Texas Sales Tax Exemption Form

Understanding the intricacies of sales tax exemptions in Texas is crucial for businesses and individuals alike. This comprehensive guide will delve into the Texas Sales Tax Exemption Form, exploring its purpose, requirements, and the benefits it offers. By navigating this complex tax landscape, we aim to provide valuable insights and clarity to ensure compliance and maximize savings.

Unveiling the Texas Sales Tax Exemption Form

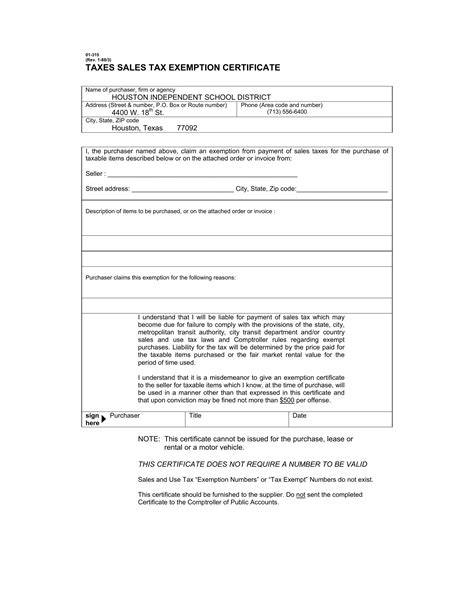

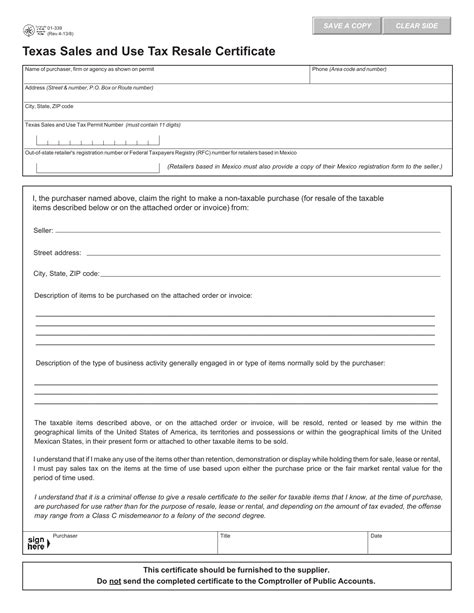

The Texas Sales Tax Exemption Form, officially known as Form 01-339, is a vital document for businesses and consumers in the Lone Star State. This form serves as a gateway to tax-exempt purchases, offering significant advantages to those who qualify. Let’s delve into the details to understand its significance and how it can be utilized effectively.

Understanding the Purpose

Texas, like many other states, imposes a sales tax on most goods and services. This tax is typically paid by the consumer at the point of sale, with the collected revenue contributing to state and local government funds. However, certain entities and purchases are eligible for exemption from this tax, and this is where the Sales Tax Exemption Form comes into play.

The primary purpose of the form is to provide a legal mechanism for eligible individuals, businesses, and organizations to claim exemption from sales tax. By completing and submitting this form, they can avoid paying the tax on specific purchases, resulting in significant cost savings.

Eligibility Criteria

Not everyone can claim a sales tax exemption in Texas. The state has outlined specific criteria that determine who qualifies for this benefit. Let’s explore the key eligibility factors:

- Residency Status: Texas residents are eligible for certain exemptions, such as the Homestead Exemption, which reduces property taxes for homeowners.

- Business Type: Certain types of businesses, like nonprofit organizations, may qualify for tax-exempt status, allowing them to purchase goods and services without paying sales tax.

- Purpose of Purchase: The intended use of the purchased items plays a crucial role. For instance, purchases made for resale are typically exempt from sales tax, as the tax is collected from the final consumer.

- Tax-Exempt Organizations: Nonprofit organizations, religious institutions, and government entities often enjoy tax-exempt status, enabling them to make tax-free purchases.

- Specific Industries: Some industries, such as agriculture and manufacturing, may have unique tax exemptions tailored to their specific needs.

It's essential to note that while these are general guidelines, the specific eligibility criteria can vary based on the type of exemption and the unique circumstances of each case. Therefore, it is advisable to consult with a tax professional or refer to the official guidelines provided by the Texas Comptroller of Public Accounts for precise information.

Benefits of Sales Tax Exemption

Claiming sales tax exemption in Texas can offer substantial advantages to eligible entities. Here are some key benefits:

- Cost Savings: The most obvious benefit is the reduction in costs. By avoiding sales tax, businesses and individuals can save a significant portion of their budget, especially for large-scale purchases.

- Competitive Advantage: For businesses, tax exemption can provide a competitive edge. It allows them to offer more competitive pricing, attracting customers and potentially increasing market share.

- Streamlined Operations: Tax-exempt status simplifies the purchasing process. Businesses no longer need to calculate and remit sales tax, reducing administrative burdens and potential errors.

- Financial Flexibility: Tax-exempt purchases provide financial flexibility, especially for nonprofit organizations and government entities. It allows them to allocate resources more efficiently, focusing on their core missions.

- Compliance and Legal Protection: Properly claiming tax exemptions ensures compliance with state regulations. This protects businesses and individuals from potential legal issues and penalties.

Completing the Form

To claim sales tax exemption in Texas, the process involves completing and submitting the appropriate form. Here’s a step-by-step guide to help you through the process:

- Obtain the Form: You can access the Texas Sales Tax Exemption Form (Form 01-339) directly from the Texas Comptroller of Public Accounts website. It is available in both PDF and fillable PDF formats, making it convenient to complete electronically.

- Review the Instructions: Before filling out the form, carefully read the instructions provided. These instructions outline the specific requirements and guidelines for completing the form accurately.

- Gather Necessary Information: Collect all the required information, such as your business or organization's details, tax identification number, and the purpose of the tax-exempt purchase. Ensure you have all the necessary documentation to support your claim.

- Complete the Form: Fill out the form with accurate and complete information. Double-check your entries to avoid errors. Incomplete or incorrect forms may result in delays or rejection of your exemption request.

- Sign and Date: Once you've reviewed and verified the information, sign and date the form. Ensure you have the appropriate authority to sign on behalf of your business or organization.

- Submit the Form: Submit the completed form to the Texas Comptroller of Public Accounts using the preferred method outlined in the instructions. This may include mailing, faxing, or even submitting the form online through their secure portal.

- Track Your Application: After submitting the form, you can track the status of your application using the reference number provided. This allows you to stay informed about the progress and receive updates regarding your exemption request.

Remember, the specific instructions and requirements may vary based on the type of exemption you are claiming. It is crucial to follow the guidelines provided by the Texas Comptroller's office to ensure a smooth and successful application process.

Maintaining Tax-Exempt Status

Obtaining tax-exempt status is just the beginning. To maintain this benefit, certain responsibilities and obligations must be fulfilled. Here are some key considerations:

- Record-Keeping: Maintain accurate records of all tax-exempt purchases. This includes keeping copies of the exemption form, receipts, and any supporting documentation. Proper record-keeping is essential for audits and compliance.

- Regular Updates: Stay informed about any changes in tax laws and regulations. Tax codes may evolve, and it is crucial to ensure your business or organization remains compliant with the latest requirements.

- Audit Preparedness: While most businesses and individuals may not undergo frequent audits, being prepared is essential. Ensure you have all the necessary documentation and are ready to provide evidence of your tax-exempt status if needed.

- Renewal: Tax-exempt status is not permanent in many cases. Some exemptions may require periodic renewal. Stay on top of the renewal process to avoid lapses in your tax-exempt privileges.

Common Misconceptions

There are several common misconceptions surrounding sales tax exemptions in Texas. Let’s clarify some of these misconceptions to provide a clearer understanding:

- Misconception: Sales Tax Exemption Means No Taxes Ever. Clarification: While sales tax exemption allows for tax-free purchases, it does not eliminate all taxes. Businesses and individuals may still be subject to other types of taxes, such as income tax, property tax, or other specific levies.

- Misconception: All Nonprofits Are Tax-Exempt. Clarification: While many nonprofit organizations enjoy tax-exempt status, it is not automatic. Nonprofits must apply for and obtain the appropriate tax-exempt classification to claim sales tax exemption.

- Misconception: Sales Tax Exemption Applies to All Purchases. Clarification: Sales tax exemption is specific to certain types of purchases. It does not cover all purchases made by a business or individual. The exemption is typically tied to the purpose of the purchase and the eligibility of the entity making the purchase.

Real-World Examples

To illustrate the practical application of sales tax exemption, let’s consider a few real-world scenarios:

- Nonprofit Organization: A local charity purchases office supplies and equipment using its tax-exempt status. By avoiding sales tax, they can allocate more funds towards their charitable programs, maximizing their impact.

- Small Business: A startup company purchases inventory for resale, claiming exemption on these purchases. This exemption helps them keep their costs low, allowing them to price their products competitively and attract more customers.

- Government Entity: A state government department purchases vehicles and office furniture, benefiting from tax-exempt status. This saves taxpayer money and ensures efficient allocation of resources.

The Future of Sales Tax Exemption

As tax laws and regulations evolve, the future of sales tax exemption in Texas may undergo changes. Here are some potential implications and considerations:

- Technological Advances: The rise of e-commerce and online sales presents unique challenges and opportunities for tax exemption. Texas may need to adapt its regulations to accommodate these changes, ensuring fair taxation practices.

- Economic Considerations: Shifts in the economic landscape may impact sales tax exemption policies. Texas may adjust its approach to support specific industries or address budget concerns, impacting the availability and scope of exemptions.

- Policy Changes: With changing political landscapes, tax policies may undergo revisions. Staying informed about any proposed changes is crucial for businesses and individuals to adapt their strategies accordingly.

FAQs

Can individuals claim sales tax exemption in Texas?

+Yes, individuals can claim sales tax exemption in certain circumstances. For example, homeowners can apply for the Homestead Exemption to reduce their property taxes. Additionally, individuals with specific disabilities or veterans with service-connected disabilities may qualify for sales tax exemption on certain purchases.

How often do I need to renew my tax-exempt status?

+The renewal process varies depending on the type of exemption and the entity claiming it. Some exemptions may require annual renewal, while others may have longer validity periods. It’s essential to stay informed about the specific renewal requirements for your exemption.

Are there any penalties for misuse of tax-exempt status?

+Yes, misuse or abuse of tax-exempt status can result in penalties. This includes claiming exemption when not eligible or failing to comply with the requirements. Penalties may involve fines, revocation of tax-exempt status, or legal consequences. It’s crucial to maintain proper documentation and use tax exemptions responsibly.

Can I apply for sales tax exemption online?

+Yes, the Texas Comptroller’s office provides an online platform for submitting certain types of exemption forms, including the Sales Tax Exemption Form. This digital process offers convenience and efficiency, allowing you to track the status of your application in real-time.

Are there any exceptions to sales tax exemption for businesses?

+Yes, while many businesses may qualify for sales tax exemption, there are exceptions. For instance, businesses involved in certain industries, such as retail sales, may not be eligible for exemption. It’s essential to understand the specific criteria and limitations of the exemption to ensure compliance.

In conclusion, the Texas Sales Tax Exemption Form is a powerful tool for businesses and individuals to navigate the complex world of sales taxation. By understanding the eligibility criteria, benefits, and proper procedures, one can effectively claim tax exemption and maximize savings. Remember, staying informed and compliant is key to leveraging the advantages of sales tax exemption in Texas.