San Diego Taxes

Welcome to an in-depth exploration of San Diego's tax landscape! As one of the most vibrant cities in California, San Diego boasts a dynamic economy and a unique tax system. Understanding the city's tax structure is crucial for both residents and businesses, as it impacts financial planning, investment decisions, and overall financial well-being. In this comprehensive guide, we will delve into the intricacies of San Diego taxes, shedding light on the various tax obligations, rates, and strategies to navigate this complex yet crucial aspect of living and doing business in this beautiful coastal metropolis.

Unraveling San Diego’s Tax Structure

San Diego’s tax system is a multifaceted entity, comprising a blend of local, state, and federal taxes. This section aims to provide a clear breakdown of these taxes, offering insights into how they function and impact the city’s residents and businesses.

Federal Taxes: The Backbone of San Diego’s Revenue

The federal government levies a range of taxes that significantly contribute to San Diego’s revenue stream. These taxes include income tax, payroll tax, and excise taxes. For individuals, the federal income tax rate can vary depending on income brackets, with rates ranging from 10% to 37%. Businesses, on the other hand, face a corporate tax rate of 21% on their profits. Additionally, the federal government imposes payroll taxes, such as Social Security and Medicare taxes, on both employees and employers, ensuring a steady flow of funds into the city’s coffers.

State Taxes: California’s Contribution

California, known for its robust tax system, plays a crucial role in San Diego’s tax structure. The state levies income tax, sales tax, and various other taxes. For individuals, the state income tax rate stands at 1%, with additional rates ranging from 1.75% to 12.3% depending on income levels. Businesses, meanwhile, face a complex web of sales and use taxes, with rates varying based on the type of goods and services provided. California’s robust tax system ensures a steady stream of revenue for the state, which is then distributed to cities like San Diego to support public services and infrastructure.

Local Taxes: San Diego’s Unique Contribution

San Diego, like many other cities, has its own set of local taxes that contribute to the city’s budget. These taxes include property taxes, which are levied on the assessed value of real estate within the city limits. The city also imposes a business tax, which varies depending on the type and size of the business. Additionally, San Diego has a transient occupancy tax, which is applied to hotel stays, further bolstering the city’s revenue. These local taxes are essential for funding city services, from maintaining public parks to providing essential services like police and fire protection.

| Tax Type | Rate | Description |

|---|---|---|

| Federal Income Tax | 10% - 37% | Varies based on income brackets for individuals. |

| Corporate Tax | 21% | Applied to business profits. |

| State Income Tax | 1% - 12.3% | Varies based on income levels for individuals. |

| Sales and Use Tax | Varies | Rates differ based on goods and services. |

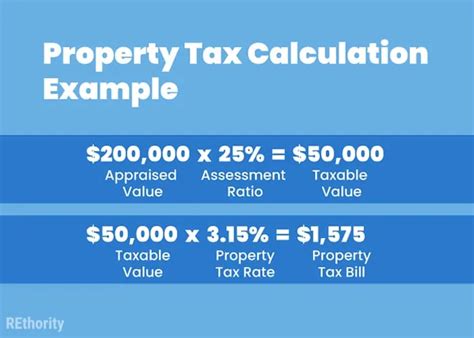

| Property Tax | Varies | Based on assessed real estate value. |

| Business Tax | Varies | Depends on business type and size. |

| Transient Occupancy Tax | Varies | Applied to hotel stays. |

Tax Strategies for San Diego Residents and Businesses

Navigating San Diego’s tax landscape requires a strategic approach. This section will delve into effective tax strategies that residents and businesses can employ to optimize their financial positions while fulfilling their tax obligations.

Maximizing Deductions and Credits for Individuals

Individuals in San Diego can benefit from a range of deductions and tax credits to reduce their overall tax burden. These include mortgage interest deductions, charitable donation deductions, and various tax credits such as the Child Tax Credit and the Earned Income Tax Credit. By carefully planning their financial strategies and taking advantage of these deductions and credits, individuals can minimize their tax liability and maximize their after-tax income.

Business Tax Optimization: A Strategic Approach

Businesses operating in San Diego have several avenues to optimize their tax positions. This includes leveraging business expenses to reduce taxable income, such as deducting costs associated with running the business, including rent, utilities, and employee salaries. Additionally, businesses can explore tax incentives and credits offered by the state and local governments, which can significantly reduce their tax liabilities. By strategically planning their financial operations and staying informed about available tax benefits, businesses can enhance their financial health while contributing to the local economy.

Estate Planning and Tax Strategies

For high-net-worth individuals in San Diego, estate planning becomes a crucial aspect of tax optimization. By employing strategies such as gift-giving, establishing trusts, and utilizing life insurance policies, individuals can minimize the tax impact on their estates. These strategies not only reduce the tax burden but also ensure that their wealth is distributed according to their wishes. Effective estate planning can also help individuals preserve their wealth for future generations, making it an essential component of financial security in San Diego.

| Tax Strategy | Description |

|---|---|

| Deductions and Credits | Individuals can utilize deductions for mortgage interest, charitable donations, and tax credits like the Child Tax Credit to reduce tax liability. |

| Business Expense Deductibility | Businesses can reduce taxable income by deducting legitimate business expenses. |

| Tax Incentives and Credits | Businesses should explore state and local tax incentives to reduce tax liabilities. |

| Estate Planning | High-net-worth individuals can minimize estate taxes through strategic gift-giving, trusts, and life insurance policies. |

The Impact of San Diego’s Taxes on Economic Development

San Diego’s tax structure plays a pivotal role in shaping the city’s economic landscape. This section will explore how the city’s tax policies influence economic development, business growth, and the overall financial health of the region.

Attracting Businesses: A Balanced Tax Approach

San Diego’s tax policies are designed to create a business-friendly environment, attracting and retaining businesses. The city’s balanced approach to taxation, which includes competitive business tax rates and a range of tax incentives, makes it an attractive destination for companies. By offering a favorable tax environment, San Diego encourages business growth, job creation, and economic diversification, all of which contribute to the city’s long-term economic prosperity.

Promoting Economic Diversity: A Key to Resilience

San Diego’s tax system supports economic diversity by encouraging growth in various sectors. The city’s tax policies are tailored to support industries such as biotechnology, defense, and tourism, which are key contributors to the local economy. By fostering economic diversity, San Diego reduces its reliance on any single industry, making the city more resilient to economic downturns and ensuring a stable economic future.

Investing in Infrastructure: The Role of Taxes

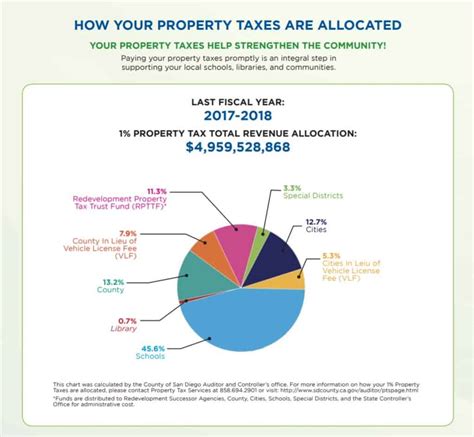

San Diego’s tax revenue is crucial for funding essential infrastructure projects. The city’s tax system ensures a steady flow of funds for maintaining and improving roads, bridges, public transportation, and other vital infrastructure. This investment in infrastructure not only enhances the city’s livability but also attracts businesses and residents, further boosting the local economy. Effective tax collection and allocation play a vital role in San Diego’s ongoing economic development and urban planning.

| Economic Impact | Description |

|---|---|

| Business Attraction | San Diego's tax policies create a business-friendly environment, attracting and retaining companies. |

| Economic Diversity | Tax policies support growth in various sectors, reducing reliance on any single industry. |

| Infrastructure Investment | Tax revenue funds essential infrastructure projects, enhancing the city's livability and economic appeal. |

Future Outlook: Navigating Tax Changes in San Diego

As San Diego continues to evolve, its tax landscape is also subject to change. This section will discuss the potential future developments in San Diego’s tax system, exploring how these changes could impact residents and businesses.

Potential Tax Reform: Implications and Opportunities

The future of San Diego’s tax system may involve potential reforms, which could significantly impact the city’s residents and businesses. These reforms could include changes in tax rates, deductions, and credits, as well as the introduction of new taxes or the elimination of existing ones. Understanding these potential changes and their implications is crucial for financial planning and business strategy. By staying informed and adaptable, residents and businesses can position themselves to take advantage of new opportunities and navigate any challenges that arise.

The Role of Technology in Tax Administration

The advancement of technology is set to play a pivotal role in San Diego’s tax administration. The city is likely to leverage digital tools and platforms to streamline tax processes, enhance efficiency, and improve taxpayer experiences. This could include the implementation of online filing systems, real-time tax payment options, and the use of data analytics for more accurate tax assessments. As technology continues to evolve, San Diego’s tax administration is poised to become more efficient and taxpayer-friendly, reducing the administrative burden on both residents and businesses.

Sustainable Tax Strategies: A Focus on the Future

San Diego’s future tax strategies are likely to emphasize sustainability and long-term economic health. This could involve the development of tax policies that promote environmental sustainability, such as incentives for green technologies and renewable energy. Additionally, the city may focus on tax policies that support social equity and inclusivity, ensuring that tax burdens are distributed fairly and that all residents have access to essential services. By adopting sustainable tax strategies, San Diego can position itself for long-term economic prosperity and social well-being.

| Future Tax Trends | Description |

|---|---|

| Potential Tax Reform | Changes in tax rates, deductions, and credits could impact financial planning and business strategy. |

| Technology in Tax Administration | Digital tools and platforms will enhance tax processes and taxpayer experiences. |

| Sustainable Tax Strategies | San Diego may focus on tax policies promoting environmental sustainability and social equity. |

What is the current federal income tax rate for individuals in San Diego?

+The federal income tax rate for individuals in San Diego varies depending on income brackets, ranging from 10% to 37%.

How do state sales and use taxes work in San Diego?

+Sales and use taxes in San Diego vary based on the type of goods and services. Businesses are responsible for collecting and remitting these taxes to the state.

What tax incentives are available for businesses in San Diego?

+San Diego offers a range of tax incentives to businesses, including tax credits for job creation, research and development, and investment in certain industries. Businesses should consult with tax professionals to explore these opportunities.

How can individuals in San Diego maximize their tax refunds?

+Individuals can maximize their tax refunds by taking advantage of deductions and credits, such as the Child Tax Credit and mortgage interest deductions. It’s essential to keep detailed records and consult with tax professionals for optimal results.

What is the impact of San Diego’s taxes on its real estate market?

+San Diego’s property taxes can influence the real estate market. While they contribute to the city’s revenue and fund essential services, they can also impact the affordability of housing for residents. Balancing tax rates is crucial for maintaining a healthy real estate market.