Fairfaxcounty Gov Taxes

Welcome to an in-depth exploration of the tax system in Fairfax County, Virginia, USA. As a vital component of the county's administration, the Fairfax County Government ensures the efficient collection of taxes to fund essential public services and infrastructure. This article will delve into the various aspects of the county's tax system, from property taxes to vehicle registration fees, providing a comprehensive understanding of the process and its impact on residents and businesses.

Understanding the Fairfax County Tax Structure

Fairfax County operates a robust tax system designed to support its vibrant community and infrastructure. The county collects a range of taxes, including property taxes, personal property taxes, vehicle registration fees, business taxes, and various other levies. These taxes are crucial for maintaining public services, such as education, public safety, transportation, and environmental initiatives.

The Fairfax County Board of Supervisors sets the tax rates annually, considering the needs of the community and the financial realities of the county. The board aims to strike a balance between providing essential services and ensuring tax burdens are manageable for residents and businesses.

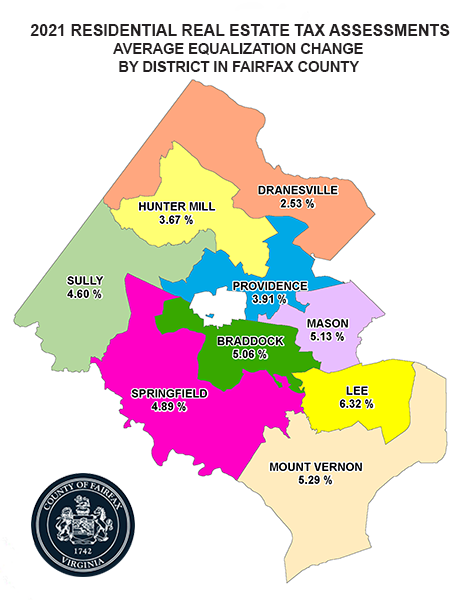

One of the key components of the county's tax structure is the real estate tax, which forms a significant portion of the county's revenue. This tax is levied on the assessed value of properties within the county, including residential, commercial, and industrial properties. The assessment process is conducted by the Fairfax County Office of Real Estate Assessments, which evaluates properties every year to ensure fair and accurate taxation.

| Tax Category | Rate (FY 2024) | Collection Period |

|---|---|---|

| Real Estate Tax | $1.165 per $100 of assessed value | June to December |

| Personal Property Tax | $4.75 per $100 of assessed value | March to November |

| Vehicle Registration Fee | Varies based on vehicle type and age | Annually, due by April 15th |

| Business License Tax | 0.25% of gross receipts | January to December |

In addition to these primary taxes, Fairfax County also imposes a range of other taxes and fees, such as the meals tax on food and beverage sales, utility taxes on various services, and hotel taxes for accommodation providers. These additional levies contribute to the county's revenue and support specific services or initiatives.

Property Taxes: A Closer Look

Property taxes in Fairfax County are a significant responsibility for homeowners and businesses. The tax is based on the assessed value of the property, which is determined by the county’s assessors. The assessment takes into account various factors, including the property’s location, size, age, and recent sales of comparable properties.

Homeowners receive an annual real estate tax bill, which details the assessed value of their property and the corresponding tax amount. This bill is typically sent out in June, with payments due by the end of December. The tax bill provides a clear breakdown of the tax calculation, allowing homeowners to understand the components that contribute to their tax liability.

For businesses, the property tax system operates similarly, with the Fairfax County Department of Tax Administration responsible for assessing and collecting these taxes. Business properties are assessed based on their use, location, and other relevant factors. The tax rate for business properties may differ from residential properties, reflecting the different services and infrastructure required to support commercial activities.

Personal Property Taxes: Vehicles and More

In addition to real estate taxes, Fairfax County also imposes a tax on personal property, which includes vehicles, boats, and other tangible assets. This tax is distinct from the property tax and is assessed and collected separately.

The personal property tax on vehicles is calculated based on the vehicle's assessed value and its age. Older vehicles typically have lower assessments, resulting in lower tax liabilities. The tax rate for personal property is set annually by the county and is applied uniformly across all personal property categories.

To ensure compliance, vehicle owners are required to register their vehicles annually with the Fairfax County Department of Tax Administration. The registration process involves providing vehicle information, such as make, model, and vehicle identification number (VIN), and paying the corresponding tax. Failure to register a vehicle can result in penalties and fines.

Other personal property, such as boats and recreational vehicles, are also subject to taxation. The assessment and collection process for these items is similar to that of vehicles, with the tax rate determined by the county and based on the item's assessed value.

Vehicle Registration Fees: Keeping Fairfax County Moving

Vehicle registration fees in Fairfax County are an essential component of the county’s transportation infrastructure funding. These fees contribute to the maintenance and improvement of roads, bridges, and public transportation systems, ensuring a safe and efficient transportation network for residents and commuters.

The vehicle registration fee varies depending on the type of vehicle and its age. Passenger vehicles, for instance, have a lower fee compared to commercial vehicles or motorcycles. The fee also increases with the age of the vehicle, as older vehicles typically require more maintenance and contribute less to road use tax revenue.

Vehicle registration in Fairfax County is managed by the Virginia Department of Motor Vehicles (DMV). Residents must register their vehicles annually, providing necessary documentation such as proof of insurance, vehicle title, and emission test results. The registration process can be completed online, by mail, or in person at a local DMV office.

The timely payment of vehicle registration fees is crucial to avoid penalties and ensure uninterrupted vehicle usage. Late payments can result in additional charges and may affect the vehicle's registration status, impacting the owner's ability to operate the vehicle legally.

Fairfax County’s Business Taxes: Supporting Local Enterprises

Fairfax County is home to a thriving business community, and the county’s tax system plays a crucial role in supporting and fostering this economic environment. The Fairfax County Government imposes various taxes and fees on businesses to generate revenue and ensure the availability of resources for essential services.

One of the primary taxes levied on businesses is the business license tax, which is based on the gross receipts of the business. This tax is designed to be proportional to the business's scale and success, with larger businesses contributing more to the county's revenue. The tax rate is set annually by the county and is applied uniformly across all businesses.

In addition to the business license tax, Fairfax County also imposes a business, professional, and occupational license tax (BPOL tax) on certain professions and occupations. This tax is intended to capture revenue from service-based businesses and professionals, ensuring that all businesses contribute to the county's revenue stream.

The Fairfax County Department of Tax Administration is responsible for administering and collecting these business taxes. Businesses are required to obtain the necessary licenses and permits and pay the corresponding taxes to operate legally within the county. The department provides resources and guidance to help businesses understand their tax obligations and ensure compliance.

Tax Incentives and Support for Businesses

Recognizing the importance of a robust business community, Fairfax County offers a range of tax incentives and support programs to attract and retain businesses. These initiatives aim to foster economic growth, create jobs, and stimulate the local economy.

One such incentive is the Enterprise Zone Tax Credit, which provides eligible businesses with a tax credit for investing in designated Enterprise Zones within the county. These zones are typically areas that have been identified as needing economic development and support. Businesses that invest in these zones can benefit from reduced tax liabilities, helping to offset the costs of establishing or expanding their operations.

Fairfax County also offers a Small Business Development Center (SBDC), which provides free business consulting and training services to small businesses. The SBDC helps businesses navigate the complexities of starting, managing, and growing a business, including understanding tax obligations and compliance requirements. This support is crucial for ensuring that small businesses can thrive and contribute to the county's economic vitality.

Community Impact and Tax Equity

The tax system in Fairfax County is designed to be fair and equitable, ensuring that all residents and businesses contribute their fair share to the community’s well-being. The county strives to balance the need for revenue with the financial realities of its residents, aiming to provide essential services without imposing excessive tax burdens.

To achieve tax equity, the county employs a range of strategies. One such strategy is the tax relief program, which provides assistance to eligible residents facing financial hardships. This program offers reduced tax rates or deferred payments for those who meet specific criteria, ensuring that financial difficulties do not prevent residents from accessing essential services.

The county also prioritizes transparency and accountability in its tax system. The Fairfax County Department of Tax Administration provides detailed information on tax rates, assessment processes, and payment schedules, ensuring that residents and businesses have the information they need to understand their tax obligations. This transparency builds trust and ensures that the tax system is perceived as fair and just.

Additionally, the county actively engages with the community to understand their needs and concerns regarding taxation. Regular public meetings and feedback sessions provide an opportunity for residents and businesses to voice their opinions and influence the tax policy-making process. This community engagement helps ensure that the tax system remains responsive to the needs and aspirations of the county's diverse population.

Conclusion

The tax system in Fairfax County, Virginia, is a comprehensive and well-designed framework that supports the county’s vibrant community and infrastructure. From property taxes to business taxes, each component plays a crucial role in funding essential services and maintaining the county’s high quality of life.

By understanding the various taxes and fees imposed by the county, residents and businesses can navigate the tax system with confidence, ensuring compliance and contributing to the community's prosperity. The Fairfax County Government continues to refine and improve its tax policies, ensuring a fair and equitable system that benefits all residents and supports the county's continued growth and development.

How often do Fairfax County residents receive their real estate tax bill?

+Fairfax County residents receive their real estate tax bill annually, typically in June. The bill details the assessed value of their property and the corresponding tax amount. The tax is due by the end of December, allowing residents ample time to make payments.

What is the role of the Fairfax County Department of Tax Administration?

+The Fairfax County Department of Tax Administration is responsible for assessing and collecting various taxes, including real estate taxes, personal property taxes, and business taxes. They provide resources and guidance to ensure tax compliance and assist residents and businesses in understanding their tax obligations.

Are there any tax incentives for businesses in Fairfax County?

+Yes, Fairfax County offers tax incentives to attract and retain businesses. One such incentive is the Enterprise Zone Tax Credit, which provides tax credits for businesses investing in designated Enterprise Zones. The county also provides support through its Small Business Development Center, offering free consulting and training services to small businesses.

How does Fairfax County ensure tax equity and fairness?

+Fairfax County strives for tax equity by offering tax relief programs to eligible residents facing financial hardships. The county also prioritizes transparency and accountability, providing detailed information on tax rates and assessment processes. Regular community engagement sessions allow residents and businesses to influence tax policies, ensuring a fair and just system.