Milwaukee Wi Sales Tax

Welcome to Milwaukee, a vibrant city nestled along the shores of Lake Michigan. As a thriving metropolitan area, Milwaukee offers a unique blend of culture, industry, and natural beauty. When exploring the city and engaging in various economic activities, it's essential to understand the sales tax system, which plays a significant role in the local economy. This comprehensive guide will delve into the intricacies of Milwaukee's sales tax, providing you with a detailed understanding of how it works, its rates, exemptions, and its impact on the local community.

Understanding Milwaukee’s Sales Tax

Sales tax in Milwaukee, Wisconsin, is a crucial component of the state’s revenue system. It is a consumption tax levied on the sale of goods and certain services within the city limits. The tax is collected by businesses and remitted to the Wisconsin Department of Revenue, which distributes the funds to various state and local government entities. The sales tax rate in Milwaukee reflects a combination of state, county, and municipal taxes, creating a unique tax structure specific to the city.

The primary purpose of sales tax is to generate revenue for the government to fund essential services and infrastructure projects. In Milwaukee, these funds contribute to the city's development, including improvements to transportation, education, healthcare, and public safety. Understanding the sales tax rate and its implications is vital for both businesses and consumers, as it directly impacts their financial decisions and the overall economic health of the city.

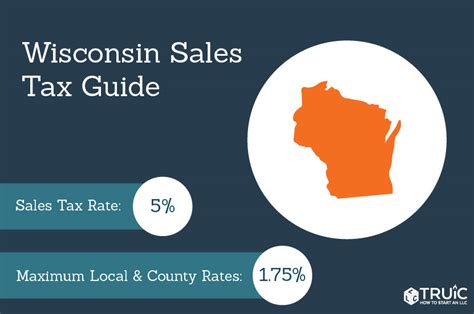

Sales Tax Rate in Milwaukee

As of the latest available information, the sales tax rate in Milwaukee stands at 5.5%, which includes the state tax rate of 5% and an additional 0.5% local tax levied by the city. This rate is applicable to most tangible personal property and certain services, making it a significant factor in the city’s economy.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 5% |

| Milwaukee City Sales Tax | 0.5% |

| Total Sales Tax in Milwaukee | 5.5% |

It's important to note that while the sales tax rate in Milwaukee is relatively stable, it can be subject to changes due to legislative decisions or special initiatives. Therefore, it is advisable to stay updated on any potential tax adjustments to ensure accurate financial planning.

Sales Tax Exemptions and Special Considerations

While the sales tax rate in Milwaukee applies to a wide range of goods and services, there are certain exemptions and special considerations that can impact the overall tax liability. Understanding these exemptions is crucial for businesses to ensure compliance and for consumers to make informed purchasing decisions.

One notable exemption in Milwaukee is the sales tax holiday, a designated period when certain items are exempt from sales tax. This holiday typically occurs during specific times of the year, often coinciding with back-to-school shopping or other significant shopping seasons. During these periods, items such as clothing, school supplies, and electronics are exempt from sales tax, providing a significant savings opportunity for consumers.

Additionally, Milwaukee offers specific exemptions for certain categories of goods and services. These exemptions can vary based on the nature of the transaction and the type of business involved. For instance, some items like prescription medications, food products, and certain agricultural equipment are often exempt from sales tax, providing relief to specific industries and consumers.

Furthermore, there are considerations for businesses regarding tax registration and collection. Businesses in Milwaukee must obtain a seller's permit to collect and remit sales tax. This permit ensures that businesses are compliant with tax regulations and enables them to accurately collect and report sales tax on behalf of the government. The process of obtaining a seller's permit involves registration with the Wisconsin Department of Revenue and compliance with specific tax laws and regulations.

Impact of Sales Tax on Milwaukee’s Economy

The sales tax system in Milwaukee plays a pivotal role in shaping the city’s economic landscape. It serves as a significant revenue stream for the government, contributing to the development and maintenance of vital infrastructure and public services. The funds generated from sales tax are allocated to various sectors, including education, healthcare, transportation, and public safety, ensuring the city’s continued growth and sustainability.

Economic Growth and Development

Sales tax revenue is a critical factor in Milwaukee’s economic growth and development strategy. The funds collected through sales tax are invested in projects that enhance the city’s infrastructure, making it more attractive for businesses and residents alike. This includes improvements to roads, public transportation, and utilities, which not only benefit the local community but also attract new businesses and investments.

Additionally, sales tax revenue supports initiatives aimed at fostering economic development and job creation. The city utilizes these funds to incentivize businesses to establish or expand their operations in Milwaukee, leading to increased employment opportunities and a thriving business environment. This cycle of investment and growth contributes to a robust and resilient local economy.

Equitable Distribution of Resources

The sales tax system in Milwaukee is designed to ensure an equitable distribution of resources across different sectors and communities. The revenue generated from sales tax is allocated based on specific needs and priorities, aiming to address disparities and promote social equity. This approach ensures that essential services, such as healthcare, education, and social programs, receive adequate funding, benefiting all residents regardless of their socioeconomic status.

Furthermore, the sales tax revenue is utilized to support initiatives that enhance the overall quality of life in Milwaukee. This includes investments in cultural and recreational facilities, affordable housing programs, and initiatives aimed at improving public health and safety. By allocating resources effectively, the city can create a more inclusive and vibrant community, fostering a sense of belonging and well-being among its residents.

Compliance and Reporting

For businesses operating in Milwaukee, compliance with sales tax regulations is essential to maintain a positive relationship with the Wisconsin Department of Revenue and avoid penalties. Understanding the tax filing process and staying updated on any changes in tax laws is crucial for effective tax management.

Sales Tax Registration and Filing

Businesses in Milwaukee must obtain a seller’s permit to collect and remit sales tax. This permit is issued by the Wisconsin Department of Revenue and requires businesses to register and provide relevant information about their operations. Once registered, businesses are assigned a unique identification number, which is used for all tax-related transactions and reporting.

The sales tax filing process involves regular reporting of sales and remittance of the collected tax to the Department of Revenue. Businesses are required to file sales tax returns on a monthly, quarterly, or annual basis, depending on their sales volume and the state's guidelines. These returns must be accurate and timely to avoid penalties and maintain compliance.

Penalties and Audits

Non-compliance with sales tax regulations can lead to significant penalties for businesses. These penalties can include fines, interest charges, and even legal consequences. The Wisconsin Department of Revenue has the authority to conduct audits to ensure that businesses are accurately reporting and remitting sales tax. During an audit, businesses must provide detailed records and documentation to support their tax filings.

To avoid penalties and maintain a good standing with the Department of Revenue, businesses should stay informed about sales tax laws, seek professional guidance when needed, and implement robust internal controls to ensure accurate tax collection and reporting.

Future Implications and Trends

As Milwaukee continues to evolve and adapt to changing economic landscapes, the sales tax system is likely to undergo modifications to address emerging challenges and opportunities. Understanding the potential future implications and trends in sales tax can provide valuable insights for businesses and policymakers alike.

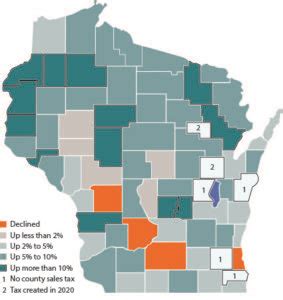

Potential Tax Reforms

In recent years, there has been growing discussion about potential reforms to the sales tax system in Wisconsin, including Milwaukee. These discussions often revolve around finding a balance between generating sufficient revenue for the state and local governments while ensuring fairness and competitiveness for businesses. Some proposed reforms include simplifying tax codes, adjusting tax rates, and exploring alternative revenue streams to reduce reliance on sales tax.

While these reforms are still in the discussion phase, they highlight the ongoing efforts to create a more efficient and equitable tax system. Businesses and consumers should stay informed about these potential changes to adapt their financial strategies accordingly.

Emerging Technologies and Sales Tax

The rapid advancement of technology is also expected to impact the sales tax system in Milwaukee. As e-commerce continues to grow and online sales become more prevalent, the challenge of accurately collecting and remitting sales tax on these transactions arises. The state and local governments are exploring ways to adapt to this changing landscape, including the implementation of new technologies and data analytics to streamline the tax collection process.

Additionally, the integration of technologies like blockchain and digital wallets may introduce new opportunities for tax compliance and transparency. These technologies could enhance the efficiency of tax collection and provide businesses with better tools for tax management.

What is the current sales tax rate in Milwaukee, Wisconsin?

+

The current sales tax rate in Milwaukee, Wisconsin, is 5.5%, which includes a state tax rate of 5% and an additional 0.5% local tax.

Are there any sales tax holidays in Milwaukee?

+

Yes, Milwaukee observes sales tax holidays, typically during specific times of the year. These holidays exempt certain items from sales tax, providing savings for consumers.

What are the consequences of non-compliance with sales tax regulations in Milwaukee?

+

Non-compliance with sales tax regulations can result in penalties, interest charges, and even legal consequences. Businesses should ensure compliance to avoid these issues.

How can businesses stay updated on sales tax laws and regulations in Milwaukee?

+

Businesses can stay informed by regularly checking the Wisconsin Department of Revenue’s website, subscribing to their newsletters, and seeking professional tax guidance when needed.

Are there any plans for sales tax reforms in Milwaukee or Wisconsin?

+

Discussions about sales tax reforms are ongoing, with a focus on balancing revenue generation and fairness. Businesses and consumers should stay tuned for any updates on potential reforms.