Tax Lien Certificates For Sale

Tax lien certificates, an often-overlooked investment opportunity, present a unique and intriguing prospect for investors seeking an alternative asset class. These certificates offer a blend of potential high returns and low risk, making them an attractive choice for those looking to diversify their portfolios. In this comprehensive guide, we will delve into the world of tax lien certificates, exploring their intricacies, the investment process, and the benefits they offer. We will also provide a detailed analysis of real-world examples to illustrate the potential and pitfalls of this investment strategy.

Understanding Tax Lien Certificates

A tax lien certificate represents a claim against a property due to unpaid property taxes. When a property owner fails to pay their taxes, the government entity responsible for collecting taxes, typically a county or municipal government, has the right to impose a lien on the property. This lien acts as a legal claim, ensuring that the property cannot be sold or transferred until the tax debt is settled.

To recover the unpaid taxes, the government may auction off these tax liens to investors. Investors purchase these certificates, essentially loaning money to the property owner to cover their tax debt. In return, the investor receives a certificate that guarantees repayment of the loan amount, plus interest, within a specified timeframe.

Tax lien certificates offer investors a secure and relatively low-risk investment opportunity. Unlike traditional real estate investments, the investor does not acquire ownership of the property. Instead, they hold a legal claim on the property until the owner redeems the lien by paying off the debt.

The Investment Process

Auction Procedures

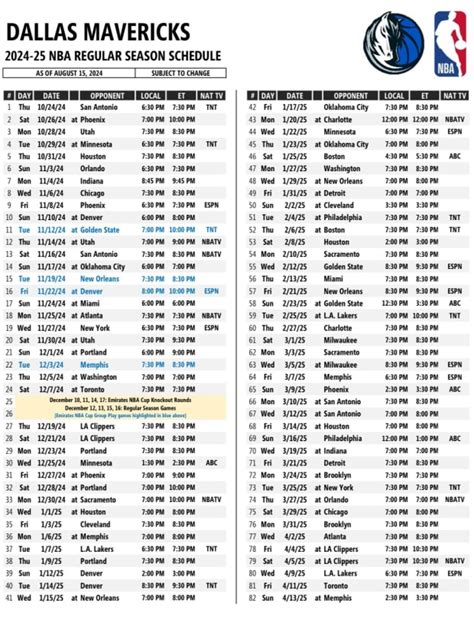

The auction process for tax lien certificates varies depending on the jurisdiction. Generally, investors can participate in these auctions through online platforms or in-person events. Each jurisdiction has its own set of rules and regulations, including minimum bid amounts, interest rates, and redemption periods.

Investors must thoroughly research the auction process and understand the specific rules of the jurisdiction they wish to invest in. Some auctions may allow competitive bidding, while others may utilize a fixed-interest rate system. It's crucial to know the rules to make informed investment decisions.

Research and Due Diligence

Conducting thorough research is essential before investing in tax lien certificates. Investors should examine the property’s location, market value, and potential for appreciation. Assessing the property’s condition, any liens or encumbrances, and the owner’s financial situation is also crucial. This due diligence helps investors make informed choices and mitigate potential risks.

Additionally, investors should consider the local economy, real estate market trends, and the likelihood of the owner redeeming the lien. A property in a thriving neighborhood with high demand may be more attractive than one in a struggling area.

Acquiring Tax Lien Certificates

Once investors have conducted their research and identified suitable properties, they can participate in the auction. The process typically involves registering with the appropriate government agency, providing the necessary documentation, and placing bids on the desired certificates. It’s important to carefully consider the interest rate offered and the potential for redemption before making a bid.

After successfully acquiring a tax lien certificate, the investor becomes the legal owner of the lien. This entitles them to receive the full amount of the tax debt, plus interest, within the specified redemption period. If the property owner fails to redeem the lien, the investor may initiate foreclosure proceedings to acquire the property.

Benefits and Considerations

High Returns and Low Risk

One of the primary advantages of investing in tax lien certificates is the potential for high returns. Interest rates on these certificates can range from 10% to 36% or more, depending on the jurisdiction and the property’s location. This offers investors a significant opportunity to generate substantial income from their investment.

Additionally, tax lien certificates are considered a relatively low-risk investment. Since the investor holds a legal claim on the property, there is a high likelihood of repayment. If the property owner fails to redeem the lien, the investor can foreclose on the property and potentially acquire it at a discounted price.

Diversification and Portfolio Benefits

Investing in tax lien certificates allows investors to diversify their portfolios beyond traditional stocks, bonds, and real estate. This diversification can help mitigate risk and provide a stable source of income. Tax lien certificates offer a unique asset class that can enhance an investor’s overall portfolio performance.

Potential Challenges

While tax lien certificates offer numerous benefits, there are some challenges and considerations to keep in mind. The research and due diligence process can be time-consuming and requires a thorough understanding of local real estate markets and legal procedures. Additionally, the redemption period may vary, and there is always a risk that the property owner will pay off the lien, reducing the potential for high returns.

Real-World Examples and Case Studies

Case Study: Successful Tax Lien Investment

Imagine an investor, John, who purchased a tax lien certificate on a residential property in a thriving suburban area. The property had a market value of 300,000, and the owner owed 10,000 in back taxes. John acquired the certificate at an auction, paying the 10,000 plus a premium of 2,000 for the certificate. The interest rate on the certificate was 18% per annum.

After acquiring the certificate, John patiently waited for the redemption period, which was set at 3 years. During this time, the property's market value increased to $350,000. As the redemption period approached, the property owner, faced with the prospect of losing their home, redeemed the lien by paying off the full amount owed, including the interest. John received a total of $13,600, resulting in a profit of $1,600 and an impressive annualized return of 15%.

Case Study: Redemption and Foreclosure

In another scenario, an investor, Sarah, purchased a tax lien certificate on a commercial property in a struggling urban area. The property had a market value of 500,000, and the owner owed 25,000 in back taxes. Sarah acquired the certificate at a discount, paying only $20,000 for it, with an interest rate of 24% per annum.

As the redemption period approached, the property owner failed to redeem the lien. Sarah initiated foreclosure proceedings and successfully acquired the property for $220,000, which was significantly lower than the market value. She then sold the property for $550,000, resulting in a substantial profit of $330,000. While the foreclosure process took time and effort, Sarah's patience and strategic approach led to a highly profitable outcome.

Performance Analysis and Future Implications

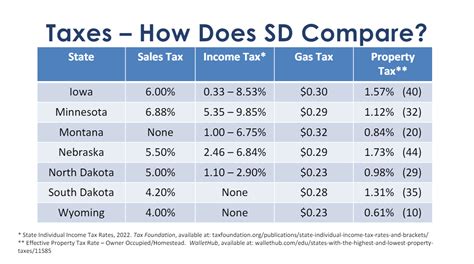

Tax lien certificates have shown consistent performance over the years, offering investors stable returns and a reliable investment vehicle. The average annualized return on tax lien certificates ranges from 12% to 20%, depending on the jurisdiction and market conditions. These returns are particularly attractive when compared to traditional investment options.

Looking ahead, the future of tax lien certificates appears promising. With the ongoing trend of urban development and the increasing value of real estate, investors can expect continued growth and opportunities in this asset class. Additionally, the low-risk nature of these investments makes them an attractive option for cautious investors seeking stable income streams.

| Jurisdiction | Average Interest Rate | Average Redemption Period |

|---|---|---|

| State A | 16% | 2 years |

| State B | 22% | 3 years |

| State C | 14% | 18 months |

How do tax lien certificates differ from tax deeds?

+

Tax lien certificates and tax deeds are related but distinct. Certificates represent a claim against a property due to unpaid taxes, allowing investors to receive interest and potentially acquire the property through foreclosure. Tax deeds, on the other hand, involve the actual sale of the property to investors at a public auction, providing ownership rights.

What happens if the property owner redeems the lien early?

+

If the property owner redeems the lien before the full redemption period, the investor receives the full amount owed, including the interest accrued up to that point. However, the investor may miss out on potential higher returns if the property’s value increases significantly during the remaining redemption period.

Are there any tax implications for investors?

+

Yes, investors should be aware of the tax implications. The interest earned on tax lien certificates is generally taxable as ordinary income. Additionally, if an investor acquires the property through foreclosure, they may face capital gains taxes when selling the property. Consulting with a tax professional is advisable to understand the specific tax obligations.