Ca State Sales Tax

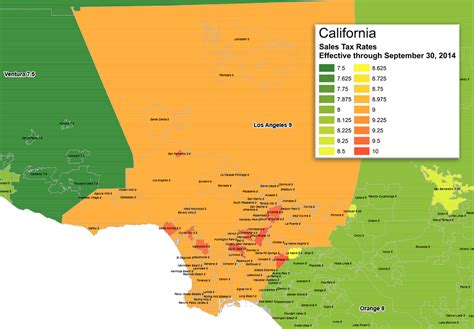

California, the Golden State, is renowned for its diverse landscapes, thriving economy, and vibrant culture. However, one aspect that often piques the curiosity of both residents and businesses alike is its sales tax system. With a complex network of rates and regulations, understanding the ins and outs of California's sales tax is crucial for anyone navigating the state's business landscape. This comprehensive guide will delve into the intricacies of the California State Sales Tax, offering a detailed exploration of its rates, structures, and implications.

The Complexity of California Sales Tax

California’s sales tax system is a multifaceted beast, comprised of state, county, and city-level taxes. This layered structure, while ensuring local control over revenue generation, also adds a layer of complexity that can be daunting for those new to the system.

The state sales tax rate serves as the base, with additional county and city sales tax rates stacked on top, creating a unique rate for each jurisdiction. As of my last update in January 2023, the California state sales tax rate stands at 7.25%, but when combined with local taxes, this can increase significantly.

For instance, in San Francisco, the city sales tax rate is 1.25%, while in Los Angeles, it's 9.5%, including the county tax. These varying rates can have a substantial impact on businesses and consumers, influencing everything from pricing strategies to consumer behavior.

Navigating the Sales Tax Landscape: A Comprehensive Overview

To provide a more granular understanding, let’s delve into the specifics of California’s sales tax structure.

State Sales Tax

As mentioned, the statewide sales tax in California is currently 7.25%, but this rate is subject to change, often influenced by legislative decisions and economic factors.

| Statewide Sales Tax | Rate |

|---|---|

| California | 7.25% |

County Sales Tax

In addition to the state tax, county sales taxes are imposed by various counties across California. These rates can vary significantly, with some counties opting for a higher rate to fund specific projects or services.

| County | Sales Tax Rate |

|---|---|

| Los Angeles County | 2.25% |

| San Diego County | 0.50% |

| Orange County | 1.00% |

City Sales Tax

Cities within California also have the authority to impose their own sales taxes, which can further complicate the sales tax landscape. These city-level taxes are often used to fund local projects, infrastructure, or services, and can vary significantly from one city to another.

| City | Sales Tax Rate |

|---|---|

| San Francisco | 1.25% |

| San Jose | 0.75% |

| Sacramento | 0.50% |

Implications for Businesses and Consumers

The complex sales tax structure in California has wide-ranging implications for both businesses and consumers.

Impact on Businesses

For businesses, especially those operating in multiple jurisdictions, managing sales tax compliance can be a significant challenge. They must ensure they are collecting and remitting the correct sales tax rate for each transaction, which can be a daunting task given the varying rates across the state.

Additionally, businesses must consider the impact of sales tax on their pricing strategies. With varying rates, businesses may need to adjust their pricing to remain competitive in different markets. This can be especially challenging for e-commerce businesses, which often have a broad customer base spanning multiple jurisdictions.

Impact on Consumers

Consumers, on the other hand, often bear the brunt of these varying sales tax rates. They may find themselves paying significantly different prices for the same product depending on where they make their purchase. This can influence consumer behavior, with some consumers opting to shop in areas with lower sales tax rates.

Moreover, the complexity of the sales tax system can make it difficult for consumers to understand their tax obligations. This lack of clarity can lead to confusion and frustration, especially for those who are new to the state or who infrequently make purchases.

Future Outlook and Potential Changes

As with any tax system, California’s sales tax is subject to potential changes and reforms. These changes can be driven by a variety of factors, including economic conditions, political ideologies, and public opinion.

One potential area of reform is the structure of the sales tax itself. While the current system provides local control over revenue generation, it can also lead to complexities and inconsistencies. Some have proposed a more uniform sales tax rate across the state, which could simplify compliance for businesses and provide a more consistent experience for consumers.

Additionally, with the rise of e-commerce and remote sales, there is a growing need to address the issue of sales tax on online transactions. Currently, the collection of sales tax on online sales can be challenging, especially for smaller businesses. Potential solutions include the implementation of a streamlined sales tax system or the adoption of a sales tax holiday, which could provide a temporary boost to the economy while also simplifying tax compliance.

What is the current California state sales tax rate?

+As of my last update, the current California state sales tax rate is 7.25%.

Do all cities and counties in California have the same sales tax rate?

+No, the sales tax rates vary across cities and counties in California. Each locality can impose its own sales tax on top of the state sales tax, resulting in different total sales tax rates.

How often do sales tax rates change in California?

+Sales tax rates can change at any time, but significant changes are typically made through legislative action. It’s important for businesses and consumers to stay updated with any changes to ensure compliance and accurate pricing.

Are there any exemptions or special considerations for certain types of businesses or products in California’s sales tax system?

+Yes, there are various exemptions and special considerations in California’s sales tax system. These can include exemptions for certain goods (e.g., food, prescription drugs), sales to certain entities (e.g., government, nonprofit organizations), and special provisions for specific industries (e.g., manufacturing, agriculture). It’s important for businesses to understand these exemptions and how they apply to their operations.

Where can I find more detailed information about California’s sales tax rates and regulations?

+For detailed information on California’s sales tax rates and regulations, you can visit the official website of the California Department of Tax and Fee Administration (CDTFA). They provide comprehensive resources, including rate lookup tools, regulations, and guidance for businesses and consumers.