What Is Sales Tax In Colorado

Sales tax in Colorado is a crucial aspect of the state's economy and tax system. It is a type of consumption tax that applies to the retail sale of goods and some services within the state. Understanding the intricacies of Colorado's sales tax is essential for businesses, consumers, and anyone interested in the economic landscape of the Centennial State.

The Basics of Sales Tax in Colorado

Colorado’s sales tax system is governed by the Colorado Department of Revenue, which collects and distributes tax revenues to support various state and local programs and services. The state’s sales tax is a percentage-based tax, meaning the tax rate is applied to the price of taxable goods and services.

As of [current year], the statewide sales and use tax rate in Colorado is 2.9%. This rate is applied uniformly across the state and serves as the foundation for the total sales tax rate. However, it's important to note that Colorado's sales tax system is not limited to this state-level tax.

Local Sales Tax Rates

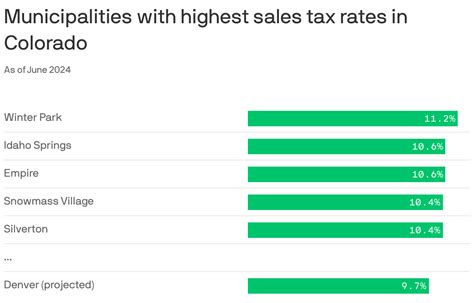

In addition to the statewide rate, Colorado allows local governments, including counties and municipalities, to impose their own sales and use taxes. These local sales tax rates can vary significantly from one area to another, adding complexity to the state’s sales tax landscape.

| County/City | Local Sales Tax Rate |

|---|---|

| Denver | 3.62% |

| Boulder | 3.25% |

| Colorado Springs | 3.1% |

| Fort Collins | 3.1% |

| Pueblo | 3.1% |

These local rates are added to the statewide rate, resulting in total sales tax rates that can vary significantly throughout the state. For example, in Denver, the total sales tax rate would be 6.52% (2.9% statewide + 3.62% local), while in Colorado Springs, it would be 6.0% (2.9% statewide + 3.1% local).

Taxable Items and Exemptions

Not all goods and services are subject to sales tax in Colorado. The state maintains a list of taxable items and exemptions that businesses and consumers should be aware of. Here’s an overview:

Taxable Items

The majority of tangible personal property sold at retail is subject to sales tax. This includes items like clothing, electronics, furniture, and most grocery items. Additionally, certain services, such as repair and installation services, are also taxable.

Exemptions

- Most groceries, including staple foods, dairy products, and certain prepared foods, are exempt from sales tax in Colorado.

- Prescription medications and medical devices are tax-exempt.

- Residential utilities, such as electricity, natural gas, and water, are not subject to sales tax.

- Certain agricultural equipment and supplies are exempt from sales tax.

- Educational materials and textbooks are tax-free.

It's important for businesses to stay updated on the state's tax guidelines to ensure compliance and for consumers to understand which items they may be able to purchase tax-free.

Sales Tax Collection and Remittance

Businesses in Colorado that sell taxable goods or services are responsible for collecting and remitting sales tax to the state. This process involves the following key steps:

- Registering for a Sales Tax Permit: Businesses must obtain a Seller's License or Sales Tax Permit from the Colorado Department of Revenue. This license authorizes the business to collect and remit sales tax.

- Calculating Sales Tax: Businesses must calculate the sales tax on each taxable transaction by multiplying the sale price by the applicable tax rate (statewide and local rates combined).

- Collecting Sales Tax: The calculated sales tax is added to the price of the goods or services and collected from the customer at the point of sale.

- Remitting Sales Tax: Businesses are required to remit the collected sales tax to the state on a regular basis, typically monthly or quarterly, depending on their sales volume. This process involves filing a sales tax return and making the appropriate payment.

Sales Tax Compliance and Penalties

Failure to comply with Colorado’s sales tax laws can result in penalties and interest charges. The state takes sales tax compliance seriously, and businesses are encouraged to stay informed about their obligations to avoid penalties.

Some common penalties include:

- Late Payment Penalties: Businesses that fail to remit sales tax on time may incur a penalty of up to 10% of the unpaid tax.

- Non-Compliance Penalties: Businesses that consistently fail to collect and remit sales tax may face more severe penalties, including fines and possible criminal charges.

- Interest on Unpaid Tax: Unpaid sales tax may accrue interest, which is typically calculated at a rate of 1.5% per month.

Sales Tax for Online Sales

With the rise of e-commerce, the collection of sales tax for online sales has become a critical issue. In Colorado, online retailers are generally required to collect and remit sales tax on transactions with Colorado customers, regardless of whether the retailer has a physical presence in the state.

Economic Nexus

Colorado, like many other states, has adopted the concept of economic nexus, which means that out-of-state sellers may be required to collect and remit sales tax if they exceed a certain threshold of sales or transactions within the state. This threshold is typically based on the seller’s gross revenue or the number of transactions.

Marketplace Facilitator Laws

Colorado has also implemented marketplace facilitator laws, which hold online marketplace operators (such as Amazon or eBay) responsible for collecting and remitting sales tax on behalf of their third-party sellers. This ensures that sales tax is collected on a wider range of online transactions.

The Impact of Sales Tax on Businesses and Consumers

Colorado’s sales tax system has both direct and indirect impacts on businesses and consumers within the state.

Impact on Businesses

- Revenue Generation: Sales tax is a significant source of revenue for the state and local governments, which helps fund public services and infrastructure.

- Compliance Challenges: Businesses, especially those with multiple locations or online sales, face the challenge of complying with varying tax rates and regulations across jurisdictions.

- Competitive Advantage: Businesses may strategically price their products to remain competitive, taking into account the impact of sales tax on consumer prices.

Impact on Consumers

- Price Transparency: Consumers in Colorado are accustomed to seeing sales tax added to the price of goods and services, promoting price transparency.

- Shopping Decisions: Sales tax rates can influence consumers’ shopping choices, with some opting to shop in areas with lower tax rates or online to avoid sales tax.

- Budgeting and Financial Planning: Consumers must consider sales tax when budgeting for large purchases, as it can significantly impact the overall cost.

Future Outlook and Potential Changes

Colorado’s sales tax landscape is subject to change, influenced by various factors such as economic trends, legislative decisions, and technological advancements.

Potential Tax Rate Adjustments

The statewide sales tax rate and local rates are subject to change through legislative actions. While the current rates have been stable for some time, future economic needs or political priorities could lead to rate adjustments.

Simplification Efforts

There have been ongoing discussions and efforts to simplify Colorado’s sales tax system, especially regarding the complex local tax rates. While no significant changes have been implemented recently, the possibility of a more uniform tax system across the state remains a topic of interest.

E-Commerce and Remote Sellers

As e-commerce continues to grow, the collection of sales tax from online sellers, particularly those without a physical presence in the state, will remain a focus for tax authorities. This could lead to further refinements in the state’s marketplace facilitator laws and economic nexus thresholds.

Conclusion

Colorado’s sales tax system is a dynamic and integral part of the state’s economic framework. From the diverse local tax rates to the impact on businesses and consumers, understanding sales tax is crucial for anyone navigating the economic landscape of the state. As the state’s tax system continues to evolve, staying informed about sales tax regulations and their potential implications will be essential for businesses and consumers alike.

How often do businesses need to remit sales tax in Colorado?

+Businesses with a monthly sales tax liability of 5,000 or more are required to remit sales tax monthly. Those with a liability of less than 5,000 can remit sales tax quarterly. However, businesses can opt to remit monthly regardless of their liability amount.

Are there any sales tax holidays in Colorado?

+Yes, Colorado observes certain sales tax holidays. These are designated periods when specific items, such as school supplies or clothing, are exempt from sales tax. The dates and eligible items for these holidays vary each year and are announced by the state.

What happens if a business fails to collect sales tax in Colorado?

+Businesses that fail to collect and remit sales tax may face penalties and interest charges. The severity of penalties can vary depending on the circumstances and the level of non-compliance. It’s crucial for businesses to stay compliant to avoid these consequences.