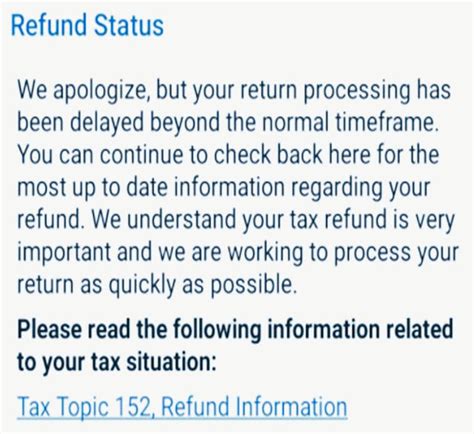

What Is Tax Topic 152

Welcome to our comprehensive guide on Tax Topic 152, an essential area of taxation that every taxpayer should be aware of. This topic covers a range of crucial information regarding the earned income tax credit, its eligibility criteria, calculation methods, and its impact on individuals and families. Understanding Tax Topic 152 is vital for ensuring compliance with tax laws and optimizing your tax returns. In this article, we delve deep into the intricacies of this subject, providing you with a thorough understanding of its significance and practical applications.

The Earned Income Tax Credit: An Overview

The Earned Income Tax Credit (EITC), often referred to as the Earned Income Credit, is a refundable tax credit available to working individuals and families who meet specific income and eligibility requirements. It was introduced as a means to provide financial support to low- and moderate-income earners, helping them keep more of their hard-earned money and offset the burden of taxes.

The EITC is a critical component of the U.S. tax system, serving as a powerful incentive for individuals to enter the workforce and a significant financial boost for those already contributing to the economy. It is particularly beneficial for families with children, as it recognizes the additional expenses and responsibilities they bear.

Eligibility Criteria for the Earned Income Credit

Determining eligibility for the EITC involves considering several factors, including income, marital status, and the number of qualifying children. The Internal Revenue Service (IRS) sets specific thresholds and guidelines for each category, which we will explore in detail.

| Eligibility Factor | Description |

|---|---|

| Income | Earned income must be below a certain threshold. The income limit varies based on filing status and the number of qualifying children. |

| Marital Status | Eligibility differs for married couples filing jointly and single individuals. Married couples may have higher income limits. |

| Qualifying Children | The number of qualifying children impacts the maximum credit amount and eligibility requirements. Having more children may increase the credit. |

Understanding these eligibility criteria is crucial, as they determine whether you qualify for the EITC and the potential credit amount you can receive.

Calculating the Earned Income Credit

The calculation of the EITC involves a series of steps to determine the exact credit amount you are eligible for. The IRS provides specific tables and worksheets to guide taxpayers through this process. The credit amount depends on factors such as:

- The taxpayer's filing status (single, head of household, or married filing jointly)

- The number of qualifying children the taxpayer is claiming

- The earned income for the tax year

The EITC calculation considers a phase-in rate, a credit amount, and a phase-out rate to determine the final credit amount. Let's break down these components:

- Phase-in Rate: This is the rate at which the EITC increases as earned income increases. It starts at 0% and gradually increases until it reaches the maximum credit amount.

- Credit Amount: This is the maximum credit amount you can receive based on your filing status and the number of qualifying children.

- Phase-out Rate: Once your earned income exceeds a certain threshold, the EITC begins to phase out. This rate determines how much your credit reduces as your income increases beyond the phase-out range.

Impact and Benefits of the Earned Income Tax Credit

The Earned Income Tax Credit has a significant impact on the financial well-being of eligible taxpayers. It provides a substantial financial boost to low- and moderate-income individuals and families, helping them meet their basic needs and improve their economic situation.

Financial Benefits

The EITC can result in a substantial refund for eligible taxpayers. This refund can be used to cover essential expenses, such as housing, education, healthcare, and other household needs. For many families, the EITC is a crucial source of financial support, helping them make ends meet and improve their quality of life.

Incentivizing Work

One of the key purposes of the EITC is to encourage and support work. By providing a tax credit for earned income, the government aims to reward individuals for their contributions to the workforce. This incentive structure can motivate individuals to enter or remain in the labor force, leading to increased productivity and economic growth.

Economic Impact

The EITC has a positive impact on the economy as a whole. By putting more money into the hands of low- and moderate-income earners, the program stimulates economic activity. These individuals are more likely to spend their refund on goods and services, contributing to local businesses and communities. Moreover, the EITC can help reduce poverty rates and improve overall economic stability.

Future Implications

The Earned Income Tax Credit continues to be a crucial component of the U.S. tax system, and its importance is likely to grow. As the cost of living rises and economic disparities persist, the EITC plays a vital role in providing financial support to those who need it most. Ongoing research and policy discussions aim to optimize the program’s effectiveness and ensure its continued relevance.

Conclusion

Tax Topic 152, encompassing the Earned Income Tax Credit, is a critical aspect of taxation that provides substantial benefits to eligible taxpayers. Understanding the eligibility criteria, calculation methods, and impact of the EITC is essential for maximizing your tax refund and contributing to a stronger economy. By staying informed and taking advantage of this credit, you can make the most of your hard-earned income and improve your financial well-being.

How do I know if I qualify for the Earned Income Tax Credit (EITC)?

+To qualify for the EITC, you must meet specific criteria set by the IRS. These include having earned income below certain thresholds, being a U.S. citizen or resident alien, and having a valid Social Security number. Additionally, your marital status and the number of qualifying children you have play a role in determining your eligibility.

What is the maximum Earned Income Credit amount I can receive?

+The maximum EITC amount varies based on your filing status and the number of qualifying children you claim. For the tax year 2023, the maximum credit amount for a taxpayer with three or more qualifying children is 6,935. For taxpayers with one or two qualifying children, the maximum credit amounts are 3,848 and $3,719, respectively. It’s important to note that these amounts may change annually.

Can I claim the EITC if I am a student or a part-time worker?

+Yes, students and part-time workers can claim the EITC if they meet the eligibility criteria. The EITC is based on earned income, so as long as you have qualifying income and meet the other requirements, you may be eligible for the credit. It’s important to review the IRS guidelines and consult a tax professional if needed.