Wa State Sales Tax Rate

In the state of Washington, sales tax is an essential component of the state's revenue system, playing a crucial role in funding various public services and infrastructure projects. The sales tax rate in Washington is a key factor for businesses and consumers alike, impacting their financial strategies and daily spending habits. This article aims to provide an in-depth analysis of the Wa State Sales Tax Rate, covering its history, current structure, exemptions, and its broader implications for the state's economy.

Understanding the Wa State Sales Tax Rate

The sales tax rate in Washington is a combination of state and local taxes, with the state setting a base rate and local jurisdictions having the authority to add additional taxes. This system allows for variations in tax rates across different regions of the state, reflecting the diverse needs and priorities of each community.

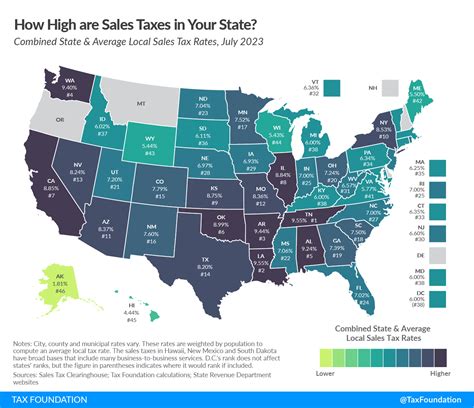

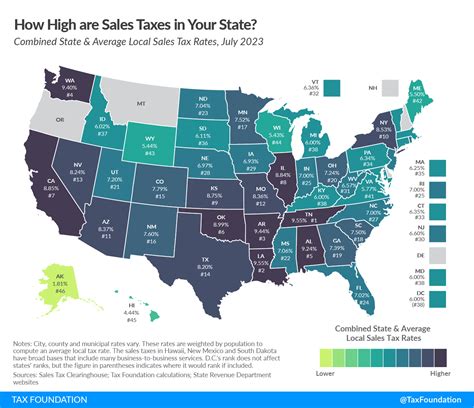

As of [most recent data available], the statewide sales tax rate in Washington is 6.5%, one of the lower rates among U.S. states. However, this rate can increase significantly when combined with local taxes, with some areas having a total sales tax rate of up to 10.4%. These local variations can have a notable impact on the cost of goods and services for residents and businesses in different parts of the state.

History and Evolution of Wa State Sales Tax

The sales tax in Washington has a long history, dating back to the early 20th century. The state’s first sales tax was introduced in 1935 as a temporary measure to address the financial challenges of the Great Depression. It was initially set at a rate of 2%, and its temporary nature was emphasized to alleviate public concerns.

Over the decades, the sales tax rate has undergone several changes, often in response to economic conditions and the state's budgetary needs. For instance, during the recession of the late 2000s, the sales tax rate was temporarily increased to provide additional revenue for the state. These fluctuations in the sales tax rate have had significant impacts on businesses and consumers, influencing their financial decisions and strategies.

One notable aspect of Washington's sales tax history is the state's lack of a sales tax on groceries, a policy that has been in place since 1969. This exemption, which applies to most food items, has been a significant relief for low-income households and has helped to keep the overall cost of living in Washington more affordable.

Sales Tax Structure and Exemptions

The sales tax in Washington applies to a wide range of goods and services, including retail sales, leases, and rentals. However, there are several notable exemptions and special provisions within the sales tax structure.

For instance, in addition to groceries, Washington also exempts prescription drugs, most medical services, and residential rent from sales tax. These exemptions are designed to reduce the tax burden on essential goods and services, making them more accessible to residents. Moreover, the state offers a resale certificate to businesses that allow them to purchase goods without paying sales tax, provided they will resell those goods to their customers, who will then pay sales tax on the final purchase.

| Category | Tax Rate |

|---|---|

| General Sales Tax | 6.5% |

| Local Taxes (Varies) | Up to 3.9% |

| Combined Rate (Maximum) | 10.4% |

The Impact of Wa State Sales Tax

The sales tax in Washington has significant implications for both the state’s economy and its residents. For businesses, the sales tax rate directly affects their pricing strategies, profitability, and competitiveness. A higher sales tax rate can increase the cost of doing business, potentially leading to higher prices for consumers and a potential decline in sales.

On the other hand, for consumers, the sales tax rate influences their purchasing decisions and overall financial planning. Higher sales tax rates can discourage discretionary spending and impact the affordability of goods and services. This, in turn, can have a ripple effect on the state's economy, affecting job markets, business growth, and the overall economic health of the state.

Future Implications and Considerations

Looking ahead, the Wa State Sales Tax Rate will continue to be a critical factor in the state’s economic landscape. As Washington’s economy evolves and faces new challenges, such as changes in consumer behavior, technological advancements, and potential shifts in federal policies, the sales tax rate may need to adapt to ensure the state’s fiscal stability and competitiveness.

One potential area of focus could be the increasing trend of online shopping, which often circumvents traditional sales tax collection methods. Washington, like many other states, is exploring ways to capture sales tax revenue from online purchases, ensuring a level playing field for brick-and-mortar businesses and maintaining a robust tax base.

Furthermore, as Washington continues to prioritize investments in infrastructure, education, and social services, the sales tax rate may be a key lever for generating the necessary revenue. Balancing the need for revenue with the impact on businesses and consumers will be a delicate task, requiring careful consideration and analysis.

Conclusion

The Wa State Sales Tax Rate is a multifaceted issue, impacting various aspects of the state’s economy and the daily lives of its residents. Understanding the current rate, its historical context, and its potential future trajectories is essential for businesses, policymakers, and the public alike. By staying informed and engaged, we can ensure that Washington’s sales tax system remains fair, effective, and aligned with the state’s economic goals and the needs of its people.

How does Washington’s sales tax compare to other states?

+Washington’s sales tax rate of 6.5% is relatively low compared to many other U.S. states. Some states have much higher rates, with several exceeding 10%. However, it’s important to note that the combined rate with local taxes can push Washington’s effective tax rate higher, making it more comparable to other states.

Are there any plans to change the sales tax rate in the near future?

+As of [current date], there are no immediate plans to change the sales tax rate. However, tax policies are subject to change based on various factors, including economic conditions and legislative priorities. It’s always advisable to stay updated with the latest news and proposals to understand potential changes.

What are the key benefits of Washington’s sales tax structure for businesses and consumers?

+For businesses, Washington’s sales tax structure provides a competitive environment with a relatively low base rate, which can attract investment and promote economic growth. For consumers, the exemptions on essential items like groceries and prescription drugs help reduce the tax burden on everyday necessities.