Homestead Tax Exemption Florida

The Homestead Tax Exemption is a valuable benefit offered to Florida residents, providing significant savings on property taxes. This exemption, available to eligible homeowners, is an essential component of Florida's tax structure, aiming to support and encourage homeownership within the state. As one of the most populous states in the U.S., Florida's real estate market is dynamic, and understanding the Homestead Tax Exemption is crucial for both current and prospective homeowners.

Understanding the Homestead Tax Exemption

The Homestead Tax Exemption, officially known as the Florida Constitution Article VII, Section 6, is a provision designed to alleviate the financial burden of property taxes for homeowners. It achieves this by providing a substantial reduction in the assessed value of a primary residence, resulting in lower property taxes. This exemption is a vital aspect of Florida’s tax policy, encouraging stability in homeownership and promoting the idea that a home is a secure investment.

The Homestead Tax Exemption is applicable to both new and existing homes, and the savings can be substantial. For instance, consider a homeowner in Miami-Dade County with a property valued at $300,000. With the Homestead Tax Exemption, the assessed value for tax purposes could be reduced by up to $50,000, resulting in significant annual tax savings.

This exemption is particularly beneficial in Florida, where property taxes are typically higher due to the state's lack of a personal income tax. By offering the Homestead Tax Exemption, Florida provides a compelling incentive for individuals to invest in real estate, fostering a stable and vibrant housing market.

Eligibility Criteria

To qualify for the Homestead Tax Exemption in Florida, certain criteria must be met. Firstly, the property must be the owner’s permanent residence. This means that it should be the primary place of abode, and the owner should have the intention of making it their long-term home.

Additionally, the owner must be a Florida resident and occupy the property as of January 1st of the tax year for which the exemption is sought. This residency requirement ensures that the exemption is available only to those who are actively contributing to the local community and economy.

There are also income restrictions for certain types of Homestead Tax Exemptions. For example, the Additional Homestead Exemption for Seniors has an income limit of $32,767 for single applicants and $44,390 for joint applicants as of 2023. These income limits are adjusted annually to account for inflation and changes in the cost of living.

| Exemption Type | Income Limit (2023) |

|---|---|

| Standard Homestead Exemption | No income limit |

| Additional Homestead Exemption for Seniors | $32,767 (single) / $44,390 (joint) |

| Widow(er) Homestead Exemption | $32,767 (single) |

Application Process

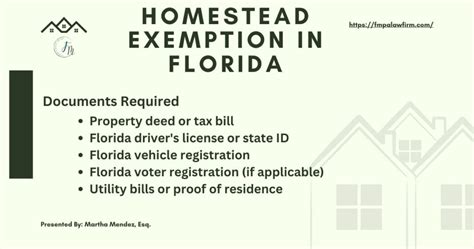

Applying for the Homestead Tax Exemption in Florida is a straightforward process, although it requires attention to detail to ensure all necessary information is provided. The application, Form DR-437, can be obtained from the property appraiser’s office in the county where the property is located. This form can also be found online, offering a convenient way to access and complete the application.

The application requires basic information about the homeowner and the property, including details such as the homeowner's name, address, and date of residency. It also asks for specific information about the property, such as the property's legal description, which can be found on the property deed or tax bill.

Once the application is complete, it should be submitted to the property appraiser's office by March 1st of the tax year for which the exemption is sought. Late applications are accepted, but they may result in a reduced exemption or no exemption at all, depending on the specific circumstances.

After submitting the application, the property appraiser's office will review the information provided and verify the homeowner's eligibility. If approved, the Homestead Tax Exemption will be applied to the property's assessed value, resulting in lower property taxes for the homeowner.

Types of Homestead Tax Exemptions in Florida

Florida offers several types of Homestead Tax Exemptions, each with its own specific criteria and benefits. Understanding these different exemptions can help homeowners maximize their savings and ensure they are receiving all the benefits they are entitled to.

Standard Homestead Exemption

The Standard Homestead Exemption is the most common type and is available to all Florida residents who meet the eligibility criteria. This exemption provides a reduction in the assessed value of the property, resulting in lower property taxes. The specific amount of the reduction depends on the county and the assessed value of the property.

For example, in Miami-Dade County, the Standard Homestead Exemption reduces the assessed value of a property by $50,000. So, if a homeowner's property is valued at $300,000, the assessed value for tax purposes would be $250,000, resulting in significant tax savings.

Additional Homestead Exemption for Seniors

The Additional Homestead Exemption for Seniors is designed to provide further tax relief to homeowners who are 65 years or older. This exemption reduces the assessed value of the property by an additional amount, beyond the Standard Homestead Exemption. However, this additional exemption is subject to income limits, as mentioned earlier.

For instance, a homeowner in Miami-Dade County who is 65 years old and meets the income requirements can qualify for an additional $50,000 reduction in their property's assessed value. This means that if their property is valued at $300,000, the assessed value for tax purposes would be further reduced to $200,000, resulting in even more significant tax savings.

Widow(er) Homestead Exemption

The Widow(er) Homestead Exemption is a special exemption available to surviving spouses who have lost their partner. This exemption allows the surviving spouse to continue receiving the Homestead Tax Exemption their partner had previously qualified for. This is particularly beneficial for widows or widowers who may have a reduced income after the loss of their partner and can help alleviate the financial burden of property taxes.

To qualify for this exemption, the surviving spouse must have been married to the deceased homeowner at the time of their death and must not have remarried. Additionally, the property must remain the surviving spouse's permanent residence. This exemption can be a crucial financial support for those who have experienced the loss of a loved one.

Impact and Benefits of the Homestead Tax Exemption

The Homestead Tax Exemption has a significant impact on Florida’s real estate market and the financial well-being of its residents. By offering substantial tax savings, this exemption encourages homeownership, promotes community stability, and fosters economic growth.

For individual homeowners, the benefits are clear. The reduced property taxes can mean substantial savings each year, providing financial relief and allowing homeowners to allocate their resources to other needs or investments. This can be especially beneficial for those on a fixed income or for families looking to save for their children's education or other long-term goals.

Furthermore, the Homestead Tax Exemption can increase the affordability of homeownership in Florida. With lower property taxes, the overall cost of owning a home is reduced, making it more accessible to a wider range of individuals and families. This promotes a diverse and thriving community, as people from various economic backgrounds can realize the dream of homeownership.

On a broader scale, the Homestead Tax Exemption contributes to the stability and growth of Florida's real estate market. By encouraging homeownership, the exemption helps maintain a steady demand for properties, which can lead to a more stable housing market. This, in turn, can attract investors and businesses, further boosting the state's economy.

Future Implications and Considerations

As Florida’s population continues to grow and its real estate market evolves, the Homestead Tax Exemption will likely remain a critical component of the state’s tax structure. However, there are ongoing discussions and considerations regarding the future of this exemption.

One key consideration is the potential impact of rising property values. As property values increase, the savings provided by the Homestead Tax Exemption may become less significant in relation to the overall property tax bill. This could lead to calls for adjustments to the exemption amounts or income limits to ensure the exemption remains effective in alleviating the tax burden for homeowners.

Additionally, the increasing diversity of Florida's population may require a review of the exemption's eligibility criteria. Ensuring that the exemption remains accessible to a broad range of residents, including those from different socioeconomic backgrounds and cultural groups, is essential for maintaining the exemption's social and economic benefits.

As with any tax-related matter, it's crucial for homeowners to stay informed about any changes or updates to the Homestead Tax Exemption. This includes being aware of application deadlines, understanding any changes to eligibility criteria or exemption amounts, and staying up-to-date with any legislative or regulatory developments that may impact this important tax benefit.

How often do I need to apply for the Homestead Tax Exemption in Florida?

+Once you have been approved for the Homestead Tax Exemption, you are not required to reapply every year. However, it is important to ensure that your information remains up-to-date with the property appraiser’s office. If there are any changes to your property or your circumstances, you may need to notify the office to maintain your eligibility.

Can I apply for the Homestead Tax Exemption if I’m a non-resident alien?

+No, the Homestead Tax Exemption is only available to Florida residents who meet the eligibility criteria. Non-resident aliens are not eligible for this exemption.

What happens if I sell my home after receiving the Homestead Tax Exemption?

+If you sell your home, you will no longer be eligible for the Homestead Tax Exemption on that property. However, if you purchase a new primary residence within Florida, you can apply for the exemption on your new home, provided you meet the eligibility criteria.

Are there any penalties for not applying for the Homestead Tax Exemption on time?

+Yes, if you do not apply for the Homestead Tax Exemption by the deadline, you may lose the exemption for the entire tax year. Late applications may be accepted, but they may result in a partial year exemption or no exemption at all, depending on the specific circumstances.

Can I apply for the Homestead Tax Exemption if I own multiple properties in Florida?

+The Homestead Tax Exemption is designed for primary residences. If you own multiple properties in Florida, you can only apply for the exemption on one of them, and it must be your permanent residence. The other properties will be assessed at their full market value for tax purposes.