Be Smart Pay Zero Taxes

Taxes are an inevitable part of our lives, but the idea of paying zero taxes seems like a dream for many. However, with careful planning, strategic financial decisions, and an understanding of tax laws, it is possible to significantly reduce your tax liability and, in some cases, even pay zero taxes. This comprehensive guide will delve into the strategies and techniques that can help you navigate the complex world of taxation and potentially achieve this coveted financial goal.

Understanding the Tax Landscape

Before we dive into the strategies, it’s essential to grasp the fundamentals of the tax system and the factors that influence your tax liability. Taxes are a vital component of any economy, serving as a primary source of revenue for governments to fund public services, infrastructure, and social programs. The tax system varies widely across different countries and jurisdictions, each with its unique set of laws, regulations, and tax rates.

In most countries, individuals and businesses are subject to various types of taxes, including income tax, sales tax, property tax, and more. Income tax, in particular, is a significant source of revenue for governments, and it's calculated based on an individual's or entity's taxable income. Taxable income is typically derived from various sources, such as employment earnings, business profits, investment gains, and other taxable activities.

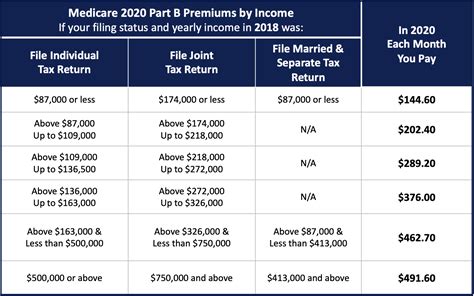

The tax system is designed to be progressive, meaning that higher earners pay a larger proportion of their income in taxes. This is achieved through tax brackets, where individuals with higher incomes are subject to higher tax rates. Additionally, various deductions, credits, and allowances are available to reduce taxable income and lower the overall tax liability.

Understanding the tax landscape in your specific jurisdiction is crucial. Tax laws and regulations can be complex and ever-changing, so staying informed and seeking professional advice is essential. Tax authorities often provide resources and guidelines to help taxpayers understand their obligations and rights. It's important to familiarize yourself with the tax rates, brackets, and any applicable tax reforms or incentives in your region.

Maximizing Tax-Efficient Strategies

Paying zero taxes is not about evading your tax obligations but rather about optimizing your financial decisions to minimize your tax liability within the boundaries of the law. Here are some key strategies to consider:

Take Advantage of Tax Deductions and Credits

Tax deductions and credits are powerful tools to reduce your taxable income and lower your tax bill. Deductions allow you to subtract certain expenses from your gross income, effectively reducing the amount of income subject to tax. Common deductions include contributions to retirement accounts, student loan interest, medical expenses, and charitable donations.

Tax credits, on the other hand, provide a direct reduction in the amount of tax you owe. They are often more valuable than deductions because they directly decrease your tax liability dollar-for-dollar. Examples of tax credits include the Child Tax Credit, Education Credits, and the Earned Income Tax Credit (EITC) for low- to moderate-income individuals.

It's crucial to understand the eligibility criteria and requirements for different deductions and credits. Keeping meticulous records of eligible expenses and consulting a tax professional can help you maximize these benefits.

Optimize Your Investment Strategies

Investing is a powerful tool for wealth building, but it can also have significant tax implications. By strategically planning your investment portfolio, you can minimize the tax impact and maximize your returns.

One key strategy is to utilize tax-advantaged investment accounts, such as Individual Retirement Accounts (IRAs) or 401(k) plans. Contributions to these accounts are often tax-deductible, and the investments grow tax-free until withdrawal. This allows your investments to compound over time without being taxed, leading to substantial long-term savings.

Additionally, consider the tax implications of different investment types. For instance, capital gains from the sale of assets are taxed at different rates depending on whether they are short-term or long-term gains. Understanding these distinctions can help you time your investments and realize tax-efficient gains.

Tax-loss harvesting is another strategy where you can sell losing investments to offset capital gains and potentially reduce your tax liability. It's a sophisticated technique that requires careful planning and an understanding of the wash sale rule to avoid tax penalties.

Business Ownership and Self-Employment

Starting your own business or becoming self-employed can offer numerous tax benefits. As a business owner, you have access to a wide range of deductions and tax incentives that can significantly reduce your taxable income.

For instance, you can deduct business expenses such as office rent, equipment, travel costs, and marketing expenses. Additionally, you may be eligible for tax breaks related to hiring employees, investing in research and development, or adopting certain environmentally friendly practices.

Self-employment also allows you to contribute to tax-advantaged retirement plans specifically designed for business owners, such as Simplified Employee Pension (SEP) IRAs or Solo 401(k) plans. These plans offer higher contribution limits than traditional IRAs, providing an excellent opportunity to save for retirement while reducing your tax burden.

Real Estate Investments

Real estate can be a powerful tool for tax planning. Rental properties, in particular, offer a range of tax benefits. You can deduct mortgage interest, property taxes, maintenance costs, and other expenses related to the rental property from your taxable income.

Furthermore, when you sell a rental property, you may be eligible for capital gains tax exclusion if you've owned and used the property as your primary residence for a certain period. This can provide a significant tax advantage, especially if you've held the property for a long time and realized substantial gains.

Another strategy is to invest in real estate through a Real Estate Investment Trust (REIT). REITs are companies that own and operate income-producing real estate, and they offer investors the opportunity to benefit from real estate investments without directly owning the properties. REITs are typically structured as pass-through entities, meaning they are not subject to corporate income tax, and the profits are distributed to investors as dividends.

Estate Planning and Gift Taxes

Estate planning is an essential aspect of financial management, especially when aiming to pay zero taxes. Proper estate planning can help you minimize estate taxes and ensure that your assets are distributed according to your wishes.

Gift taxes are another consideration. By making strategic gifts to family members or charitable organizations, you can reduce the value of your estate and potentially lower your tax liability. However, it's crucial to understand the annual exclusion limits and lifetime gift tax exemption to avoid unexpected tax consequences.

Working with an estate planning attorney and a tax professional can help you navigate the complex world of estate and gift taxes, ensuring that your plans are legally sound and tax-efficient.

Alternative Tax Strategies

In addition to the traditional tax-saving strategies, there are alternative approaches that can help you further reduce your tax burden. These strategies may be more complex and require specialized knowledge, so it’s essential to consult experts in these areas.

Charitable Giving Strategies

Charitable giving not only supports important causes but can also provide significant tax benefits. Donating to qualified charitable organizations allows you to deduct the value of your donations from your taxable income. Additionally, certain types of donations, such as appreciated assets, can provide even greater tax advantages.

Strategies like Donor-Advised Funds (DAFs) allow you to make a charitable contribution and receive an immediate tax deduction, while the funds are invested and grow tax-free. This provides a way to maximize the tax benefits of charitable giving while supporting your favorite causes over the long term.

Tax Havens and Offshore Strategies

Tax havens are jurisdictions with low or zero tax rates, offering individuals and businesses the opportunity to legally reduce their tax liabilities. By establishing an offshore company or trust in a tax haven, you can minimize taxes on your international income and assets.

However, it's crucial to approach these strategies with caution and seek expert advice. Tax havens have become increasingly scrutinized by tax authorities, and improper use of these structures can lead to severe penalties and legal consequences. Working with reputable professionals who specialize in international tax planning is essential to ensure compliance and avoid potential pitfalls.

Future Implications and Considerations

Paying zero taxes is an ambitious goal, and while it may be achievable for some, it’s important to consider the long-term implications and potential drawbacks.

First and foremost, it's essential to ensure that your financial decisions align with your overall goals and priorities. While minimizing taxes is important, it should not be the sole focus of your financial planning. Maintaining a balanced approach that considers your short-term and long-term financial needs is crucial.

Additionally, tax laws and regulations are subject to change. Governments may introduce new tax reforms, increase tax rates, or eliminate certain deductions and credits. Staying informed about potential changes and adapting your financial strategies accordingly is vital to maintain your tax-efficient position.

Furthermore, paying zero taxes may not always be desirable or possible. In some cases, it may indicate that you are not contributing your fair share to society through taxes. Taxes fund essential public services and infrastructure, and it's important to recognize the role taxes play in supporting the community and the greater good.

Conclusion

Paying zero taxes is a complex and multifaceted goal that requires careful planning, strategic financial decisions, and a deep understanding of tax laws. While it may be achievable for some, it’s essential to approach tax planning with a holistic view that considers your overall financial well-being and the needs of your community.

By maximizing tax-efficient strategies, optimizing your investments, and seeking professional guidance, you can significantly reduce your tax liability and potentially pay zero taxes. However, it's crucial to remain mindful of the long-term implications, stay informed about tax reforms, and maintain a balanced financial approach.

Remember, tax planning is an ongoing process, and staying adaptable and informed is key to navigating the ever-changing tax landscape successfully.

How can I start implementing tax-efficient strategies in my financial planning?

+Start by educating yourself about the tax laws and regulations in your jurisdiction. Consult a tax professional or financial advisor who can guide you through the process of maximizing deductions and credits. Additionally, consider setting up tax-advantaged investment accounts and exploring business ownership opportunities to take advantage of the available tax benefits.

Are there any potential risks associated with tax-saving strategies?

+While tax-saving strategies are legal and can provide significant benefits, it’s important to be aware of potential risks. Improperly claiming deductions or credits can lead to audits and penalties. Additionally, certain strategies, such as offshore tax planning, carry higher risks and should be approached with caution. It’s crucial to seek professional advice to ensure compliance and minimize potential pitfalls.

Can paying zero taxes impact my eligibility for certain government benefits?

+Yes, paying zero taxes may impact your eligibility for certain government benefits. Many social welfare programs, such as Medicaid or social security benefits, are means-tested and consider your income and assets. By reducing your taxable income through tax-saving strategies, you may lower your eligibility for these benefits. It’s important to carefully consider the trade-offs and consult a financial advisor to ensure you’re making informed decisions.

How often should I review and update my tax planning strategies?

+Tax planning is an ongoing process, and it’s essential to review and update your strategies regularly. Tax laws and your personal financial situation can change over time, so an annual review is generally recommended. Additionally, significant life events, such as marriage, divorce, starting a business, or major investments, should prompt a thorough review of your tax planning to ensure it remains aligned with your goals and the current tax landscape.