Does Wyoming Have Estate Tax

Wyoming, nestled in the heart of the American West, is renowned for its stunning natural beauty and wide-open spaces. While the state offers a unique and vibrant lifestyle, its tax policies, particularly concerning estate planning, often raise questions among residents and prospective newcomers alike.

This comprehensive guide aims to delve into the intricacies of Wyoming's estate tax landscape, providing a detailed understanding of the state's approach to estate planning and the potential implications for individuals and families.

Understanding Estate Tax in Wyoming

Estate tax, often referred to as the inheritance tax, is a tax levied on the transfer of a person’s estate, including their assets and property, upon their death. This tax is a critical component of many states’ revenue systems and can significantly impact the distribution of wealth among beneficiaries.

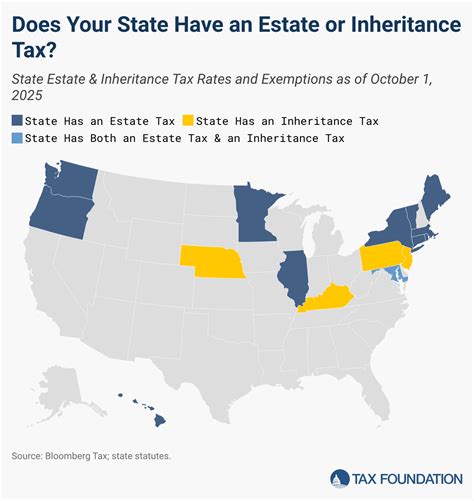

In Wyoming, the estate tax landscape is unique and favorable for many individuals. The state has a unique position in the United States as one of the few states that does not impose an estate tax on its residents. This means that when a Wyoming resident passes away, their estate is not subject to state-level taxation, providing a significant advantage in estate planning.

This absence of an estate tax in Wyoming is a strategic decision by the state government, aiming to encourage economic growth, attract new residents, and promote the state as a desirable location for individuals with substantial assets. By eliminating the estate tax, Wyoming aims to simplify the estate planning process and reduce the financial burden on families during a difficult time.

Wyoming’s Tax Environment: A Comparative Analysis

When comparing Wyoming’s tax policies to other states, the absence of an estate tax is a notable distinction. Many states, particularly those with high population densities and a focus on social services, implement estate taxes to generate revenue. These taxes often target high-net-worth individuals and can significantly impact the distribution of wealth.

In contrast, Wyoming's tax environment is characterized by a low-tax approach, with a focus on attracting businesses and individuals with favorable tax rates. This strategy has proven successful, with Wyoming consistently ranking among the top states for business friendliness and economic growth.

The elimination of the estate tax is just one aspect of Wyoming's tax policies. The state also boasts a low income tax rate, with a maximum of 3.4% for individual income, and no corporate income tax, making it an attractive destination for businesses and high-income earners. This holistic approach to taxation positions Wyoming as a state with a competitive advantage in attracting and retaining wealth.

| Wyoming Estate Tax Status | Estate Tax Details |

|---|---|

| Imposition | Wyoming does not impose an estate tax. |

| Benefits | Simplifies estate planning, reduces tax burden for beneficiaries. |

| Comparison | Contrasts with states that levy high estate taxes. |

The Implications for Estate Planning in Wyoming

The absence of an estate tax in Wyoming has significant implications for individuals and families planning their estates. While the state’s tax policies provide advantages, it’s essential to understand the broader estate planning landscape to make informed decisions.

Simplified Estate Planning Process

Without the burden of estate taxes, Wyoming residents can focus on a more straightforward estate planning process. This simplicity allows individuals to allocate their assets and property according to their wishes without the complexity of navigating tax laws and potential tax liabilities.

The simplified process can lead to efficient estate distribution, ensuring that beneficiaries receive their inheritances without significant delays or financial encumbrances. This efficiency is particularly beneficial for families with complex asset structures or multiple beneficiaries.

Maximizing Wealth Transfer

The absence of an estate tax in Wyoming provides an opportunity for individuals to maximize the transfer of wealth to their beneficiaries. With no state-level tax on the transfer of assets, individuals can ensure that a larger portion of their estate reaches their intended recipients.

This advantage is particularly beneficial for high-net-worth individuals who wish to preserve their wealth and ensure its efficient distribution. By leveraging Wyoming's tax-friendly environment, individuals can reduce the overall tax burden on their estates, allowing for a more substantial legacy.

Strategic Estate Planning Considerations

While Wyoming’s estate tax policies offer advantages, it’s crucial to consider the broader tax landscape. Federal estate taxes still apply to estates valued above a certain threshold, and individuals with substantial assets should consult with estate planning professionals to ensure compliance and optimize their strategies.

Additionally, Wyoming's absence of an estate tax may impact the state's ability to provide certain public services. Residents should be aware of the trade-offs and consider the overall tax environment when making decisions about their estates.

Wyoming’s Tax Strategies for Attracting Residents

Wyoming’s decision to eliminate the estate tax is part of a broader strategy to attract residents and businesses to the state. This strategy is centered on creating a business-friendly environment with low taxes and regulatory burdens, positioning Wyoming as a competitive destination for economic growth.

Business-Friendly Tax Policies

In addition to the absence of an estate tax, Wyoming boasts a range of business-friendly tax policies. These include low income tax rates, no corporate income tax, and minimal sales taxes, creating an attractive environment for businesses to operate and thrive.

These policies have contributed to Wyoming's reputation as a pro-business state, attracting companies and entrepreneurs seeking a favorable tax environment. The state's focus on low taxes has led to a thriving business landscape, with a diverse range of industries flourishing.

Economic Growth and Development

Wyoming’s tax strategies have had a significant impact on the state’s economic growth and development. The absence of an estate tax, combined with other tax incentives, has attracted high-net-worth individuals and their businesses, contributing to the state’s overall economic health.

The influx of businesses and individuals has led to job creation, increased tax revenue from other sources, and a thriving real estate market. This economic growth has a ripple effect, benefiting communities across the state and contributing to a higher quality of life for residents.

Future Implications and Considerations

As Wyoming continues to thrive economically, it’s essential to consider the future implications of its tax policies. While the absence of an estate tax has clear advantages, it’s crucial to monitor the state’s fiscal health and ensure that the tax strategies remain sustainable in the long term.

Sustainability and Fiscal Health

Wyoming’s tax policies, including the absence of an estate tax, have contributed to the state’s economic success. However, it’s important to ensure that these policies are fiscally responsible and sustainable over the long term. The state must carefully manage its revenue streams to maintain its tax-friendly environment without compromising essential public services.

Monitoring Federal Tax Changes

While Wyoming’s estate tax policies are advantageous, individuals must stay informed about potential changes at the federal level. Federal estate tax laws can impact the overall tax landscape, and residents should consult professionals to understand the implications and adjust their estate plans accordingly.

State-Level Considerations

Wyoming’s unique tax policies have positioned it as a desirable state for residents and businesses. However, it’s important to consider the potential for future changes in state-level tax policies. While the absence of an estate tax is currently a significant advantage, it’s essential to monitor any potential shifts in tax strategies to ensure long-term planning remains effective.

What is the current status of Wyoming’s estate tax laws?

+Wyoming does not currently impose an estate tax on its residents, providing a tax-efficient environment for estate planning.

How does Wyoming’s absence of an estate tax compare to other states?

+Wyoming stands out as one of the few states without an estate tax, contrasting with many states that levy high estate taxes to generate revenue.

What are the advantages of Wyoming’s tax-friendly environment for estate planning?

+Wyoming’s tax-friendly environment simplifies estate planning, reduces tax burdens, and allows for efficient wealth transfer to beneficiaries.

Are there any potential drawbacks to Wyoming’s absence of an estate tax?

+While the absence of an estate tax offers advantages, it’s important to consider the state’s fiscal health and the potential for future changes in tax policies.