2018 Tax Brackets

As we delve into the intricacies of the tax system, understanding the tax brackets for a specific year can provide valuable insights into the financial landscape. In this article, we will explore the tax brackets for the year 2018, shedding light on the rates, thresholds, and the impact they had on individual taxpayers.

Understanding the 2018 Tax Landscape

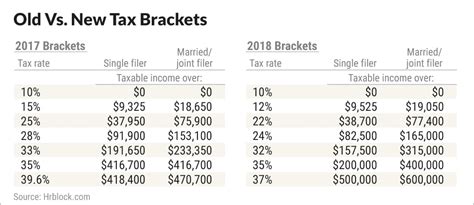

The tax brackets, also known as tax rates and income thresholds, are a crucial component of the federal income tax system in the United States. These brackets determine the amount of tax individuals and households pay based on their taxable income. In 2018, the Internal Revenue Service (IRS) implemented a series of tax reforms, which resulted in significant changes to the tax landscape.

The 2018 tax year brought about a seven-bracket tax structure, with each bracket corresponding to a specific tax rate. These brackets were designed to ensure a progressive tax system, where individuals with higher incomes pay a proportionally larger share of their income in taxes. Let's explore each bracket in detail.

Tax Brackets and Rates for 2018

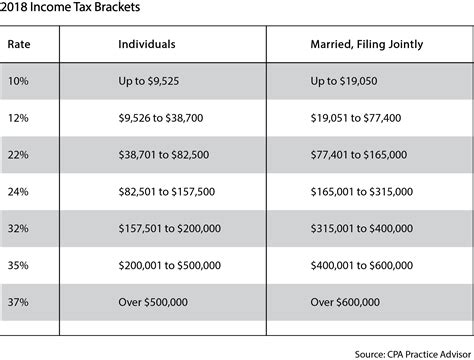

The tax brackets for the 2018 tax year are as follows:

| Tax Bracket | Tax Rate | Applicable Income Range (for Single Filers) |

|---|---|---|

| 10% | 10% | $0 - $9,525 |

| 12% | 12% | $9,526 - $38,700 |

| 22% | 22% | $38,701 - $82,500 |

| 24% | 24% | $82,501 - $157,500 |

| 32% | 32% | $157,501 - $200,000 |

| 35% | 35% | $200,001 - $500,000 |

| 37% | 37% | $500,001 and above |

These tax brackets applied to single filers, heads of households, married filing jointly, and qualifying widow(er)s. For married individuals filing separately, the income thresholds were half of the amounts mentioned above.

It's important to note that these tax brackets and rates were the result of the Tax Cuts and Jobs Act, which brought about significant changes to the tax code. The act reduced tax rates across the board and introduced new thresholds for each bracket.

Impact on Taxpayers

The 2018 tax brackets had a notable impact on taxpayers across different income levels. For individuals with lower incomes, the 10% and 12% brackets provided a relatively low tax burden, allowing them to keep a larger portion of their earnings. As income increased, the higher tax brackets ensured that those with higher incomes contributed a larger share to the federal tax revenue.

The reforms also introduced a higher standard deduction, which reduced the number of taxpayers who itemized their deductions. This change simplified the tax filing process for many individuals, as they no longer needed to track and document various expenses to claim deductions.

Additionally, the 2018 tax reforms doubled the child tax credit, providing a significant benefit to families with children. This credit helped reduce the tax burden for families and contributed to a more equitable distribution of tax benefits.

Tax Bracket Analysis

Now, let’s delve deeper into the analysis of the 2018 tax brackets and explore some key aspects:

Taxable Income and Thresholds

The taxable income ranges for each bracket are carefully calculated to ensure a progressive tax system. The thresholds are determined based on factors such as inflation adjustments and the desired distribution of tax burdens. For instance, the 2018 tax reforms aimed to provide relief to middle-income taxpayers, hence the expansion of the 12% bracket to cover a larger income range.

Understanding the taxable income thresholds is crucial for taxpayers to estimate their tax liability accurately. By knowing which bracket their income falls into, individuals can calculate their tax obligation and plan their finances accordingly.

Marginal and Effective Tax Rates

When discussing tax brackets, it’s essential to differentiate between marginal and effective tax rates. The marginal tax rate is the rate applied to the highest portion of an individual’s income, while the effective tax rate is the average rate calculated based on their total taxable income.

For example, consider a single filer with a taxable income of $100,000. Their marginal tax rate would be 24% (as their income falls within the $82,501 - $157,500 bracket), but their effective tax rate would be lower due to the progressive nature of the tax system.

Understanding the difference between these rates is crucial for financial planning and tax optimization. It allows individuals to make informed decisions about their investments, retirement planning, and other financial strategies.

Tax Brackets and Income Inequality

Tax brackets play a significant role in addressing income inequality. The progressive nature of the tax system ensures that those with higher incomes contribute a larger share of their earnings to the government. This redistribution of wealth aims to create a more equitable society and support social programs and infrastructure.

However, the effectiveness of tax brackets in combating income inequality is a subject of ongoing debate. Some argue that higher tax rates on the wealthy can discourage entrepreneurship and investment, while others believe that a more progressive tax system is necessary to address the growing wealth gap.

Historical Perspective

The 2018 tax brackets were not set in stone and have evolved over time. Tax rates and brackets have been adjusted throughout history to respond to economic conditions, societal needs, and political priorities. For instance, during times of war or economic downturns, tax rates may be increased to generate additional revenue for the government.

Understanding the historical context of tax brackets provides valuable insights into the current tax landscape. It allows us to analyze the impact of past reforms and make informed decisions about future tax policies.

The Future of Tax Brackets

As we look ahead, the future of tax brackets remains a topic of discussion and speculation. The Tax Cuts and Jobs Act, which introduced the 2018 tax brackets, is set to expire in 2025. This means that unless Congress acts to extend or modify the current tax law, the tax rates and brackets will revert to their pre-2018 levels.

However, the political landscape and economic conditions can influence tax policy. There is ongoing debate about whether to make the 2018 tax cuts permanent, extend them, or let them expire. The outcome of these discussions will have a significant impact on taxpayers and the overall economy.

Additionally, the COVID-19 pandemic has brought about unprecedented economic challenges. The government's response to the pandemic, including stimulus packages and economic relief measures, may also influence future tax policies. Tax brackets and rates could be adjusted to support economic recovery or address emerging financial needs.

As we navigate the post-pandemic world, it is crucial to stay informed about tax reforms and their potential impact on individual taxpayers. Staying up-to-date with tax policies ensures that individuals can make informed financial decisions and plan their taxes effectively.

FAQs

How does the tax bracket system work?

+The tax bracket system is a progressive tax structure where individuals pay a certain percentage of their income as tax, depending on their taxable income. Each bracket has a specific tax rate, and as income increases, individuals move into higher brackets with higher tax rates.

Are the tax brackets the same for all filing statuses?

+No, the tax brackets and income thresholds vary depending on the filing status. Single filers, heads of households, married filing jointly, and qualifying widow(er)s have different brackets and thresholds. Married individuals filing separately have half the income thresholds compared to married filing jointly.

How do I know which tax bracket I fall into?

+You can determine your tax bracket by comparing your taxable income to the income thresholds for each bracket. Your taxable income is calculated after deductions and credits, and the bracket you fall into will determine your marginal tax rate.

Can I reduce my tax liability by changing my filing status?

+Changing your filing status can impact your tax liability, but it’s important to consider the overall financial implications. Each filing status has different tax rates and thresholds, so it’s advisable to consult a tax professional to determine the most advantageous filing status for your specific circumstances.

Are there any tax brackets for businesses?

+Yes, businesses also have tax brackets, but they operate under a different tax structure. Corporations and sole proprietorships are subject to different tax rates and thresholds based on their business income. It’s essential for businesses to consult tax professionals to ensure compliance with the appropriate tax brackets.