Federal Tax Lien Search

In the realm of financial and legal matters, understanding the implications of a federal tax lien is crucial, especially when conducting due diligence or managing one's own financial affairs. A federal tax lien search is a vital step to uncover potential financial encumbrances and ensure a clear understanding of one's financial landscape.

Unraveling the Federal Tax Lien Search Process

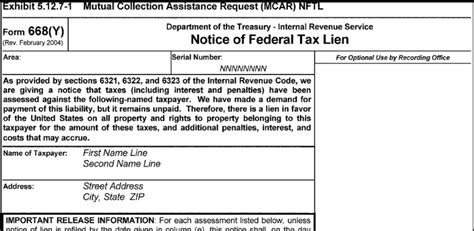

A federal tax lien is a powerful tool utilized by the Internal Revenue Service (IRS) to secure payment of outstanding taxes. When an individual or entity fails to meet their tax obligations, the IRS may file a Notice of Federal Tax Lien, which essentially acts as a legal claim on the taxpayer’s assets. This lien serves as a public notice, alerting creditors and potential buyers of the taxpayer’s debt.

Conducting a federal tax lien search is a critical step in various scenarios. For instance, when considering a business partnership, purchasing a property, or even evaluating a potential employee's financial background, a tax lien search can provide valuable insights. It ensures that all parties involved are aware of any existing financial obligations and potential risks.

Steps to Perform a Federal Tax Lien Search

Performing a federal tax lien search is a straightforward process, albeit with specific steps to ensure accuracy and legality. Here’s a step-by-step guide:

- Identify the Taxpayer: Begin by obtaining the full legal name, Social Security Number (SSN), or Employer Identification Number (EIN) of the individual or entity you wish to search. This information is crucial for an accurate search.

- Determine the Search Scope: Decide on the geographic area for your search. Federal tax liens are recorded at the county, state, and federal levels. Depending on the taxpayer's activities and assets, you may need to search across multiple jurisdictions.

- Utilize Online Resources: The IRS offers an online search tool called the Public Lien Disclosure Program. This platform allows individuals to search for federal tax liens against their own name or SSN. However, it's important to note that this service is only available to taxpayers themselves, and not to third parties.

- Visit County Recorders' Offices: For a more comprehensive search, consider visiting the offices of county recorders or clerks. These offices maintain records of tax liens, mortgages, and other encumbrances. While this method may require more legwork, it ensures a thorough investigation, especially for older liens that may not be available online.

- Engage a Professional Search Service: If you require a more extensive search or wish to maintain confidentiality, consider hiring a professional search service. These services specialize in conducting comprehensive lien searches and can provide detailed reports on an individual's or entity's tax history.

What Information Can Be Uncovered?

A federal tax lien search can reveal a wealth of information, including:

- Lien Amount: The amount of tax owed, including penalties and interest.

- Lien Date: The date the lien was filed, which can indicate the duration of the debt.

- Release or Discharge Information: Details about any subsequent releases or discharges of the lien, indicating if the debt has been resolved.

- Property Details: Information about the taxpayer's assets, such as real estate holdings, vehicles, or other valuable possessions.

It's important to note that federal tax liens can have serious implications for taxpayers. They can impact an individual's credit score, hinder their ability to secure loans or mortgages, and even lead to the seizure of assets. Therefore, it is crucial to address any outstanding tax obligations promptly to avoid such consequences.

The Role of Federal Tax Liens in Real Estate Transactions

In the context of real estate, federal tax liens can significantly impact property transactions. When a taxpayer with a federal tax lien wishes to sell their property, the lien must be addressed to ensure a smooth transfer of ownership.

The IRS typically requires that the tax debt be paid in full or suitable arrangements be made before allowing the property to be sold. This often involves the buyer taking on the lien as part of the purchase agreement or ensuring that the proceeds from the sale are used to satisfy the lien.

Challenges and Solutions for Property Buyers

For buyers considering a property with a federal tax lien, there are a few key considerations:

- Due Diligence: Conduct a thorough due diligence process, including a comprehensive title search and a federal tax lien search. This ensures that you are aware of all potential encumbrances on the property.

- Negotiation: Discuss the lien with the seller and explore options for resolving it. In some cases, the seller may be willing to negotiate a lower sale price to cover the lien or offer other incentives.

- Lien Satisfaction: Work with the seller and the IRS to ensure the lien is satisfied before completing the transaction. This may involve obtaining a lien release or a statement of non-disbursement from the IRS.

It's crucial to approach such transactions with caution and seek professional advice from real estate attorneys or tax specialists to navigate the complexities involved.

The Impact of Federal Tax Liens on Creditworthiness

Federal tax liens can have a significant impact on an individual’s creditworthiness and financial standing. When a lien is filed, it becomes a matter of public record and can remain on an individual’s credit report for up to 10 years.

The presence of a federal tax lien can negatively affect an individual's credit score, making it difficult to obtain loans, mortgages, or even certain types of employment. It is a serious financial encumbrance that requires prompt attention and resolution.

Strategies for Addressing Federal Tax Liens

If you find yourself facing a federal tax lien, there are strategies to address and resolve the situation:

- Pay the Lien: The most straightforward approach is to pay the full amount owed, including any penalties and interest. This can be done in a single payment or through a payment plan arranged with the IRS.

- Offer in Compromise: In some cases, the IRS may accept an Offer in Compromise, where the taxpayer offers to settle the debt for less than the full amount owed. This is a complex process and requires careful consideration and preparation.

- Installment Agreement: If you cannot pay the full amount, you may be able to negotiate an installment agreement with the IRS. This allows you to pay the debt over time, typically with a monthly payment plan.

- Penalty Abatement: In certain circumstances, the IRS may consider reducing or waiving certain penalties. This is often a last resort and requires a compelling reason and proper documentation.

It's essential to seek professional advice from tax experts or accountants who specialize in resolving tax issues. They can guide you through the process and help you understand your options.

The Future of Federal Tax Lien Searches: Technological Advancements

The landscape of federal tax lien searches is evolving with technological advancements. Online platforms and digital record-keeping systems are making it easier and faster to conduct searches, providing real-time information on tax liens and other financial encumbrances.

Additionally, the use of AI and machine learning algorithms is enhancing the accuracy and efficiency of tax lien searches. These technologies can analyze vast amounts of data, identify patterns, and provide comprehensive reports, making the search process more streamlined and reliable.

Benefits of Technological Integration

The integration of technology in federal tax lien searches offers several advantages:

- Speed and Efficiency: Online platforms and digital records allow for quicker searches, reducing the time and effort required to obtain information.

- Data Accuracy: AI and machine learning can cross-reference multiple data sources, ensuring more accurate and up-to-date information.

- Cost-Effectiveness: Digital solutions often reduce the costs associated with manual searches, making the process more affordable for individuals and businesses.

- Enhanced Security: Digital platforms can employ robust security measures to protect sensitive financial information, ensuring data privacy and security.

As technology continues to advance, we can expect further innovations in the field of federal tax lien searches, making the process even more efficient and accessible.

Conclusion: Navigating the Complex World of Federal Tax Liens

Federal tax liens are a serious matter, with significant implications for individuals and businesses. Conducting a thorough federal tax lien search is a critical step in due diligence, whether for personal financial management or business transactions.

By understanding the process, implications, and strategies for resolution, individuals can navigate the complex world of federal tax liens with confidence. It is a journey that requires diligence, expertise, and sometimes, creative solutions to ensure financial stability and security.

How long does a federal tax lien remain on my credit report?

+A federal tax lien can remain on your credit report for up to 10 years from the date it was filed. However, if the lien is released or paid off, it will be removed from your credit report within a few months of the release or payment.

Can I remove a federal tax lien from my credit report early?

+Yes, it is possible to request an early removal of a federal tax lien from your credit report. You can do this by paying off the lien in full or by entering into a direct debit installment agreement with the IRS. Once the lien is satisfied or released, you can contact the credit bureaus to request the removal of the lien from your credit report.

What happens if I ignore a federal tax lien?

+Ignoring a federal tax lien can have severe consequences. The IRS may take enforcement actions, such as seizing your assets or garnishing your wages to satisfy the debt. Additionally, the lien will remain on your credit report, affecting your ability to obtain credit or loans. It is crucial to address a federal tax lien promptly to avoid further complications.