Tax Rates Pa

Pennsylvania, a vibrant state in the northeastern region of the United States, boasts a diverse economy and a rich cultural heritage. As such, understanding its tax landscape is crucial for individuals and businesses alike. This article aims to provide an in-depth analysis of Pennsylvania's tax rates, shedding light on the various aspects that influence the financial obligations of its residents and enterprises.

Pennsylvania’s Tax Structure: A Comprehensive Overview

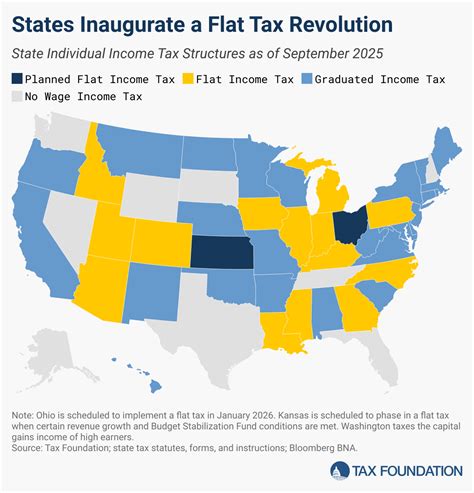

The Keystone State, Pennsylvania, operates a comprehensive tax system that encompasses a range of revenue streams. At its core lies the Personal Income Tax, which forms a significant portion of the state’s tax revenue. This tax is applied to the income of individuals and businesses, with rates varying based on income brackets.

Pennsylvania also levies a Corporate Net Income Tax, targeting businesses operating within its borders. This tax is crucial for funding public services and infrastructure development. Additionally, the state imposes a Sales and Use Tax, applicable to the sale of tangible goods and certain services. This tax contributes to the state's revenue and influences the purchasing decisions of consumers.

For real estate investors and homeowners, Pennsylvania imposes a Real Estate Tax, which varies across counties and municipalities. This tax is essential for maintaining local services and infrastructure. Moreover, the state's Inheritance Tax and Estate Tax come into play upon the transfer of assets after an individual's death, further contributing to the state's fiscal health.

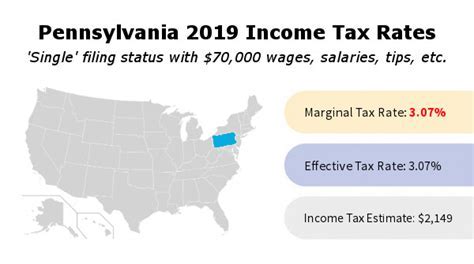

Personal Income Tax: A Deep Dive

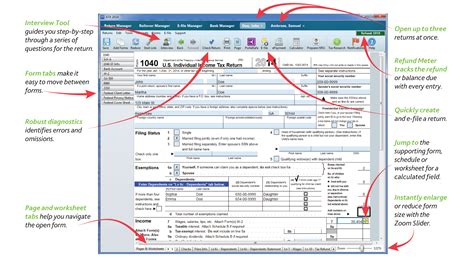

Pennsylvania’s Personal Income Tax is a progressive tax system, meaning that higher income brackets are subjected to higher tax rates. As of [Year], the state’s tax brackets and corresponding rates are as follows:

| Income Bracket | Tax Rate |

|---|---|

| First $35,000 | 3.07% |

| $35,001 - $85,000 | 3.32% |

| $85,001 - $170,000 | 3.52% |

| $170,001 and above | 3.70% |

These rates are subject to change annually, so it's essential to stay updated with the latest tax laws. The state also offers various deductions and credits to ease the tax burden on its residents. For instance, taxpayers can claim deductions for medical expenses, property taxes, and certain charitable contributions.

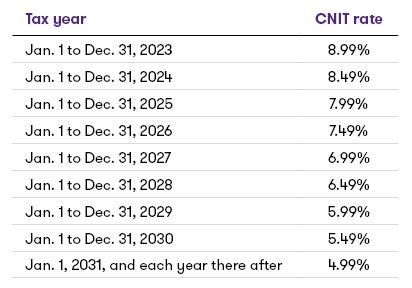

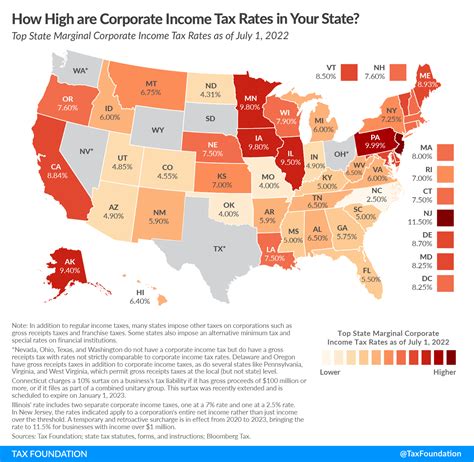

Corporate Taxes: Attracting Businesses

Pennsylvania’s Corporate Net Income Tax stands at a competitive rate of 9.99%, which is applied to the net income of C-corporations and S-corporations. This tax is designed to encourage business growth and investment within the state. However, it’s important to note that certain industries may be subject to additional taxes or incentives, depending on their sector and the region they operate in.

The state also provides tax incentives for businesses that create jobs or invest in research and development. These incentives can significantly reduce the effective tax rate for eligible companies, making Pennsylvania an attractive destination for corporate entities.

Sales and Use Tax: Impact on Consumers

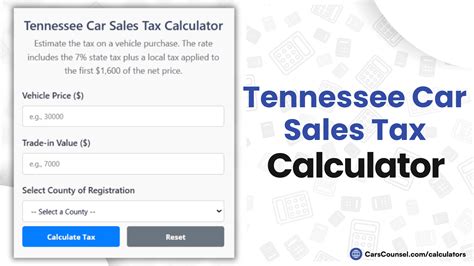

Pennsylvania’s Sales and Use Tax is currently set at 6%, with some exceptions for specific goods and services. This tax is imposed on the sale of tangible personal property and certain services, such as restaurant meals and hotel accommodations. The tax rate can vary across different counties, with some localities imposing additional taxes, known as “pizza taxes” or “jock taxes,” on certain goods or services.

For instance, Philadelphia imposes a 1% additional tax on most goods and a 2% tax on certain amusements, while Allegheny County has a 1% tax on most goods and a 10% tax on car rentals. These variations in tax rates can influence consumer behavior and business strategies, especially for businesses operating in multiple counties.

Real Estate Tax: Localized Assessments

Pennsylvania’s Real Estate Tax is assessed at the local level, meaning each county and municipality sets its own tax rates. This tax is primarily used to fund local services, such as schools, police departments, and fire services. As a result, real estate tax rates can vary significantly across the state.

For instance, in [Year], the median real estate tax rate in Allegheny County was 2.07%, while in Philadelphia County, it stood at 1.34%. These rates are typically calculated based on the assessed value of the property and can be a significant expense for homeowners and real estate investors.

Inheritance and Estate Taxes: Transferring Wealth

Pennsylvania’s Inheritance Tax and Estate Tax are applied to the transfer of assets upon an individual’s death. The Inheritance Tax is a flat 4.5% rate on the fair market value of the assets received by beneficiaries, with some exemptions for close relatives.

The Estate Tax, on the other hand, is a tax on the value of the decedent's taxable estate. As of [Year], the Estate Tax exemption amount is set at $3.5 million, meaning estates valued at or below this amount are not subject to the tax. For estates exceeding this threshold, the tax rate starts at 4.5% and increases incrementally up to 15% for the largest estates.

Tax Credits and Incentives: Easing the Burden

To encourage economic growth and support its residents, Pennsylvania offers a variety of tax credits and incentives. For instance, the state provides a Research and Development Tax Credit to businesses engaged in qualifying research activities. This credit can offset a portion of the corporate net income tax, providing a financial boost to innovative enterprises.

Additionally, Pennsylvania offers a Film Production Tax Credit, aimed at attracting film and television productions to the state. This credit can be applied against various state taxes, including the corporate net income tax and the personal income tax, making Pennsylvania an appealing location for media productions.

What is the average effective tax rate for individuals in Pennsylvania?

+The average effective tax rate for individuals in Pennsylvania varies based on income and tax bracket. As of [Year], the average effective rate is estimated to be around [Percentage], but it can fluctuate based on deductions, credits, and personal circumstances.

Are there any tax incentives for renewable energy projects in Pennsylvania?

+Yes, Pennsylvania offers tax incentives for renewable energy projects. The state provides a Solar Energy Production Tax Credit, which can offset a portion of the corporate net income tax for businesses engaged in solar energy production. Additionally, the Alternative Energy Investment Tax Credit is available for investments in alternative energy sources, further encouraging the development of clean energy initiatives.

How does Pennsylvania’s tax structure compare to neighboring states?

+Pennsylvania’s tax structure varies significantly from its neighboring states. For instance, New Jersey has a higher personal income tax rate, while Delaware does not impose a sales tax. Pennsylvania’s tax rates are generally competitive, offering a balance between revenue generation and business incentives.