Ohio State Tax Refund Status

Ohio residents eagerly anticipate their tax refunds, which provide a welcome financial boost. Understanding the process and status of these refunds is crucial for taxpayers to plan their finances effectively. This article aims to provide an in-depth guide on the Ohio state tax refund status, offering insights into the timeline, procedures, and tools available to track refunds.

The Ohio Tax Refund Process: A Comprehensive Overview

The Ohio Department of Taxation manages the state’s tax refund process, ensuring a smooth and efficient system for taxpayers. This section delves into the key stages of the process, from the initial filing to the eventual refund.

Filing Your Ohio State Taxes

Ohio taxpayers have several options for filing their state taxes. The most common methods include online filing through the Ohio Department of Taxation website, using tax preparation software, or hiring a professional tax preparer. The department encourages electronic filing, as it is faster and more secure, with a quicker processing time.

When filing, taxpayers need to ensure they have all the necessary documents, such as W-2 forms, 1099 forms, and any other income statements. It's also crucial to verify the accuracy of the information to avoid delays or penalties.

Processing Time: When to Expect Your Refund

The processing time for Ohio state tax refunds varies depending on the filing method and the time of year. Generally, electronic filings are processed faster than paper returns. The Ohio Department of Taxation aims to process refunds within 45 days of receipt, but this timeline can be affected by various factors.

For instance, returns with errors or those requiring additional information may take longer. Taxpayers can expect a delay if they file a complex return or if they are selected for an audit. Additionally, the tax season rush can slow down processing times.

| Filing Method | Average Processing Time |

|---|---|

| Electronic Filing | 2-6 weeks |

| Paper Filing | 6-12 weeks |

It's worth noting that these are average times, and some refunds may arrive sooner or later depending on individual circumstances.

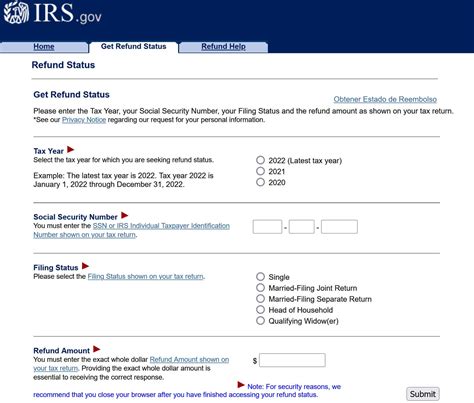

Tracking Your Ohio State Tax Refund

The Ohio Department of Taxation offers several tools to help taxpayers track the status of their refunds. The most popular method is the online Where’s My Refund tool, which provides real-time updates on the progress of a refund. Taxpayers need to enter their Social Security Number, filing status, and the exact amount of their expected refund to access this service.

For those who prefer traditional methods, the department also offers a refund status hotline. By calling the hotline, taxpayers can get automated updates on their refund status by following the provided instructions.

In addition, the Ohio Department of Taxation sends out status updates via email or text message for those who opt for this service during the filing process. These updates provide a convenient way to stay informed without actively checking the refund status.

Factors Affecting Ohio State Tax Refund Timelines

Several factors can influence the timeline for receiving an Ohio state tax refund. Understanding these factors can help taxpayers manage their expectations and plan their finances accordingly.

Common Delays and How to Avoid Them

Delays in tax refund processing can occur for a variety of reasons. One of the most common causes is errors on the tax return. Simple mistakes, such as incorrect Social Security Numbers or math errors, can slow down the process as the department verifies the information.

Another factor that can lead to delays is the filing of a paper return. As mentioned earlier, paper filings typically take longer to process than electronic returns. To avoid this delay, taxpayers are encouraged to file their taxes electronically.

In some cases, the Ohio Department of Taxation may require additional information or documentation to process a refund. This can lead to significant delays if the taxpayer fails to respond promptly. Therefore, it's essential to keep an eye on your tax correspondence and respond to any requests from the department as soon as possible.

Audit Considerations and Their Impact

In rare cases, the Ohio Department of Taxation may select a tax return for an audit. An audit is a detailed review of a taxpayer’s financial records to ensure the accuracy of the information provided. If a return is selected for audit, the refund process will be paused until the audit is complete.

Audits can be time-consuming and may require the taxpayer to provide additional documentation or explanations. While audits are relatively rare, they can significantly impact the refund timeline. Taxpayers who are selected for an audit should cooperate fully with the department to expedite the process.

The Impact of Tax Season and Peak Times

The tax season is a busy time for the Ohio Department of Taxation, and it can affect the processing time of refunds. During the peak filing period, which typically falls between January and April, the department receives a high volume of returns, leading to longer processing times.

Taxpayers who file early in the season may experience faster processing and refunds. Conversely, those who file towards the end of the season may encounter delays due to the increased workload.

To avoid the rush and potential delays, it's advisable to file taxes as early as possible, especially if you're expecting a refund.

Ohio State Tax Refund Options: Direct Deposit and Checks

Ohio taxpayers have two main options for receiving their state tax refunds: direct deposit and checks. Both methods have their advantages and considerations, and taxpayers should choose the option that best suits their financial needs and preferences.

Direct Deposit: A Quick and Convenient Option

Direct deposit is the preferred method for receiving tax refunds as it is fast, secure, and convenient. With direct deposit, the Ohio Department of Taxation electronically transfers the refund directly into the taxpayer’s bank account, eliminating the need for a paper check.

This method offers several benefits. Firstly, direct deposit refunds are typically received faster than checks, often within a week of the refund being approved. Secondly, it eliminates the risk of a check being lost or stolen in the mail. Lastly, direct deposit is environmentally friendly, reducing paper waste.

To set up direct deposit, taxpayers need to provide their bank account information, including the routing and account numbers, during the filing process. It's crucial to ensure the accuracy of this information to avoid delays or errors.

Check Refunds: A Traditional Method

While direct deposit is the more modern option, some taxpayers still prefer to receive their refunds via check. Checks are a traditional method that offers a physical record of the refund, which can be useful for certain financial transactions or record-keeping purposes.

However, checks can take longer to receive and cash than direct deposits. The Ohio Department of Taxation typically mails checks within 2-3 weeks of the refund being approved. Once received, the taxpayer must endorse and deposit the check, which can add additional time to the process.

It's important to note that if a check is not cashed within a certain period (usually 90 days), it may be voided, and the taxpayer will need to request a replacement.

Choosing the Right Refund Method for Your Needs

The choice between direct deposit and checks largely depends on personal preference and financial circumstances. Direct deposit is generally recommended for its speed and convenience, especially for those who are comfortable with online banking.

On the other hand, checks may be a better option for taxpayers who don't have a bank account or prefer a physical record of their refund. Additionally, for those who need to make a specific financial transaction, such as a down payment on a car or a home, a check can provide the necessary documentation.

Ultimately, taxpayers should choose the refund method that aligns with their financial goals and preferences, ensuring a smooth and stress-free refund process.

The Future of Ohio State Tax Refunds: Digital Innovations and Enhanced Services

The Ohio Department of Taxation is committed to enhancing its services and leveraging digital innovations to improve the tax refund process for Ohio residents. This section explores the future of Ohio state tax refunds, highlighting potential improvements and the benefits they could bring to taxpayers.

Exploring Digital Innovations for a Seamless Experience

The department is actively exploring ways to leverage technology to streamline the tax refund process. One potential innovation is the development of a dedicated mobile app for tracking refunds. This app could provide real-time updates, push notifications, and a more user-friendly interface for taxpayers to check their refund status.

Additionally, the department could implement a digital wallet system, allowing taxpayers to receive their refunds directly into a digital wallet, such as Apple Pay or Google Pay. This method would further enhance security and convenience, providing an instant and secure way to access refund funds.

Another digital innovation could be the integration of blockchain technology, which would ensure a secure and transparent record of tax refunds, reducing the risk of fraud and enhancing trust in the system.

Enhanced Services: Making the Tax Process Simpler

In addition to digital innovations, the Ohio Department of Taxation is also focused on improving its customer service and support. One area of focus is expanding the refund status hotline, offering more comprehensive information and support to taxpayers.

The department could also implement a live chat feature on its website, providing real-time assistance to taxpayers with questions or concerns about their refunds. This would offer a convenient and efficient way to get help without having to make a phone call.

Furthermore, the department could develop an online knowledge base or FAQ section, addressing common refund-related queries. This resource would empower taxpayers to find answers to their questions quickly and easily, reducing the need for direct contact with the department.

The Potential Impact on Taxpayers: A Brighter Financial Future

The proposed digital innovations and enhanced services could significantly improve the tax refund process for Ohio residents. By leveraging technology, the department can make the process faster, more secure, and more transparent, providing taxpayers with a seamless and stress-free experience.

Enhanced customer support would ensure that taxpayers receive the assistance they need, making the tax process simpler and more accessible. Overall, these improvements could lead to a brighter financial future for Ohio residents, providing them with timely refunds and improved financial planning opportunities.

FAQs: Your Ohio State Tax Refund Questions Answered

How can I check the status of my Ohio state tax refund online?

+

You can check the status of your Ohio state tax refund online using the Where’s My Refund tool on the Ohio Department of Taxation website. You’ll need your Social Security Number, filing status, and the exact amount of your expected refund to access this service.

What if I don’t receive my Ohio state tax refund within the expected timeframe?

+

If you don’t receive your Ohio state tax refund within the expected timeframe, you should first verify your refund status using the Where’s My Refund tool. If the tool indicates a delay, you can call the refund status hotline for more information. If the tool shows that your refund has been issued, contact your financial institution to ensure the refund was not deposited into your account or that the check was not cashed.

How can I request a replacement check if my original Ohio state tax refund check is lost or stolen?

+

If your original Ohio state tax refund check is lost or stolen, you can request a replacement check by contacting the Ohio Department of Taxation and providing your tax filing information, including your Social Security Number, filing status, and the amount of the original refund. The department will then issue a stop payment on the original check and issue a new check, which will be mailed to your address on file.

What happens if my Ohio state tax return is selected for an audit?

+

If your Ohio state tax return is selected for an audit, you will receive a notice from the Ohio Department of Taxation explaining the audit process and what you need to do. You may be required to provide additional documentation or explanations to support the information on your return. It’s important to cooperate fully with the audit process and respond promptly to any requests from the department to avoid delays in processing your refund.

Can I choose to receive my Ohio state tax refund via direct deposit instead of a check?

+

Yes, you can choose to receive your Ohio state tax refund via direct deposit instead of a check. To do this, you’ll need to provide your bank account information, including the routing and account numbers, during the filing process. Direct deposit is a faster and more secure method of receiving your refund, as it eliminates the need for a paper check and reduces the risk of loss or theft.

For more information on Ohio state tax refunds, visit the Ohio Department of Taxation website or contact their customer service team.