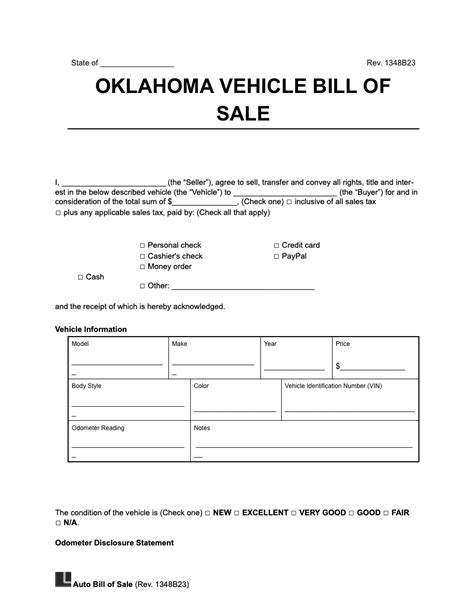

Oklahoma Vehicle Sales Tax

The Oklahoma vehicle sales tax is a crucial aspect of the state's revenue generation, contributing significantly to its economic landscape. This tax is applied to the purchase of vehicles, including cars, trucks, motorcycles, and other motorized vehicles, and it plays a vital role in funding various public services and infrastructure projects across the state.

Understanding the intricacies of the Oklahoma vehicle sales tax is essential for both residents and businesses operating within the state. This comprehensive guide aims to delve into the specifics of this tax, providing a detailed analysis of its structure, rates, exemptions, and implications for vehicle buyers and sellers.

Understanding the Oklahoma Vehicle Sales Tax Structure

The Oklahoma vehicle sales tax is a consumption tax, meaning it is levied on the purchase of goods and services, including vehicles. It is a state-level tax, which means the rate and administration of the tax are determined by the Oklahoma Tax Commission (OTC). The tax is imposed on the gross sale price of the vehicle, which includes any additional fees, such as dealer preparation charges and optional equipment.

One unique aspect of the Oklahoma vehicle sales tax is its progressive nature. Unlike a flat tax rate, Oklahoma's sales tax on vehicles is structured to vary based on the purchase price of the vehicle. This progressive rate system ensures that individuals purchasing more expensive vehicles contribute a higher proportion of their purchase price towards the tax, while those buying less expensive vehicles pay a relatively lower tax rate.

The specific rates and brackets for the Oklahoma vehicle sales tax are outlined in the following table:

| Vehicle Purchase Price | Sales Tax Rate |

|---|---|

| $0 - $4,000 | 3.25% |

| $4,001 - $5,000 | 3.50% |

| $5,001 - $6,000 | 3.75% |

| $6,001 - $7,000 | 4.00% |

| $7,001 and above | 4.50% |

It's important to note that these rates are subject to change, and it is advisable to refer to the OTC's official website for the most up-to-date information. Additionally, local municipalities may impose additional sales taxes, so buyers should be aware of any applicable city or county sales tax rates.

Calculation Example

Let’s illustrate the calculation process with an example. Suppose an individual purchases a vehicle with a gross sale price of 12,000. The applicable sales tax rate for this purchase would be 4.50% as the vehicle falls within the 7,001 and above bracket.

To calculate the sales tax due, we multiply the purchase price by the applicable rate:

Sales Tax = Purchase Price x Sales Tax Rate

Sales Tax = $12,000 x 0.045

Sales Tax = $540

So, for this vehicle purchase, the buyer would owe $540 in sales tax to the state of Oklahoma.

Exemptions and Special Considerations

While the Oklahoma vehicle sales tax is a standard requirement for most vehicle purchases, there are certain exemptions and special considerations that buyers and sellers should be aware of. These exemptions can significantly impact the overall cost of a vehicle purchase, so understanding them is crucial.

Trade-In Vehicles

When a buyer trades in their old vehicle as part of a new purchase, the trade-in value is deducted from the gross sale price of the new vehicle. This deduction can impact the applicable sales tax rate and the overall tax liability. The OTC provides guidelines on how to calculate the sales tax in such cases, ensuring that the tax is applied fairly.

Exemptions for Certain Vehicle Types

Oklahoma offers exemptions from the vehicle sales tax for specific types of vehicles. These exemptions are designed to support specific industries, promote environmental initiatives, and cater to individuals with unique needs.

For instance, the state provides a sales tax exemption for the purchase of alternative fuel vehicles, such as electric cars and hydrogen-powered vehicles. This exemption aims to encourage the adoption of environmentally friendly transportation options. Similarly, vehicles adapted for disabled individuals are also exempt from the sales tax, ensuring equal access to transportation for all residents.

Out-of-State Purchases

If a vehicle is purchased out of state, the buyer is still required to pay sales tax to Oklahoma. The OTC has a process in place for such transactions, where the buyer pays the tax based on the vehicle’s purchase price and the applicable rate. This ensures that individuals who purchase vehicles out of state do not evade the sales tax obligation.

Impact on Vehicle Buyers and Sellers

The Oklahoma vehicle sales tax has a significant impact on both buyers and sellers of vehicles. For buyers, it represents an additional cost that must be factored into their vehicle purchase decision. The progressive nature of the tax means that buyers of more expensive vehicles will pay a higher proportion of their purchase price in tax.

On the other hand, sellers benefit from the sales tax as it generates revenue for the state, which can be used to improve infrastructure, education, and other public services. Sellers must ensure they are compliant with the tax laws and properly collect and remit the sales tax to the OTC.

Additionally, the sales tax can influence the overall vehicle market in Oklahoma. Buyers may consider the tax implications when deciding between different vehicles or even when choosing to purchase a vehicle out of state. Sellers, too, may need to adjust their pricing strategies to account for the sales tax and remain competitive in the market.

Comparison with Other States

Comparing the Oklahoma vehicle sales tax with other states provides an interesting perspective. While the progressive rate structure is unique to Oklahoma, the overall tax burden on vehicle purchases can vary significantly across states. Some states have higher flat rates, while others may have additional fees or surcharges on top of the sales tax.

This comparison can be crucial for individuals considering a move to Oklahoma or for businesses looking to expand their operations. Understanding the tax landscape can help them make informed decisions about vehicle purchases and their overall financial planning.

Future Implications and Potential Changes

The Oklahoma vehicle sales tax, like any tax policy, is subject to potential changes and reforms. As the state’s economic landscape evolves and new initiatives are introduced, the tax system may need to adapt to remain effective and equitable.

One potential area of focus could be the progressive rate structure. While it currently ensures that higher-income individuals contribute more to the tax, there may be considerations about its impact on the overall vehicle market and the affordability of vehicles for different income brackets. Future reforms could involve adjusting the rate brackets or exploring alternative tax structures to promote fairness and economic growth.

Additionally, with the increasing adoption of electric and alternative fuel vehicles, the state may need to reassess its tax policies to encourage further adoption of these environmentally friendly options. This could involve expanding or modifying the existing sales tax exemptions to make these vehicles more affordable and accessible to a wider range of consumers.

Staying informed about potential changes and engaging in discussions around tax policy is crucial for both residents and businesses in Oklahoma. It ensures that individuals can plan their vehicle purchases effectively and that businesses can adapt their strategies to remain competitive in the changing tax landscape.

How often are the sales tax rates updated in Oklahoma?

+The Oklahoma Tax Commission regularly reviews and updates the sales tax rates, typically on an annual basis. However, there can be occasional special sessions or emergency measures that may lead to rate changes at other times. It’s advisable to check the OTC’s official website for the most current information.

Are there any penalties for not paying the vehicle sales tax on time?

+Yes, there are penalties for late payment of the vehicle sales tax. The OTC imposes penalties and interest on overdue tax payments. It’s crucial to pay the tax promptly to avoid additional financial burdens.

Can I claim a refund if I overpaid the vehicle sales tax?

+Yes, if you believe you have overpaid the vehicle sales tax, you can file a refund claim with the Oklahoma Tax Commission. The OTC has a process in place for refund requests, and you should follow their guidelines to initiate the refund process.