Tax Return Status Ohio

Tax return status is a critical aspect of managing one's financial obligations and understanding the progression of one's tax filing journey. For residents of Ohio, this process can be both informative and intricate. Let's delve into the specifics of checking the status of your tax returns in the Buckeye State.

Understanding the Ohio Tax Return Process

In Ohio, the tax filing process is overseen by the Ohio Department of Taxation, which provides resources and guidelines for residents to navigate their tax obligations effectively. Whether you’re an individual filer or a business owner, understanding the status of your tax return is essential for financial planning and ensuring compliance with state regulations.

Ohio offers a comprehensive online portal, known as the Ohio Taxpayer Access Point (OTAP), which serves as a one-stop destination for taxpayers to manage their accounts, access forms, and, most importantly, check the status of their tax returns.

Accessing the Ohio Taxpayer Access Point (OTAP)

To begin your journey into the world of Ohio tax return status, you’ll need to access the OTAP portal. This can be done by visiting the official Ohio Department of Taxation website and navigating to the Online Services section. Here, you’ll find a link to OTAP, where you can register or log in to your existing account.

If you're a first-time user, the registration process is straightforward and secure. You'll need to provide personal details, such as your Social Security Number, date of birth, and other identifying information. Once registered, you'll gain access to a wealth of information, including your tax return status.

Checking Your Tax Return Status in OTAP

Once logged into OTAP, you’ll find a user-friendly dashboard that provides an overview of your tax account. Here’s a step-by-step guide to checking your tax return status:

- Account Overview: Upon logging in, you'll see a summary of your tax-related activities. This may include pending returns, refunds, or any outstanding payments.

- Navigate to Return Status: Within the dashboard, locate the section dedicated to Return Status. Here, you'll find a detailed breakdown of your tax return progress.

- Return Details: Click on the specific tax return for which you want to check the status. This will provide you with a comprehensive view of the return's journey, from submission to processing.

- Status Updates: The Return Status page will display the current status of your tax return. This could range from "Received" to "In Progress" or "Completed", depending on where your return is in the processing pipeline.

- Estimated Timelines: OTAP often provides estimated timelines for refund processing. These timelines can help you understand when to expect your refund, should you be entitled to one.

What to Do if Your Return is Delayed

While most tax returns in Ohio are processed efficiently, there may be instances where your return experiences delays. In such cases, OTAP provides resources to help you understand the reasons for the delay and offers guidance on how to expedite the process.

If your return is marked as "In Progress" for an extended period, consider the following steps:

- Review Your Return: Double-check your tax return for any errors or omissions. Sometimes, simple mistakes can lead to delays in processing.

- Contact Support: Reach out to the Ohio Department of Taxation's support team. They can provide insights into the specific reasons for the delay and offer solutions.

- Update Your Information: Ensure that your contact details, especially your mailing address, are up-to-date. This is crucial for receiving any correspondence related to your tax return.

Tips for a Smooth Tax Return Status Check

To ensure a seamless experience when checking your tax return status in Ohio, consider the following tips:

- Use a Secure Connection: Always access OTAP using a secure internet connection to protect your personal information.

- Keep Your Information Updated: Regularly update your personal details within OTAP to ensure smooth communication.

- Understand the Processing Timeline: Familiarize yourself with the typical processing times for tax returns in Ohio. This can help manage expectations.

- Stay Informed: Keep an eye on your OTAP account for any updates or notifications related to your tax return status.

The Role of Technology in Tax Return Status Tracking

The introduction of online portals like OTAP has revolutionized the way Ohio residents track their tax return status. This technology streamlines the process, making it more accessible and efficient for taxpayers.

With OTAP, you have the power to check your tax return status from the comfort of your home, eliminating the need for tedious paperwork and long wait times. The portal's user-friendly interface ensures that even those less tech-savvy can navigate the system with ease.

The Benefits of Online Status Tracking

Online status tracking offers several advantages over traditional methods:

- Real-time Updates: You can access the latest information on your tax return status at any time, ensuring you're always in the loop.

- Convenience: There's no need to wait for postal mail or make phone calls. Everything is available at your fingertips.

- Security: Online portals like OTAP employ robust security measures to protect your sensitive tax information.

- Historical Records: OTAP maintains a record of your tax return status over the years, providing a comprehensive overview of your tax history.

The Future of Tax Return Status Tracking

As technology continues to advance, we can expect further enhancements to the tax return status tracking process. Ohio’s Department of Taxation is committed to staying at the forefront of technological advancements, ensuring that taxpayers benefit from the latest innovations.

In the coming years, we may see the integration of artificial intelligence and machine learning algorithms to provide even more accurate and personalized status updates. Additionally, the development of mobile apps could make tax return status tracking even more accessible, allowing taxpayers to check their status on the go.

Conclusion

Checking your tax return status in Ohio is now easier than ever, thanks to the Ohio Taxpayer Access Point (OTAP). By understanding the process, utilizing the online portal, and staying informed, you can effectively manage your tax obligations and plan your financial future with confidence.

Remember, staying on top of your tax return status is not only a responsibility but also a privilege that empowers you to take control of your financial well-being.

How often should I check my tax return status in OTAP?

+It’s recommended to check your tax return status regularly, especially during the initial processing period. However, excessive checking may not provide additional insights, as updates are not instantaneous. A weekly check is generally sufficient.

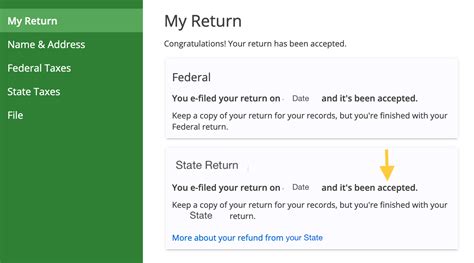

Can I track my tax return status if I e-filed with a third-party software provider?

+Yes, even if you used a third-party software provider to e-file your tax return, you can still track its status through OTAP. The Ohio Department of Taxation receives electronic returns from various sources, including software providers, and updates the status accordingly.

What should I do if my tax return status shows an error or discrepancy?

+If you notice any errors or discrepancies in your tax return status, it’s essential to take immediate action. Contact the Ohio Department of Taxation’s support team, who can guide you through the necessary steps to rectify the issue. They may require additional documentation or information to resolve the problem.