Tennessee Estate Tax

Welcome to an in-depth exploration of the Tennessee Estate Tax, a topic that holds significant importance for residents and investors in the state. With its unique tax structure, Tennessee offers an intriguing landscape for estate planning, and understanding its intricacies is crucial for making informed financial decisions.

Unraveling the Tennessee Estate Tax Landscape

The state of Tennessee, renowned for its vibrant culture and diverse economy, has implemented a tax system that sets it apart from many others across the nation. While some states have opted to abolish their estate taxes, Tennessee has chosen a different path, implementing a system that affects high-value estates.

The Tennessee Estate Tax, also known as the "Pick-Up Tax," is a unique feature of the state's tax code. It is designed to pick up the federal credit for state death taxes, ensuring that estates are taxed in a manner that aligns with federal guidelines. This system allows Tennessee to maintain a certain level of control over its tax revenue while still adhering to federal standards.

Understanding the Mechanics

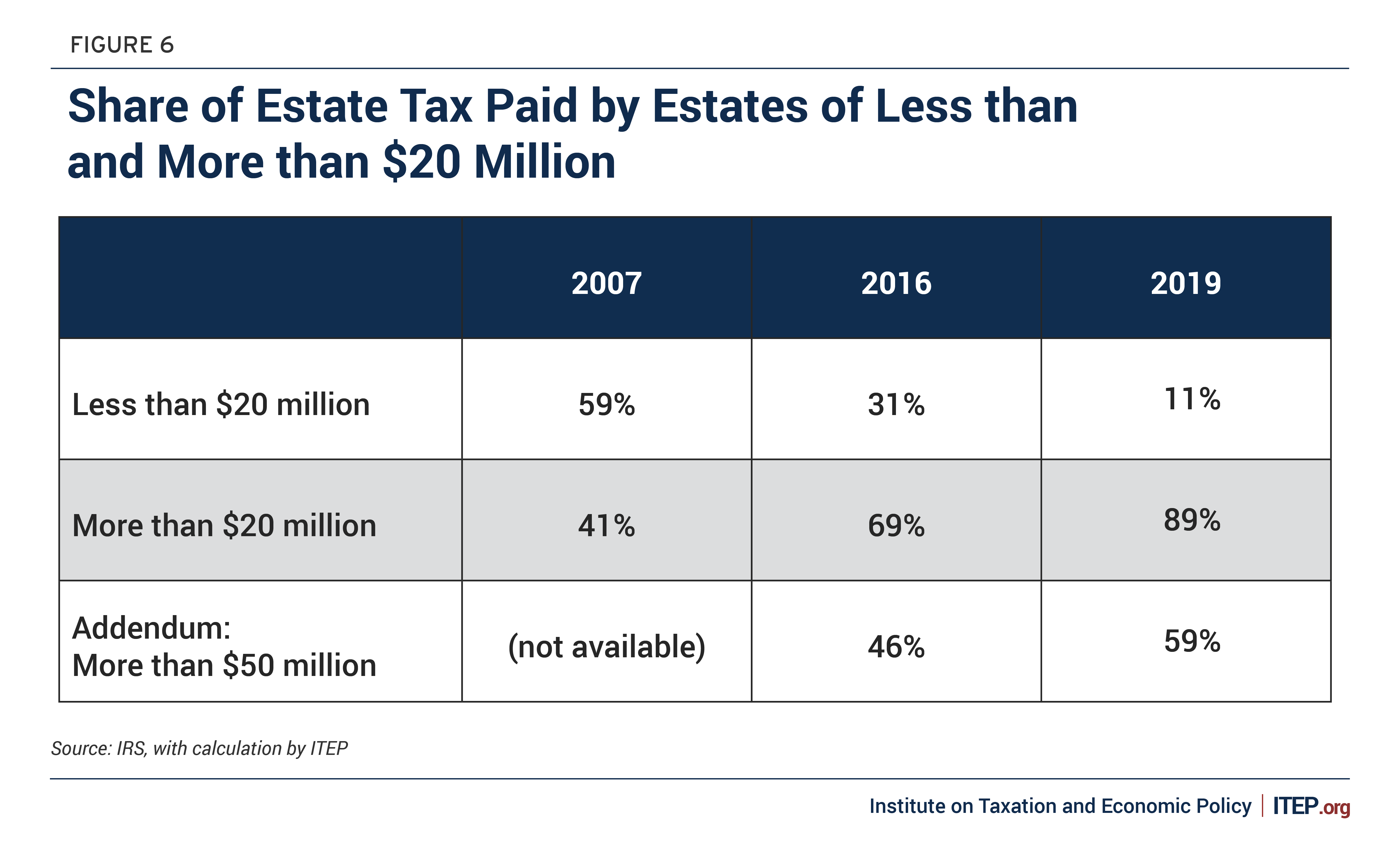

The Tennessee Estate Tax operates on a progressive scale, meaning that the tax rate increases as the value of the estate increases. This structure ensures that larger estates contribute a higher proportion of their value to the state’s tax revenue.

| Estate Value | Tax Rate |

|---|---|

| $1,000,000 - $1,250,000 | 0.8% |

| $1,250,001 - $1,500,000 | 0.9% |

| $1,500,001 - $2,000,000 | 1.0% |

| Over $2,000,000 | 1.5% |

It's important to note that these tax rates are applicable only to the portion of the estate that falls within each bracket. For instance, if an estate is valued at $1,300,000, the first $1,000,000 would be taxed at 0.8%, the next $250,000 at 0.9%, and the remaining $50,000 at 1.0%.

Exemptions and Deductions

Tennessee offers certain exemptions and deductions that can reduce the overall tax liability for estates. One notable exemption is the unlimited marital deduction, which allows spouses to transfer assets to each other without incurring any estate tax. This provision encourages the efficient transfer of wealth within families.

Additionally, Tennessee allows for a charitable deduction, which permits estates to reduce their taxable value by the amount of any charitable contributions made during the individual's lifetime. This encourages philanthropy and supports the state's nonprofit sector.

Real-World Examples and Implications

Let’s consider a hypothetical scenario to illustrate the impact of the Tennessee Estate Tax. Imagine a successful entrepreneur, Ms. Johnson, who has built a substantial estate worth $3 million. Upon her passing, her estate would be subject to the following tax calculations:

- First $1,000,000: Taxed at 0.8%, resulting in a tax liability of $8,000.

- $1,000,001 - $1,250,000: Taxed at 0.9%, incurring an additional tax of $1,350.

- $1,250,001 - $2,000,000: Taxed at 1.0%, leading to a tax of $7,500.

- Over $2,000,000: Taxed at 1.5%, resulting in a tax of $15,000.

In total, Ms. Johnson's estate would owe $32,350 in Tennessee Estate Tax. While this is a significant sum, it is notably lower than the federal estate tax, which has a much higher threshold and a more complex structure.

Planning Strategies

Given the progressive nature of the Tennessee Estate Tax, effective planning strategies can help reduce the overall tax burden. Some common strategies include:

- Gift Giving: Encouraging individuals to make gifts during their lifetime can reduce the value of their taxable estate. Tennessee, like many states, does not impose a gift tax, making this a viable option for reducing estate value.

- Irrevocable Trusts: Establishing irrevocable trusts can help remove assets from the taxable estate. These trusts are particularly useful for individuals with substantial wealth who wish to pass on assets to future generations.

- Life Insurance: Utilizing life insurance policies can provide a significant sum to cover estate taxes. The death benefit can be structured to pay the tax liability, ensuring that heirs receive a larger portion of the estate.

Future Outlook and Considerations

The future of the Tennessee Estate Tax remains an intriguing topic for discussion. With a growing focus on economic development and attracting high-net-worth individuals, the state may consider adjusting its tax policies. Some potential future implications include:

- Threshold Increases: As the cost of living and asset values rise, there may be pressure to increase the threshold at which the estate tax kicks in. This would ensure that a larger portion of estates are exempt from the tax, mirroring the approach taken by some other states.

- Rate Adjustments: With a progressive tax structure, rate adjustments can be a powerful tool for revenue generation. The state could consider modifying the tax rates to either increase or decrease the burden on high-value estates, depending on its economic goals.

- Inheritance Tax Introduction: While Tennessee currently has no inheritance tax, there is always the possibility of introducing one in the future. Such a move would shift the tax burden from the estate to the heirs, impacting the distribution process.

Staying Informed

For individuals and businesses with a stake in Tennessee’s tax landscape, staying informed about potential changes is crucial. The state’s tax policies can have a significant impact on estate planning, business succession, and overall financial strategies. Regularly reviewing tax laws and consulting with financial advisors is essential to ensure compliance and optimize financial outcomes.

What is the difference between the Tennessee Estate Tax and the Federal Estate Tax?

+The Tennessee Estate Tax, also known as the Pick-Up Tax, is a state-level tax that aligns with the federal credit for state death taxes. It is designed to ensure that estates are taxed in a manner that complies with federal guidelines. In contrast, the Federal Estate Tax is a separate tax levied by the federal government, with its own set of thresholds and rates.

Are there any exemptions or deductions available under the Tennessee Estate Tax?

+Yes, Tennessee offers several exemptions and deductions. These include an unlimited marital deduction, allowing spouses to transfer assets tax-free, and a charitable deduction, which reduces the taxable value of the estate based on charitable contributions made during the individual’s lifetime.

What planning strategies can be employed to reduce the Tennessee Estate Tax burden?

+Effective planning strategies include making gifts during one’s lifetime, establishing irrevocable trusts to remove assets from the taxable estate, and utilizing life insurance policies to cover potential tax liabilities. These strategies can help reduce the overall tax burden and ensure a larger portion of the estate is passed on to heirs.