Property Tax In Ventura County Ca

Ventura County, located in Southern California, is renowned for its stunning coastline, vibrant communities, and diverse landscapes. As a homeowner or prospective buyer in this picturesque region, understanding the intricacies of property taxes is essential. Property taxes in Ventura County, like in many other areas, are a significant factor in the overall cost of homeownership. This article aims to provide a comprehensive guide to property taxes in Ventura County, covering everything from assessment processes to potential exemptions and strategies to minimize your tax burden.

Understanding Property Tax Assessments in Ventura County

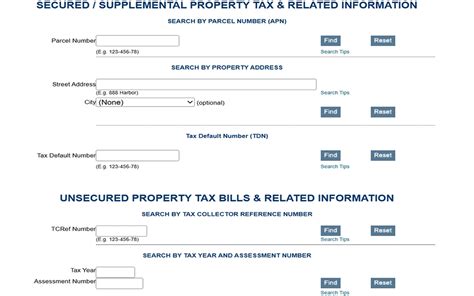

Property tax assessments in Ventura County are governed by the Ventura County Assessor’s Office, which is responsible for determining the value of each property within the county. The assessed value of a property serves as the basis for calculating the annual property tax liability. The assessment process involves several key steps:

Annual Assessment

Every year, the Assessor’s Office conducts an annual assessment to update property values. This process considers various factors, including recent sales of comparable properties, improvements made to the property, and market trends. The assessed value is typically a percentage of the property’s fair market value, which is the price it would likely sell for on the open market.

| Assessment Year | Average Assessed Value |

|---|---|

| 2022 | $750,000 |

| 2023 | $780,000 (projected) |

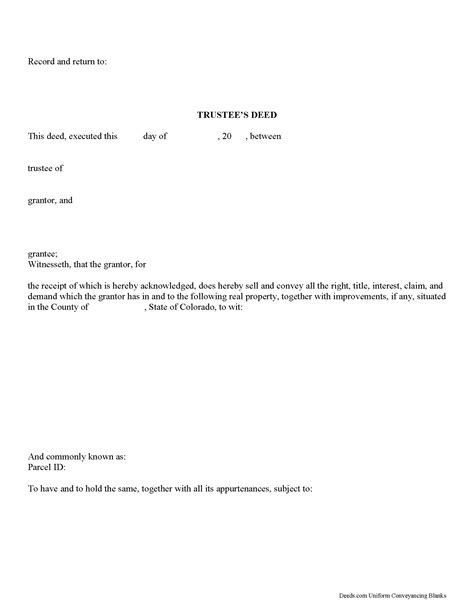

Change of Ownership

When a property changes ownership, a new assessment is triggered. The assessed value in such cases is typically based on the sale price, ensuring that the property’s value aligns with recent market transactions.

New Construction and Improvements

If you’ve made significant improvements to your property, such as adding a new wing or renovating an existing structure, the Assessor’s Office may re-evaluate the property’s value to reflect these changes. This process ensures that property taxes accurately reflect the enhanced value of the property.

Calculating Property Taxes in Ventura County

Once the assessed value of your property is determined, the calculation of your property taxes involves a straightforward formula. In California, the Proposition 13 tax rate, which limits property tax increases, is a key component of this calculation.

Proposition 13 Tax Rate

Enacted in 1978, Proposition 13 set a maximum property tax rate of 1% of the assessed value, with an annual increase limit of 2% or the inflation rate, whichever is lower. This means that even if your property’s value increases significantly, your property taxes cannot increase by more than 2% per year, providing a measure of stability for homeowners.

Tax Rate Example

Let’s consider an example. If your property’s assessed value is $750,000, your annual property tax would be calculated as follows:

Property Tax = Assessed Value x Tax Rate

Property Tax = $750,000 x 1% = $7,500

So, in this case, your annual property tax liability would be $7,500.

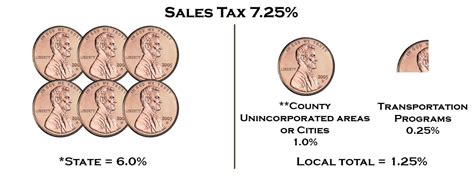

Special Assessment Districts

In addition to the standard property tax, some areas within Ventura County may have special assessment districts, such as Mello-Roos districts, which are used to fund specific community improvements. These assessments are in addition to the standard property tax and are calculated based on the assessed value of your property.

Property Tax Exemptions and Relief Programs

Ventura County offers several property tax exemptions and relief programs designed to assist specific groups of homeowners. These programs can significantly reduce your property tax burden, so it’s essential to understand which ones you may be eligible for.

Homestead Exemption

The Homestead Exemption program provides a reduction in the assessed value of your primary residence. To qualify, you must own and occupy the property as your primary residence. The exemption amount varies based on your income level and the county’s guidelines. For example, low-income seniors may be eligible for a higher exemption.

Veterans’ Exemption

Veterans who meet certain criteria, such as having a service-connected disability or being on active duty, may be eligible for a property tax exemption. This exemption can provide a significant reduction in property taxes, making homeownership more affordable for our nation’s heroes.

Disability Exemption

Individuals with permanent disabilities may qualify for a disability exemption, which can reduce the assessed value of their property. This exemption aims to provide financial relief to those facing physical challenges.

Senior Citizen Exemption

Senior citizens who are 65 years or older and meet specific income requirements may be eligible for a senior citizen exemption. This program can help older adults maintain their homes by reducing the property tax burden.

Strategies to Minimize Property Taxes

While property taxes in Ventura County are relatively stable due to Proposition 13, there are still strategies you can employ to potentially reduce your tax liability. Here are some tips to consider:

Appeal Your Property Assessment

If you believe your property’s assessed value is too high, you have the right to appeal. The process involves gathering evidence, such as recent sales of similar properties, to support your case. An accurate and fair assessment is crucial for minimizing your property taxes.

Explore Tax Relief Programs

Stay informed about the various tax relief programs offered by Ventura County. These programs can provide significant savings, especially for eligible homeowners. Make sure to research and apply for any programs that align with your circumstances.

Consider a Property Tax Loan

If you’re facing financial challenges and need assistance paying your property taxes, a property tax loan can be an option. These loans are designed to help homeowners avoid penalties and late fees associated with unpaid property taxes.

Utilize Homeowner Associations

Homeowner associations (HOAs) in Ventura County often advocate for their members’ interests, including property tax matters. Staying engaged with your HOA can provide valuable insights and support in navigating property tax issues.

Future Implications and Property Tax Trends

Looking ahead, it’s essential to consider the potential future implications of property taxes in Ventura County. While Proposition 13 provides stability, there are ongoing discussions and proposals that could impact property taxes in the future.

Proposition 13 Reform Proposals

Some policymakers and advocacy groups have proposed reforms to Proposition 13, suggesting changes to the assessment process and tax rates. These proposals aim to address concerns about fairness and ensure that property taxes remain sustainable in the long term. Staying informed about these discussions is crucial for understanding potential future changes.

Market Fluctuations and Assessments

Ventura County’s real estate market, like any other, is subject to fluctuations. In periods of rapid market growth, property values may increase significantly, leading to higher assessments and, consequently, higher property taxes. Staying abreast of market trends can help you anticipate and plan for potential changes in your property tax liability.

Community Development and Infrastructure

Ventura County’s continued development and infrastructure improvements may lead to the establishment of new assessment districts or special taxes. These measures are often implemented to fund specific projects, such as road improvements or community facilities. Being aware of these initiatives can help you understand how they may impact your property taxes.

Conclusion: Navigating Property Taxes in Ventura County

Understanding and managing property taxes is an essential aspect of homeownership in Ventura County. By staying informed about the assessment process, exploring exemptions and relief programs, and employing strategic approaches, you can navigate the property tax landscape effectively. Remember, staying proactive and engaged with your local government and community can provide valuable insights and support in managing your property tax obligations.

How often are property tax assessments conducted in Ventura County?

+

Property tax assessments in Ventura County are conducted annually. The Assessor’s Office updates property values each year to ensure that taxes are calculated based on current market conditions.

Can I appeal my property’s assessed value if I disagree with it?

+

Yes, you have the right to appeal your property’s assessed value if you believe it is inaccurate or unfair. The appeal process involves gathering evidence and presenting your case to the Assessor’s Office.

Are there any property tax relief programs specifically for low-income homeowners in Ventura County?

+

Yes, Ventura County offers several property tax relief programs for low-income homeowners. These programs include the Homestead Exemption and Senior Citizen Exemption, which can provide significant reductions in property taxes.

What happens if I don’t pay my property taxes on time in Ventura County?

+

If you fail to pay your property taxes on time, you may incur penalties and interest. In some cases, the county may initiate tax sale procedures to recover the unpaid taxes. It’s crucial to stay current with your property tax payments to avoid these consequences.

Can I deduct my property taxes on my federal income tax return?

+

Yes, property taxes paid on your primary residence are generally deductible on your federal income tax return. However, there are limitations and restrictions, so it’s advisable to consult with a tax professional to understand the specific rules and maximize your deductions.