Las Vegas Tax

Las Vegas, a city synonymous with glitz, glamour, and gaming, has long been a magnet for tourists seeking an escape from the ordinary. But beyond the dazzling lights and entertainment, there's another aspect that often intrigues visitors and residents alike: the tax system. The Las Vegas tax landscape is unique, offering a blend of state, county, and city regulations that can significantly impact individuals and businesses operating within this vibrant metropolis. This comprehensive guide aims to demystify the tax structure of Las Vegas, providing an in-depth analysis for those seeking to navigate its financial intricacies.

Unveiling the Las Vegas Tax Structure

Las Vegas operates within the broader framework of the state of Nevada’s tax system, but it also has its own city and county regulations that add layers of complexity. Understanding this hierarchy is crucial for anyone looking to conduct business or settle in this dynamic city.

State Taxes: A Foundation for All Nevadans

Nevada, often praised for its business-friendly environment, has a relatively simple state tax structure. Here’s a breakdown of the key state taxes that apply across the board:

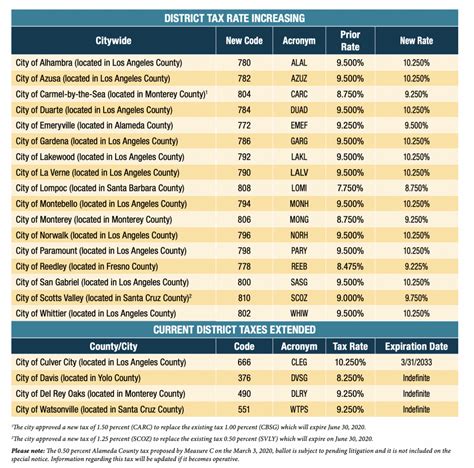

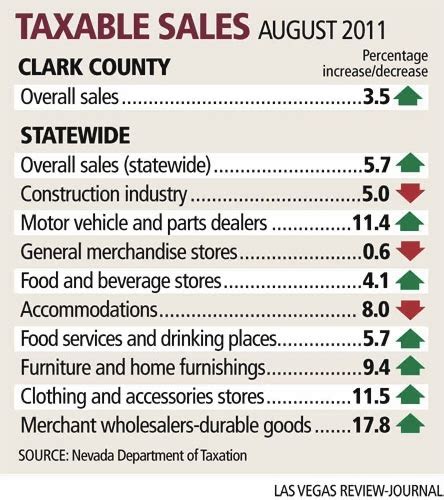

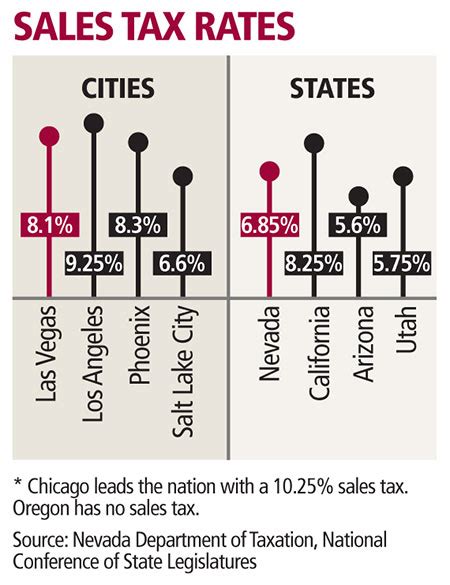

- Sales and Use Tax: Nevada imposes a 6.85% sales and use tax rate on most goods and services. This rate is applicable state-wide, with additional local taxes in certain areas.

- Modified Business Tax (MBT): This is a gross revenue tax applicable to most businesses operating within the state. The MBT is calculated as a percentage of gross revenue, with rates varying based on the industry and the business’s location.

- Real Property Tax: Property taxes in Nevada are levied on the assessed value of real estate. The tax rate varies between counties, with Clark County, where Las Vegas is located, having a slightly different assessment process compared to other counties.

County and City Taxes: Unique to Las Vegas

In addition to state taxes, Las Vegas residents and businesses must also navigate county and city-specific tax regulations. These taxes often fund essential services and infrastructure projects, making them a vital component of the city’s financial ecosystem.

- Clark County Taxes: Clark County, where Las Vegas is situated, has its own set of taxes. These include a county sales and use tax, a lodging tax for hotel and motel stays, and a real property tax. The county also imposes a vehicle registration fee and a fuel tax.

- Las Vegas City Taxes: The city of Las Vegas imposes several taxes to support its operations and development. These include a city sales and use tax, a hotel room tax, and a business license tax. The city also levies a privilege license tax on certain types of businesses.

| Tax Type | Rate | Description |

|---|---|---|

| State Sales and Use Tax | 6.85% | Applied to most goods and services |

| Clark County Sales and Use Tax | Varies (2.75% to 4.60%) | Additional to state sales tax |

| Las Vegas City Sales and Use Tax | 2.65% | Additional to state and county sales tax |

| Modified Business Tax (MBT) | Varies (0.1% to 6.25%) | Based on industry and revenue |

| Lodging Tax | 12% | Imposed on hotel and motel stays |

| Business License Tax | Varies | Varies based on business type and location |

Tax Incentives and Benefits in Las Vegas

Despite the complex tax structure, Las Vegas and Nevada offer several incentives and benefits that make doing business here attractive. These incentives are designed to foster economic growth and encourage investment in the state.

Business-Friendly Tax Climate

Nevada’s reputation as a business-friendly state is well-deserved. The state does not impose personal income tax, which makes it an appealing destination for individuals and businesses looking to minimize their tax liabilities. Additionally, Nevada has no corporate income tax, making it an attractive jurisdiction for corporations.

Incentives for Specific Industries

Las Vegas and Nevada have recognized the potential of several key industries and have introduced targeted incentives to attract and support businesses in these sectors. These include:

- Film and Entertainment: Nevada offers a 20% refundable tax credit for qualified production expenditures. This incentive has helped establish Las Vegas as a popular filming location, attracting numerous film and television productions.

- Renewable Energy: The state has set ambitious renewable energy goals and offers various incentives for businesses involved in the renewable energy sector. These include tax abatements, grants, and low-interest loans.

- Advanced Manufacturing: Businesses involved in advanced manufacturing can benefit from a 100% abatement of the Modified Business Tax (MBT) for the first five years of operation. This incentive aims to attract high-tech manufacturing businesses to the state.

Research and Development Tax Credits

Nevada provides tax credits for research and development activities. Eligible businesses can claim a tax credit of up to 15% of their qualified research expenses, providing a significant incentive for innovation and technological advancement.

Tax Compliance and Reporting in Las Vegas

Navigating the tax landscape in Las Vegas requires a proactive approach to compliance and reporting. The Nevada Department of Taxation provides comprehensive guidelines and resources to assist taxpayers in understanding their obligations.

Registration and Licensing

All businesses operating in Las Vegas must register with the Nevada Secretary of State and obtain the necessary licenses and permits. This process typically involves:

- Registering the business entity with the state.

- Obtaining a Federal Employer Identification Number (FEIN) if applicable.

- Applying for the relevant business licenses and permits, which may include a sales and use tax license, a business license, and industry-specific permits.

Tax Filing and Payment

Businesses and individuals in Las Vegas have specific tax filing and payment obligations. These include:

- Sales and Use Tax: Businesses must collect and remit sales tax on taxable goods and services. The frequency of filing and payment depends on the business’s tax liability, with options ranging from monthly to quarterly filings.

- Modified Business Tax (MBT): Businesses must calculate and pay the MBT based on their gross revenue. The tax is due quarterly, with an extended deadline for the final payment.

- Property Tax: Property owners must pay property taxes annually. The due date is typically in March, with penalties for late payments.

- Income Tax: Individuals and businesses with Nevada-sourced income must file state income tax returns. The filing deadline is typically aligned with the federal deadline.

The Future of Las Vegas Taxes

As Las Vegas continues to evolve and adapt to changing economic landscapes, its tax structure is likely to undergo modifications. Here’s a glimpse into potential future developments:

Potential Tax Reform

There have been ongoing discussions about reforming the state’s tax system to make it more equitable and sustainable. Proposed changes include introducing a personal income tax, modifying the MBT, and restructuring property tax assessments.

Economic Development Initiatives

Las Vegas and Nevada are committed to diversifying their economies and attracting new industries. As part of this strategy, they may introduce new tax incentives and benefits to encourage investment in targeted sectors, such as technology, healthcare, and education.

Impact of Remote Work

With the rise of remote work, there’s a growing discussion about how to tax individuals who work remotely in Nevada but reside in other states. This issue could lead to changes in the state’s tax regulations, potentially impacting both businesses and individuals.

Conclusion: Navigating the Las Vegas Tax Landscape

Understanding and navigating the tax system in Las Vegas requires a comprehensive understanding of the state, county, and city regulations. While the structure may seem complex, the city’s unique tax incentives and business-friendly environment make it an attractive destination for individuals and businesses. Staying informed about tax obligations and taking advantage of available incentives can significantly impact financial success in this vibrant city.

¿Qué tasa de impuestos aplica en Las Vegas para las ventas y uso?

+

La tasa de impuestos sobre las ventas y el uso en Las Vegas es del 6.85% a nivel estatal. A esto se le suma una tasa adicional del 2.65% a nivel de la ciudad y otra que varía entre el 2.75% y el 4.60% a nivel del condado de Clark.

¿Hay algún incentivo fiscal para las empresas que operan en Las Vegas?

+

Sí, Las Vegas y Nevada ofrecen varios incentivos fiscales para fomentar la actividad empresarial. Estos incluyen créditos fiscales para la producción cinematográfica, incentivos para energías renovables y abonos para la fabricación avanzada.

¿Cómo puedo registrarme como empresa en Las Vegas y cumplir con mis obligaciones fiscales?

+

Para registrarte como empresa en Las Vegas, debes seguir varios pasos. Primero, debes registrarte con la Secretaría de Estado de Nevada y obtener un Número de Identificación Federal para Empleadores (FEIN) si corresponde. Luego, necesitarás obtener las licencias y permisos comerciales necesarios, lo que puede incluir una licencia de impuesto sobre las ventas y el uso, una licencia comercial y permisos específicos para tu industria.

¿Qué tipo de impuestos debo pagar como propietario de un negocio en Las Vegas?

+

Como propietario de un negocio en Las Vegas, tienes obligaciones fiscales específicas. Estas incluyen el impuesto sobre las ventas y el uso, que debes recaudar y remitir sobre bienes y servicios gravables. También debes pagar el Impuesto Modificado sobre los Negocios (MBT) basado en tus ingresos brutos, y los impuestos sobre la propiedad si eres propietario de una propiedad.