Texas Property Tax Estimator

Welcome to our comprehensive guide on the Texas Property Tax Estimator, a valuable tool for homeowners and property investors alike. In the vast state of Texas, where property ownership is a significant part of the economy and culture, understanding the intricacies of property taxes is essential. This article aims to provide an in-depth analysis of the Texas Property Tax Estimator, shedding light on its features, benefits, and how it can assist individuals in navigating the complex world of property tax assessments.

Understanding the Texas Property Tax Estimator

The Texas Property Tax Estimator is an innovative online tool designed by the Texas Comptroller’s Office to assist taxpayers in estimating their property taxes. It serves as a user-friendly interface, allowing property owners to input specific details about their real estate holdings and receive an estimated tax amount. This estimator is particularly useful for those planning to purchase property in Texas or for existing homeowners who wish to understand their tax obligations better.

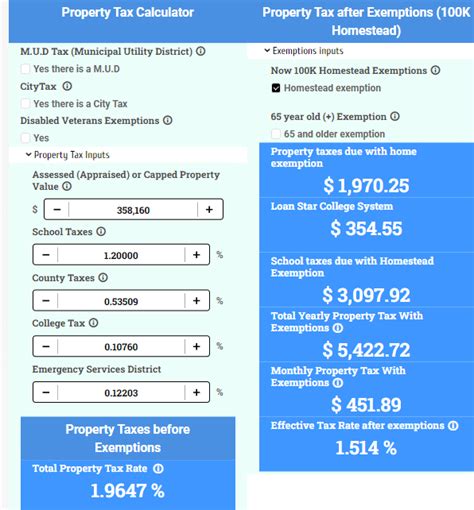

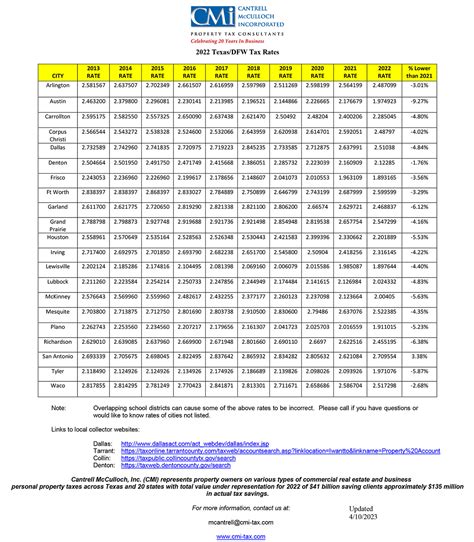

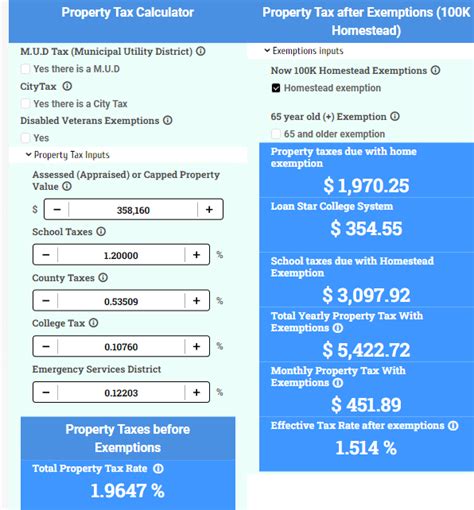

The tool takes into account various factors, including the property's location, market value, exemptions, and the tax rates applicable in the specific county or municipality. By providing this comprehensive data, the estimator offers a realistic projection of the property tax liability, helping individuals make informed decisions about their financial planning and budgeting.

Key Features and Benefits of the Estimator

The Texas Property Tax Estimator boasts several features that make it an invaluable resource for taxpayers:

- Accuracy: The estimator utilizes the most up-to-date tax rates and property values, ensuring a high level of accuracy in the estimated tax figures.

- User-Friendly Interface: With a simple and intuitive design, the tool is accessible to users of all technical backgrounds, making it easy to navigate and use.

- Customizable: Users can input specific details about their property, such as improvements made, to receive a tailored tax estimate.

- Educational Tool: Beyond providing estimates, the estimator offers insights into how different factors, like property value changes or exemptions, impact tax liability. This educates taxpayers on the inner workings of the property tax system.

- Time-Saving: By offering quick and convenient estimates, the tool saves taxpayers the time and effort of calculating taxes manually or waiting for official assessments.

The benefits of using the Texas Property Tax Estimator extend beyond just convenience. It empowers taxpayers with knowledge, enabling them to plan their finances effectively and make informed decisions about property purchases or improvements. Furthermore, the tool's transparency fosters trust between taxpayers and the state, promoting a more positive perception of the tax system.

How to Use the Texas Property Tax Estimator

Using the Texas Property Tax Estimator is a straightforward process, and it can be accessed via the Texas Comptroller’s website. Here’s a step-by-step guide to help you navigate the tool:

- Access the Estimator: Visit the Texas Comptroller's website and navigate to the "Property Tax Estimator" section.

- Select Your County: Start by choosing the county where your property is located. This helps the tool retrieve the specific tax rates and other relevant information for that area.

- Enter Property Details: Input the necessary details about your property, including the address, type of property (residential, commercial, etc.), and its market value. You can also add information about any improvements or renovations made to the property.

- Apply Exemptions (if applicable): The estimator allows you to select from a range of exemptions, such as homestead exemptions, if you qualify. This step ensures that your estimated tax takes into account any reductions you are entitled to.

- Review and Calculate: Once all the details are entered, review the information for accuracy. Then, click on the "Calculate" button to generate your estimated property tax.

- View and Analyze the Results: The estimator will display the estimated tax amount, along with a breakdown of how this figure was calculated. This includes the tax rate, the assessed value, and any exemptions applied. Take time to understand these components to gain a comprehensive view of your tax liability.

It's important to note that while the Texas Property Tax Estimator provides a reliable estimate, it is not a substitute for the official tax assessment. The actual tax liability may vary based on the official appraisal process and any changes in tax rates or property values after the estimation. However, the estimator serves as an excellent starting point for understanding your potential tax obligations.

The Role of Property Tax Assessors

While the Texas Property Tax Estimator offers a convenient way to understand your tax obligations, it’s crucial to recognize the role of professional property tax assessors in the process. These assessors, employed by local governments, are responsible for conducting official appraisals of properties to determine their taxable value.

The assessor's job involves inspecting properties, considering recent sales data, and applying valuation techniques to arrive at a fair and accurate assessment. This assessed value, along with the applicable tax rate, determines the final property tax bill. While the estimator provides a valuable estimate, the official assessment by a qualified assessor ensures the accuracy and fairness of the tax liability.

Property tax assessors also play a crucial role in ensuring that the tax system remains equitable. They help identify and rectify any discrepancies in property values, ensuring that similar properties are taxed similarly. Their expertise and dedication to accuracy are vital in maintaining a fair and transparent tax system.

Real-World Applications and Success Stories

The Texas Property Tax Estimator has proven to be a valuable tool for numerous taxpayers across the state. Here are some real-world scenarios where the estimator has made a significant impact:

- Homeowners Planning Renovations: Mr. Johnson, a homeowner in Houston, used the estimator to understand the potential tax implications of a planned home renovation. By inputting the details of the proposed improvements, he received an estimate that helped him budget effectively and make informed decisions about the project.

- Investors Analyzing Property Options: Ms. Garcia, a real estate investor in Austin, utilized the estimator to compare the tax liabilities of different properties she was considering for purchase. This allowed her to make a more strategic investment decision, taking into account the potential tax costs associated with each property.

- First-Time Homebuyers Educating Themselves: John and Sarah, a young couple in San Antonio, used the estimator to educate themselves about property taxes before purchasing their first home. The tool helped them understand the tax obligations they would incur and plan their finances accordingly, ensuring a smoother transition into homeownership.

These success stories highlight the versatility and effectiveness of the Texas Property Tax Estimator. Whether for personal financial planning, investment analysis, or simply gaining a better understanding of the tax system, the estimator has proven to be an invaluable resource for taxpayers.

Future Enhancements and Improvements

While the Texas Property Tax Estimator is already a robust and useful tool, there is always room for improvement. The Texas Comptroller’s Office, recognizing the importance of continuous enhancement, is dedicated to updating and refining the estimator to meet the evolving needs of taxpayers.

Some potential future enhancements could include:

- Incorporating Historical Data: Adding a feature that allows users to view historical tax estimates for their property, providing a long-term perspective on tax liabilities and helping with trend analysis.

- Integration with Online Payment Systems: Enabling users to not only estimate their taxes but also pay their property taxes online, streamlining the entire process and offering convenience.

- Mobile App Development: Developing a mobile application for the estimator, making it even more accessible and convenient for taxpayers on the go.

- Advanced Exemptions Calculator: Enhancing the exemption selection process by providing a more detailed calculator, allowing users to input specific criteria to determine their eligibility for various exemptions.

By implementing such improvements, the Texas Property Tax Estimator can become an even more powerful tool, catering to the diverse needs of taxpayers and keeping pace with the evolving digital landscape.

Conclusion: A Valuable Resource for Texas Taxpayers

The Texas Property Tax Estimator stands as a testament to the state’s commitment to transparency and taxpayer empowerment. By offering a user-friendly, accurate, and educational tool, the estimator has become an essential resource for homeowners, investors, and anyone with an interest in understanding their property tax obligations.

As we've explored in this comprehensive guide, the estimator's features, benefits, and real-world applications highlight its significance in the Texas tax landscape. Whether it's planning a renovation, analyzing investment options, or simply gaining a better understanding of the tax system, the Texas Property Tax Estimator is a go-to resource for taxpayers seeking clarity and convenience.

With continuous improvements and a dedication to serving the needs of taxpayers, the Texas Property Tax Estimator is poised to remain a valuable asset for years to come. So, whether you're a seasoned homeowner or a first-time buyer, remember to leverage this powerful tool to navigate the complex world of Texas property taxes with confidence and ease.

How often should I use the Texas Property Tax Estimator?

+It is recommended to use the estimator annually, especially if you have made significant changes to your property or if there have been notable fluctuations in the real estate market. Additionally, if you are considering a major renovation or purchase, using the estimator can provide valuable insights into the potential tax implications.

Can the estimator account for changes in tax rates or property values after I use it?

+The estimator provides an accurate estimate based on the data available at the time of calculation. However, it’s important to note that tax rates and property values can change. Therefore, it’s advisable to periodically check for updates or consult with a tax professional to stay informed about any changes that may impact your tax liability.

Is the Texas Property Tax Estimator available for all types of properties?

+Yes, the estimator is designed to accommodate various property types, including residential, commercial, and agricultural properties. However, it’s crucial to provide accurate and detailed information about your specific property to ensure the most precise estimate.

Can I trust the estimated tax amount provided by the estimator?

+While the Texas Property Tax Estimator is an excellent tool for gaining insights into your potential tax liability, it’s important to remember that it is an estimate. The official tax assessment by professional assessors may differ slightly due to various factors. Nonetheless, the estimator provides a reliable and accurate estimate based on the information you provide.

Are there any limitations to using the Texas Property Tax Estimator for investment purposes?

+The estimator is a valuable tool for investors, but it’s important to consider that it provides an estimate based on current data. When making investment decisions, it’s crucial to conduct thorough research, consult professionals, and analyze a range of factors beyond tax liability to ensure a well-informed investment strategy.