Mo Personal Property Tax

Property taxes are an essential component of local government funding, contributing significantly to essential services like education, public safety, and infrastructure maintenance. Among the various types of property taxes, the Motor Vehicle Personal Property Tax stands out as a crucial revenue stream for many jurisdictions, including cities and counties. This tax, often referred to as the Mo Personal Property Tax, is a key financial pillar for local governments, helping them maintain a stable and robust economic foundation.

In this comprehensive guide, we will delve deep into the world of Mo Personal Property Tax, exploring its history, significance, assessment process, and its impact on local economies. We will also discuss strategies for effective tax management and explore future trends that may shape this essential revenue stream.

Understanding Mo Personal Property Tax

Mo Personal Property Tax, a specific type of ad valorem tax, is levied on the value of motor vehicles owned by individuals or businesses. It is a critical source of revenue for local governments, especially in regions where property taxes are a primary funding mechanism for public services.

Historical Context

The origins of Mo Personal Property Tax can be traced back to the early 20th century when motor vehicles began to proliferate across the United States. As the number of vehicles increased, so did the need for dedicated funding to maintain roads, bridges, and other transportation infrastructure. Local governments recognized the potential of taxing vehicle ownership to generate revenue for these essential services.

Over the years, the Mo Personal Property Tax has evolved to become a well-established and significant revenue source. Its role in funding local governments has only grown, especially in light of increasing demands for services and infrastructure improvements.

Significance in Local Economies

Mo Personal Property Tax plays a pivotal role in the economic health of local communities. The revenue generated from this tax supports a wide range of vital services, including:

- Education: A substantial portion of Mo Personal Property Tax funds is allocated to local schools, ensuring the provision of quality education to the community's children.

- Public Safety: This tax contributes to the funding of police departments, fire services, and emergency response teams, thereby enhancing the safety and security of the community.

- Infrastructure Maintenance: Roads, bridges, and other public infrastructure require regular upkeep. Mo Personal Property Tax funds are crucial for maintaining and improving these essential assets.

- Social Services: The tax also supports social welfare programs, healthcare initiatives, and community development projects, ensuring a holistic approach to local governance.

The significance of Mo Personal Property Tax extends beyond these direct services. It also fosters economic growth by funding initiatives that attract businesses and residents, thus contributing to a thriving local economy.

The Assessment Process

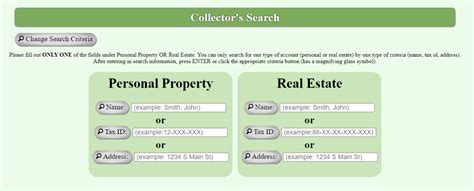

The assessment of Mo Personal Property Tax involves several critical steps to ensure fairness and accuracy in taxation.

Vehicle Valuation

The first step in the assessment process is determining the value of each taxable vehicle. This valuation is typically based on the vehicle’s make, model, year, and condition. Assessors use various resources, including Blue Book values, to establish an accurate assessment of each vehicle’s worth.

| Vehicle Details | Assessed Value |

|---|---|

| Toyota Camry, 2018, Excellent Condition | $18,000 |

| Ford F-150, 2020, Good Condition | $32,500 |

| Honda Civic, 2016, Fair Condition | $12,500 |

Tax Rate Determination

Once the vehicle’s value is established, the applicable tax rate is determined. This rate, often set by local governing bodies, varies across jurisdictions. It can be a flat rate or a percentage of the vehicle’s assessed value.

Tax Calculation

The Mo Personal Property Tax is calculated by multiplying the assessed value of the vehicle by the applicable tax rate. This calculation results in the tax amount due for each vehicle.

For example, if the assessed value of a vehicle is $20,000 and the tax rate is 3%, the Mo Personal Property Tax due would be $600.

Assessment Notice and Payment

After the assessment process is complete, property owners receive an assessment notice detailing the assessed value of their vehicle(s) and the corresponding tax amount. Property owners are then responsible for making timely tax payments to the local government.

Strategies for Effective Tax Management

For property owners, understanding and managing Mo Personal Property Tax is essential for effective financial planning. Here are some strategies to consider:

Stay Informed

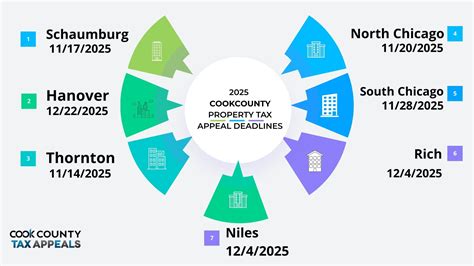

Keep yourself updated on local tax rates and assessment practices. Being aware of any changes in tax policies can help you budget effectively and anticipate tax payments.

Timely Payment

Make sure to pay your Mo Personal Property Tax on time to avoid late fees and potential penalties. Many jurisdictions offer discounts for early payments, so take advantage of these incentives.

Understand Assessment Process

Familiarize yourself with the vehicle valuation process. If you believe your vehicle’s assessed value is inaccurate, you may have the right to appeal. Understanding the assessment process can help you navigate potential disputes effectively.

Utilize Exemptions and Credits

Some jurisdictions offer exemptions or credits for specific vehicles or circumstances. For instance, veterans or individuals with disabilities may be eligible for tax relief. Research and understand these exemptions to take advantage of any applicable benefits.

Future Trends and Implications

The landscape of Mo Personal Property Tax is evolving, and several trends are shaping its future.

Increasing Emphasis on Electric Vehicles

With the growing popularity of electric vehicles (EVs), jurisdictions are exploring ways to tax these vehicles equitably. While EVs may not require the same level of infrastructure maintenance as traditional vehicles, they still contribute to road usage and congestion. As such, many regions are considering tax structures that account for the unique characteristics of EVs.

Digitalization of Assessment Processes

The digitalization of tax assessment processes is another emerging trend. Online platforms and digital tools are being utilized to streamline the valuation and assessment process, making it more efficient and transparent. Property owners can expect a more user-friendly experience when it comes to tax payments and interactions with local governments.

Potential for Tax Reform

As the transportation landscape continues to evolve, so too may the tax structures that fund it. Discussions around tax reform are ongoing, with some jurisdictions exploring alternative funding mechanisms to support infrastructure and public services. While Mo Personal Property Tax remains a critical revenue source, its role and structure may evolve to meet the changing needs of local communities.

Conclusion

Mo Personal Property Tax is a vital revenue stream for local governments, playing a crucial role in funding essential services and infrastructure. From its historical origins to its evolving role in the digital age, this tax has proven its worth as a reliable and significant funding mechanism. As we look to the future, continued innovation and reform will ensure its relevance and effectiveness in supporting thriving local communities.

FAQ

What is the difference between Mo Personal Property Tax and other property taxes?

+Mo Personal Property Tax specifically targets motor vehicles, whereas other property taxes may encompass a broader range of assets, such as real estate, personal property, or business equipment. Mo Personal Property Tax is an ad valorem tax, meaning it is based on the value of the vehicle, while other property taxes can have different valuation methods.

How often is Mo Personal Property Tax assessed?

+The frequency of assessment varies by jurisdiction. In some regions, it may be assessed annually, while in others, it could be assessed biennially or even once every three years. The assessment schedule is typically set by local governing bodies.

Are there any exemptions or discounts available for Mo Personal Property Tax?

+Yes, many jurisdictions offer exemptions or discounts for specific vehicles or circumstances. Common exemptions include vehicles owned by veterans, disabled individuals, or vehicles used for charitable purposes. Additionally, some regions offer early payment discounts to encourage timely tax payments.

How can I appeal my Mo Personal Property Tax assessment if I believe it is inaccurate?

+If you believe your Mo Personal Property Tax assessment is incorrect, you have the right to appeal. The appeal process typically involves submitting documentation to support your claim, such as vehicle purchase records, repair receipts, or other relevant information. Contact your local tax assessor’s office to initiate the appeal process and understand the specific requirements in your jurisdiction.

What happens if I don’t pay my Mo Personal Property Tax on time?

+Late payments of Mo Personal Property Tax can result in penalties and interest charges. Additionally, failure to pay the tax may lead to legal consequences, including potential liens on your property or vehicle registration issues. It’s important to pay your tax on time to avoid these complications.