Az Sales Tax

Welcome to this in-depth exploration of the world of sales tax, a complex and often misunderstood topic in the realm of business and finance. In today's global economy, understanding the intricacies of sales tax is crucial for businesses, consumers, and even governments. This comprehensive guide will delve into the specifics of sales tax, its mechanisms, and its impact on various industries, providing you with a comprehensive understanding of this essential aspect of commerce.

Understanding Sales Tax: A Global Perspective

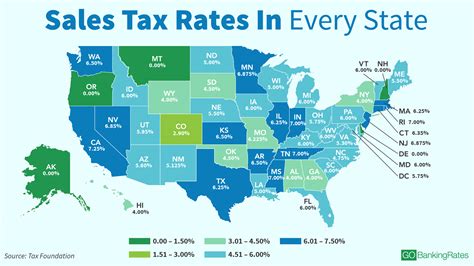

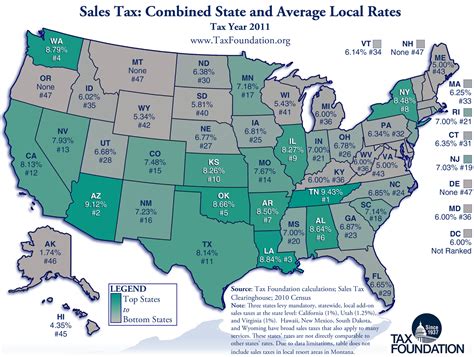

Sales tax is a consumption tax levied on the sale of goods and services. It is a crucial revenue source for governments, contributing significantly to the funding of public services and infrastructure. The concept of sales tax varies widely across countries and regions, with different rates, exemptions, and enforcement mechanisms.

For instance, in the United States, sales tax is typically collected by states, counties, and municipalities, resulting in a patchwork of tax rates and regulations. This complexity often poses challenges for businesses operating across state lines, requiring meticulous record-keeping and compliance with varying tax laws.

The Impact on Business Operations

Sales tax has a direct and immediate impact on the day-to-day operations of businesses. For retailers, it affects the final price of goods, influencing purchasing decisions and customer satisfaction. Moreover, businesses must navigate the complex process of registering, collecting, and remitting sales tax, often utilizing specialized software and accounting procedures to ensure compliance.

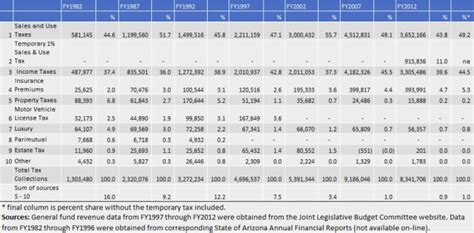

| Country | Average Sales Tax Rate |

|---|---|

| United States | 7.25% (National Average) |

| Canada | 13% (GST/HST National Average) |

| European Union | Varies by Country (Range: 17-27%) |

| Australia | 10% (GST) |

The above table provides a glimpse into the varying sales tax rates across different countries, highlighting the diversity and complexity of sales tax systems worldwide.

Consumer Perspective

From a consumer standpoint, sales tax is a visible and tangible cost added to purchases. While some consumers may view sales tax as a necessary evil, contributing to the maintenance of public services, others may perceive it as an unnecessary burden, especially when it comes to essential goods and services.

Understanding the sales tax system is crucial for consumers to make informed purchasing decisions. It also allows them to advocate for fair and transparent tax policies, ensuring that their tax contributions are utilized effectively by the government.

The Mechanics of Sales Tax

Sales tax operates through a complex system of regulations and processes. Here’s a simplified breakdown of how it works:

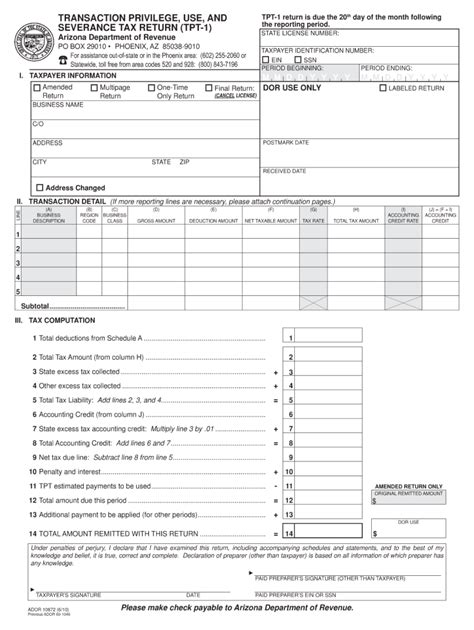

- Registration: Businesses engaged in taxable activities must register with the relevant tax authority. This process often involves providing detailed information about the business, its activities, and its tax obligations.

- Taxable Transactions: Sales tax is typically applied to the sale of goods and services, with specific exemptions and exclusions varying by jurisdiction. Some common taxable items include clothing, electronics, and restaurant meals.

- Collection: Businesses act as tax collectors, adding the applicable sales tax to the retail price of goods or services. This tax is then collected from the customer at the point of sale.

- Remittance: Periodically, usually on a monthly or quarterly basis, businesses must remit the collected sales tax to the tax authority. This process involves filing tax returns and providing detailed reports of taxable sales.

- Compliance and Enforcement: Tax authorities employ various measures to ensure compliance, including audits, penalties for non-compliance, and educational initiatives to assist businesses in understanding their tax obligations.

The mechanics of sales tax are intricate and can vary significantly depending on the jurisdiction. It is essential for businesses and consumers alike to stay informed about the specific sales tax regulations in their area to ensure compliance and make informed financial decisions.

Industry Insights: Sales Tax in Action

Sales tax has a profound impact on various industries, influencing their business models, pricing strategies, and operational costs. Let’s explore how sales tax affects three distinct industries:

Retail Industry

In the retail sector, sales tax is a critical factor in pricing strategies. Retailers must carefully consider the impact of sales tax on their products’ final prices, ensuring that they remain competitive while still generating sufficient revenue. Moreover, with the rise of e-commerce, retailers must navigate the complexities of sales tax in the online space, often requiring specialized software and expertise.

Hospitality Industry

The hospitality industry, including restaurants, hotels, and tourism businesses, is heavily influenced by sales tax. For instance, a restaurant’s menu prices must include the applicable sales tax, impacting customer expectations and satisfaction. Additionally, sales tax on accommodations can significantly affect the profitability of hotels and other lodging businesses.

Manufacturing and Wholesale Industry

Sales tax in the manufacturing and wholesale sector is often more complex due to the nature of B2B (Business-to-Business) transactions. Manufacturers and wholesalers must navigate a range of tax regulations, including those related to interstate and international trade. They also face challenges in managing tax obligations for their diverse customer base, often requiring advanced tax software and accounting practices.

The Future of Sales Tax: Trends and Innovations

The landscape of sales tax is continually evolving, influenced by technological advancements, changing consumer behavior, and evolving government policies. Here are some key trends and innovations shaping the future of sales tax:

Digital Taxation

With the rise of e-commerce and digital platforms, governments are increasingly focusing on digital taxation. This includes the implementation of digital services taxes and the development of guidelines for taxing cross-border digital transactions. Businesses operating in the digital space must stay updated with these evolving regulations to ensure compliance and maintain a competitive edge.

Simplification and Automation

To address the complexity of sales tax, there is a growing trend towards simplification and automation. Governments and businesses are investing in technology to streamline the tax collection and remittance process. This includes the use of advanced software, machine learning, and blockchain technology to enhance accuracy, efficiency, and transparency in sales tax management.

International Harmonization

In an era of increasing globalization, there is a push for international harmonization of sales tax regulations. This includes efforts to standardize tax rates, exemptions, and enforcement mechanisms across borders. While still in its early stages, this trend aims to simplify cross-border trade and reduce the administrative burden on businesses operating internationally.

Conclusion: Embracing the Complexity of Sales Tax

Sales tax is an intricate and ever-evolving aspect of the global economy. Its impact on businesses, consumers, and governments is profound, influencing financial decisions, operational strategies, and public policy. By understanding the complexities and nuances of sales tax, businesses and individuals can navigate this landscape with confidence, ensuring compliance, and optimizing their financial strategies.

Stay tuned for further insights and updates as the world of sales tax continues to evolve, shaping the future of commerce and taxation.

What is the difference between sales tax and VAT (Value Added Tax)?

+

Sales tax and VAT are both consumption taxes, but they differ in their mechanisms and application. Sales tax is typically applied at the point of sale, with the tax amount added to the retail price of goods or services. VAT, on the other hand, is a multi-stage tax levied on the value added at each stage of production and distribution. While sales tax is more straightforward, VAT can provide more flexibility in tax collection and administration.

How do businesses ensure compliance with sales tax regulations?

+

Ensuring compliance with sales tax regulations is a complex task that requires careful planning and attention to detail. Businesses typically utilize specialized tax software and accounting systems to track taxable sales, calculate tax liabilities, and generate tax returns. Regular training and education for employees involved in tax-related tasks are also essential to maintain compliance.

What are the consequences of non-compliance with sales tax regulations?

+

Non-compliance with sales tax regulations can result in significant penalties and legal consequences. Tax authorities have the power to impose fines, interest charges, and even criminal penalties for severe cases of tax evasion. Additionally, non-compliance can lead to a loss of business reputation and trust, impacting future growth and success.