Nj Paycheck Tax Calculator

Calculating your paycheck tax deductions is an essential aspect of understanding your financial situation and ensuring compliance with tax regulations. New Jersey, like many other states, has its own set of tax laws and rates that can impact your take-home pay. This article aims to provide an in-depth guide to using the NJ Paycheck Tax Calculator, helping you estimate your tax obligations accurately and efficiently.

Understanding the NJ Paycheck Tax Calculator

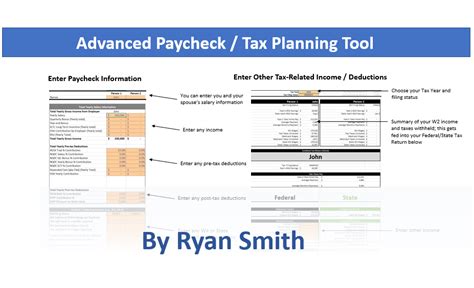

The NJ Paycheck Tax Calculator is an online tool designed to assist New Jersey residents and businesses in estimating their tax liabilities associated with payroll. It considers various factors, including income tax rates, federal and state tax obligations, and potential deductions, to provide a comprehensive view of your paycheck’s tax landscape.

This calculator is particularly useful for individuals who want to plan their finances effectively, businesses looking to manage their payroll efficiently, and tax professionals seeking a quick reference tool. By inputting relevant details, users can obtain a clear breakdown of their tax obligations, helping them make informed financial decisions.

Key Features of the Calculator

- Income Tax Calculation: The primary function of the calculator is to determine your income tax liability. It considers your annual salary, deductions, and tax credits to estimate the amount of income tax you owe.

- Federal and State Tax Comparison: New Jersey residents are subject to both federal and state taxes. The calculator provides a side-by-side comparison, helping you understand the distribution of your tax payments between these two entities.

- Deduction Analysis: Understanding deductions is crucial for tax planning. The tool offers insights into various deductions applicable to your situation, such as standard deductions, itemized deductions, and any state-specific deductions.

- Payroll Tax Overview: In addition to income tax, the calculator provides an overview of other payroll taxes, including Social Security and Medicare taxes, to give you a complete picture of your tax obligations.

Using the NJ Paycheck Tax Calculator: A Step-by-Step Guide

To ensure you make the most of the NJ Paycheck Tax Calculator, follow this detailed step-by-step guide:

Step 1: Access the Calculator

The NJ Paycheck Tax Calculator is typically accessible through the official website of the New Jersey Division of Taxation. You can find it by searching for “NJ Paycheck Tax Calculator” or visiting the direct link https://www.state.nj.us/treasury/taxation/index.shtml. Ensure you are on the official government website to maintain data security and accuracy.

Step 2: Input Your Information

Once you’ve accessed the calculator, you’ll be prompted to enter various details about your income, deductions, and tax status. Here’s a breakdown of the information you’ll need:

- Annual Income: Enter your gross annual income, including wages, salaries, and any other taxable income sources.

- Deductions: Specify any applicable deductions, such as standard deductions, itemized deductions (e.g., mortgage interest, charitable contributions), and any state-specific deductions you qualify for.

- Filing Status: Select your filing status, which could be single, married filing jointly, married filing separately, or head of household. This impacts your tax rates and potential deductions.

- Number of Exemptions: Indicate the number of dependents or other individuals you can claim as exemptions on your tax return.

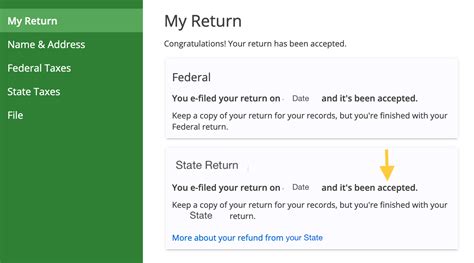

Step 3: Calculate Your Taxes

After providing all the necessary information, click the “Calculate” or “Submit” button to initiate the tax calculation process. The calculator will process your data and generate a detailed report, typically within seconds.

Step 4: Review the Results

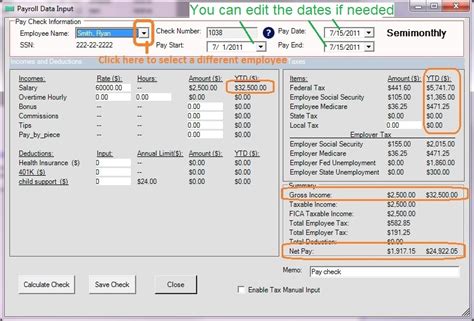

The calculator will present you with a comprehensive report, which may include the following:

- Income Tax Liability: The estimated amount of income tax you owe, broken down into federal and state components.

- Deduction Summary: A summary of the deductions you’ve claimed and their impact on your taxable income.

- Payroll Tax Breakdown: A breakdown of other payroll taxes, such as Social Security and Medicare, and their respective amounts.

- Take-Home Pay: An estimate of your net pay after all tax deductions have been applied.

Benefits of Using the NJ Paycheck Tax Calculator

Employing the NJ Paycheck Tax Calculator offers several advantages, making it an indispensable tool for individuals and businesses alike:

Accuracy and Compliance

The calculator ensures that your tax calculations are accurate and in line with the latest tax laws and regulations. This accuracy is crucial for maintaining compliance with the Internal Revenue Service (IRS) and the New Jersey Division of Taxation.

Financial Planning

By providing a clear picture of your tax obligations, the calculator empowers you to make informed financial decisions. You can better plan your budget, understand your disposable income, and make strategic choices regarding savings, investments, and tax-efficient spending.

Efficient Payroll Management

For businesses, the calculator simplifies payroll management. It allows employers to estimate tax liabilities accurately, helping them budget effectively and ensure compliance with tax regulations. This tool is particularly beneficial for small businesses with limited accounting resources.

Quick Reference

Whether you’re an individual taxpayer or a tax professional, the calculator serves as a quick reference tool. It provides instant estimates, saving you time and effort compared to manual calculations or navigating complex tax forms.

Limitations and Considerations

While the NJ Paycheck Tax Calculator is an invaluable resource, it’s essential to acknowledge its limitations and consider the following:

Simplified Calculations

The calculator provides estimates based on simplified assumptions. It may not account for all possible tax scenarios, especially those involving complex financial structures or unique tax situations. For highly complex tax situations, consulting a tax professional is advisable.

Tax Law Changes

Tax laws are subject to frequent changes and updates. While the calculator is regularly updated, it’s crucial to stay informed about any recent changes in tax regulations that may impact your calculations. Always refer to official government sources for the latest tax information.

Additional Forms and Filings

The calculator assists with tax estimation, but it doesn’t replace the need to file official tax returns. You’ll still need to complete and submit the appropriate tax forms, such as the NJ-1040, to the New Jersey Division of Taxation and the IRS.

Conclusion: Enhancing Your Tax Understanding

The NJ Paycheck Tax Calculator is a powerful tool that empowers individuals and businesses to navigate the complex world of tax obligations. By providing accurate estimates and simplifying the calculation process, it contributes to better financial planning and compliance with tax regulations.

As you utilize this calculator, remember to stay informed about tax law changes, consult professionals when needed, and make use of the official resources provided by the New Jersey Division of Taxation. With a clear understanding of your tax obligations, you can make confident financial decisions and ensure a smoother tax filing experience.

How often should I use the NJ Paycheck Tax Calculator?

+It’s recommended to use the calculator at least annually, preferably before filing your tax returns. Additionally, consider using it whenever your financial situation changes significantly, such as receiving a raise, changing jobs, or experiencing life events that impact your tax status.

Can I rely solely on the calculator for my tax calculations?

+While the calculator is a valuable tool, it’s essential to understand that it provides estimates. For complex tax situations or when seeking professional advice, it’s best to consult a tax advisor or accountant who can offer personalized guidance.

Are there any fees associated with using the NJ Paycheck Tax Calculator?

+No, the NJ Paycheck Tax Calculator is a free service provided by the New Jersey Division of Taxation. It’s designed to assist taxpayers in estimating their tax liabilities without any cost.