Taxes Of India

Welcome to an in-depth exploration of the taxation system in India, a complex yet crucial aspect of the country's economic framework. This comprehensive guide aims to unravel the intricacies of India's tax landscape, providing a detailed analysis for those seeking to understand the ins and outs of this vital financial mechanism.

The Indian Taxation System: A Comprehensive Overview

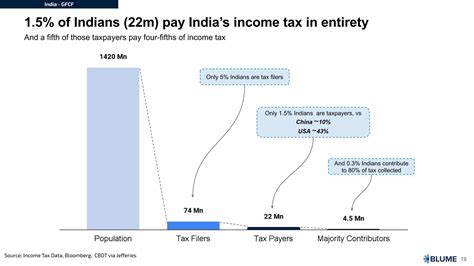

India’s tax system is a multifaceted network of laws, regulations, and procedures, governing the collection of revenue by the government. With a rich history spanning centuries, the taxation landscape in India has evolved significantly, reflecting the country’s diverse demographics, economic growth, and policy changes.

At its core, the Indian tax system is designed to generate revenue for the government to fund various public services and infrastructure projects. It also plays a pivotal role in redistributing wealth, promoting economic growth, and achieving social welfare objectives. The system is a blend of direct and indirect taxes, each with its own set of rules and regulations.

Direct Taxes: Unraveling the Personal and Corporate Tax Structure

Direct taxes in India are levied on an individual’s income, profits, or gains, and are paid directly to the government. These taxes are progressive in nature, meaning the tax rate increases with the increase in taxable income.

Income Tax

The Income Tax Act, 1961, forms the bedrock of India’s direct tax structure. It imposes taxes on various sources of income, including salary, business profits, house property, capital gains, and other sources. The tax slabs for individuals are updated annually, offering varying rates for different income brackets. For the financial year 2023-24, the income tax slabs for individuals are as follows:

| Income Slab | Tax Rate |

|---|---|

| Up to ₹2,50,000 | 0% |

| ₹2,50,001 - ₹5,00,000 | 5% |

| ₹5,00,001 - ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

These rates are applicable after taking into account various deductions and exemptions, such as those under Section 80C (e.g., investments in PPF, EPF, life insurance, etc.) and Section 80D (medical insurance premiums). The government also provides tax benefits for senior citizens and those with disabilities.

Corporate Tax

Corporate tax in India is levied on the profits of companies and is a significant source of revenue for the government. The Corporate Tax is governed by the Income Tax Act, 1961, and the Companies Act, 2013. The tax rate for domestic companies is 25% for companies with a turnover of less than ₹400 crore, and 30% for those with a turnover of ₹400 crore and above. For foreign companies, the tax rate is generally 40%.

In recent years, the Indian government has taken steps to simplify the corporate tax structure and encourage investment. In 2019, a new tax regime was introduced, offering companies an option to pay tax at a lower rate (22% for domestic companies and 25.17% for foreign companies) but without the benefit of various deductions and exemptions.

Indirect Taxes: A Revolution with GST

The indirect tax system in India underwent a revolutionary change with the introduction of the Goods and Services Tax (GST) on July 1, 2017. GST replaced a complex web of indirect taxes, such as VAT, service tax, excise duty, and others, with a unified tax system.

The Goods and Services Tax (GST)

GST is a multi-stage, destination-based tax levied on the supply of goods and services. It is levied at every point of sale, with set-off benefits at all stages of the supply chain. The tax is collected by the government of the state where the goods or services are consumed, making it a destination-based tax.

The GST regime in India has five tax slabs: 0%, 5%, 12%, 18%, and 28%. Essential items such as food products, healthcare services, and educational services are often taxed at lower rates or are exempt. On the other hand, luxury items and sin goods (such as tobacco and aerated drinks) are taxed at higher rates.

One of the key advantages of GST is its simplicity and transparency. It has streamlined the indirect tax system, making it easier for businesses to comply with tax regulations. It has also helped in widening the tax base and increasing revenue collection for the government.

Other Indirect Taxes

While GST has largely replaced most indirect taxes, there are still some taxes that are outside the GST purview. These include taxes on petroleum products, electricity duties, and taxes on alcohol and tobacco products, which are levied by state governments.

Other Important Taxes in India

Apart from the direct and indirect taxes, there are several other taxes that play a significant role in India’s taxation system.

Wealth Tax

Wealth tax is levied on individuals and Hindu Undivided Families (HUFs) who have a net wealth exceeding a certain threshold. It is currently levied at a rate of 1% on the amount by which the net wealth exceeds ₹30 lakh. However, the government has proposed to abolish the wealth tax from the financial year 2023-24.

Property Tax

Property tax is a tax levied by local municipal bodies on the ownership of land and buildings. The rates and rules for property tax vary across different municipal corporations and states.

Stamp Duty and Registration Fees

Stamp duty and registration fees are applicable on the purchase of immovable property, such as land or buildings. The rates vary from state to state and are typically a percentage of the property’s value.

Securities Transaction Tax (STT)

STT is a tax levied on transactions of equity shares, derivatives, and other specified securities. It is applicable on both buyers and sellers of these instruments and is collected by the stock exchanges, which then remit the tax to the government.

Customs Duty and Excise Duty

Customs duty is a tax levied on goods imported into India, while excise duty is levied on goods manufactured or produced in India. These taxes are a significant source of revenue for the government and are often used to protect domestic industries.

The Impact of Taxation on India’s Economy

The Indian taxation system plays a pivotal role in shaping the country’s economic landscape. It is a key tool for the government to manage the economy, stimulate growth, and redistribute wealth.

Revenue Generation and Economic Growth

Taxation is the primary source of revenue for the government, which is essential for funding various public services, infrastructure projects, and social welfare schemes. The revenue collected through taxes enables the government to invest in sectors like education, healthcare, and transportation, which are crucial for the overall development of the country.

Moreover, taxes can also be used to incentivize certain sectors or industries. For instance, the government can offer tax incentives to attract foreign investment or promote domestic industries. This can stimulate economic growth and create jobs, thereby contributing to the overall prosperity of the nation.

Redistribution of Wealth and Social Equity

The progressive nature of India’s direct tax system ensures that those with higher incomes pay a larger proportion of their income as tax. This helps in reducing income inequality and promoting social equity. The tax revenue collected can then be used to fund social welfare programs, such as subsidies for the poor, free education, and healthcare services, further enhancing social equity.

Inflation and Price Control

Taxes can also be used as a tool to control inflation. For instance, by increasing taxes on luxury goods or sin goods, the government can reduce the demand for these products, thereby controlling their prices. Similarly, by offering tax incentives on essential goods, the government can encourage their production and keep their prices in check.

Investment and Business Environment

A stable and predictable tax system is crucial for attracting investments and fostering a healthy business environment. The introduction of GST, for instance, has simplified the indirect tax system, making it easier for businesses to comply with tax regulations. This has not only reduced compliance costs but has also improved the ease of doing business in India, making it more attractive for domestic and foreign investors.

Tax Compliance and Administration in India

Effective tax compliance and administration are crucial for the smooth functioning of any tax system. In India, the government has taken several steps to simplify tax compliance, improve taxpayer experience, and enhance tax administration.

Simplifying Tax Compliance

The Indian government has made significant efforts to simplify tax compliance, especially with the introduction of GST. The GST regime has streamlined the indirect tax system, reducing the number of taxes and compliance requirements. The government has also introduced various online platforms and tools to make tax compliance easier and more efficient.

For instance, the Income Tax Department provides an online portal, Income Tax e-Filing, which allows taxpayers to file their returns, pay taxes, and manage their tax accounts online. Similarly, the GST Network (GSTN) provides an online portal for GST registration, filing returns, and paying taxes.

Taxpayer Experience and Awareness

The government has also focused on improving the taxpayer experience by making the tax system more transparent and user-friendly. The Taxpayer Charter, introduced by the Central Board of Direct Taxes (CBDT), outlines the rights and responsibilities of taxpayers, ensuring a fair and respectful treatment.

Furthermore, the government has launched various awareness campaigns to educate taxpayers about their rights and responsibilities. The Pradhan Mantri Garib Kalyan Yojana (PMGKY), for instance, is a scheme aimed at encouraging tax compliance and bringing more people into the tax net.

Tax Administration and Enforcement

The Central Board of Direct Taxes (CBDT) and the Central Board of Indirect Taxes and Customs (CBIC) are the two key bodies responsible for the administration and enforcement of direct and indirect taxes, respectively. These bodies work closely with various government departments and agencies to ensure effective tax administration and compliance.

The government has also taken steps to improve tax enforcement and curb tax evasion. The Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, for instance, was introduced to tackle the issue of black money and tax evasion. The government has also set up specialized agencies, such as the Income Tax Department's Directorate of Income Tax (Investigation), to investigate and prosecute tax evasion cases.

The Future of Taxation in India

The Indian taxation system is continuously evolving to adapt to the changing economic landscape and technological advancements. The government is committed to making the tax system more efficient, transparent, and taxpayer-friendly.

With the increasing digital transformation, the government is leveraging technology to enhance tax administration and compliance. The introduction of the Goods and Services Tax Network (GSTN) and the Income Tax e-Filing portal are prime examples of this digital transformation. The government is also exploring the use of blockchain technology and artificial intelligence to further streamline tax processes and curb tax evasion.

Furthermore, the government is focused on simplifying the tax structure and reducing the compliance burden on taxpayers. The recent corporate tax rate cuts and the proposed abolition of wealth tax are steps in this direction. The government is also working towards integrating various tax systems, such as the direct and indirect tax systems, to make tax compliance more efficient and seamless.

Conclusion

The Indian taxation system is a complex yet dynamic framework that plays a crucial role in the country’s economic growth and development. It is a vital tool for the government to manage the economy, redistribute wealth, and promote social equity. While the system has its challenges, the government is actively working towards making it more efficient, transparent, and taxpayer-friendly.

As India continues to evolve and grow, its tax system will also evolve, adapting to the changing economic landscape and technological advancements. With its commitment to reform and innovation, India's taxation system is poised to become even more efficient and effective in the coming years.

What is the current income tax slab for individuals in India for the financial year 2023-24?

+For the financial year 2023-24, the income tax slabs for individuals are as follows: Up to ₹2,50,000 - 0%, ₹2,50,001 - ₹5,00,000 - 5%, ₹5,00,001 - ₹10,00,000 - 20%, and above ₹10,00,000 - 30%. These rates are applicable after taking into account various deductions and exemptions.

What is the GST tax rate for luxury items in India?

+The GST tax rate for luxury items in India is 28%. Luxury items include items such as high-end cars, tobacco products, aerated drinks, and certain electronic items.

How has the introduction of GST impacted the Indian economy?

+The introduction of GST has had a significant impact on the Indian economy. It has streamlined the indirect tax system, making it easier for businesses to comply with tax regulations. GST has also widened the tax base and increased revenue collection for the government. Additionally, it has improved the ease of doing business in India, making it more attractive for domestic and foreign investors.

What is the role of wealth tax in India’s tax system?

+Wealth tax is levied on individuals and Hindu Undivided Families (HUFs) who have a net wealth exceeding ₹30 lakh. It is currently levied at a rate of 1% on the amount by which the net wealth exceeds this threshold. Wealth tax plays a role in redistributing wealth and promoting social equity.

How is the Indian government using taxes to control inflation?

+The Indian government uses taxes as a tool to control inflation. By increasing taxes on luxury goods or sin goods, the government can reduce the demand for these products, thereby controlling their prices. Similarly, by offering tax incentives on essential goods, the government can encourage their production and keep their prices in check.