What Is New Jersey Sales Tax

New Jersey, nestled along the northeastern coast of the United States, is renowned for its vibrant cities, lush countryside, and diverse communities. As one of the most densely populated states, it boasts a thriving economy with a diverse range of industries. In this bustling economic landscape, understanding the intricacies of sales tax is crucial for both residents and businesses alike.

Sales tax in New Jersey is a critical component of the state's revenue generation and is applied to a wide array of goods and services. This comprehensive guide will delve into the specifics of New Jersey sales tax, offering an in-depth analysis of its rates, exemptions, collection processes, and the impact it has on the state's economy. Whether you're a resident curious about how sales tax affects your daily purchases or a business owner navigating the complexities of tax compliance, this article aims to provide invaluable insights.

The Basics of New Jersey Sales Tax

Sales tax in New Jersey, much like in other states, is a consumption tax levied on the sale of tangible personal property and certain services. It is a critical source of revenue for the state government, helping to fund essential public services, infrastructure development, and social programs. Understanding the fundamentals of New Jersey sales tax is essential for businesses and consumers alike, as it ensures compliance and promotes a fair tax system.

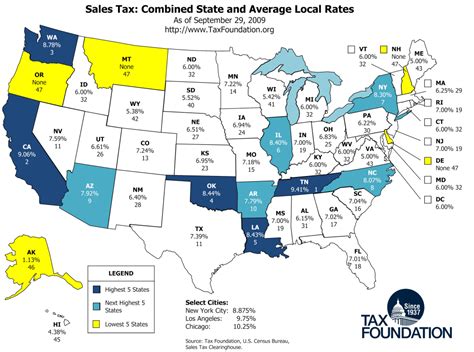

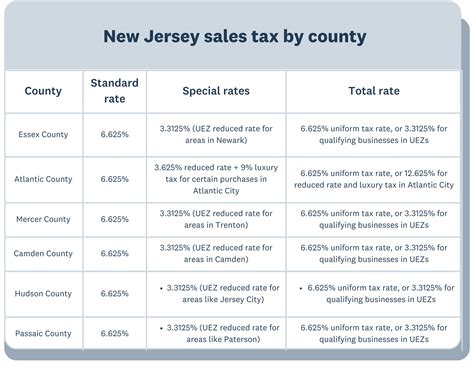

The state of New Jersey imposes a 6.625% general sales and use tax on most retail sales of tangible personal property and certain services. This rate is applicable statewide and is often referred to as the "base rate." However, it's important to note that in addition to this base rate, there may be local add-on rates imposed by municipalities, bringing the total sales tax rate to 7.625% or higher in certain areas.

The sales tax rate in New Jersey is comprised of two components: the state sales tax and the local sales tax. The state sales tax is a uniform rate applied across the state, while the local sales tax varies depending on the jurisdiction. This local component is crucial, as it allows municipalities to generate revenue for local projects and services.

State Sales Tax

The state sales tax in New Jersey is set at a consistent rate of 6.625%. This rate is applied to most retail sales and is collected by businesses at the point of sale. The revenue generated from this tax is then remitted to the state government, where it is utilized to fund various state-level initiatives and services.

The state sales tax is a vital component of New Jersey's revenue system, providing a stable and predictable income stream. It plays a significant role in supporting public education, maintaining infrastructure, and funding healthcare services, among other critical state functions.

Local Sales Tax

In addition to the state sales tax, New Jersey allows local jurisdictions, such as counties and municipalities, to impose their own local sales taxes. These local add-on rates can vary significantly, resulting in different total sales tax rates across the state.

The local sales tax rates are typically used to fund specific local projects, such as infrastructure improvements, community development initiatives, or public safety enhancements. This decentralized approach to sales tax collection empowers local governments to address the unique needs and priorities of their communities.

| County | Local Sales Tax Rate |

|---|---|

| Atlantic County | 1.00% |

| Bergen County | 1.00% |

| Burlington County | 0.50% |

| Camden County | 1.00% |

| Cape May County | 0.50% |

| Cumberland County | 1.00% |

| Essex County | 1.00% |

| Gloucester County | 0.50% |

| Hudson County | 1.00% |

| Hunterdon County | 0.50% |

| Mercer County | 1.00% |

| Middlesex County | 1.00% |

| Monmouth County | 1.00% |

| Morris County | 1.00% |

| Ocean County | 0.50% |

| Passaic County | 1.00% |

| Salem County | 1.00% |

| Somerset County | 1.00% |

| Sussex County | 0.50% |

| Union County | 1.00% |

| Warren County | 0.50% |

It's important to note that while these local sales tax rates are standard for each county, municipalities within a county may have their own municipal sales tax on top of the county rate. These municipal rates can further increase the total sales tax burden in specific areas.

Sales Tax Exemptions and Special Cases

While the general sales tax rate in New Jersey is applicable to most retail sales, there are certain exemptions and special cases where sales tax may not be applicable or may be applied at a reduced rate. These exemptions are designed to alleviate the tax burden on specific goods, services, or entities, promoting economic fairness and encouraging certain activities.

Exempt Goods and Services

New Jersey has a list of goods and services that are exempt from sales tax. These exemptions are typically granted to essential items or services that are considered necessities. Some common examples of exempt items in New Jersey include:

- Prescription drugs and certain over-the-counter medications

- Food and beverages sold for consumption off-premises

- Clothing and footwear under a certain price threshold

- Most medical devices and equipment

- Educational materials and textbooks

- Certain agricultural supplies

- Machinery and equipment used in manufacturing

It's important to note that while these items are generally exempt, there may be specific conditions or qualifications that apply. For instance, certain clothing items may be exempt only if they are purchased for personal use, not for resale or commercial purposes.

Special Tax Rates

In addition to exemptions, New Jersey also applies special tax rates to certain goods and services. These special rates are designed to encourage specific behaviors or support particular industries. Some examples of special tax rates in New Jersey include:

- 3.5% Sales Tax Rate for Home Improvement Contractors: Contractors performing home improvement services are subject to a reduced sales tax rate of 3.5%. This rate applies to the sale of materials and services provided in connection with home improvement projects.

- 3.5% Sales Tax Rate for Certain Manufactured Homes: The sale of manufactured homes is subject to a reduced sales tax rate of 3.5%. This rate is intended to promote the affordability and accessibility of housing.

- Special Tax Rates for Specific Counties: In some counties, such as Atlantic and Cape May, certain items are subject to a special county tax rate of 3.5%. This rate is applied in addition to the standard local sales tax rate.

These special tax rates are carefully designed to strike a balance between revenue generation and the promotion of specific economic activities. They provide incentives for certain industries or behaviors, contributing to the overall economic health of the state.

Sales Tax Collection and Compliance

Sales tax collection and compliance are critical aspects of doing business in New Jersey. Businesses are responsible for collecting and remitting sales tax to the state, ensuring that the tax system functions efficiently and that revenue is allocated appropriately. Non-compliance with sales tax regulations can result in significant penalties and legal consequences.

Registering for Sales Tax

To collect and remit sales tax in New Jersey, businesses must first register with the New Jersey Division of Taxation. This process involves completing the appropriate forms, providing business information, and obtaining a Sales and Use Tax Permit. The permit number is then used to identify the business in all sales tax-related transactions.

The registration process ensures that businesses are officially recognized by the state and are legally authorized to collect and remit sales tax. It also provides businesses with the necessary tools and resources to understand their sales tax obligations and comply with the relevant regulations.

Sales Tax Calculation and Remittance

Once registered, businesses are required to calculate and collect sales tax on each taxable sale. This involves applying the appropriate sales tax rate (state and local) to the total sale amount. The sales tax collected is then remitted to the state on a regular basis, typically on a monthly or quarterly basis, depending on the business's sales volume.

Businesses use specific sales tax calculation formulas to determine the exact amount of tax due. These formulas take into account the base rate, any applicable local add-ons, and any exemptions or special rates that may apply. Accurate calculation is crucial to ensure compliance and avoid over- or under-collection of sales tax.

Sales Tax Filing and Reporting

In addition to collecting and remitting sales tax, businesses must also file regular sales tax returns with the New Jersey Division of Taxation. These returns provide a detailed breakdown of the sales tax collected during a specific period, along with any applicable credits, adjustments, or refunds.

The sales tax return filing process typically involves completing a sales tax return form, which may be available online or in paper format. The form requires businesses to provide information about their taxable sales, any applicable exemptions, and the total amount of sales tax due. Accurate and timely filing is essential to maintain compliance and avoid penalties.

Businesses are also required to keep detailed records of their sales and purchases for a specified period, typically several years. These records serve as evidence of sales tax collection and compliance and may be requested by the state for audit purposes.

Impact of Sales Tax on the Economy

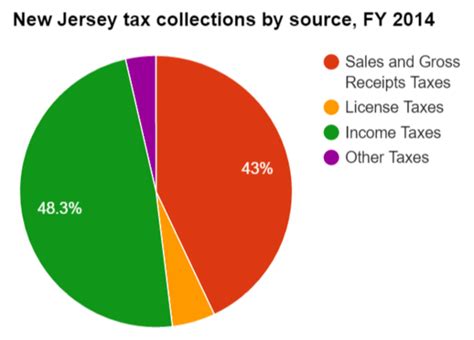

Sales tax plays a significant role in shaping the economic landscape of New Jersey. It is a critical component of the state's revenue system, providing funds for essential services and infrastructure development. Understanding the impact of sales tax on the economy can offer valuable insights into the state's fiscal health and the overall well-being of its residents.

Revenue Generation and Allocation

Sales tax is a major source of revenue for the state of New Jersey. In Fiscal Year 2022, the state collected $10.6 billion in sales and use taxes, accounting for a significant portion of its total revenue. This revenue is vital for funding a wide range of public services and initiatives.

The revenue generated from sales tax is allocated across various state departments and agencies, each with its own specific responsibilities and mandates. These allocations are carefully determined by the state legislature and are subject to regular review and adjustment.

| Department/Agency | Revenue Allocation |

|---|---|

| Department of Education | A significant portion of sales tax revenue is allocated to support public education, including funding for schools, teacher salaries, and educational programs. |

| Department of Transportation | Sales tax revenue is used to maintain and improve the state's transportation infrastructure, including roads, bridges, and public transit systems. |

| Department of Human Services | The revenue supports social services, healthcare programs, and assistance for vulnerable populations, ensuring access to essential services for all residents. |

| Department of Environmental Protection | Sales tax funds contribute to environmental protection and conservation efforts, promoting sustainability and the preservation of natural resources. |

| Local Governments | A portion of the sales tax revenue is allocated to local governments, empowering them to address community needs and fund local projects. |

The allocation of sales tax revenue ensures that the funds are directed towards areas of critical importance, addressing the needs of residents and supporting the overall well-being of the state.

Economic Impact on Businesses and Consumers

The sales tax in New Jersey has a direct impact on both businesses and consumers. For businesses, the sales tax adds to their cost of doing business, influencing pricing strategies and operational decisions. On the other hand, consumers bear the burden of the sales tax, affecting their purchasing power and overall economic behavior.

For businesses, the sales tax is an additional expense that must be factored into their financial planning. It influences the pricing of goods and services, as businesses may choose to absorb the tax or pass it on to consumers. The sales tax can also impact a business's competitive position, especially when compared to online retailers or businesses in neighboring states with lower sales tax rates.

For consumers, the sales tax directly affects their purchasing power. It adds to the cost of goods and services, potentially influencing their buying decisions and spending habits. Consumers may strategically plan their purchases to minimize the impact of sales tax, such as by shopping during sales tax holidays or purchasing items online from out-of-state retailers to avoid the tax.

Future Implications and Trends

The future of sales tax in New Jersey is subject to ongoing discussions and policy changes. As the state's economy evolves and new technologies emerge, the sales tax system may undergo transformations to adapt to changing circumstances.

One of the key trends in sales tax is the increasing reliance on e-commerce. With the rise of online shopping, the state is exploring ways to effectively tax online sales and ensure that businesses, both local and out-of-state, are contributing to the state's revenue stream. This includes implementing sales tax nexus rules, which define the circumstances under which a business is required to collect and remit sales tax, even if they have no physical presence in the state.

Additionally, there is ongoing debate about the fairness and efficiency of the current sales tax system. Critics argue that the system disproportionately affects lower-income individuals and may hinder economic growth. As a result, there have been proposals to reform the sales tax structure, potentially introducing new tax rates or expanding the list of exempt items.

The future of sales tax in New Jersey will likely involve a careful balance between revenue generation, economic fairness, and the state's evolving economic landscape. It will require ongoing dialogue and collaboration between policymakers, businesses, and residents to ensure a sustainable and equitable tax system.

Frequently Asked Questions

What is the sales tax rate in New Jersey for online purchases?

+The sales tax rate for online purchases in New Jersey is the same as the rate for in-store purchases, which is 6.625% at the state level. However, local add-on rates may apply, bringing the total sales tax rate to 7.625% or higher in certain areas. It’s important for online retailers to understand and apply the correct sales tax rates based on the shipping destination.