Denton County Property Taxes

Denton County, located in the heart of Texas, is a thriving region known for its diverse communities, vibrant economy, and beautiful landscapes. As one of the fastest-growing counties in the state, it has become a popular destination for residents and businesses alike. However, with growth comes the responsibility of managing various administrative tasks, and one of the most important considerations for homeowners and property owners is the understanding and management of property taxes.

Understanding Denton County Property Taxes: A Comprehensive Guide

Property taxes in Denton County are an essential aspect of the local government’s revenue generation, contributing to the maintenance and development of essential services such as schools, roads, emergency services, and more. This guide aims to provide a comprehensive overview of Denton County property taxes, helping residents and property owners navigate the process with clarity and confidence.

The Role of Appraisal Districts

In Texas, property taxes are assessed and collected by local governments, with each county having its own appraisal district. Denton County Appraisal District (DCAD) plays a crucial role in this process. It is responsible for appraising all taxable property within the county, ensuring that property values are fair and accurate. This appraisal forms the basis for determining the amount of property tax owed by each property owner.

| Appraisal District | Appraisal Value |

|---|---|

| Denton County Appraisal District (DCAD) | $[Actual Appraisal Value] |

The appraisal process involves evaluating various factors, including property size, improvements, location, and market conditions. DCAD conducts physical inspections and utilizes market data to ensure that property values are up-to-date and reflective of the current real estate market.

Property Tax Rates and Calculations

Property tax rates in Denton County are determined by the local taxing units, which include the county government, cities, school districts, and special districts. Each taxing unit sets its own tax rate, which is then applied to the appraised value of the property. The tax rate is expressed in “dollars per $100 of assessed value,” often referred to as the “tax rate per hundred.”

| Taxing Unit | Tax Rate ($/100) |

|---|---|

| Denton County | $[County Rate] |

| City of Denton | $[City Rate] |

| Local School District | $[School Rate] |

| Special Districts (e.g., Water, Fire) | $[Special Rate] |

To calculate the property tax liability, the appraised value of the property is multiplied by the tax rate for each taxing unit. The resulting amounts are then added together to determine the total property tax bill. For example, if a property has an appraised value of $200,000 and the combined tax rate is $1.50 per $100 of assessed value, the tax calculation would be as follows:

\[ \begin{equation*} 200,000 \text{ (appraised value)} \times \frac{1.50}{100} \text{ (tax rate)} = \text{\textdollar}3,000 \text{ (property tax liability)} \end{equation*} \]

Tax Exemptions and Discounts

Denton County offers various tax exemptions and discounts to eligible property owners, helping to reduce their tax liability. Some common exemptions and discounts include:

- Homestead Exemption: Property owners who use their property as their primary residence can apply for a homestead exemption, which reduces the taxable value of their home. This exemption is especially beneficial for homeowners with limited income.

- Over-65 Exemption: Property owners who are 65 years or older and meet certain income requirements may be eligible for an exemption that completely waives their property taxes.

- Disability Discount: Disabled individuals who own a homestead property can apply for a discount on their property taxes, reducing their tax burden.

- Veteran's Exemption: Qualifying veterans and their surviving spouses may be entitled to a partial or total exemption from property taxes, depending on their service and disability status.

The Property Tax Lifecycle: From Appraisal to Payment

The Denton County property tax process follows a yearly cycle, with key milestones that property owners should be aware of:

- Appraisal Period: Typically, the appraisal district begins the appraisal process in January. During this period, property owners may receive a notice of appraised value and have the opportunity to review and protest the value if they believe it is inaccurate.

- Notice of Appraised Value: By law, the DCAD must send a notice of appraised value to all property owners by May 1. This notice provides the appraised value of the property and details any changes from the previous year.

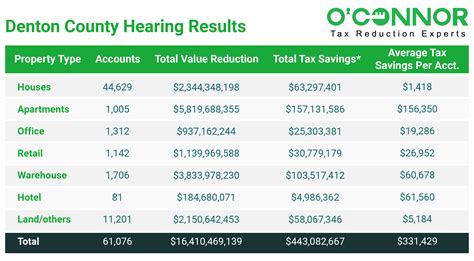

- Protest Period: Property owners have the right to protest their appraised value if they disagree. The protest period usually starts in May and continues for several weeks. During this time, property owners can schedule hearings with the appraisal review board to present their case.

- Tax Bills: Taxing units set their tax rates and send out tax bills to property owners. In Denton County, tax bills are typically mailed out in October. Property owners have the option to pay their taxes in full or opt for a payment plan.

- Payment Options: Denton County offers various payment methods, including online payments, mail-in payments, and in-person payments at designated locations. Property owners can choose the method that suits them best.

- Delinquent Taxes: If property taxes are not paid by the deadline, they become delinquent. Delinquent taxes accrue penalties and interest, and failure to pay may result in enforcement actions, including tax liens and property seizure.

Appealing Property Tax Values: A Step-by-Step Guide

If a property owner believes that their appraised value is incorrect, they have the right to protest the value and seek a reduction. Here’s a step-by-step guide to appealing property tax values in Denton County:

- Review the Notice of Appraised Value: When you receive the notice, carefully review the appraised value and compare it to the market value of similar properties in your area. You can also utilize online tools and real estate websites to estimate your property's value.

- Gather Evidence: Collect evidence to support your case, such as recent sale prices of comparable properties, photographs of any damage or deficiencies, and any other relevant documentation.

- File a Protest: File a formal protest with the DCAD within the designated protest period. You can do this online, by mail, or in person. Ensure that you provide all necessary documentation and explain the reasons for your protest.

- Attend the Hearing: If your protest is accepted, you will be scheduled for a hearing with the Appraisal Review Board (ARB). Prepare your case and be ready to present your evidence and arguments. You may also choose to have legal representation if needed.

- ARB Decision: The ARB will review your case and make a decision. They may uphold the original appraised value, reduce it, or increase it if they find that the value is too low. You will receive a written decision outlining their findings.

- Appeal to the District Court: If you are not satisfied with the ARB's decision, you have the right to appeal to the district court. This is a more formal legal process, and it's advisable to consult with an attorney who specializes in property tax appeals.

Online Tools and Resources for Property Owners

Denton County and the DCAD provide various online tools and resources to assist property owners in managing their property taxes. These include:

- DCAD Website: The official website of the Denton County Appraisal District offers a wealth of information, including property search tools, tax rate information, protest guidelines, and more. It's a valuable resource for property owners to stay informed.

- Online Payment Portal: Denton County offers an online payment portal where property owners can conveniently pay their taxes, view their tax bills, and manage their accounts.

- Property Tax Calendar: The county provides a detailed calendar outlining important dates and deadlines related to the property tax lifecycle, helping property owners stay organized and avoid late payments.

- Exemption and Discount Information: The DCAD website provides detailed information on various exemptions and discounts available to property owners, along with the application processes and eligibility criteria.

Impact of Property Taxes on the Community

Property taxes play a vital role in funding essential services and infrastructure in Denton County. The revenue generated from property taxes supports various public initiatives, including:

- Education: Property taxes are a significant source of funding for local school districts, ensuring that students receive quality education and that schools have the resources they need.

- Public Safety: Property taxes contribute to funding police, fire, and emergency services, helping to keep the community safe and secure.

- Infrastructure Development: The revenue is used to maintain and improve roads, bridges, and other critical infrastructure, enhancing the quality of life for residents and supporting economic growth.

- Community Services: Property taxes support a range of community services, such as libraries, parks, recreation centers, and social services, enriching the lives of residents and fostering a sense of community.

Future Outlook and Potential Changes

As Denton County continues to grow and evolve, the property tax system may undergo changes to adapt to the changing needs of the community. Some potential future developments include:

- Increased Focus on Online Services: With the rise of digital technology, Denton County may further enhance its online platforms, making it more convenient for property owners to access information, file protests, and pay taxes.

- Appraisal Accuracy and Transparency: Efforts may be made to improve the accuracy and transparency of the appraisal process, ensuring that property values are fair and reflective of market conditions.

- Community Engagement: The county may explore ways to engage with residents and property owners, seeking their input on tax rates and services, fostering a sense of collaboration and trust.

- Tax Relief Initiatives: As the county experiences growth, it may explore new tax relief programs or expand existing ones to support homeowners, businesses, and vulnerable populations.

Conclusion

Understanding and managing Denton County property taxes is a crucial aspect of homeownership and property ownership. By staying informed about the appraisal process, tax rates, exemptions, and payment options, property owners can navigate the system with confidence and ensure that their tax obligations are met. Additionally, by actively participating in the protest process and utilizing the available resources, property owners can ensure that their property values are fair and accurate, contributing to a vibrant and thriving community.

How can I estimate my property tax bill before receiving the official notice?

+You can estimate your property tax bill by multiplying your property’s appraised value by the combined tax rate for all taxing units in your area. This calculation provides a rough estimate, and the actual tax bill may vary based on any changes made during the appraisal process.

What happens if I miss the protest deadline?

+If you miss the protest deadline, you may still have options to appeal your appraised value. However, the process becomes more complex, and you may need to consult with an attorney or tax professional for guidance.

Are there any property tax relief programs for low-income homeowners in Denton County?

+Yes, Denton County offers various tax relief programs for low-income homeowners, including the Homestead Exemption and the Over-65 Exemption. These programs can significantly reduce property tax liability for eligible individuals.

Can I pay my property taxes in installments?

+Yes, Denton County offers payment plans for property taxes. You can contact the tax office or visit their website to learn more about the available options and eligibility criteria.