Sales Tax For Tampa Fl

Sales tax is an essential aspect of commerce, impacting both consumers and businesses alike. In the United States, sales tax regulations vary from state to state, and even within states, there can be different tax rates and rules. This article will delve into the specifics of sales tax in Tampa, Florida, exploring the rates, applicability, and potential implications for both residents and businesses operating in this vibrant city.

Understanding Sales Tax in Tampa, FL

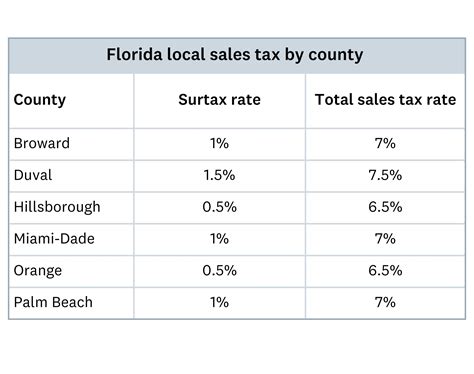

Tampa, located in Hillsborough County, Florida, is subject to a unique combination of state, county, and municipal sales tax rates. This layered structure can make understanding the total sales tax a bit complex, but it’s crucial for both consumers and businesses to grasp these rates to ensure compliance and avoid potential penalties.

State Sales Tax

Florida, known for its sunny beaches and diverse attractions, imposes a state sales tax rate of 6%. This rate is applied to most tangible personal property and certain services. The state sales tax is a vital revenue stream for Florida, contributing to the funding of various state-wide projects and initiatives.

County Sales Tax

In addition to the state sales tax, Hillsborough County, where Tampa is located, levies its own county sales tax of 1%. This additional tax is used to support county-wide projects and infrastructure, ensuring the continued development and maintenance of the area.

Municipal Sales Tax

The city of Tampa further imposes a municipal sales tax of 1.5%. This tax is specifically dedicated to supporting the city’s operations and initiatives, including local infrastructure, public safety, and community development projects.

| Sales Tax Type | Rate |

|---|---|

| State Sales Tax | 6% |

| County Sales Tax (Hillsborough) | 1% |

| Municipal Sales Tax (Tampa) | 1.5% |

When combined, the total sales tax rate in Tampa, Florida is 9%. This rate is applicable to most retail sales, including goods purchased from stores, online retailers, and even certain services. However, it's important to note that there are exemptions and special considerations for certain items and situations, which we will explore further.

Sales Tax Exemptions and Special Cases

While the general sales tax rate in Tampa is 9%, there are specific scenarios where sales tax may not apply or where it is subject to different rates. Understanding these exemptions and special cases is crucial for both consumers and businesses to ensure accurate tax compliance.

Food and Groceries

One notable exemption in Tampa’s sales tax structure is for the sale of unprepared food and groceries. Under Florida law, the sale of items such as fresh produce, meat, dairy products, and other staple groceries is exempt from state sales tax. This exemption extends to most non-prepared food items, offering some relief to consumers’ grocery budgets.

Prescription Drugs

The sale of prescription drugs is another category exempt from state sales tax in Florida. This exemption applies to both over-the-counter medications and those requiring a prescription. It’s important to note, however, that sales tax may still apply to non-essential items sold within pharmacies, such as cosmetics or personal care products.

Manufacturing and Resale

For businesses engaged in manufacturing or wholesale operations, there are special considerations regarding sales tax. In Tampa, manufacturers and wholesale distributors are typically not required to pay sales tax on purchases made for resale. This exemption encourages economic growth and allows businesses to operate more efficiently.

Real Estate

The sale of real estate in Tampa is subject to a different tax structure known as documentary stamp tax. This tax is levied on deeds, mortgages, and other documents related to the transfer of real property. The rate varies depending on the type of transaction and the value of the property involved.

Compliance and Enforcement

Ensuring compliance with sales tax regulations is a shared responsibility between businesses and consumers. In Tampa, the Florida Department of Revenue is responsible for overseeing sales tax compliance and enforcing the relevant laws.

Businesses operating in Tampa must obtain a sales tax permit and collect the appropriate sales tax on taxable transactions. They are also required to file regular sales tax returns and remit the collected taxes to the state. Failure to comply with these obligations can result in penalties, interest charges, and even legal consequences.

For consumers, it's important to understand that while they may not directly handle the collection and remittance of sales tax, they still play a role in the process. By purchasing goods and services subject to sales tax, consumers indirectly contribute to the tax revenue that supports the community and the state. It's essential to be aware of the applicable sales tax rates and to ask for clarification if needed.

The Impact of Sales Tax on Businesses and Consumers

Sales tax can have a significant impact on both businesses and consumers in Tampa. For businesses, the collection and remittance of sales tax can add administrative burdens and potentially affect pricing strategies. However, it’s also a necessary cost of doing business, as it contributes to the overall economic health of the community and supports essential services.

For consumers, sales tax can influence purchasing decisions and overall spending habits. The 9% sales tax rate in Tampa may impact the affordability of certain goods and services, particularly for those on a tight budget. However, it's important to note that the revenue generated from sales tax supports vital community initiatives and infrastructure projects, ultimately benefiting the residents of Tampa.

Future Outlook and Potential Changes

Sales tax regulations are subject to change over time, influenced by various factors such as economic conditions, political decisions, and public opinion. In Tampa, there have been discussions and proposals for potential modifications to the sales tax structure, including the possibility of increasing or decreasing rates, expanding exemptions, or introducing new tax categories.

While it's difficult to predict the future with certainty, staying informed about potential changes is crucial for both businesses and consumers. Keeping an eye on local news, attending community meetings, and engaging with local government representatives can help individuals and businesses stay ahead of any potential shifts in sales tax regulations.

Additionally, as e-commerce continues to grow, there may be further discussions and developments regarding the collection and enforcement of sales tax for online transactions. This could have significant implications for both online retailers and consumers, potentially affecting the pricing and availability of goods purchased online.

Frequently Asked Questions

What is the current sales tax rate in Tampa, FL?

+The current sales tax rate in Tampa, Florida is 9%, which includes the state sales tax of 6%, the county sales tax of 1%, and the municipal sales tax of 1.5%.

Are there any sales tax exemptions in Tampa?

+Yes, there are several sales tax exemptions in Tampa. The sale of unprepared food and groceries, prescription drugs, and certain manufacturing and wholesale transactions are exempt from state sales tax. Additionally, the sale of real estate is subject to a different tax structure known as documentary stamp tax.

How often do businesses need to file sales tax returns in Tampa?

+Businesses in Tampa are typically required to file sales tax returns on a monthly, quarterly, or annual basis, depending on their sales volume and tax liability. It’s important for businesses to consult with the Florida Department of Revenue to determine their specific filing frequency.

What happens if a business fails to collect or remit sales tax in Tampa?

+Failing to collect or remit sales tax in Tampa can result in significant penalties and interest charges. The Florida Department of Revenue may impose fines, assess additional taxes, and even pursue legal action against non-compliant businesses. It’s crucial for businesses to understand their obligations and seek professional guidance if needed.

Are there any special considerations for online retailers in Tampa regarding sales tax?

+Yes, online retailers operating in Tampa or selling to Tampa residents must comply with sales tax regulations. They are responsible for collecting and remitting sales tax on taxable transactions, including online sales. The specific requirements may vary depending on the nature of the business and the jurisdiction in which the transaction occurs.

In conclusion, understanding the sales tax landscape in Tampa, Florida is crucial for both businesses and consumers. With a combined sales tax rate of 9%, residents and businesses contribute to the funding of essential services and community initiatives. By staying informed about sales tax regulations, exemptions, and potential changes, individuals and businesses can ensure compliance, avoid penalties, and actively participate in the economic vitality of Tampa.