Alabama Sales Taxes

Sales taxes are an essential component of revenue generation for many states, and Alabama is no exception. This article delves into the intricacies of Alabama sales taxes, providing a comprehensive understanding of how they work, their impact on businesses and consumers, and the latest regulations and rates. Whether you're a business owner, an accountant, or simply curious about the financial landscape of the Yellowhammer State, this guide will offer valuable insights.

Understanding Alabama Sales Taxes

Alabama’s sales tax system is a vital revenue stream for the state, contributing significantly to its overall financial health. It’s a consumption tax levied on the sale of tangible goods and some services, with rates varying depending on the location and the type of transaction.

The Alabama Department of Revenue is the primary authority responsible for administering and enforcing sales tax laws. They provide clear guidelines and resources to help businesses understand their sales tax obligations, ensuring compliance and fair practices.

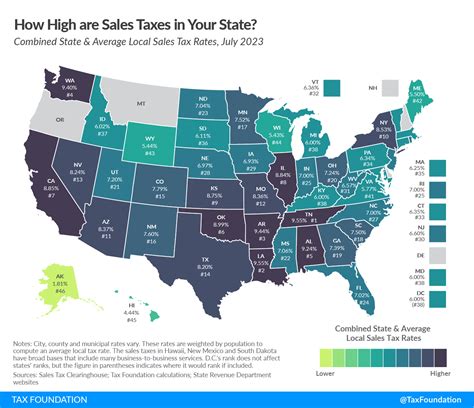

Alabama's sales tax system is a combination of state and local taxes. The state imposes a uniform sales tax rate, but local municipalities and counties can also levy their own taxes, creating a complex but flexible system. This local variation allows for tailored tax rates based on specific community needs and priorities.

Sales Tax Rates in Alabama

As of [current date], Alabama’s state sales tax rate stands at 4%. This rate is applied to most retail sales across the state. However, it’s important to note that this is not the only tax consumers might encounter.

In addition to the state sales tax, local governments have the authority to impose their own sales taxes. These local sales tax rates can vary significantly from one county or city to another. For instance, Birmingham, Alabama's largest city, has a local sales tax rate of 5%, while the surrounding Jefferson County adds an additional 1%, resulting in a combined sales tax rate of 10% in this specific area.

To illustrate the impact of these varying rates, consider the following table showcasing some of Alabama's major cities and their corresponding total sales tax rates:

| City | State Sales Tax | Local Sales Tax | Total Sales Tax |

|---|---|---|---|

| Birmingham | 4% | 5% | 9% |

| Montgomery | 4% | 3% | 7% |

| Mobile | 4% | 3% | 7% |

| Huntsville | 4% | 2% | 6% |

These varying rates mean that a consumer's sales tax burden can change significantly depending on where they make their purchases within the state.

Sales Tax Exemptions

While most tangible goods are subject to Alabama’s sales tax, there are certain categories of items that are exempt. These exemptions are designed to alleviate the tax burden on essential items or to support specific industries.

For instance, Alabama offers a sales tax exemption for groceries, a move that can significantly reduce the tax burden on lower-income households. Other exempt items include prescription medications, certain agricultural equipment, and machinery used in manufacturing processes.

It's important for businesses to stay updated on these exemptions, as incorrectly applying sales tax can lead to compliance issues and potential penalties.

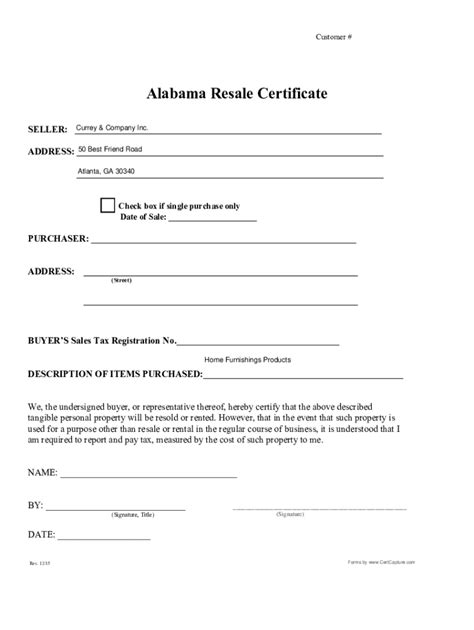

Registration and Compliance

For businesses operating within Alabama, registering for a sales tax permit is a crucial step. This permit authorizes the business to collect and remit sales tax on behalf of the state and local governments. The Alabama Department of Revenue provides an online platform for businesses to register, making the process more efficient and accessible.

Once registered, businesses are responsible for accurately calculating and collecting the appropriate sales tax on each transaction. This includes understanding the applicable tax rates for the specific location of the sale and any relevant exemptions. Regularly reconciling sales tax collections with actual sales is essential to ensure accuracy and timely remittances.

Compliance with sales tax regulations is not only a legal requirement but also crucial for maintaining the trust of customers and the community. Businesses that fail to comply may face penalties, interest charges, or even revocation of their sales tax permit.

Impact on Businesses and Consumers

Alabama’s sales tax system has a profound impact on both businesses and consumers within the state.

Impact on Businesses

For businesses, especially small and medium-sized enterprises (SMEs), the sales tax system can present both opportunities and challenges. On the one hand, collecting and remitting sales tax is a necessary part of doing business in Alabama, ensuring compliance with state and local laws.

However, the administrative burden of managing sales tax obligations can be significant, particularly for businesses with multiple locations or those selling online. Businesses must stay informed about changing tax rates and regulations, which can be complex given the variation in local sales tax rates across the state.

Additionally, businesses must consider the impact of sales tax on their pricing strategies. While sales tax is typically added on top of the sale price, businesses need to ensure that their prices remain competitive while also covering their costs and profit margins. This delicate balance can be challenging, especially in a market with varying sales tax rates.

Despite these challenges, sales tax also presents an opportunity for businesses to build customer loyalty. By clearly communicating sales tax rates and providing accurate receipts, businesses can foster trust and transparency with their customers.

Impact on Consumers

Consumers in Alabama are directly affected by sales taxes through the prices they pay for goods and services. The sales tax system can influence purchasing decisions, with consumers potentially favoring lower-tax jurisdictions for certain purchases.

However, the impact of sales tax extends beyond the point of sale. Sales tax revenue funds essential public services and infrastructure, benefiting all residents. This includes funding for education, healthcare, public safety, and more. Thus, while sales tax may increase the cost of purchases, it also supports the overall well-being of the community.

Furthermore, the varying sales tax rates across Alabama can lead to price differences for the same item, depending on the location of purchase. This variation can provide opportunities for consumers to seek out better deals, especially for higher-priced items. However, it also requires consumers to be more informed about local tax rates when making purchasing decisions.

Future Outlook and Potential Changes

Alabama’s sales tax system is subject to ongoing evaluation and potential changes. Here are some key considerations for the future:

Potential Rate Changes

The state sales tax rate, currently at 4%, could be adjusted in the future to address budgetary needs or economic changes. While a higher rate could increase revenue, it might also impact consumer spending and business profitability. Conversely, a lower rate could stimulate economic growth but might require cuts in public services or increased taxes in other areas.

Streamlining Local Sales Taxes

The variation in local sales tax rates can create administrative challenges for businesses and potential confusion for consumers. There have been discussions about standardizing or simplifying these rates to create a more uniform system. Such a change could simplify tax collection and compliance for businesses, while also making it easier for consumers to understand the taxes they’re paying.

Exemptions and Incentives

Alabama’s sales tax exemptions play a crucial role in supporting specific industries and communities. The state might consider expanding or modifying these exemptions to encourage economic growth or support underserved populations. For example, expanding the grocery exemption could further reduce the tax burden on lower-income households.

Online Sales Tax

With the rise of e-commerce, the collection of sales tax on online sales is an evolving issue. Alabama, like many other states, has implemented laws to ensure that online retailers collect and remit sales tax on purchases made by Alabama residents. As online shopping continues to grow, the state may need to adapt its sales tax policies to ensure fair competition between brick-and-mortar and online retailers.

Impact of Economic Changes

Economic downturns or recoveries can significantly impact sales tax revenue. During economic downturns, sales tax revenue may decline as consumers reduce spending, impacting the state’s budget. Conversely, economic recoveries can lead to increased sales tax revenue, providing an opportunity to invest in public services and infrastructure.

Conclusion

Alabama’s sales tax system is a dynamic and evolving component of the state’s economy. It impacts businesses and consumers alike, shaping pricing strategies, purchasing decisions, and the overall financial landscape of the state. By understanding the current regulations, businesses can ensure compliance and consumers can make informed purchasing choices.

As Alabama continues to adapt to economic changes and technological advancements, its sales tax system will likely undergo further refinements. Staying informed about these changes is essential for all stakeholders, from businesses looking to stay competitive to consumers making informed purchasing decisions.

What is the current state sales tax rate in Alabama?

+As of [current date], the state sales tax rate in Alabama is 4%.

Are there any sales tax exemptions in Alabama?

+Yes, Alabama offers sales tax exemptions for certain items, including groceries, prescription medications, and specific agricultural equipment.

How do I register my business for sales tax in Alabama?

+Businesses can register for a sales tax permit through the Alabama Department of Revenue’s online platform. This process typically involves providing business details and choosing a convenient payment method for remitting sales tax.

How do local sales tax rates impact businesses and consumers in Alabama?

+Local sales tax rates can vary significantly across Alabama. This variation can impact businesses by adding complexity to their sales tax management and pricing strategies. For consumers, it can lead to price differences for the same item, depending on the location of purchase.