Why Is Social Security Taxed Twice

The concept of Social Security and its taxation is a complex and crucial aspect of financial planning and understanding for individuals and families in the United States. Social Security, officially known as the Old-Age, Survivors, and Disability Insurance (OASDI) program, is a federal program that provides income to retirees, disabled individuals, and survivors of deceased workers. It is a vital component of the nation's social safety net, offering financial security to millions of Americans. However, the taxation of Social Security benefits has been a topic of discussion and concern for many, as it can lead to a situation where individuals experience what is commonly referred to as "double taxation."

Understanding the Social Security Tax System

Social Security taxation operates on a two-fold system. Firstly, workers contribute to the Social Security trust fund through payroll taxes during their working years. This tax, known as the Federal Insurance Contributions Act (FICA) tax or Self-Employment Contributions Act (SECA) tax for self-employed individuals, is automatically deducted from paychecks and is used to fund current Social Security beneficiaries. The tax rate is currently set at 6.2% for employees and employers each, totaling 12.4% of an employee’s wages, up to a certain annual income threshold.

Secondly, when individuals retire and start receiving Social Security benefits, they may be subject to federal income tax on a portion of their benefits. The taxability of Social Security benefits depends on an individual's total income, including half of their Social Security benefits, other pensions, and any other taxable income. For individuals with a modified adjusted gross income (MAGI) over a certain threshold, a portion of their Social Security benefits becomes taxable. The thresholds vary depending on filing status: for single filers, the threshold is $25,000, for married couples filing jointly it's $32,000, and for married couples filing separately it's $0.

The Double Taxation Dilemma

The term “double taxation” in the context of Social Security refers to the situation where an individual’s Social Security benefits are taxed after they have already been taxed through payroll deductions during their working years. This occurs when a recipient’s total income, including their Social Security benefits, exceeds the applicable threshold, making a portion of their benefits subject to federal income tax. Critics of this system argue that it is unfair for individuals to be taxed on benefits that were already funded by their own contributions.

For instance, consider a retired couple who both receive Social Security benefits and have additional pension income. If their combined income, including half of their Social Security benefits, exceeds the threshold for their filing status, a portion of their Social Security benefits will be taxable. This means that they are essentially paying tax on money that they have already paid taxes on during their working years, leading to what some perceive as an unfair and burdensome tax situation.

Factors Affecting Social Security Taxation

The likelihood of experiencing double taxation on Social Security benefits depends on several factors. Firstly, an individual’s income from sources other than Social Security plays a significant role. The higher an individual’s income, the more likely it is that a portion of their Social Security benefits will be taxable. This includes income from pensions, investments, and other retirement accounts.

Secondly, the amount of Social Security benefits an individual receives can also impact the potential for double taxation. Higher benefit amounts can push an individual's total income over the applicable threshold, leading to taxability. The base year for determining the threshold is 1984, and the thresholds are adjusted annually for inflation. As a result, the thresholds have increased over time, but so has the average Social Security benefit amount, making double taxation a more common occurrence.

| Filing Status | Modified Adjusted Gross Income Threshold | Percentage of Benefits Taxable |

|---|---|---|

| Single | $25,000 | 50% taxable |

| Joint | $32,000 | 50% taxable |

| Joint with Both Recipients Receiving Benefits | $44,000 | 85% taxable |

Strategies to Minimize Double Taxation

There are several strategies that individuals can employ to potentially reduce or minimize the impact of double taxation on their Social Security benefits. One approach is to carefully manage and plan their retirement income sources. By structuring their income to stay below the applicable thresholds, individuals can avoid or reduce the taxation of their Social Security benefits.

For instance, individuals may consider delaying Social Security benefit claims until a later age, as benefits increase with delayed claiming. This can help reduce the likelihood of exceeding the income thresholds and thus minimize the tax burden. Additionally, individuals can explore tax-efficient withdrawal strategies from their retirement accounts, such as Roth conversions, to potentially reduce their taxable income and keep their Social Security benefits tax-free.

The Future of Social Security Taxation

The issue of double taxation on Social Security benefits has been a topic of debate and policy discussion for years. While the current system aims to ensure fairness by taxing benefits for those with higher incomes, critics argue that it places an undue burden on retirees who have already contributed to the system through payroll taxes. As a result, there have been proposals and discussions to reform the taxation of Social Security benefits.

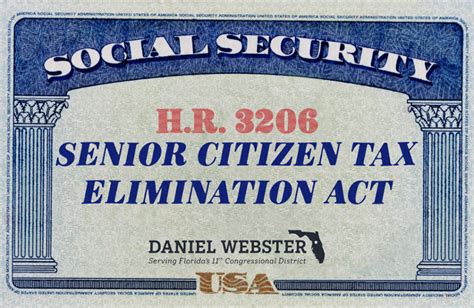

One proposed solution is to exempt a certain amount of Social Security benefits from taxation, similar to the exemption for certain types of pension income. This would provide a tax break for retirees and reduce the perception of double taxation. Another proposal suggests eliminating the taxation of Social Security benefits altogether, treating them as a return on investment rather than income, which could simplify the tax system for retirees.

However, implementing such reforms would require careful consideration of the potential impact on the Social Security trust fund and the broader tax system. The current taxation of Social Security benefits helps fund the program and contributes to the overall tax base. Eliminating or significantly reducing the taxation of benefits could have implications for the program's long-term sustainability and the distribution of tax burdens across different income levels.

Potential Reforms and Their Implications

Reforming the taxation of Social Security benefits could take several forms, each with its own set of advantages and challenges. Here are a few potential reforms and their potential implications:

- Exemption of a Portion of Benefits: Excluding a certain amount of Social Security benefits from taxation, similar to the treatment of pension income, could provide a tax break for retirees. However, this approach may require adjustments to the thresholds and income limits to maintain the program's funding and fairness.

- Progressive Taxation: Implementing a progressive tax system for Social Security benefits, where higher benefits are taxed at a higher rate, could address concerns about fairness while maintaining revenue for the program. However, this approach may face opposition from those who argue for a more simplified tax system.

- Universal Exemption: Exempting all Social Security benefits from taxation, regardless of income level, would provide a universal tax break for retirees. However, this could result in a significant loss of revenue for the Social Security trust fund and may require alternative funding mechanisms or adjustments to benefit levels.

The future of Social Security taxation is closely tied to broader discussions about tax policy, retirement income, and social welfare programs. As the population ages and the demand for Social Security benefits increases, finding a balanced approach that ensures the program's sustainability while providing financial security for retirees remains a complex challenge.

What is the purpose of taxing Social Security benefits?

+Taxing Social Security benefits helps fund the program and contributes to the overall tax base. It ensures that higher-income retirees, who have the capacity to pay, contribute to the system, maintaining its sustainability.

How can I reduce the impact of double taxation on my Social Security benefits?

+To minimize double taxation, consider strategies such as delaying Social Security benefit claims, managing your retirement income sources to stay below applicable thresholds, and exploring tax-efficient withdrawal strategies from other retirement accounts.

Are there any proposals to reform the taxation of Social Security benefits?

+Yes, there have been proposals to exempt a portion of benefits from taxation, implement a progressive tax system, or provide a universal exemption. These reforms aim to address concerns about double taxation while ensuring the program’s sustainability.