Property Taxes Protest

Property taxes are an essential part of the revenue stream for local governments, funding various public services and infrastructure. However, these taxes can sometimes be a source of contention, leading homeowners and business owners to question the assessed value of their properties and consider protesting the tax assessment. In this comprehensive guide, we will delve into the world of property tax protests, exploring the process, strategies, and potential outcomes to empower property owners to navigate this complex yet crucial aspect of homeownership.

Understanding Property Tax Assessments

Property tax assessments are an integral part of the tax system, serving as the foundation for determining the tax liability of property owners. These assessments are conducted by local government authorities, typically by designated assessors, who are responsible for evaluating the value of real estate properties within their jurisdiction. The assessment process aims to ensure fairness and accuracy in property taxation, as the value assigned to a property directly influences the tax burden borne by its owner.

The valuation of a property for tax purposes is influenced by a range of factors, including its location, size, age, and condition. Assessors consider market trends, recent sales of comparable properties, and other relevant data to estimate the fair market value of each property. This value is then used as the basis for calculating the property tax owed by the owner.

It's important to note that property tax assessments are not static; they are subject to periodic reviews and updates to reflect changes in the property's value or market conditions. These reassessments can occur annually, biennially, or at longer intervals, depending on the policies and practices of the local government.

The Impact of Property Tax Assessments

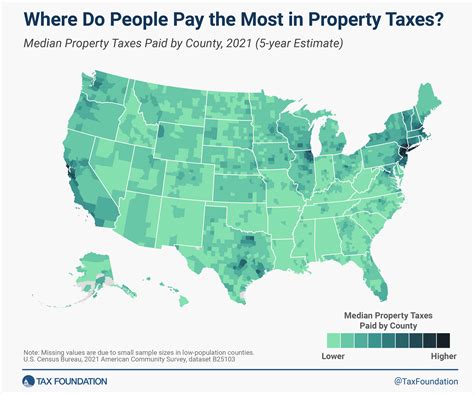

The implications of property tax assessments extend beyond the financial burden they impose on property owners. They play a significant role in shaping the real estate market and the overall economy of a region. High property tax assessments can deter potential buyers, especially in areas with already elevated housing prices, further exacerbating affordability challenges. Conversely, accurately assessed property values can attract investors and stimulate economic growth by ensuring a fair and transparent tax system.

Additionally, property tax assessments influence the distribution of public resources. Local governments rely on property taxes to fund essential services such as education, public safety, infrastructure development, and maintenance. Accurate assessments ensure that these services are adequately funded and that the tax burden is distributed fairly among property owners.

Given the critical role of property tax assessments, it's not surprising that they can be a source of contention for property owners. When a property owner believes that their assessment is incorrect or unfair, they have the right to protest and seek a reassessment. This process, known as a property tax protest, allows owners to challenge the assessed value of their property and potentially reduce their tax liability.

The Property Tax Protest Process

Initiating a property tax protest involves a systematic approach, beginning with a thorough understanding of the assessment process and the factors influencing property values. Property owners should gather relevant documentation, including property records, recent sales data, and any evidence supporting their claim of an inaccurate assessment.

Gathering Evidence and Documentation

The first step in building a strong case for a property tax protest is gathering comprehensive evidence and documentation. This process entails obtaining copies of the property’s assessment records, including the assessed value, the basis for the assessment, and any supporting documentation used by the assessor. Property owners can request these records from the local tax assessor’s office, which is typically responsible for maintaining and providing access to assessment information.

In addition to assessment records, property owners should gather evidence that supports their claim of an inaccurate assessment. This evidence can include recent sales data of comparable properties in the area, which can demonstrate that the assessed value of the subject property is higher than the market value. Property owners can access this data through real estate websites, local multiple listing services (MLS), or by consulting with a real estate agent or appraiser.

Other relevant documentation may include photographs or videos of the property's condition, especially if there are visible issues or recent improvements that could impact its value. Additionally, property owners may gather expert opinions or appraisals from licensed appraisers or real estate professionals who can provide an independent assessment of the property's value.

By assembling a comprehensive package of evidence and documentation, property owners can present a strong case for a property tax protest. This information will be crucial in supporting their claim and demonstrating that the assessed value is inaccurate or unfair.

Filing a Protest: Deadlines and Requirements

To initiate a property tax protest, property owners must adhere to specific deadlines and requirements set by their local government. These deadlines typically align with the assessment cycle, allowing a window of opportunity for owners to review their assessments and file protests. Missing these deadlines can result in the loss of the right to protest for that tax year.

The filing process often involves completing and submitting a formal protest application, which can be obtained from the local tax assessor's office or downloaded from their website. This application typically requires detailed information about the property, including its address, owner's name, and the basis for the protest. Property owners should carefully review and complete the application, ensuring that all required information is accurate and comprehensive.

In addition to the application, owners may be required to provide supporting documentation, such as copies of assessment records, sales data, and other evidence gathered during the initial research phase. It's crucial to submit all required documents to avoid delays or potential rejection of the protest.

Once the protest application and supporting documentation are submitted, the local tax assessor's office will review the information and determine whether a further review or hearing is necessary. Property owners should stay informed about the status of their protest and be prepared to provide additional information or attend hearings if required.

The Appeal Process: Hearings and Decisions

If a property owner’s initial protest is denied or they are dissatisfied with the outcome, they have the option to appeal the decision through a formal appeal process. This process typically involves a hearing before an independent review board or an administrative law judge, providing an opportunity for the owner to present their case and challenge the assessment.

During the appeal hearing, property owners have the chance to present their evidence, testimony, and arguments in support of their protest. They may be accompanied by legal counsel or represent themselves, depending on the jurisdiction's rules and regulations. The hearing provides a platform for owners to address any discrepancies or inaccuracies in the assessment and present their case for a reduced tax liability.

The appeal process can be complex and may require extensive preparation. Property owners should thoroughly review the hearing procedures, gather additional evidence if necessary, and consider seeking professional advice or representation to ensure a strong presentation of their case. The outcome of the appeal can vary, ranging from a complete reversal of the initial assessment to a partial reduction or no change at all.

Strategies for a Successful Protest

Maximizing the chances of a successful property tax protest requires a strategic approach. Property owners should focus on gathering compelling evidence, comparing their property’s assessment to recent sales of similar properties, and identifying any unique factors that may impact their property’s value. Consulting with real estate professionals and seeking expert advice can provide valuable insights and guidance throughout the protest process.

Comparative Analysis: Assessing Market Value

A critical aspect of a successful property tax protest is conducting a comprehensive comparative analysis. This involves researching and analyzing recent sales of comparable properties in the same area. By identifying properties with similar characteristics, such as size, age, condition, and amenities, property owners can establish a range of market values for their property.

When conducting a comparative analysis, it's essential to consider not only the sale price but also the timing and circumstances of the sale. Recent sales that occurred in a robust market may not accurately reflect the current market value, especially if market conditions have changed. Property owners should focus on sales that are as recent as possible and consider any factors that may have influenced the sale price, such as distressed sales or unique buyer circumstances.

By gathering data on multiple comparable sales, property owners can calculate an average market value for their property. This value can then be compared to the assessed value to determine if there is a significant discrepancy. If the assessed value is significantly higher than the market value, it provides a strong basis for a property tax protest.

Identifying Unique Factors: Adjusting for Property Specifics

Every property is unique, and certain factors may influence its value beyond the standard assessment criteria. Property owners should carefully consider any unique characteristics or circumstances that may impact their property’s value. These factors can include recent improvements or renovations, functional obsolescence, or environmental issues.

For example, if a property has undergone significant renovations or additions, the assessed value may not accurately reflect the increased value. Similarly, if the property has functional limitations or requires substantial repairs, it may warrant a reduction in assessed value. Property owners should document these unique factors and provide evidence to support their impact on the property's overall value.

Additionally, environmental factors such as proximity to noise, pollution, or natural hazards can influence property values. If a property is located in an area with known environmental concerns, property owners should research and gather data to support their argument for a reduced assessment.

Expert Advice: Consulting Real Estate Professionals

Navigating the property tax protest process can be complex and challenging, especially for those unfamiliar with the intricacies of real estate valuation and tax laws. Seeking expert advice from real estate professionals, such as licensed appraisers or tax consultants, can provide valuable insights and guidance throughout the protest process.

Real estate appraisers are trained to assess property values based on a range of factors, including market conditions, comparable sales data, and unique property characteristics. They can conduct a detailed appraisal of the property, providing an independent valuation that can be used as evidence in the protest. Appraisers can also assist in identifying any discrepancies or inaccuracies in the initial assessment.

Tax consultants, on the other hand, specialize in understanding the tax laws and regulations specific to property taxes. They can provide guidance on the protest process, including deadlines, requirements, and strategies for presenting a strong case. Tax consultants can also assist in gathering relevant data, preparing documentation, and representing property owners during hearings or appeals.

By engaging the expertise of real estate professionals, property owners can increase their chances of a successful protest and ensure that their case is presented effectively and persuasively.

Potential Outcomes and Implications

The outcome of a property tax protest can vary, with several possible scenarios. Property owners may receive a full reduction in their assessed value, resulting in lower property taxes. Alternatively, they may achieve a partial reduction or, in some cases, no change in the assessed value. Understanding these potential outcomes and their implications is crucial for property owners to make informed decisions about their protest strategy.

Full Reduction: Lower Property Taxes

A full reduction in the assessed value of a property is the ideal outcome for property owners protesting their tax assessment. This reduction leads to a decrease in the property taxes owed, providing significant financial relief. Property owners who achieve a full reduction can expect a lower tax bill for the current tax year and potentially for future years, depending on the assessment cycle.

The financial benefits of a full reduction can be substantial, especially for properties with high assessed values. Property owners may see a substantial decrease in their annual tax liability, freeing up funds for other expenses or investments. Additionally, a reduced tax burden can make the property more affordable, attracting potential buyers or tenants and increasing the property's marketability.

Partial Reduction: Some Savings

In many cases, property owners may receive a partial reduction in their assessed value, resulting in some savings on their property taxes. While a partial reduction may not provide the same level of financial relief as a full reduction, it still offers a significant advantage. Property owners with a partial reduction can expect a lower tax bill, albeit not as significant as a full reduction.

A partial reduction can still provide financial benefits, especially for properties with substantial assessed values. Even a modest reduction can result in notable savings on property taxes, providing property owners with some relief and potentially increasing their cash flow. Additionally, a partial reduction can be a stepping stone towards achieving a full reduction in future tax years, especially if the property's value continues to be overassessed.

No Change: Understanding the Ruling

In some instances, property owners may receive a ruling that upholds the initial assessment, resulting in no change to their assessed value. While this outcome may be disappointing, it’s important to understand the reasons behind the ruling and explore any options for further appeal or protest.

If a property owner receives a no-change ruling, they should carefully review the decision and consider the evidence presented during the protest process. The ruling may provide insights into the assessor's reasoning and any factors that were considered in the assessment. Property owners can use this information to strengthen their case and identify areas for improvement in future protests.

In some cases, a no-change ruling may be a result of a lack of compelling evidence or a failure to demonstrate an inaccurate assessment. Property owners should consider seeking professional advice to identify any weaknesses in their protest strategy and gather additional evidence to support their claim.

The Impact on Property Values and Market

The outcome of property tax protests can have a ripple effect on property values and the real estate market. When property owners successfully protest their assessments, it can lead to a decrease in the overall tax burden for similar properties in the area. This reduction in taxes can make the area more attractive to potential buyers, stimulating the real estate market and potentially increasing property values.

Additionally, successful protests can set a precedent for future assessments, influencing the way assessors evaluate properties in the area. If a significant number of property owners successfully protest their assessments, it may prompt a reevaluation of assessment practices and criteria, ensuring a more accurate and fair assessment process for all property owners.

Conversely, unsuccessful protests or a lack of protests can lead to an increase in the overall tax burden for property owners in the area. This can deter potential buyers and investors, impacting the real estate market and potentially slowing down economic growth in the region. Property owners should be mindful of these broader implications when considering a property tax protest.

Future Implications and Ongoing Strategies

Property tax protests are not a one-time event; they are part of an ongoing process of ensuring fair and accurate assessments. Property owners should remain vigilant and proactive in monitoring their property’s assessment and market value. Regularly reviewing assessment records and staying informed about market trends can help identify potential discrepancies or overassessments.

Staying Informed: Monitoring Assessments and Market Trends

Property owners should make it a habit to review their assessment records annually or whenever a reassessment is conducted. This practice allows them to identify any sudden increases in assessed value that may not align with market trends or their property’s condition. By staying informed, property owners can take prompt action and initiate a protest if necessary.

In addition to reviewing assessment records, property owners should monitor market trends and sales data in their area. Keeping an eye on recent sales of comparable properties can provide valuable insights into the fair market value of their property. If there is a significant discrepancy between the assessed value and the market value, it may be an indication that a protest is warranted.

Long-Term Strategies: Maintaining Property Value and Assessment Accuracy

Maintaining the value of a property and ensuring accurate assessments requires a long-term strategy. Property owners should focus on maintaining their property’s condition, making necessary repairs, and considering upgrades or improvements that can enhance its value. Regular maintenance not only preserves the property’s value but also ensures that it remains in good condition for future assessments.

Additionally, property owners should stay informed about changes in tax laws and assessment practices. Local governments may introduce new policies or update assessment criteria, which can impact the way properties are valued. By staying updated on these changes, property owners can adapt their strategies and ensure that their assessments remain fair and accurate.

Engaging with the local tax assessor's office and building a positive relationship can also be beneficial. Property owners can request feedback on their assessments and provide input on any unique factors that may impact their property's value. Open communication can lead to more accurate assessments and a better understanding of the assessment process.

Conclusion: Empowering Property Owners

Property tax protests are a crucial mechanism for property owners to ensure fair and accurate assessments, providing an opportunity to challenge assessments they believe are incorrect or unfair. By understanding the process, gathering compelling evidence, and employing strategic approaches, property owners can navigate the protest process effectively and increase their chances of a successful outcome.

Throughout this guide, we've explored the intricacies of property tax assessments, the protest process, and the potential outcomes. We've highlighted the importance of comparative analysis, the impact of unique factors, and the value of seeking expert advice. By adopting these strategies and staying informed, property owners can take control of their property tax obligations and ensure a fair and equitable assessment process.

Property tax protests are not only about reducing tax liability but also about upholding the principles of fairness and accuracy in the tax system. By empowering property owners with knowledge and guidance, we can foster a more transparent and accountable tax system, benefiting both property owners and the communities they call home.

What is the success rate of property tax protests?

+The success rate of property tax protests can vary depending on various factors, including the strength of the evidence presented, the accuracy of the initial assessment, and the jurisdiction’s protest policies. Some studies suggest that a significant percentage of protests result in a reduction in assessed value, while others may not be as successful. It’s important to conduct thorough research and gather compelling evidence to increase the chances of a successful protest.