City Of Dallas Property Tax

Welcome to an in-depth exploration of the City of Dallas' property tax system, a crucial aspect of urban governance that impacts homeowners, businesses, and the overall economic landscape. Understanding the intricacies of property taxes is essential for anyone navigating the real estate market in Dallas, as it influences investment decisions, budget planning, and the city's financial stability.

Understanding the Dallas Property Tax Landscape

The property tax system in Dallas, like in many other cities, serves as a primary revenue source for local governments, funding vital services and infrastructure projects. This article aims to demystify the complex world of property taxes, shedding light on how they are assessed, calculated, and applied in the City of Dallas.

Assessment and Appraisal Process

The journey of a property’s tax assessment begins with a comprehensive appraisal process. In Dallas, this is handled by the Dallas Central Appraisal District (DCAD), an independent entity responsible for determining the market value of each property within the city limits. DCAD employs certified appraisers who consider various factors, including:

- Market Conditions: The appraisers analyze recent sales of similar properties to establish a fair market value.

- Property Features: From the number of bedrooms to the square footage and any unique amenities, every detail is considered.

- Location: The property’s neighborhood, proximity to amenities, and any potential development plans can impact its value.

Once the appraisal is complete, property owners receive a notice of their appraised value, known as the Notice of Appraised Value. This document forms the basis for the subsequent tax calculation.

| Appraisal Timeline | Key Dates |

|---|---|

| Appraisal Period | January 1 to July 20 |

| Notice of Appraised Value | Around May |

| Protest Period | 30 days after receiving the notice |

Tax Rate Calculation

The appraised value is just one piece of the puzzle. The tax rate, set by various taxing entities, is another crucial factor. In Dallas, property taxes are levied by multiple entities, including the city, the county, and various special districts like school districts and utility districts.

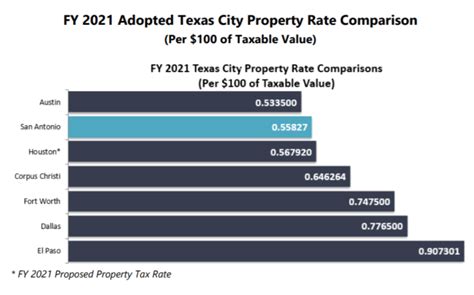

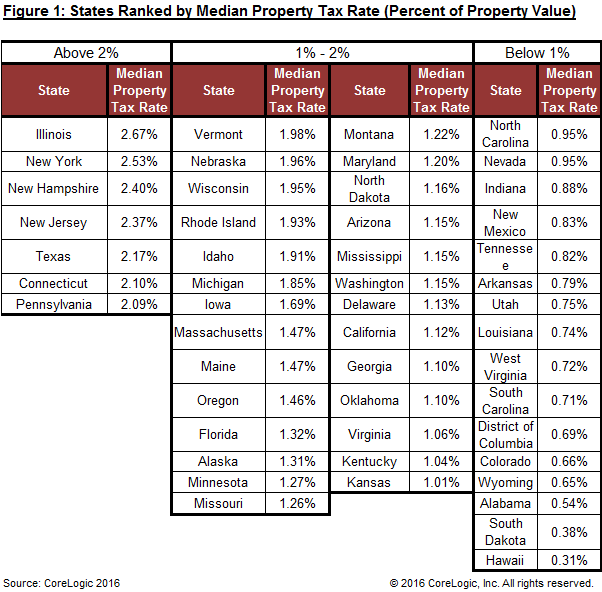

Each entity determines its tax rate based on its budgetary needs. These rates are expressed in dollars per $100 of the property's appraised value, known as the tax rate per hundred. For instance, a tax rate of $1.00 per hundred means that for every $100 of appraised value, the property owner will pay $1.00 in taxes.

The combined tax rate for all entities is known as the effective tax rate, which can vary significantly from one neighborhood to another.

| Taxing Entity | Tax Rate ($ per $100) |

|---|---|

| City of Dallas | $0.5856 |

| Dallas County | $0.3739 |

| Dallas ISD | $1.4200 |

| Other Special Districts | Varies |

Property Tax Calculation

Now, let’s delve into the calculation of the actual property tax amount. This is where the appraised value and the tax rate come together.

The formula for calculating property taxes is:

Property Tax = (Appraised Value / 100) x Tax Rate

Let's illustrate this with an example. Consider a residential property with an appraised value of $300,000. Using the tax rates from the table above, the calculation would be:

Property Tax = ($300,000 / 100) x ($0.5856 + $0.3739 + $1.4200 + Other Special District Rates)

Assuming the other special district rates are $0.7500, the calculation would be:

Property Tax = $3,000 x $2.73 ($0.5856 + $0.3739 + $1.4200 + $0.7500)

Resulting in a total property tax amount of $8,190 for the year.

Tax Payment Options and Due Dates

Once the tax amount is determined, property owners have various options for paying their taxes. The City of Dallas offers convenient payment methods, including online payments, payment by phone, and traditional mail-in payments. Property owners can also set up automatic payments to ensure timely payment without the hassle of remembering due dates.

The tax year in Dallas runs from January 1 to December 31. Property taxes are due by January 31 of the following year. However, early payment discounts are available. If paid by February 1, a 7% discount is applied, and if paid by March 31, a 3% discount is offered. Penalties and interest accrue on unpaid taxes starting from February 1.

Navigating Property Tax Appeals

The property tax system is not without its complexities, and sometimes, property owners may feel their appraisal value is inaccurate. In such cases, Dallas offers a protest process to ensure fairness and accuracy.

The Protest Process

If a property owner disagrees with their appraised value, they have the right to protest. The protest process in Dallas is straightforward and designed to be accessible to all property owners.

Here's a step-by-step guide to protesting your property taxes in Dallas:

- Review the Notice of Appraised Value: Carefully examine the notice to understand the appraised value and the factors considered.

- Determine the Grounds for Protest: Common reasons for protest include errors in property description, recent property damage, or a belief that the appraised value is higher than similar properties in the area.

- Submit a Protest: Property owners can protest online, by mail, or in person. The protest must be filed within 30 days of receiving the notice.

- Attend a Hearing: If the protest is not resolved through written communication, a hearing will be scheduled. Property owners can present their case to an independent panel of appraisers.

- Receive the Decision: The panel's decision will be mailed to the property owner, and if the protest is successful, the appraised value will be adjusted accordingly.

Key Considerations for Property Tax Appeals

When considering a property tax appeal, it's important to keep the following in mind:

- Timeliness: Protests must be filed within the specified timeframe to be considered.

- Evidence: Gathering supporting evidence, such as recent sales data of similar properties, can strengthen your case.

- Professional Assistance: While not required, engaging a property tax consultant or attorney can provide expert guidance and representation.

Conclusion: A Comprehensive Guide to Dallas Property Taxes

Understanding the intricacies of the City of Dallas' property tax system is essential for both residential and commercial property owners. From the appraisal process to tax rate calculations and payment options, this guide aims to provide a clear roadmap. Additionally, the protest process ensures that property owners have a voice and can advocate for fair and accurate assessments.

As you navigate the real estate landscape in Dallas, remember that property taxes are a vital component, impacting not only your financial planning but also the city's overall development and services. By staying informed and engaged, you can make informed decisions and contribute to the vibrant community of Dallas.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline can result in penalties and interest. The City of Dallas allows for a grace period until February 1, after which a 7% penalty is applied. If the taxes remain unpaid by March 31, an additional 3% penalty is added. Interest also accrues on the unpaid balance starting from February 1.

Are there any property tax exemptions available in Dallas?

+Yes, Dallas offers various property tax exemptions. These include exemptions for homeowners over 65, disabled veterans, and properties used for religious or charitable purposes. Each exemption has specific eligibility criteria and application processes. It’s advisable to consult with the Dallas Central Appraisal District or a tax professional for detailed information.

How often are property values reassessed in Dallas?

+Property values in Dallas are reassessed annually. The Dallas Central Appraisal District conducts a comprehensive appraisal process each year to ensure that property values reflect the current market conditions. This process ensures fairness and accuracy in the property tax system.