have access to quality healthcare, regardless of their financial situation.

- Education: Santa Barbara’s tax revenue helps fund public schools, ensuring that students receive a high-quality education. Additionally, the city supports after-school programs, adult education, and other educational initiatives that benefit the community.

- Recreation and Culture: Tax revenue contributes to the development and maintenance of parks, recreation centers, and cultural venues. These amenities enhance the city’s reputation as a vibrant and engaging place, attracting tourists and boosting the local economy.

Fiscal Responsibility and Long-Term Planning

Santa Barbara takes a proactive approach to fiscal management, ensuring that tax revenue is used responsibly and efficiently. The city’s commitment to financial stability and long-term planning is evident in its budgeting process and investment strategies.

- Budgeting: The city’s budgeting process is transparent and inclusive, involving community input and feedback. This ensures that tax revenue is allocated based on the needs and priorities of the residents. The budget is reviewed annually, allowing for adjustments to meet changing demands.

- Reserves and Contingency Planning: Santa Barbara maintains healthy reserves to ensure financial stability during economic downturns or emergencies. These reserves provide a buffer, allowing the city to continue essential services and invest in critical projects even during challenging times.

- Capital Improvement Projects: Tax revenue is allocated to long-term capital improvement projects, such as major infrastructure upgrades, new public buildings, and environmental initiatives. These projects not only enhance the city’s infrastructure but also create jobs and stimulate the local economy.

The Future of Santa Barbara’s Tax System

As Santa Barbara continues to evolve and grow, its tax system will play a pivotal role in shaping the city’s future. Here are some insights into how the tax landscape may change and adapt to meet the needs of the community.

Potential Tax Reforms and Initiatives

Santa Barbara’s tax system is subject to ongoing review and potential reforms to ensure fairness, efficiency, and sustainability. Here are some possible future initiatives:

- Property Tax Reform: With the ever-changing real estate market, there may be proposals to reform the property tax system to ensure it remains fair and equitable. This could involve adjustments to assessment methods or tax rates to better reflect the current market conditions.

- Sales Tax Modifications: As consumer spending patterns evolve, there may be discussions around modifying the sales tax structure. This could include expanding the list of exempt items or introducing incentives to encourage certain types of purchases, such as eco-friendly products or local goods.

- Business Tax Incentives: To attract and support businesses, the city may explore new tax incentives or modify existing ones. This could involve offering tax breaks for businesses that create jobs, invest in research and development, or adopt sustainable practices.

Impact of Technological Advancements

Technological advancements are transforming various aspects of life, including tax administration. Santa Barbara is likely to embrace these advancements to streamline tax processes and improve efficiency.

- Online Tax Payment and Filing: The city may continue to enhance its online platforms, allowing residents and businesses to pay taxes and file returns digitally. This not only simplifies the process for taxpayers but also reduces administrative costs for the city.

- Data Analytics: By leveraging data analytics, Santa Barbara can gain deeper insights into tax revenue trends, identify areas for improvement, and make more informed decisions about tax policy and allocation of resources.

- Blockchain and Cryptocurrency: As the use of blockchain and cryptocurrency grows, the city may explore ways to incorporate these technologies into its tax system. This could involve accepting cryptocurrency for tax payments or exploring the potential for a more secure and transparent tax collection process.

Community Engagement and Tax Awareness

Santa Barbara recognizes the importance of community engagement in shaping tax policies and ensuring transparency. The city is likely to continue its efforts to educate residents and businesses about the tax system and encourage active participation in the decision-making process.

- Town Hall Meetings: The city may organize more town hall meetings and community forums to discuss tax-related issues, allowing residents to voice their concerns and suggestions. These meetings provide a platform for open dialogue and help the city understand the needs and priorities of its residents.

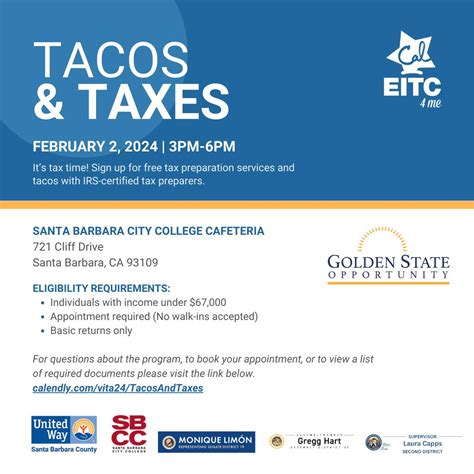

- Tax Education Programs: Santa Barbara may invest in tax education programs, especially for low-income residents and small businesses. These programs can help taxpayers understand their rights and responsibilities, ensuring they are compliant with tax laws and taking advantage of available tax benefits.

- Online Resources: The city can continue to enhance its online resources, providing easy access to tax information, forms, and guidelines. This ensures that residents and businesses can find the information they need quickly and conveniently.

Frequently Asked Questions

What is the average property tax rate in Santa Barbara?

+The average property tax rate in Santa Barbara typically falls between 1.00% and 1.15% of the assessed value of the property. However, it’s important to note that the actual rate can vary based on specific factors, such as the property’s location and any applicable special assessments.

Are there any property tax exemptions in Santa Barbara?

+Yes, Santa Barbara offers several property tax exemptions. These include the Senior Citizens Exemption, Disabled Veterans Exemption, and exemptions for certain agricultural lands and historic properties. It’s advisable to consult with the County Assessor’s Office or a tax professional to determine eligibility.

How much is the sales tax in Santa Barbara?

+The total sales tax rate in Santa Barbara is currently 8.75%, which includes the statewide base rate of 7.25% and local add-on rates. However, it’s important to note that sales tax rates can change, so it’s advisable to check the official Santa Barbara County website for the most up-to-date information.

Are there any sales tax exemptions in Santa Barbara?

+Yes, Santa Barbara, like many other areas in California, has certain sales tax exemptions. These include prescription medications, most groceries, and some agricultural products. Additionally, non-profit organizations and government entities are often exempt from sales tax on their purchases.

What is the Transient Occupancy Tax (TOT) in Santa Barbara?

+The Transient Occupancy Tax (TOT) is a tax imposed on the rent paid for temporary accommodations, such as hotels, motels, and vacation rentals. In Santa Barbara, the TOT rate is typically 12% of the rent, and it is a significant source of revenue for the city, particularly in the tourism sector.