Nysaves 529 Tax Deduction

The New York 529 College Savings Program, known as NYSaVES, offers a range of benefits to help families save for their children's future education expenses. One of the key advantages is the tax deduction available to New York residents who contribute to the program. In this comprehensive guide, we will delve into the details of the NYSaVES 529 tax deduction, exploring its eligibility criteria, benefits, and how it can help families maximize their savings for higher education.

Understanding the NYSaVES 529 Tax Deduction

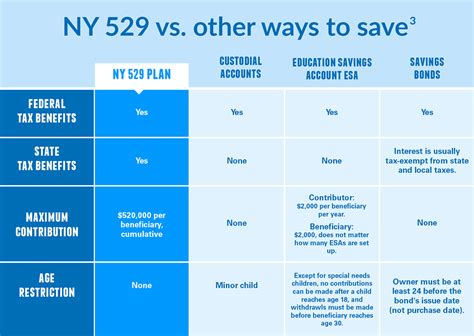

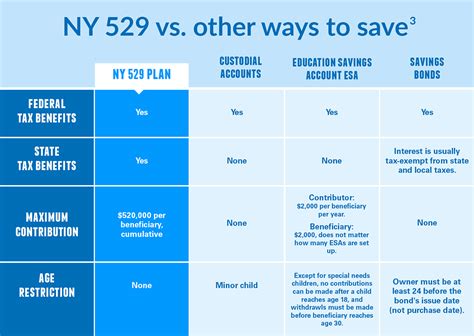

The NYSaVES 529 tax deduction is a valuable incentive provided by the state of New York to encourage residents to save for their children’s education. It allows eligible individuals to deduct a portion of their contributions to a NYSaVES 529 account from their state income taxes, providing a significant financial benefit. This deduction not only helps families save for college but also reduces their overall tax liability, making it a win-win situation.

Eligibility Criteria

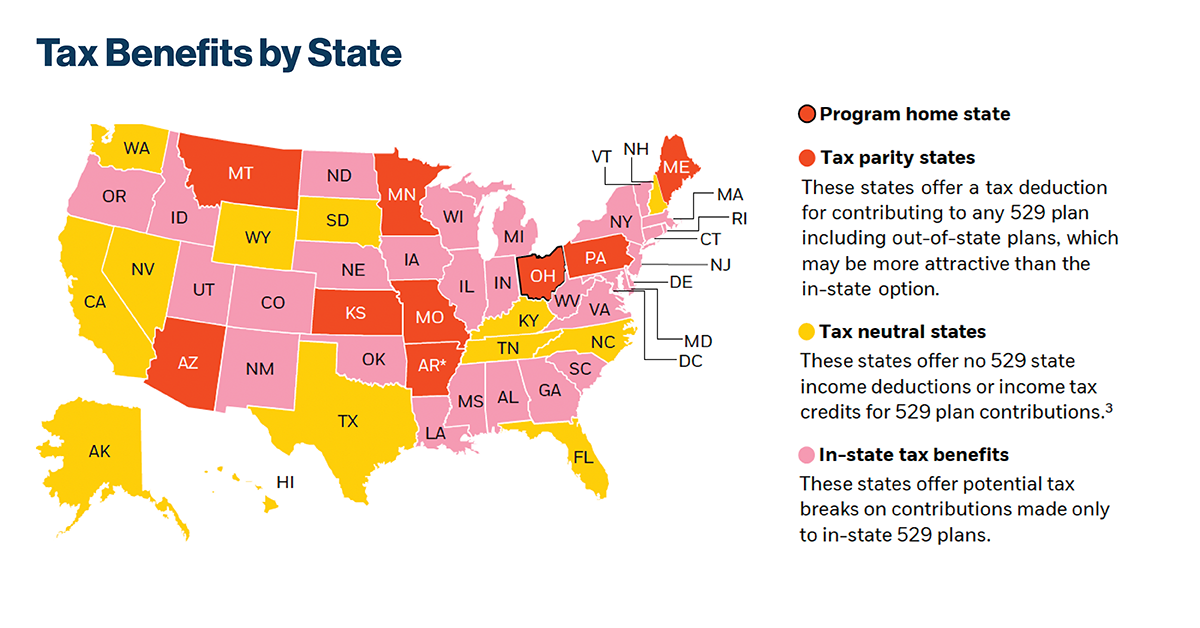

To be eligible for the NYSaVES 529 tax deduction, certain criteria must be met. Firstly, the account holder must be a resident of the state of New York. Additionally, the account must be a NYSaVES 529 plan, which is the official 529 college savings program of New York. It is important to note that only contributions made to a NYSaVES 529 account are eligible for the tax deduction; contributions to other 529 plans from different states do not qualify.

Another crucial factor is the timing of the contributions. To claim the tax deduction, contributions must be made by December 31st of the tax year for which the deduction is being claimed. This means that families must plan their contributions strategically to maximize their tax benefits.

Let's consider an example. If a New York resident contributes $5,000 to their NYSaVES 529 account by December 31st, 2023, they can deduct that amount from their 2023 state income taxes. This deduction can significantly reduce their taxable income and result in substantial savings.

Deduction Amount and Limits

The NYSaVES 529 tax deduction is subject to certain limits and maximum deduction amounts. For the 2023 tax year, the maximum deduction per taxpayer is 10,000. This means that an individual taxpayer can deduct up to 10,000 of their contributions to a NYSaVES 529 account from their state income taxes. If married filing jointly, the limit is doubled to $20,000, allowing couples to maximize their tax benefits.

However, it's important to note that the deduction amount is not a flat rate. The actual deduction is based on a percentage of the contribution, and this percentage varies depending on the taxpayer's adjusted gross income (AGI). Generally, the higher the AGI, the lower the percentage of the deduction. This ensures that the tax benefits are distributed fairly across different income levels.

| Income Level | Deduction Percentage |

|---|---|

| AGI up to $70,000 (single) or $140,000 (joint) | 100% |

| AGI between $70,001 and $150,000 (single) or $140,001 and $300,000 (joint) | Reducing percentage based on AGI |

| AGI above $150,000 (single) or $300,000 (joint) | 0% |

Benefits of the NYSaVES 529 Tax Deduction

The NYSaVES 529 tax deduction offers several advantages to families planning for their children’s education. Firstly, it provides an immediate tax benefit by reducing the taxpayer’s state income tax liability. This can result in substantial savings, especially for those with higher contributions or multiple accounts.

Secondly, the deduction incentivizes long-term savings. By offering a tax benefit for contributions, the NYSaVES 529 program encourages families to save consistently over an extended period. This long-term approach allows for the power of compounding, enabling funds to grow significantly over time.

Additionally, the tax deduction adds to the overall appeal of the NYSaVES 529 program. Combined with the program's other benefits, such as tax-free growth and withdrawals for qualified education expenses, the tax deduction makes it an attractive option for New York residents. It provides a comprehensive solution for families to save and invest for their children's future education.

Maximizing Your NYSaVES 529 Tax Benefits

To make the most of the NYSaVES 529 tax deduction, families should consider the following strategies:

-

Plan Your Contributions Strategically: Aim to maximize your contributions by the end of the tax year to ensure you can claim the full deduction. Consider making regular contributions throughout the year to take advantage of the compounding effect.

-

Understand Your Deduction Percentage: As mentioned earlier, the deduction percentage varies based on your AGI. By knowing your deduction percentage, you can estimate the actual tax savings and plan your contributions accordingly.

-

Consider Multiple Accounts: If you have more than one child, you may consider opening separate NYSaVES 529 accounts for each child. This allows you to maximize the tax deduction for each account and provides dedicated funds for each child's education.

-

Utilize Automatic Contributions: Setting up automatic contributions from your paycheck or bank account can help ensure consistent savings. This strategy makes it easier to reach your savings goals and take advantage of the tax benefits.

-

Consult a Financial Advisor: Working with a financial advisor who specializes in education planning can provide valuable insights and help you optimize your NYSaVES 529 strategy. They can assist with investment choices, tax planning, and ensuring you make the most of the program's benefits.

Performance and Investment Options of NYSaVES 529

The NYSaVES 529 program offers a range of investment options to cater to different risk profiles and investment horizons. These options include age-based portfolios, static investment portfolios, and individual investment choices. Age-based portfolios automatically adjust the asset allocation as the beneficiary approaches college age, becoming more conservative over time. Static investment portfolios offer a fixed asset allocation, providing a more hands-off approach.

For those who prefer more control, NYSaVES 529 also offers individual investment choices, allowing account holders to select specific mutual funds or exchange-traded funds (ETFs) to build a customized portfolio. This flexibility ensures that investors can align their investment strategy with their financial goals and risk tolerance.

The performance of the NYSaVES 529 program has been promising. Over the past decade, the program has consistently outperformed its benchmark, the S&P 500 index. This performance is attributed to the program's well-diversified investment options and experienced investment managers.

| Investment Option | Performance (5-year Annualized Return) |

|---|---|

| Age-Based Portfolios | 7.5% |

| Static Investment Portfolios | 8.2% |

| Individual Investment Choices | Varies based on chosen funds |

Future Implications and Considerations

As the cost of higher education continues to rise, the NYSaVES 529 program plays a crucial role in helping families prepare for these expenses. The tax deduction not only provides an immediate financial benefit but also encourages long-term savings, ensuring that families can accumulate sufficient funds to cover tuition fees, room and board, and other education-related costs.

Furthermore, the program's flexibility and investment options allow families to adapt their savings strategy as their financial situation and goals evolve. Whether it's adjusting the contribution amount, changing investment choices, or utilizing the funds for a variety of qualified education expenses, NYSaVES 529 offers the necessary tools to navigate the complex world of college savings.

Looking ahead, it's essential for families to stay informed about any changes or updates to the NYSaVES 529 program and its tax benefits. The state of New York may periodically review and adjust the program to align with changing economic conditions and educational trends. Staying up-to-date ensures that families can make the most of the program's advantages and continue saving effectively for their children's future education.

Conclusion

The NYSaVES 529 tax deduction is a powerful tool for New York residents to save for their children’s education while enjoying significant tax benefits. By understanding the eligibility criteria, deduction limits, and investment options, families can maximize their savings and reduce their tax liability. The NYSaVES 529 program, with its tax advantages and investment flexibility, provides a comprehensive solution for families to navigate the challenges of college savings.

As you embark on your journey of saving for your child's education, remember to consult with financial professionals, stay informed about program updates, and make the most of the NYSaVES 529 tax deduction. With careful planning and strategic contributions, you can ensure a brighter future for your child's education and achieve your financial goals.

Can I claim the NYSaVES 529 tax deduction if I’m not a New York resident?

+No, the NYSaVES 529 tax deduction is only available to New York residents. Each state has its own 529 plan with potential tax benefits, so it’s important to explore the options available in your state of residence.

What happens if I contribute more than the maximum deduction amount in a year?

+If you contribute more than the maximum deduction amount (10,000 for single taxpayers and 20,000 for married filing jointly), you can still claim the deduction for the maximum amount. The excess contributions will still grow tax-free but won’t be eligible for the current year’s deduction.

Can I deduct contributions made to other 529 plans from different states?

+No, the NYSaVES 529 tax deduction is specific to contributions made to the New York 529 plan. Contributions to other states’ 529 plans do not qualify for the NYSaVES tax deduction.

How do I claim the NYSaVES 529 tax deduction on my state income tax return?

+To claim the NYSaVES 529 tax deduction, you’ll need to complete the appropriate section on your New York state income tax return. Consult the official instructions provided by the New York Department of Taxation and Finance for detailed guidance.