West Virginia Income Tax

In the realm of personal finance and tax management, understanding the intricacies of state-level income taxes is crucial. West Virginia, with its unique economic landscape and tax policies, presents an interesting case study for taxpayers and financial experts alike. This article aims to delve deep into the world of West Virginia income tax, exploring its history, current structure, and potential future developments.

The Evolution of West Virginia Income Tax

The history of income taxation in West Virginia is a tale of economic evolution and legislative adaptation. The state’s first encounter with income tax can be traced back to the early 20th century, a time when the concept of progressive taxation was gaining traction across the United States. In 1931, West Virginia took its first steps towards implementing an income tax system, primarily as a means to bolster its revenue streams during the Great Depression.

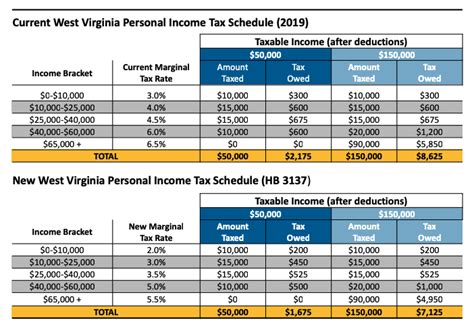

The initial income tax structure in West Virginia was designed with a progressive rate system, meaning that higher incomes were taxed at progressively higher rates. This approach aimed to ensure that the tax burden was distributed fairly across different income levels. Over the decades, the state's income tax system has undergone numerous revisions and amendments, adapting to changing economic circumstances and policy priorities.

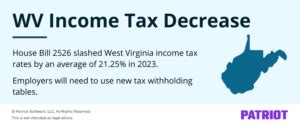

One significant development in West Virginia's income tax history was the introduction of tax brackets in the 1970s. This move allowed the state to tailor tax rates to specific income levels, providing a more nuanced approach to taxation. Additionally, West Virginia has periodically adjusted its tax rates and brackets to align with inflation and economic growth, ensuring that the tax system remains responsive to the changing financial landscape.

Current Income Tax Structure in West Virginia

As of [current year], West Virginia operates a relatively straightforward income tax system, characterized by a flat tax rate for all individual taxpayers. This flat-rate system, implemented in [year of implementation], has brought a sense of simplicity and predictability to the state’s tax landscape. Unlike some other states with progressive tax systems, West Virginia’s flat rate ensures that all taxpayers, regardless of their income level, pay the same percentage of their income in taxes.

The current flat tax rate in West Virginia is [current tax rate]%, which applies to all taxable income, including wages, salaries, interest, dividends, and capital gains. This rate is among the lowest in the nation, positioning West Virginia as a state with a relatively low tax burden for its residents and businesses. However, it's important to note that this flat rate doesn't apply to certain types of income, such as federal tax refunds, Social Security benefits, and some forms of public assistance, which are exempt from taxation in the state.

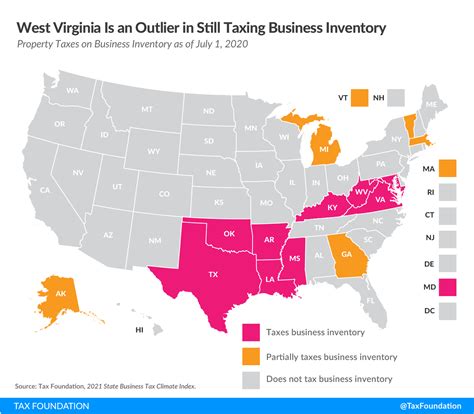

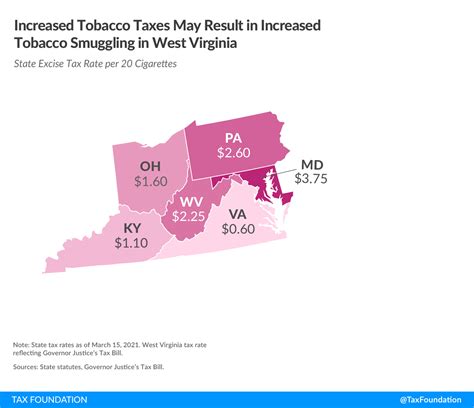

In addition to the flat tax rate, West Virginia also imposes a Consumer Sales and Service Tax on the sale or lease of tangible personal property and certain services. This tax, which varies based on the type of goods or services, contributes significantly to the state's revenue. Furthermore, West Virginia has a Severance Tax on the extraction of natural resources, including coal, natural gas, and oil, which is an important source of revenue for the state, especially given its historical reliance on these industries.

Tax Filing and Payment Process

For individual taxpayers in West Virginia, the tax filing process is relatively straightforward. Taxpayers are required to file their returns by April 15th of each year, or the due date set by the IRS if it differs. The state offers both paper and electronic filing options, with the latter being encouraged for its convenience and efficiency. Electronic filing also allows taxpayers to receive their refunds faster, usually within a few weeks.

West Virginia provides various payment methods for taxpayers to settle their tax liabilities. These include direct debit, credit card, and electronic funds transfer. Additionally, taxpayers who find themselves unable to pay their taxes in full by the due date have the option to request a payment plan, known as a Payment Agreement, from the West Virginia Tax Department. This agreement allows taxpayers to make regular payments towards their tax debt over an extended period.

| Tax Type | Rate |

|---|---|

| Income Tax (Individual) | [Current Tax Rate]% |

| Consumer Sales and Service Tax | Varies |

| Severance Tax | Varies |

Comparative Analysis: West Virginia vs. Other States

When compared to other states, West Virginia’s income tax system stands out for its simplicity and low tax rates. While some states employ complex progressive tax systems with multiple brackets, West Virginia’s flat tax rate simplifies the tax filing process and provides clarity for taxpayers. This approach has the added benefit of making West Virginia an attractive destination for businesses and individuals seeking a stable and predictable tax environment.

However, it's important to note that West Virginia's low tax rates are not without trade-offs. The state's reliance on a flat tax rate may lead to a regressive tax system, where lower-income earners pay a larger percentage of their income in taxes compared to higher-income earners. This disparity can be mitigated through effective tax policy design and by ensuring that essential public services are adequately funded through other sources of revenue.

State Revenue and Economic Impact

West Virginia’s flat income tax rate has had a notable impact on the state’s revenue streams. While the state’s tax revenue has grown over the years, the flat rate has resulted in a slower growth rate compared to states with progressive tax systems. This slower growth is partly due to the nature of a flat tax, which collects a uniform percentage from all taxpayers, regardless of their ability to pay.

However, the flat tax rate has also contributed to West Virginia's economic growth and stability. By providing a predictable and stable tax environment, the state has been able to attract businesses and investors, fostering economic development and job creation. Additionally, the simplicity of the tax system has reduced administrative costs for both taxpayers and the state government, allowing resources to be allocated more efficiently.

Potential Future Developments and Implications

As West Virginia continues to evolve economically, its income tax system is likely to undergo further transformations to align with changing circumstances and policy goals. One potential area of development is the introduction of tax incentives and credits to encourage specific economic activities, such as renewable energy development or small business growth. These incentives could help drive economic diversification and create a more resilient economic landscape.

Another possible future development is the implementation of a progressive tax system, which could address concerns about the regressive nature of a flat tax. A progressive system would ensure that higher-income earners contribute a larger share of their income to the state's revenue, providing a more equitable tax burden. However, such a change would require careful consideration and planning to ensure it does not negatively impact the state's economic competitiveness.

Additionally, as the state's economic structure continues to diversify, there may be a need to revisit the tax treatment of certain industries or income sources. For instance, with the growing importance of the technology sector, West Virginia might consider adjusting its tax policies to better support and attract tech companies, which could drive innovation and job growth in the state.

What are the tax brackets for West Virginia income tax?

+West Virginia operates a flat-rate income tax system, meaning there are no tax brackets. All individual taxpayers pay the same rate, which is currently [current tax rate]%.

Are there any tax deductions or credits available in West Virginia?

+Yes, West Virginia offers various tax deductions and credits, including the Personal Exemption Credit, Dependent Exemption Credit, and the Child and Dependent Care Credit. These credits can help reduce the amount of tax you owe.

How does West Virginia’s income tax compare to other states?

+West Virginia’s flat tax rate is among the lowest in the nation, making it a relatively tax-friendly state. However, it’s important to consider the overall tax burden, which includes sales tax, property tax, and other state and local taxes.