Sales Tax Rate In La

The sales tax landscape in the United States is complex and varies greatly from state to state, and even within cities and counties. Los Angeles, often referred to as LA, is no exception. This article aims to delve into the specifics of the sales tax rate in LA, exploring the various factors that influence it and providing a comprehensive understanding of this crucial aspect of consumer transactions in the city.

Understanding the Sales Tax Rate in Los Angeles

The sales tax rate in Los Angeles is not a singular, static number. It is a combination of various tax rates imposed by different governmental entities, each serving a unique purpose and contributing to the overall tax burden on consumers.

State Sales Tax

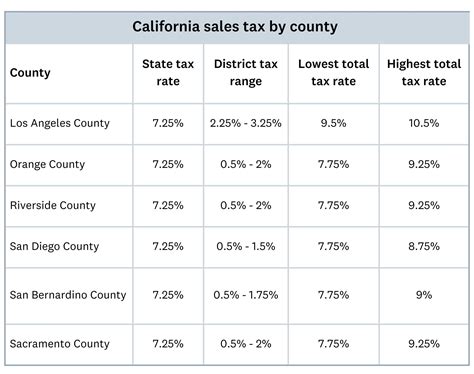

California, the state in which Los Angeles is located, imposes a statewide sales and use tax rate of 7.25%. This rate is applicable to most retail transactions, including the sale of tangible personal property and some services. The state tax rate serves as a foundation for the overall sales tax rate in LA, but it is not the only component.

County Sales Tax

In addition to the state tax, Los Angeles County imposes its own countywide sales and use tax, often referred to as the “LA County Tax.” As of [Date], the LA County Tax rate stands at 0.25%, bringing the total sales tax rate to 7.50% for most goods and services within the county.

City Sales Tax

Los Angeles, as a city, has the authority to impose its own municipal sales tax on top of the state and county rates. The LA City Sales Tax is currently set at 0.50%, making the total sales tax rate within the city of Los Angeles 8.00% for many purchases.

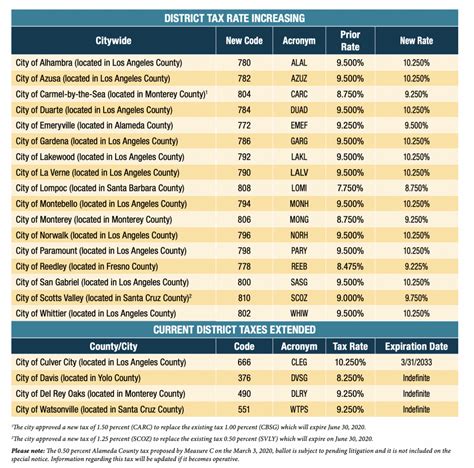

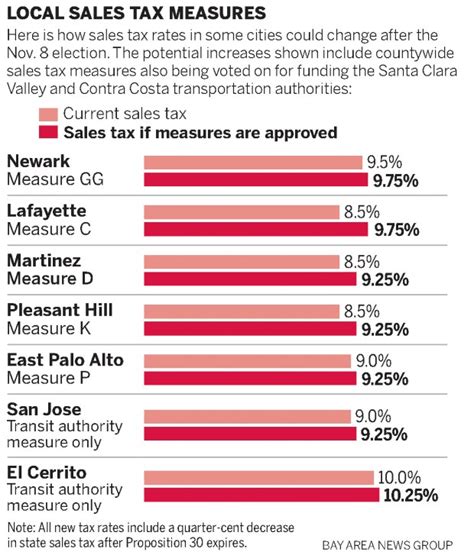

Special District Taxes

Beyond the state, county, and city taxes, Los Angeles is also home to various special districts, each with its own tax authority. These special districts, which can include transportation districts, healthcare districts, and other specific-purpose entities, may impose additional sales taxes to fund their operations. The rates and applicability of these taxes can vary widely, often depending on the specific district and the type of transaction.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of California | 7.25% |

| Los Angeles County | 0.25% |

| City of Los Angeles | 0.50% |

| Special Districts (varies) | Varies |

| Total Sales Tax Rate in LA | 8.00% (or higher with special district taxes) |

Sales Tax Exemptions and Special Considerations

While the general sales tax rate in LA is 8.00%, there are certain transactions and items that are exempt from sales tax or subject to reduced rates. These exemptions and special considerations are designed to promote specific policies or provide relief to certain industries or consumers.

Food and Groceries

In California, certain food items and groceries are subject to a reduced sales tax rate of 1.25%. This reduced rate applies to unprepared foods, such as raw produce, meats, and dairy products. However, it does not apply to restaurant meals or prepared foods, which are taxed at the full rate.

Clothing and Shoes

California offers a clothing exemption for sales tax. Clothing and footwear items priced below a certain threshold, which varies by county, are exempt from sales tax. In Los Angeles County, the threshold is 110</strong>, meaning items priced at 110 or less are not subject to sales tax.

Prescription Drugs

Sales tax does not apply to the sale of prescription drugs in California. This exemption aims to reduce the financial burden on individuals who require essential medications.

Fuel and Energy

The sales tax rate on fuel and energy products, such as gasoline and electricity, is reduced in California. This reduction is designed to alleviate the tax burden on these essential commodities and is often set at a rate lower than the standard sales tax.

Temporary Sales Tax Relief

In response to economic downturns or specific circumstances, California and its local governments may implement temporary sales tax relief programs. These programs can take various forms, such as reduced tax rates or rebates, to stimulate consumer spending and support local businesses.

Compliance and Enforcement

Ensuring compliance with the complex sales tax landscape in Los Angeles is a critical responsibility for businesses operating in the city. Failure to comply with sales tax regulations can result in significant penalties and legal consequences. The California Department of Tax and Fee Administration (CDTFA) is responsible for overseeing sales tax compliance and enforcement in the state.

Registration and Reporting

Businesses that make taxable sales in Los Angeles must register with the CDTFA and obtain a Seller’s Permit. This permit authorizes the business to collect and remit sales tax on behalf of the state, county, and city. Registered businesses are required to file periodic sales tax returns, reporting their taxable sales and remitting the corresponding tax amounts.

Audit and Investigation

The CDTFA has the authority to audit businesses to ensure compliance with sales tax regulations. Audits can cover a range of areas, including the accuracy of sales tax reporting, proper collection of tax, and adherence to tax exemption rules. Businesses found to be in violation of sales tax laws may face penalties, interest charges, and even criminal prosecution in severe cases.

Future Implications and Potential Changes

The sales tax rate in Los Angeles, like many other tax policies, is subject to change over time. Economic conditions, political shifts, and changes in consumer behavior can all influence the future direction of sales tax rates and policies.

Economic Considerations

During periods of economic growth, governments may choose to maintain or increase sales tax rates to generate additional revenue for public services and infrastructure projects. Conversely, in times of economic downturn, sales tax rates may be reduced or temporary relief measures may be implemented to stimulate spending and support businesses.

Political Influences

The political landscape can also significantly impact sales tax rates. Elected officials and policymakers may propose changes to sales tax policies to align with their political agendas or respond to constituent demands. For example, a new administration or a shift in political power could lead to proposals for tax reform, including potential changes to sales tax rates or structures.

Consumer Behavior and E-Commerce

The rise of e-commerce and online shopping has introduced new challenges and opportunities for sales tax collection. As consumers increasingly make purchases online, states and local governments are exploring ways to ensure fair tax collection from out-of-state sellers. This includes the implementation of economic nexus laws, which require remote sellers to collect and remit sales tax if they exceed a certain sales threshold in a state or locality.

Conclusion: Navigating the Sales Tax Landscape in LA

Understanding the sales tax rate in Los Angeles is essential for both businesses and consumers. For businesses, accurate compliance with sales tax regulations is critical to avoid legal issues and maintain a positive relationship with the local community. For consumers, knowledge of the sales tax rate and applicable exemptions can help them make informed purchasing decisions and budget effectively.

The sales tax landscape in LA is dynamic and complex, with various rates and considerations to navigate. By staying informed about these tax policies and staying compliant with sales tax regulations, businesses and consumers can contribute to the economic health and well-being of the city.

Are there any online resources to help businesses understand and manage their sales tax obligations in Los Angeles?

+Yes, the California Department of Tax and Fee Administration (CDTFA) provides a wealth of resources and tools to assist businesses in understanding their sales tax obligations. This includes online guides, webinars, and a dedicated help center. Businesses can also utilize tax preparation software and services that specialize in sales tax compliance to ensure accurate reporting and filing.

How often do sales tax rates change in Los Angeles, and how can businesses stay updated on these changes?

+Sales tax rates can change periodically, often in response to legislative actions or special initiatives. Businesses can stay updated on these changes by subscribing to tax news services, monitoring local government websites, and utilizing tax compliance software that provides real-time updates on tax rate changes.

Are there any tax incentives or programs available to support businesses in Los Angeles?

+Yes, California and Los Angeles offer various tax incentives and programs to support businesses, especially those that are locally owned or focused on specific industries. These incentives can include tax credits, reduced tax rates, and grant programs. Businesses can explore these opportunities through local economic development agencies and business support organizations.