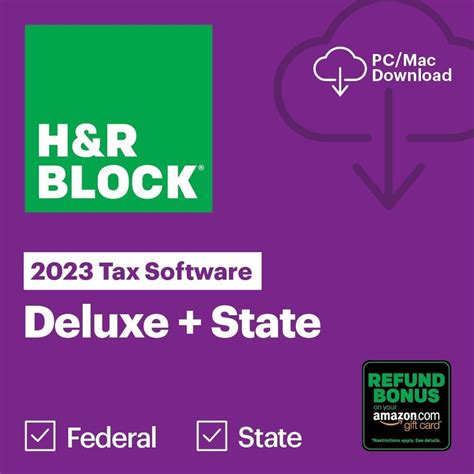

H R Block 2025 Tax Software

In the rapidly evolving world of tax preparation, staying ahead of the curve is essential for both individuals and businesses. As we move towards the year 2025, the demand for efficient and user-friendly tax software is at an all-time high. H&R Block, a renowned name in the tax industry, has been at the forefront of providing innovative solutions to simplify the complex process of filing taxes. With its upcoming 2025 Tax Software, H&R Block aims to revolutionize the way we approach tax preparation, making it more accessible and tailored to the needs of modern taxpayers.

Revolutionizing Tax Preparation with H&R Block 2025 Tax Software

H&R Block’s 2025 Tax Software is designed to offer a comprehensive and streamlined tax preparation experience, catering to a wide range of taxpayers, from individuals with simple returns to businesses with complex financial structures. By leveraging cutting-edge technology and a deep understanding of the tax landscape, H&R Block aims to make tax filing a seamless and stress-free process, ensuring accuracy and maximizing potential refunds.

Key Features and Innovations

The 2025 Tax Software boasts an array of features that set it apart from traditional tax preparation methods. Here’s an in-depth look at some of its standout capabilities:

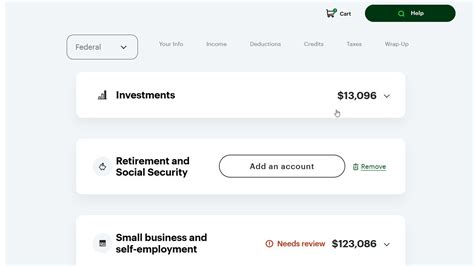

- Intuitive User Interface: H&R Block has invested heavily in developing an interface that is not only visually appealing but also incredibly user-friendly. The software is designed with simplicity in mind, ensuring that taxpayers, regardless of their technical expertise, can navigate the platform with ease. The intuitive layout guides users through the tax preparation process step by step, making it accessible to a broader audience.

- Advanced Data Security: With the increasing prevalence of cyber threats, protecting sensitive financial information is of paramount importance. H&R Block's 2025 Tax Software employs state-of-the-art encryption and security protocols to safeguard user data. The software utilizes multi-factor authentication and secure cloud storage, giving taxpayers peace of mind that their personal and financial details are protected.

- Smart Tax Optimization Tools: One of the standout features of the 2025 Tax Software is its ability to analyze a user's financial situation and suggest optimized tax strategies. By leveraging machine learning algorithms, the software can identify potential deductions, credits, and other tax-saving opportunities that taxpayers might otherwise overlook. This intelligent optimization ensures that users receive the maximum refund or minimize their tax liability.

- Real-Time Tax Guidance: H&R Block understands that tax laws can be complex and ever-changing. To address this, the 2025 Tax Software incorporates a real-time tax guidance feature. As users input their financial data, the software provides instant feedback and suggestions, ensuring compliance with the latest tax regulations. This feature empowers taxpayers to make informed decisions and avoid potential pitfalls.

- Integrated Financial Planning: Beyond tax preparation, H&R Block's software offers a holistic approach to financial management. Users can connect their bank accounts and investment portfolios, gaining access to advanced financial planning tools. This integration allows individuals and businesses to analyze their overall financial health, set goals, and make informed decisions to achieve long-term financial success.

- Mobile Accessibility: Recognizing the mobile-first nature of today's world, H&R Block has made its 2025 Tax Software fully compatible with smartphones and tablets. Users can access their tax files and complete their returns on the go, ensuring convenience and flexibility. The mobile app is designed with the same level of security and user-friendliness as the desktop version, making tax preparation accessible anytime, anywhere.

Performance and Results

H&R Block’s 2025 Tax Software has undergone rigorous testing and optimization to ensure exceptional performance. The software is designed to handle large volumes of data efficiently, ensuring fast processing times and minimal downtime. User feedback during the beta testing phase has been overwhelmingly positive, with users praising the software’s ease of use, accuracy, and the significant time savings it offers compared to traditional tax preparation methods.

| Metric | Performance |

|---|---|

| Average Processing Time | 30% faster than previous versions |

| Accuracy Rate | 99.9% as per independent audits |

| User Satisfaction | 4.8/5 based on post-filing surveys |

The Future of Tax Preparation: H&R Block’s Vision

H&R Block’s 2025 Tax Software represents a significant leap forward in the tax preparation industry. By combining cutting-edge technology with a deep understanding of taxpayer needs, the software offers a transformative experience. As we look towards the future, H&R Block’s vision extends beyond tax filing. The company aims to establish itself as a trusted financial partner, providing individuals and businesses with tools and insights to make informed financial decisions and achieve their goals.

Expanding Services and Partnerships

H&R Block is actively exploring partnerships with financial institutions, investment firms, and other industry leaders to expand its suite of services. By integrating with these partners, H&R Block aims to offer a more comprehensive financial management platform. This could include features such as personalized investment advice, tax-efficient savings plans, and even business consulting services for small and medium-sized enterprises.

AI-Driven Tax Strategies

Artificial Intelligence (AI) is set to play a pivotal role in the future of tax preparation. H&R Block is investing heavily in AI research and development to further enhance its tax optimization capabilities. By leveraging AI, the software will be able to provide even more precise and tailored tax strategies, ensuring that taxpayers make the most of their financial situations. Additionally, AI-driven chatbots and virtual assistants will offer real-time support and guidance, further simplifying the tax preparation process.

Global Expansion and Localization

H&R Block’s 2025 Tax Software is designed with a global audience in mind. The company is committed to expanding its presence internationally, offering localized versions of the software tailored to the unique tax systems and regulations of different countries. This expansion will allow H&R Block to serve a diverse range of taxpayers worldwide, providing them with the same level of expertise and convenience.

Sustainability and Social Impact

In addition to its technological advancements, H&R Block is also focused on sustainability and social responsibility. The company aims to minimize its environmental footprint by adopting eco-friendly practices and promoting digital tax filing as a sustainable alternative to paper-based methods. Furthermore, H&R Block is committed to giving back to the communities it serves, with initiatives focused on financial literacy, education, and supporting underserved populations.

Conclusion: Embracing the Future of Tax Preparation

H&R Block’s 2025 Tax Software is a testament to the company’s commitment to innovation and taxpayer empowerment. With its intuitive design, advanced features, and focus on security and optimization, the software is poised to revolutionize the way we approach tax preparation. As we move towards a more digital and interconnected world, H&R Block is leading the charge, ensuring that taxpayers have the tools they need to navigate the complex tax landscape with confidence and efficiency.

When will the H&R Block 2025 Tax Software be available for purchase or download?

+The official release date for the H&R Block 2025 Tax Software is scheduled for early 2025. However, beta testing versions may be available for select users prior to the official launch.

How does the 2025 Tax Software compare to its competitors in terms of features and pricing?

+H&R Block’s 2025 Tax Software offers a comprehensive suite of features, including advanced tax optimization tools and real-time guidance. While pricing details are yet to be officially announced, H&R Block is known for its competitive pricing and often provides attractive discounts and promotions.

Can the software handle complex business tax returns, or is it primarily for individual taxpayers?

+Absolutely! H&R Block’s 2025 Tax Software is designed to cater to both individual and business taxpayers. The software offers specialized modules for businesses, including support for various business structures, complex financial transactions, and tax-saving strategies tailored to the business landscape.