Aarp Tax Locations

As the tax season approaches, many individuals seek assistance and guidance to navigate the complex world of tax preparation. One trusted resource that comes to mind is the AARP Tax-Aide program, a valuable service offered by the American Association of Retired Persons (AARP). This program provides free tax preparation services to eligible individuals, particularly focusing on those aged 50 and above.

Understanding the AARP Tax-Aide Program

The AARP Tax-Aide program is a nationwide initiative that operates through a network of trained and certified volunteers. These volunteers dedicate their time and expertise to offering free tax assistance to taxpayers with moderate to low income, ensuring they receive the support they need to file their taxes accurately and efficiently.

What sets this program apart is its focus on catering to the unique needs of older adults and low-income individuals. The volunteers are not only well-versed in tax laws and regulations but also receive specialized training to handle the specific tax situations often encountered by retirees and those with limited financial means.

Eligibility and Services Offered

The AARP Tax-Aide program is open to all taxpayers, regardless of age, who meet certain income requirements. However, the program’s primary target audience is individuals aged 50 and older, as they often face unique tax challenges associated with retirement and senior benefits.

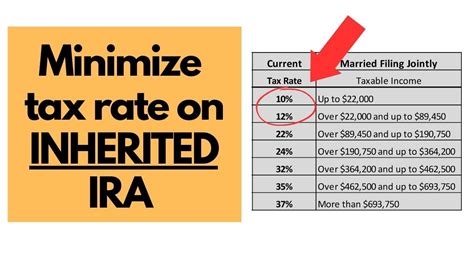

Services provided by the program include assistance with federal and state tax return preparation, e-filing, and claiming tax credits for which the taxpayer may be eligible. Volunteers are also equipped to handle more complex tax scenarios, such as dealing with pension and annuity income, Social Security benefits, and various tax deductions specific to older adults.

| Service Category | Description |

|---|---|

| Tax Return Preparation | Volunteers help individuals complete their federal and state tax returns, ensuring all necessary forms are filled out accurately. |

| E-Filing | AARP Tax-Aide assists with electronic filing of tax returns, a secure and efficient way to submit tax documents. |

| Tax Credit Claims | Volunteers guide taxpayers in claiming eligible tax credits, such as the Earned Income Tax Credit (EITC) and Child Tax Credit. |

| Retirement Income | Experts in the program are trained to handle tax implications of retirement income, including pension and annuity income. |

| Social Security Benefits | AARP Tax-Aide volunteers provide guidance on how Social Security benefits are taxed and help maximize tax refunds. |

In addition to these core services, the AARP Tax-Aide program also offers educational resources and workshops to empower taxpayers with the knowledge they need to make informed decisions about their taxes. These resources cover a range of topics, from understanding tax forms to exploring tax-saving strategies.

Finding Your Nearest AARP Tax-Aide Location

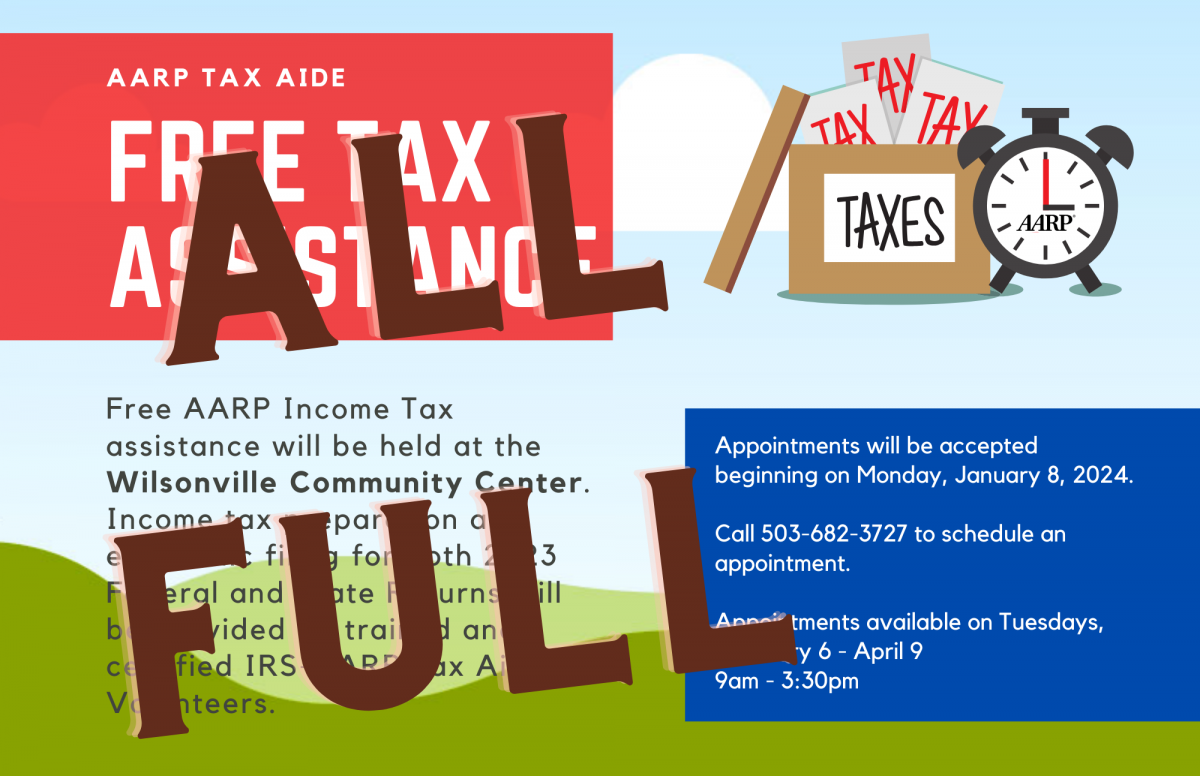

Locating your nearest AARP Tax-Aide site is straightforward, thanks to the program’s user-friendly website and comprehensive search tool. Here’s a step-by-step guide to finding a location near you:

- Visit the official AARP Tax-Aide website: https://www.aarp.org/tax-aide.

- On the homepage, you'll find a search bar labeled "Find a Location." Enter your zip code or city and state to initiate the search.

- The website will display a list of nearby AARP Tax-Aide sites, including their addresses and contact information.

- Choose the location most convenient for you and note the operating hours and any specific instructions provided, such as appointment requirements.

- If you prefer, you can also call the AARP Tax-Aide hotline at 1-888-AARPNOW (1-888-227-7669) for assistance in finding a location or scheduling an appointment.

Tips for a Smooth Tax Preparation Experience

To make the most of your visit to an AARP Tax-Aide location, here are some tips to keep in mind:

- Bring all necessary tax documents, such as W-2 forms, 1099s, and any other relevant income and deduction information.

- If you have complex tax situations, consider making an appointment in advance to ensure sufficient time for your tax preparation.

- Arrive early to avoid long wait times, especially if you're visiting during peak tax season.

- Be prepared to provide identification, such as a driver's license or state ID, to verify your identity.

- Feel free to ask questions throughout the process; the volunteers are there to ensure you understand your tax situation and make informed decisions.

The Impact of AARP Tax-Aide

The AARP Tax-Aide program has made a significant impact on the lives of millions of taxpayers over the years. By providing free, expert tax assistance, the program ensures that individuals, particularly those who might otherwise struggle with tax preparation, can navigate the tax system with confidence and accuracy.

In addition to the direct benefits to taxpayers, the program also contributes to the overall economic well-being of communities. By helping individuals claim tax credits and maximize their refunds, AARP Tax-Aide boosts the financial stability of families and individuals, enabling them to invest more in their local economies.

A Community-Driven Initiative

At its core, the AARP Tax-Aide program is a testament to the power of community involvement and volunteerism. The dedication and expertise of the program’s volunteers are what make it such a successful and widely respected initiative. These volunteers not only provide a valuable service but also foster a sense of community and support, especially among older adults who may feel isolated or overwhelmed by tax-related tasks.

By participating in the AARP Tax-Aide program, volunteers gain a sense of purpose and satisfaction, knowing they are making a difference in the lives of their fellow community members. This reciprocal relationship between taxpayers and volunteers is a key strength of the program, fostering a culture of mutual support and trust.

Conclusion

The AARP Tax-Aide program stands as a shining example of how a community-driven initiative can have a profound impact on the financial well-being of its members. Through its network of dedicated volunteers and expert guidance, the program ensures that taxpayers, especially those who might otherwise face barriers, can navigate the complex world of taxes with confidence and accuracy.

As we approach tax season, it's a great time to take advantage of the resources and support offered by the AARP Tax-Aide program. Whether you're a retiree, a low-income individual, or simply someone seeking guidance, the program's services are tailored to meet your needs. With its convenient locations, expert volunteers, and comprehensive services, AARP Tax-Aide is a trusted partner in ensuring your tax obligations are met efficiently and effectively.

Can I still use AARP Tax-Aide services if I’m not an AARP member?

+Absolutely! AARP Tax-Aide services are open to all taxpayers, regardless of their membership status with AARP. The program’s primary focus is on providing assistance to those who need it, especially older adults and low-income individuals.

Are there any fees associated with using AARP Tax-Aide services?

+No, AARP Tax-Aide services are completely free. The program is funded by donations and grants, allowing it to offer its services without any cost to taxpayers.

What if I have a complex tax situation? Can AARP Tax-Aide still help me?

+Yes, AARP Tax-Aide is equipped to handle complex tax scenarios. The volunteers receive specialized training to assist with retirement income, Social Security benefits, and other unique tax situations faced by older adults. They can guide you through the process and ensure your tax return is accurate and complete.