Does Arkansas Have State Income Tax

When considering the financial landscape of the United States, one key aspect that often varies across states is the implementation of income taxes. Arkansas, nestled in the heart of the South, presents a unique tax system that impacts its residents and businesses. This article aims to delve into the specifics of Arkansas's state income tax, exploring its history, structure, rates, and the implications it holds for individuals and entities operating within its borders.

A Historical Perspective on Arkansas State Income Tax

Arkansas’s journey with state income tax began in 1929, a year that marked a significant shift in the state’s fiscal policy. Prior to this, Arkansas relied primarily on property taxes and other revenue streams to fund its operations. However, the Great Depression’s economic turmoil prompted the state to seek additional sources of revenue, leading to the introduction of a state income tax.

The initial income tax system in Arkansas was designed to be progressive, with rates varying based on an individual's income level. This approach aimed to ensure that those with higher earnings contributed a larger share of their income to the state's coffers. Over the years, the state has periodically adjusted its income tax rates and brackets to align with economic changes and revenue needs.

Arkansas’s Current State Income Tax Structure

As of my last update in January 2023, Arkansas operates a graduated income tax system, meaning that taxpayers are subject to different rates depending on their taxable income. This system is designed to ensure that individuals with higher incomes contribute a larger proportion of their earnings to the state’s revenue.

Arkansas's income tax brackets are divided into six categories, each with its own tax rate. The current rates for tax year 2023 are as follows:

| Tax Rate | Taxable Income Range |

|---|---|

| 0% | Up to $2,500 |

| 1.0% | $2,501 - $4,000 |

| 2.0% | $4,001 - $7,500 |

| 3.0% | $7,501 - $10,000 |

| 4.0% | $10,001 - $25,000 |

| 5.9% | Above $25,000 |

These tax rates apply to Arkansas residents' income, including wages, salaries, commissions, bonuses, and other types of earnings. Non-residents who earn income within the state, such as through business activities or investments, are also subject to Arkansas's income tax.

Exemptions and Deductions

Arkansas offers various exemptions and deductions to reduce the tax burden on its residents. These include:

- Standard Deduction: Arkansas taxpayers can claim a standard deduction, which reduces their taxable income. For tax year 2023, the standard deduction is $4,500 for single filers and $9,000 for married couples filing jointly.

- Personal Exemptions: Arkansas allows personal exemptions, which further reduce taxable income. The personal exemption amount for tax year 2023 is $2,500 per taxpayer, spouse, and dependent.

- Itemized Deductions: Taxpayers can opt for itemized deductions, allowing them to deduct specific expenses such as medical costs, state and local taxes, charitable contributions, and mortgage interest. However, the state's standard deduction often provides a more beneficial tax reduction for most residents.

Tax Credits

Arkansas provides a range of tax credits to encourage certain behaviors and support specific groups. These credits can significantly reduce a taxpayer’s liability or even result in a refund. Some notable tax credits include:

- Low-Income Tax Credit: This credit is designed to offset the income tax burden for low-income individuals and families.

- Education Tax Credits: Arkansas offers credits for qualified educational expenses, encouraging investment in education.

- Research and Development Tax Credit: Businesses engaged in research and development activities can claim this credit, fostering innovation within the state.

Implications for Arkansas Residents and Businesses

Arkansas’s state income tax system has several implications for its residents and businesses. For individuals, the progressive tax structure means that higher earners contribute a larger share of their income to the state’s revenue. This can influence financial planning, investment strategies, and even retirement decisions.

Businesses operating in Arkansas also face unique considerations. The state's income tax rates and tax credits can impact a company's financial health and its decision-making processes. For instance, businesses engaged in research and development may find Arkansas's tax credits attractive, while those with high-income employees may need to factor in the state's progressive tax rates when determining payroll and compensation packages.

Comparative Analysis

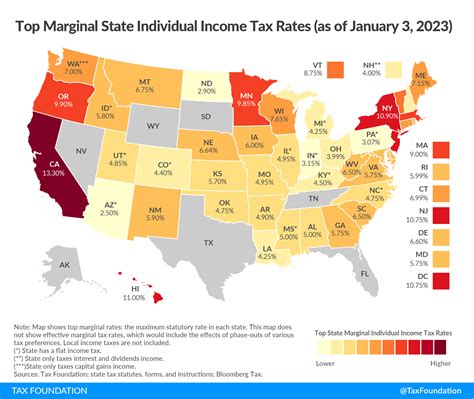

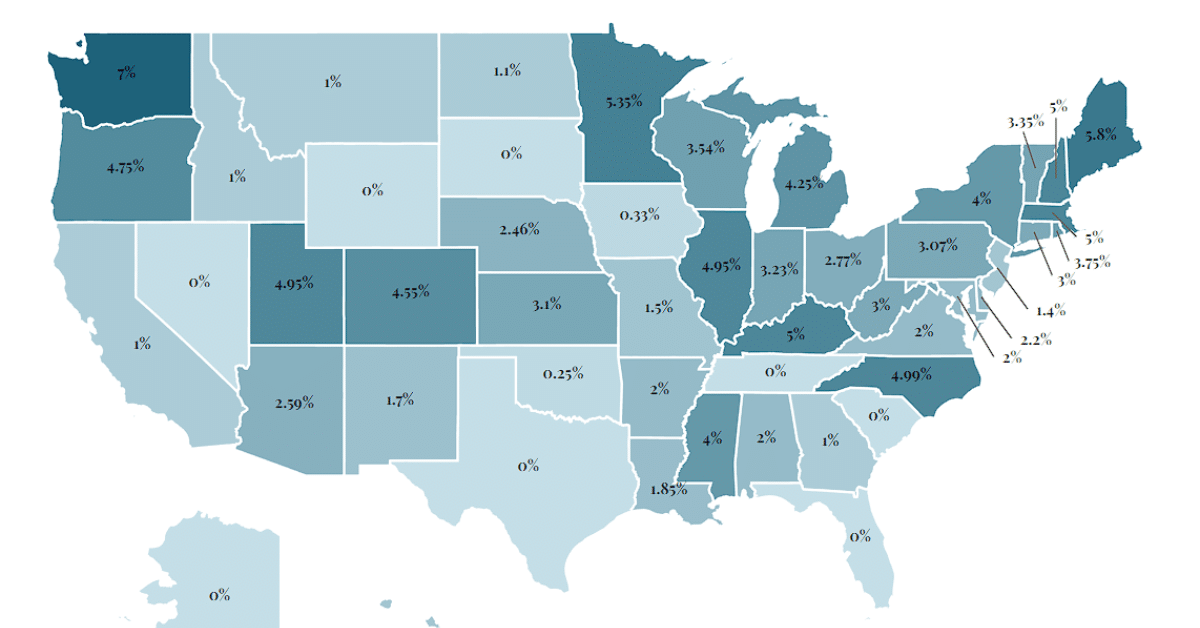

When compared to other states, Arkansas’s income tax system stands out for its relatively low rates. Many states have higher income tax rates, especially for high earners. This can make Arkansas an appealing destination for individuals and businesses seeking to minimize their tax liabilities. However, it’s essential to consider the overall tax landscape, including property taxes and sales taxes, when making relocation or investment decisions.

Future Outlook

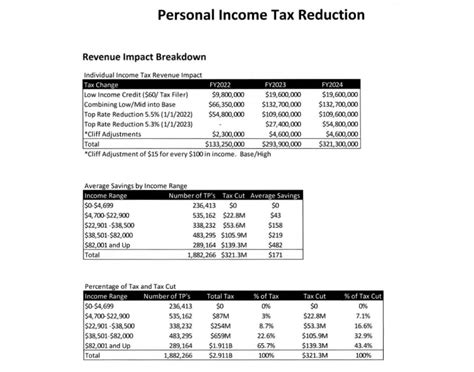

Arkansas’s state income tax system is subject to ongoing discussions and potential reforms. Economic shifts, changes in state revenue needs, and political dynamics can all influence future tax policies. Some proposed changes include adjusting tax brackets to account for inflation, introducing new tax credits, or even exploring a flat tax rate to simplify the system.

The state's commitment to economic growth and development also shapes its tax policies. As Arkansas strives to attract businesses and create jobs, the tax system may evolve to provide incentives and support for specific industries or sectors. This dynamic nature of tax policy ensures that Arkansas remains competitive in the ever-changing economic landscape.

Conclusion

Arkansas’s state income tax system, with its historical roots and progressive structure, plays a crucial role in the state’s fiscal health and economic development. For residents and businesses, understanding the nuances of this tax system is essential for effective financial planning and decision-making. As the state continues to evolve, its income tax policies will likely adapt to meet the changing needs of its citizens and businesses, ensuring a balanced approach to revenue generation and economic growth.

What is the deadline for filing Arkansas state income tax returns?

+The deadline for filing Arkansas state income tax returns typically aligns with the federal tax deadline, which is generally April 15th. However, it’s important to note that this date may vary depending on the day of the week and any observed holidays. It’s always advisable to check the official state tax website for the most up-to-date information on tax filing deadlines.

Are there any special tax considerations for remote workers in Arkansas?

+Arkansas, like many states, has implemented tax laws regarding remote work, especially in the wake of the COVID-19 pandemic. Remote workers who earn income from outside the state but work remotely within Arkansas may have specific tax obligations. It’s crucial for remote workers to understand their tax responsibilities and consult with tax professionals to ensure compliance.

How does Arkansas’s state income tax compare to other Southern states?

+Arkansas’s income tax rates are generally lower compared to many other Southern states. This can make Arkansas an attractive destination for individuals and businesses seeking to minimize their tax liabilities. However, it’s important to consider the overall tax landscape, including property taxes and sales taxes, when comparing states.