Greenville Property Tax

Welcome to our comprehensive guide on the Greenville Property Tax, a crucial aspect of owning real estate in the vibrant city of Greenville. This article aims to provide an in-depth analysis of property taxes in this thriving region, offering valuable insights for both existing homeowners and prospective buyers.

Understanding Greenville’s Property Tax Landscape

Greenville, known for its vibrant culture, bustling economy, and stunning natural surroundings, boasts a diverse real estate market. Property taxes play a significant role in the city’s fiscal structure and are an essential consideration for any property owner. Let’s delve into the specifics of Greenville’s property tax system.

The property tax in Greenville is primarily determined by the assessed value of your property, which is established by the Greenville County Assessor's Office. This office conducts regular assessments to ensure property values are accurately reflected. The assessed value is then multiplied by the applicable millage rate, which varies based on the property's location and classification.

Factors Influencing Property Tax

Several factors contribute to the calculation of property taxes in Greenville. These include the property’s:

- Location: Properties situated in different areas of Greenville County may have varying tax rates due to disparities in local government services and infrastructure.

- Size and Improvements: The size of your property, as well as any structural improvements or renovations, can impact its assessed value and, consequently, the property tax.

- Use Classification: Greenville County classifies properties into different categories, such as residential, commercial, agricultural, or industrial. Each category has its own millage rate.

- Local Government Budget: Property taxes contribute significantly to the local government’s budget, which funds various services like education, public safety, and infrastructure development.

Understanding these factors is crucial for property owners as it allows them to anticipate and plan for their annual tax obligations.

Assessed Value and Tax Rates

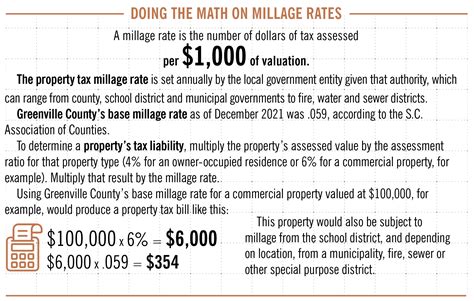

The assessed value of a property is not necessarily the same as its market value. It is typically determined by the Assessor’s Office through a combination of sales data, construction costs, and depreciation analysis. Once the assessed value is established, it is multiplied by the applicable millage rate to calculate the property tax.

The millage rate, expressed as a decimal, represents the tax rate per $1,000 of assessed value. For instance, a millage rate of 0.0200 implies a tax of $20 for every $1,000 of assessed value. These rates are set annually by local governing bodies and can vary from one municipality to another within Greenville County.

| Property Type | Millage Rate (2023) |

|---|---|

| Residential | 0.0200 |

| Commercial | 0.0300 |

| Agricultural | 0.0150 |

| Industrial | 0.0250 |

Property Tax Payments and Due Dates

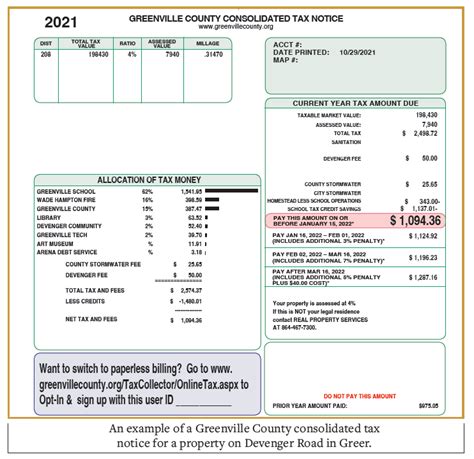

Property tax payments in Greenville are typically due semi-annually, with deadlines falling in January and July of each year. Property owners receive tax bills from the Greenville County Treasurer’s Office, which provides detailed information on the assessed value, applicable tax rate, and the total amount due.

Late payments incur penalties, so it's crucial to stay informed about the due dates and ensure timely remittance. Property owners can pay their taxes online, by mail, or in person at the Treasurer's Office.

Exemptions and Deductions

Greenville County offers several exemptions and deductions to eligible property owners, which can significantly reduce their tax liabilities. These include:

- Homestead Exemption: Greenville residents who use their property as their primary residence can apply for a homestead exemption, which reduces the assessed value of their property for tax purposes.

- Senior Citizen Deduction: Property owners aged 65 or older may qualify for a deduction on their taxable value, subject to certain income limits.

- Veteran’s Exemption: Greenville honors its veterans by offering property tax exemptions based on disability status and length of service.

- Agricultural Use Valuation: Properties used for agricultural purposes may be eligible for a lower assessed value if they meet specific criteria.

It is important for property owners to explore these options and consult with the Assessor's Office to determine their eligibility and potential savings.

Appealing Property Assessments

If a property owner believes their property’s assessed value is inaccurate, they have the right to appeal. The Greenville County Board of Assessment Appeals handles such disputes. The process typically involves submitting an appeal application, providing supporting evidence, and attending a hearing to present their case.

Appeals can be based on various grounds, such as:

- A recent decrease in property value due to market conditions or improvements.

- Discrepancies in the property's physical characteristics as recorded by the Assessor's Office.

- Errors in the property's classification or zoning.

It is advisable to seek professional advice or consult with the Assessor's Office to ensure a successful appeal.

The Impact of Property Taxes on Greenville’s Economy

Property taxes are a significant revenue source for Greenville County, contributing to the development and maintenance of vital infrastructure and services. These taxes fund schools, roads, public safety, and various community programs, shaping the city’s overall growth and quality of life.

The stability and efficiency of Greenville's property tax system have been instrumental in attracting businesses and residents, fostering a vibrant and sustainable community.

Comparative Analysis

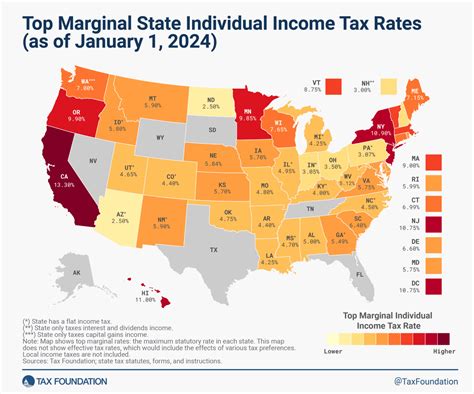

When compared to other cities in South Carolina, Greenville’s property tax rates are relatively competitive. A 2022 study by the SC Department of Revenue revealed that Greenville’s effective property tax rate was lower than the state average, making it an attractive option for homeowners and investors.

Future Outlook and Potential Changes

As Greenville continues to grow and evolve, its property tax system may undergo adjustments to accommodate changing needs and priorities. The city’s commitment to sustainable development and community enhancement suggests that property taxes will remain a vital component of the local economy.

Property owners can anticipate potential changes in assessment methodologies, tax rates, and exemptions as the city adapts to new challenges and opportunities. Staying informed about these developments is crucial for effective financial planning.

How often are property assessments conducted in Greenville County?

+Property assessments in Greenville County are typically conducted every five years, but the Assessor’s Office may perform additional assessments as needed.

Can property owners estimate their tax liability before receiving the tax bill?

+Yes, property owners can estimate their tax liability by multiplying their property’s assessed value by the applicable millage rate. However, it’s important to note that this is an estimate and the actual tax bill may vary slightly.

What happens if a property owner disagrees with their assessed value?

+If a property owner believes their assessed value is incorrect, they can appeal to the Greenville County Board of Assessment Appeals. The process involves submitting an appeal application, providing evidence, and attending a hearing to present their case.