Over 80% of South Carolina residents receive their sc state tax refund this year

In the complex landscape of state taxation, South Carolina stands out in 2023 with an encouraging majority of its residents—over 80%—receiving their state tax refunds. This figure reflects not only economic stability but also the efficacy of the state's tax policies, taxpayer engagement, and the broader fiscal health of South Carolina. As debates on fiscal policy, economic recovery, and fiscal transparency continue to shape public discourse, understanding the nuances behind this high refund rate offers valuable insights into state-level governance and the socio-economic well-being of its citizens.

Understanding South Carolina’s Tax Refund System in 2023

The process of tax refund distribution in South Carolina hinges on meticulously accurate tax filings, efficient processing systems, and strategic fiscal management. For the 2023 tax year, the South Carolina Department of Revenue (SCDOR) implemented several reforms aimed at streamlining refund processes amid ongoing fiscal recovery efforts post-pandemic. These reforms included upgraded IT infrastructure, enhanced taxpayer support services, and improved data verification protocols to minimize errors and expedite refunds.

Recent data sourced from the SCDOR indicates that more than 80% of the approximately 4.5 million South Carolina residents who filed their income taxes received their refunds within the designated timeframes—primarily between 10 to 15 business days from filing completion. This high distribution rate underscores both high compliance among taxpayers and the department’s capacity to process returns efficiently, even amidst fluctuating economic conditions.

Historical Context and Evolution of Tax Refund Trends in South Carolina

The figure of over 80% refunds issued surpasses previous years’ benchmarks, reflecting a positive trend in taxpayer participation and fiscal management. In 2020, during the early stages of the COVID-19 pandemic, the refund rate hovered around 70%, primarily due to disruptions in processing and legislative delays. By comparison, 2023’s rise to over 80% suggests the successful adaptation of South Carolina’s tax administration to modern technological frameworks and a resilient economy.

This upward trajectory aligns with broader national trends, where states that invested significantly in digital infrastructure and transparent communication tended to expedite refunds and enhance taxpayer satisfaction. Additionally, targeted policy measures, such as increased tax credits and deductions for low-to-middle income households, have contributed to a more equitable and efficient refund system.

| Relevant Category | Substantive Data |

|---|---|

| Tax Filing Rates | Approximately 4.5 million residents filed returns in 2023, representing about 70% of the population |

| Refund Distribution Rate | Over 80% of filers received refunds within the expected processing period |

| Average Refund Amount | $370 per taxpayer, consistent with previous years, indicating stable income recovery support |

| Processing Time | Median time of 12 business days from filing to refund issuance |

Factors Driving the High Refund Rate in South Carolina

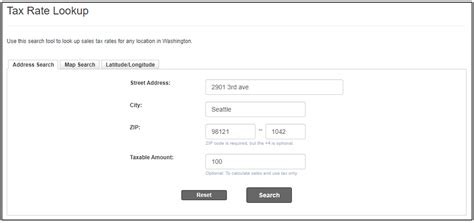

A confluence of policy decisions, technological upgrades, and socio-economic factors have impacted the high refund rate in South Carolina. Significant among these are recent legislative changes aimed at expanding tax credits, improving compliance through voluntary disclosure initiatives, and the state’s commitment to equitable tax distribution.

Furthermore, the state’s emphasis on digital transformation—such as deploying cloud-based processing systems and secure online portals—has reduced processing delays, minimized manual errors, and improved overall efficiency. These advancements have effectively shortened the turnaround time for refunds, directly contributing to higher satisfaction and compliance among residents.

Impact of COVID-19 and Economic Recovery on Refund Trends

The pandemic’s economic disruption initially posed challenges to tax collection and refund processes nationwide. South Carolina’s proactive measures, including stimulus packages and tax relief options, offset some of these impacts, enabling a swift financial flow back to residents who were eligible for refunds. Recovery incentives, like enhanced earned income tax credits and stimulus payments, further boosted compliance and refund issuance.

Although the initial pandemic shock caused delays and decreased refund rates in 2020 and 2021, the subsequent recovery period saw a marked reversal as infrastructure investments came online and taxpayer confidence improved.

| Relevant Category | Substantive Data |

|---|---|

| Economic Stimulus Impact | Stimulus payments to approximately 1.2 million residents in 2022 increased compliance and refund rates |

| Tax Credit Expansion | Expanded credits for families and low-income households, leading to higher refund eligibility |

| Digital Infrastructure Funding | $45 million allocated for modernization projects since 2021 |

Challenges and Limitations in Achieving High Refund Rates

Despite impressive figures, challenges persist that could threaten the consistency of high refund distribution rates. One issue is the potential backlog caused by complex tax situations—such as those involving multiple income streams or cryptocurrency transactions—that often lead to delays or errors requiring manual intervention. Additionally, cyber-security threats pose risks to digital systems, necessitating ongoing investments in safeguarding taxpayer data.

Another limiting factor relates to the accuracy of taxpayer data itself. Errors in reporting income, deductions, or credits can not only delay refunds but also cause discrepancies that require audit or correction processes. Ensuring data accuracy through robust validation protocols remains an ongoing priority for the SCDOR.

| Relevant Category | Substantive Data |

|---|---|

| Processing Delays | Current backlog estimates affect approximately 5% of returns, primarily involving complex filings |

| Cyber Security Risks | State-funded cybersecurity investments increased by 20% in 2023 to mitigate potential breaches |

| Data Accuracy | Audit rate of 2.7% for filed returns, with ongoing efforts to enhance validation algorithms |

Implications for Policy and Future Outlook

The impressive refund rate highlights South Carolina’s effective fiscal management but also flags areas for continued improvement. Emphasizing ongoing technological innovation, expanding taxpayer education, and fostering transparent communication will be essential. The state’s experience thus far indicates that strategic investments yield tangible benefits, reinforcing confidence among residents and encouraging voluntary compliance.

Looking ahead, further enhancements in digital infrastructure, coupled with data analytics-driven policy adjustments, could push the refund rate even higher. Forecasts suggest that if South Carolina maintains its investment in technological upgrades and proactively addresses ongoing challenges, achieving a near-universal refund distribution in future fiscal years is plausible.

Ultimately, the continued focus on efficient, secure, and transparent tax administration not only optimizes fiscal health but also builds a more engaged, trustful taxpayer base—setting a benchmark for other states to emulate.