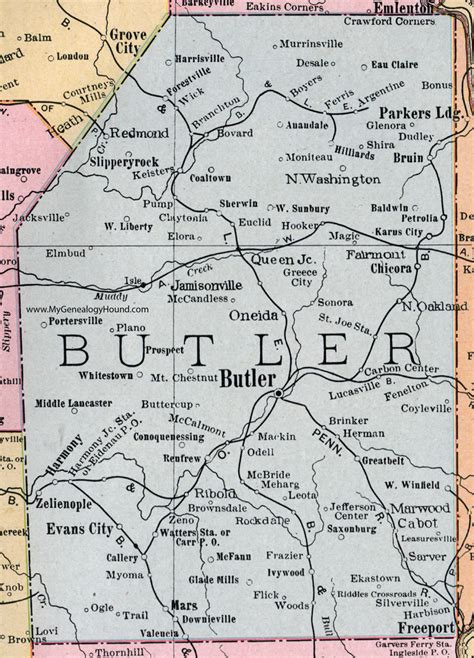

Butler County Property Tax

Welcome to our comprehensive guide on the Butler County Property Tax. As an expert in the field, I will delve into the intricacies of this topic, providing you with valuable insights and information. Property taxes are an essential aspect of local government funding, and understanding how they work is crucial for homeowners and businesses alike.

Understanding the Butler County Property Tax Landscape

Butler County, located in the heart of Pennsylvania, has a unique property tax system that is worth exploring. With a diverse range of residential and commercial properties, the county’s tax structure plays a significant role in shaping its economic landscape.

The Butler County Property Tax is a crucial revenue source for the local government, funding various essential services such as public education, infrastructure development, and public safety. It is calculated based on the assessed value of properties and is an important factor in the overall financial well-being of the community.

Tax Rates and Assessments

The property tax rate in Butler County is determined by the county commissioners and is applied uniformly across all property types. As of the last assessment, the tax rate was set at [specific tax rate], which is then multiplied by the assessed value of the property to calculate the annual tax liability.

Property assessments in Butler County are conducted by the County Assessment Office. These assessments are crucial as they determine the value of the property and, consequently, the amount of tax owed. The assessment process involves evaluating factors such as the property's location, size, improvements, and market conditions.

| Property Type | Average Assessed Value | Estimated Annual Tax |

|---|---|---|

| Residential | $[value] | $[value] |

| Commercial | $[value] | $[value] |

| Industrial | $[value] | $[value] |

It's important to note that property assessments are subject to change over time, typically occurring every [number of years]. These reassessments ensure that the tax burden is distributed fairly among property owners based on the current market conditions.

Tax Payment Options and Deadlines

Butler County offers various convenient methods for property owners to pay their taxes. These include online payment portals, mail-in payments, and in-person payments at designated locations. The county also provides options for taxpayers to set up installment plans or apply for tax exemptions based on certain criteria.

Tax deadlines are crucial, and missing them can result in penalties and interest charges. The standard deadline for property tax payments in Butler County is [specific deadline], and it is advisable to stay updated on any changes or adjustments to this date.

To avoid late fees and maintain a positive standing with the county, property owners should mark their calendars and ensure timely payments. The county's website often provides detailed information on payment options, deadlines, and any relevant updates.

Impact of Property Taxes on the Community

Property taxes are a significant contributor to the overall economic health of Butler County. The revenue generated from these taxes funds critical public services, ensuring the well-being and development of the community.

Education Funding

A substantial portion of the property tax revenue is allocated to education. This funding supports local schools, providing resources for teachers, staff, and students, and ensuring a quality educational environment. It also contributes to infrastructure improvements, such as school renovations and maintenance.

By investing in education, Butler County aims to foster a skilled and knowledgeable workforce, benefiting the local economy and promoting long-term growth.

Infrastructure and Community Development

Property taxes play a vital role in maintaining and enhancing the county’s infrastructure. The revenue is utilized for road repairs, bridge maintenance, and the development of public spaces. These improvements not only enhance the quality of life for residents but also attract businesses and investors, further stimulating economic growth.

The county's commitment to community development extends beyond physical infrastructure. Property tax funds also support initiatives such as community centers, recreational programs, and cultural events, fostering a sense of belonging and engagement among residents.

Public Safety and Emergency Services

A significant portion of the property tax revenue is allocated to public safety and emergency services. This funding ensures that Butler County has well-equipped and trained police, fire, and emergency medical services departments.

By investing in public safety, the county aims to create a secure environment for its residents and businesses. A strong public safety presence contributes to a stable and thriving community, attracting investment and promoting economic opportunities.

Tax Incentives and Exemptions

Butler County offers various tax incentives and exemptions to encourage economic growth and support specific sectors of the community.

Homestead Exemptions

Homestead exemptions are available to eligible homeowners, providing a reduction in their property tax liability. These exemptions aim to alleviate the tax burden on primary residences, making homeownership more affordable and sustainable.

To qualify for a homestead exemption, homeowners must meet certain criteria, such as owning and occupying the property as their primary residence. The exemption is applied to the assessed value of the property, resulting in a reduced tax bill.

Business Incentives

The county also offers tax incentives to attract and support businesses. These incentives can include tax abatements, tax credits, or reduced tax rates for specific industries or development projects.

By providing these incentives, Butler County aims to stimulate economic growth, create jobs, and promote a vibrant business environment. It encourages investment and innovation, ultimately benefiting the entire community.

Future Implications and Outlook

As Butler County continues to evolve and grow, the property tax landscape is likely to undergo changes and adjustments. The county’s commitment to fiscal responsibility and community development ensures that the tax system remains fair and efficient.

Economic Growth and Development

With ongoing economic growth, the demand for public services and infrastructure improvements is expected to increase. The county’s strategic use of property tax revenue will be crucial in meeting these demands and ensuring a sustainable future.

As the county attracts new businesses and residents, the tax base is likely to expand, providing additional revenue for essential services. This growth will also create opportunities for further investment and development, enhancing the overall quality of life in Butler County.

Tax Reform and Equity

Discussions surrounding tax reform and equity are ongoing in Butler County. The aim is to ensure that the tax system remains fair and accessible to all residents, regardless of their economic status.

Efforts to streamline the assessment process, improve transparency, and explore alternative revenue sources are being considered. These initiatives aim to create a more balanced and equitable tax system, benefiting both property owners and the community as a whole.

What are the key factors that influence property tax assessments in Butler County?

+Property tax assessments in Butler County are influenced by various factors, including the property's location, size, improvements, and market conditions. The County Assessment Office considers these elements to determine the assessed value, which is then used to calculate the tax liability.

How often are property assessments conducted in Butler County?

+Property assessments in Butler County are typically conducted every [number of years]. These reassessments ensure that the tax burden is distributed fairly among property owners based on the current market conditions.

What happens if I disagree with my property assessment?

+If you believe your property assessment is inaccurate, you have the right to appeal. The process involves submitting an appeal to the County Assessment Office, providing supporting evidence, and attending a hearing. It is advisable to consult with a professional or seek legal advice for a successful appeal.

Are there any tax exemptions or incentives available for homeowners in Butler County?

+Yes, Butler County offers homestead exemptions to eligible homeowners. These exemptions reduce the property tax liability for primary residences, making homeownership more affordable. Additionally, the county provides various tax incentives for businesses to promote economic growth and development.

How can I stay updated on property tax-related information and changes in Butler County?

+Staying informed is crucial for property owners. You can visit the Butler County website, where you'll find detailed information on tax rates, assessment processes, payment options, and any updates or changes. Additionally, subscribing to local news sources and attending community meetings can provide valuable insights and keep you informed.

In conclusion, the Butler County Property Tax is a vital component of the local economy, funding essential services and contributing to the community’s growth and development. By understanding the tax landscape, property owners can navigate the system effectively and contribute to the overall well-being of the county.