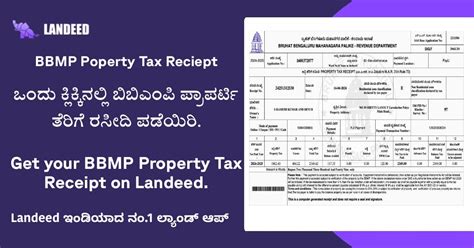

Bbmp Land Tax

In the bustling city of Bengaluru, India, property owners and administrators are familiar with the term BBMP Land Tax, an essential component of the city's revenue system. This tax, levied by the Bruhat Bengaluru Mahanagara Palike (BBMP), plays a crucial role in the urban development and management of the city. Understanding the nuances of BBMP Land Tax is vital for property owners, as it directly impacts their financial obligations and contributes to the city's growth.

Understanding BBMP Land Tax: A Comprehensive Guide

The BBMP Land Tax, officially known as the Property Tax, is a critical revenue source for the Bruhat Bengaluru Mahanagara Palike, the administrative body responsible for managing the city’s affairs. This tax is levied annually on all properties within the BBMP limits, covering both residential and commercial establishments.

Legal Framework and History

The BBMP Land Tax is governed by the Karnataka Municipal Corporations Act, 1976, which provides the legal basis for the imposition and collection of this tax. The Act empowers the BBMP to determine tax rates, assessment procedures, and collection mechanisms. The tax has been in effect since the establishment of the BBMP, with periodic revisions to keep pace with the city’s growth and changing economic landscape.

Tax Assessment and Valuation

The BBMP employs a systematic approach to assess and value properties for tax purposes. The assessment is based on various factors, including the property’s location, built-up area, usage type (residential or commercial), and the prevailing market rates. The valuation process is carried out by trained assessors who visit the properties and collect relevant data. This data is then used to calculate the tax liability for each property.

The BBMP uses a unit area value (UAV) method for residential properties, where the tax is determined based on the property's built-up area multiplied by the applicable UAV rate. For commercial properties, the tax is calculated using a different formula, considering factors such as the property's usage, location, and rental value. The BBMP regularly updates the UAV rates to reflect changes in the property market.

| Property Type | Tax Assessment Methodology |

|---|---|

| Residential | Unit Area Value (UAV) x Built-up Area |

| Commercial | Complex formula considering usage, location, and rental value |

Tax Rates and Categories

The BBMP categorizes properties into different tax slabs based on their location and usage. The tax rates vary across these categories, with residential properties generally enjoying lower rates compared to commercial properties. The BBMP periodically revises these rates to ensure fairness and to keep up with the city’s economic growth.

| Property Category | Tax Rate (%) |

|---|---|

| Residential (A-1 Zone) | 0.50 |

| Residential (A-2 Zone) | 0.60 |

| Residential (B Zone) | 0.70 |

| Commercial (A-1 Zone) | 1.00 |

| Commercial (A-2 Zone) | 1.20 |

| Commercial (B Zone) | 1.40 |

Payment Methods and Due Dates

The BBMP offers various payment methods for property owners to settle their land tax obligations. These include online payment portals, direct bank transfers, and payment through authorized agents. The tax payment due date is typically aligned with the financial year, and the BBMP provides a grace period for timely payments.

| Payment Method | Description |

|---|---|

| Online Payment | BBMP's official website allows property owners to pay tax online using credit/debit cards or net banking. |

| Bank Transfer | Property owners can transfer tax amounts directly to the BBMP's bank account. |

| Authorized Agents | The BBMP has authorized certain agents to collect tax payments on its behalf. |

Benefits and Incentives

The BBMP offers certain incentives to encourage timely tax payments and promote compliance. Property owners who pay their taxes promptly are eligible for discounts on the total tax amount. Additionally, the BBMP provides waivers for certain categories of property owners, such as senior citizens and individuals with disabilities.

Challenges and Controversies

While the BBMP Land Tax is essential for the city’s development, it has faced its share of challenges and controversies. Some property owners have raised concerns about the assessment process, claiming that the valuation methods are outdated and do not accurately reflect the property’s true value. There have also been instances of tax evasion, with some property owners failing to declare their holdings or providing incorrect information to reduce their tax liability.

To address these issues, the BBMP has taken steps to modernize its assessment and collection processes. It has implemented new technologies, such as GIS mapping and digital records, to improve accuracy and efficiency. The BBMP has also strengthened its enforcement mechanisms to deter tax evasion and ensure compliance.

Future Outlook and Potential Reforms

Looking ahead, the BBMP is exploring ways to reform the land tax system to make it more equitable and efficient. One potential reform is the introduction of a self-assessment system, where property owners would be responsible for declaring their property details and calculating their own tax liability. This system, if implemented successfully, could reduce the administrative burden on the BBMP and empower property owners to take a more active role in the tax process.

Furthermore, the BBMP is considering adopting a capital value-based system, similar to that used in some other Indian cities. This system would base the tax on the property's capital value, which is the market price of the property minus any outstanding loans or mortgages. This approach aims to make the tax more reflective of the property's true worth and reduce the impact of fluctuating market rates on tax liability.

Frequently Asked Questions

How often is the BBMP Land Tax revised?

+

The BBMP revises the Land Tax rates periodically, typically every 2-3 years, to ensure they remain aligned with the city’s economic growth and market trends.

Are there any discounts or waivers available for BBMP Land Tax payments?

+

Yes, the BBMP offers discounts for early payment and waivers for certain categories of property owners, such as senior citizens and individuals with disabilities.

Can I appeal my BBMP Land Tax assessment if I disagree with the valuation?

+

Absolutely! Property owners have the right to appeal their tax assessments. The BBMP provides an appeals process, where owners can present their case and request a review of the valuation.

What happens if I fail to pay my BBMP Land Tax on time?

+

Late payment of BBMP Land Tax incurs penalties and interest. The BBMP may also initiate enforcement actions, including property seizure, to recover the outstanding tax.